Maine Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

Choosing the best legitimate document web template can be quite a struggle. Obviously, there are a lot of web templates available on the net, but how will you discover the legitimate type you will need? Take advantage of the US Legal Forms internet site. The services gives a huge number of web templates, including the Maine Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P., which can be used for company and personal requirements. Each of the varieties are examined by experts and meet federal and state demands.

If you are already signed up, log in for your profile and then click the Obtain switch to have the Maine Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.. Utilize your profile to appear throughout the legitimate varieties you possess acquired earlier. Visit the My Forms tab of your profile and acquire another version of your document you will need.

If you are a fresh customer of US Legal Forms, listed below are simple guidelines so that you can adhere to:

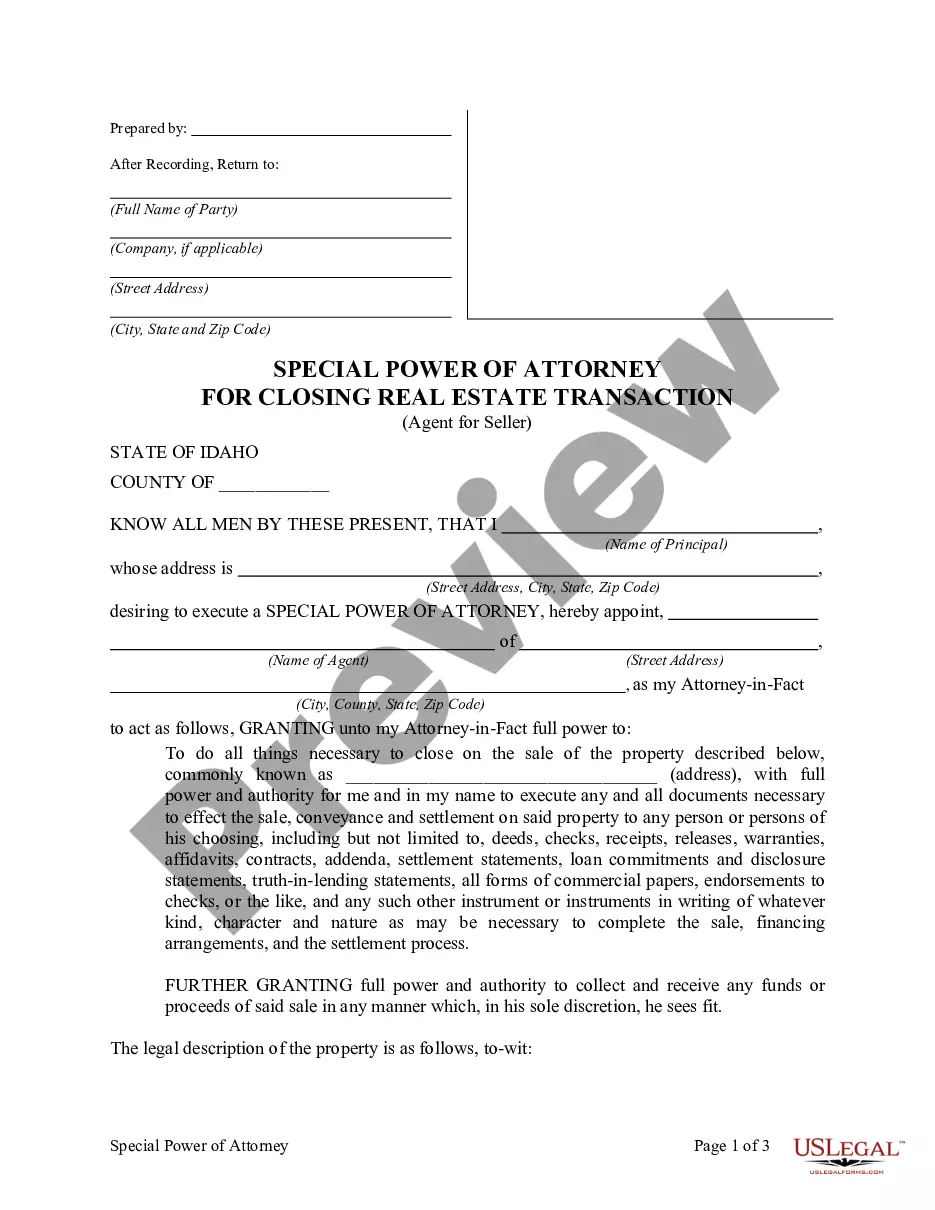

- First, make certain you have chosen the proper type for your metropolis/region. It is possible to examine the form making use of the Review switch and study the form outline to guarantee this is the best for you.

- In case the type does not meet your needs, take advantage of the Seach field to get the right type.

- When you are sure that the form is suitable, click on the Purchase now switch to have the type.

- Select the costs prepare you desire and enter in the required information. Build your profile and buy your order utilizing your PayPal profile or credit card.

- Pick the document formatting and down load the legitimate document web template for your product.

- Total, modify and produce and indicator the obtained Maine Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

US Legal Forms may be the greatest catalogue of legitimate varieties where you can see a variety of document web templates. Take advantage of the company to down load professionally-created files that adhere to express demands.