Maine Indemnification Agreement among Financial Security Assurance, ABCs, and American Business Credit is a legal agreement that establishes the terms and conditions of indemnification between these three parties. It aims to protect and safeguard the interests of all parties involved in various transactions and financial activities. Financial Security Assurance, commonly known as FSA, is a prominent financial services company specializing in providing insurance and credit enhancement products. ABC refers to American Business Credit, a leading provider of asset-based lending and financing solutions. These companies often collaborate and enter into financial agreements that require indemnification provisions to mitigate potential risks and liabilities. The Maine Indemnification Agreement outlines the responsibilities and obligations of each party involved. It establishes a framework for indemnification, which is the act of compensating for any losses, damages, or liabilities incurred due to certain events or circumstances. This agreement ensures that if one party suffers a loss or is held liable for any claims, the other parties will provide compensation or cover the financial damages. Keywords: Maine Indemnification Agreement, Financial Security Assurance, ABCs, American Business Credit, indemnification provisions, insurance, credit enhancement, financial services, asset-based lending, financing solutions, risks, liabilities, compensation, losses, damages, claims. Different types of Maine Indemnification Agreement: 1. Financial Liability Indemnification Agreement: This type of agreement specifies the indemnification terms related to financial liabilities, such as financial losses, obligations, or debts incurred during the course of a business transaction or partnership. 2. Legal Indemnification Agreement: This agreement focuses on indemnifying parties against any legal claims, expenses, or liabilities arising from legal disputes or litigation connected to the activities covered by the agreement. 3. Contractual Indemnification Agreement: This type of agreement specifically addresses indemnification provisions related to breaches of contractual terms or obligations, ensuring that parties are protected against any financial losses resulting from such breaches. 4. Environmental Indemnification Agreement: This agreement is applicable when the parties involved are engaged in activities that involve environmental risks, such as pollution, contamination, or hazardous materials. It establishes the terms of indemnification in case of any environmental liabilities or remediation costs. 5. Indemnification Agreement for Mergers and Acquisitions: This agreement is commonly used in the context of mergers, acquisitions, or business transfers. It outlines the indemnification terms and conditions related to any pre-existing liabilities or contingent liabilities associated with the target company. Note: It is important to consult with legal professionals or review the specific agreement to understand the exact terms and provisions of any Maine Indemnification Agreement among Financial Security Assurance, ABCs, and American Business Credit, as the details may vary.

Maine Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit

Description

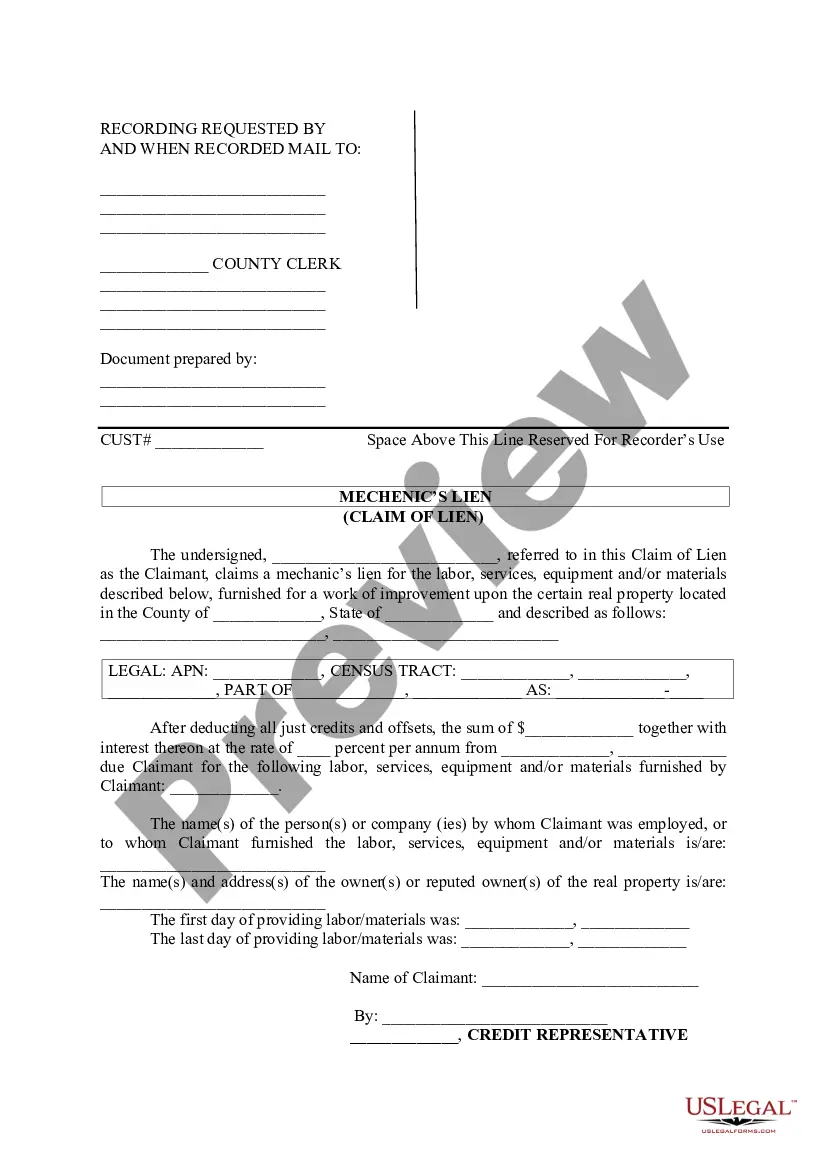

How to fill out Maine Indemnification Agreement Among Financial Security Assurance, ABFS And American Business Credit?

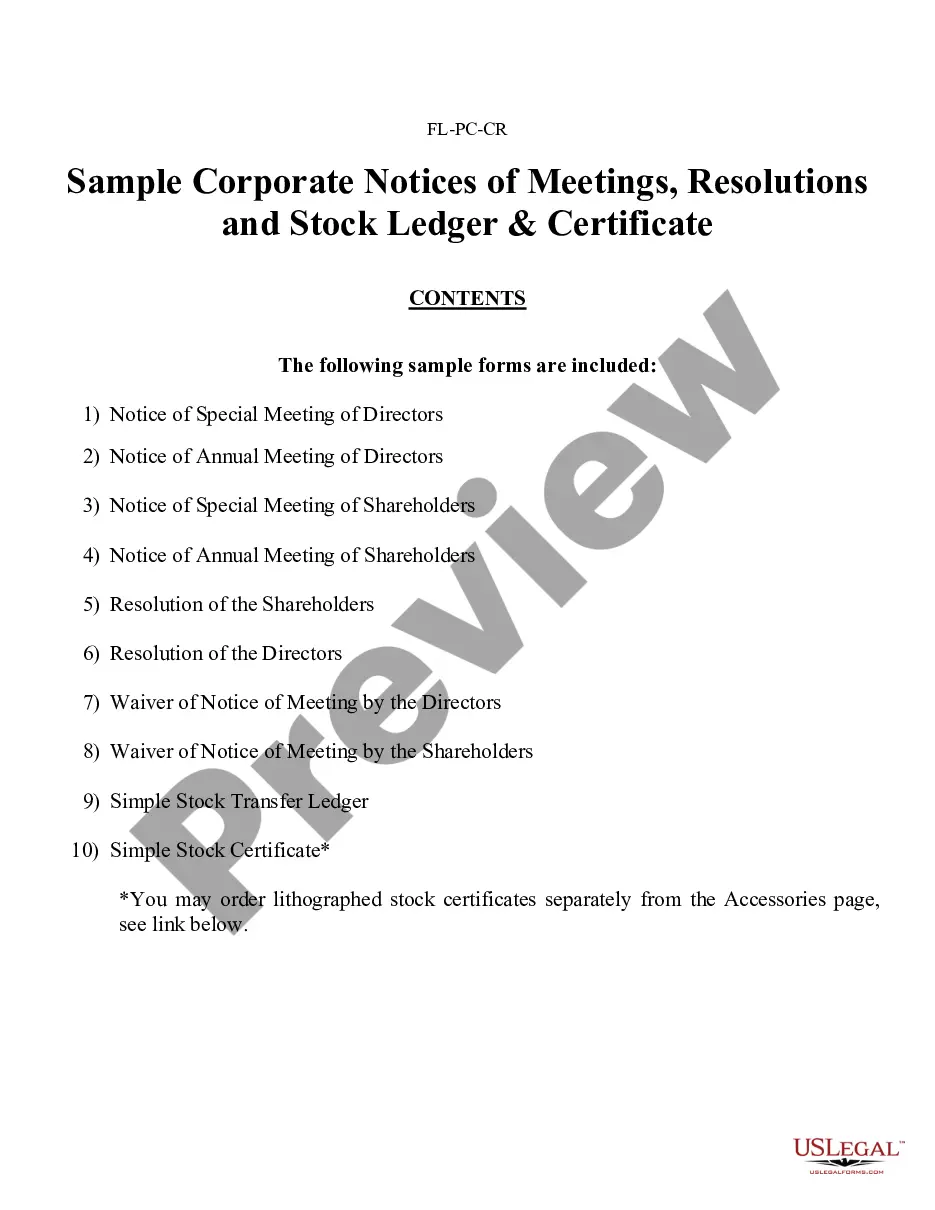

You can invest hours on the Internet trying to find the lawful document design that meets the federal and state demands you need. US Legal Forms offers thousands of lawful varieties that are examined by specialists. You can easily obtain or produce the Maine Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit from our assistance.

If you currently have a US Legal Forms account, you are able to log in and then click the Acquire switch. Next, you are able to full, modify, produce, or indication the Maine Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit. Every lawful document design you get is yours permanently. To acquire another version of the bought type, check out the My Forms tab and then click the related switch.

If you use the US Legal Forms web site the very first time, stick to the easy recommendations under:

- Initial, be sure that you have chosen the best document design for that area/metropolis that you pick. Browse the type explanation to make sure you have picked the appropriate type. If accessible, take advantage of the Review switch to appear with the document design too.

- If you want to find another edition of the type, take advantage of the Lookup field to discover the design that meets your needs and demands.

- Once you have identified the design you need, just click Acquire now to continue.

- Pick the pricing program you need, type in your qualifications, and sign up for a free account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal account to purchase the lawful type.

- Pick the file format of the document and obtain it for your device.

- Make modifications for your document if required. You can full, modify and indication and produce Maine Indemnification Agreement among Financial Security Assurance, ABFS and American Business Credit.

Acquire and produce thousands of document web templates utilizing the US Legal Forms website, that provides the most important collection of lawful varieties. Use skilled and status-distinct web templates to deal with your small business or individual requires.

Form popularity

FAQ

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen. What is an Indemnity Clause and When is Indemnity Required? Britton & Time Solicitors ? 2019/05/13 ? what-is-an-ind... Britton & Time Solicitors ? 2019/05/13 ? what-is-an-ind...

To indemnify, also known as indemnity or indemnification, means compensating a person for damages or losses they have incurred or will incur related to a specified accident, incident, or event. indemnify | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? indemnify cornell.edu ? wex ? indemnify

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

Each party shall indemnify, defend, protect, hold harmless, and release the other, its officers, agents, and employees, from and against any and all claims, loss, proceedings, damages, causes of action, liability, costs, or expense (including attorneys' fees and witness costs) arising from or in connection with, or ...

Indemnifications, or ?hold harmless? provisions, shift risks or potential costs from one party to another. One party to the contract promises to defend and pay costs and expenses of the other if specific circumstances arise (often a claim or dispute with a third party to the contract). Indemnification Clause Sample | Bloomberg Law Bloomberg Law ? brief ? indemnificatio... Bloomberg Law ? brief ? indemnificatio...

Under cross-indemnity agreements, the indemnification obligation is reciprocal in nature, regardless of fault. Therefore, each party obligates itself to indemnify the other for liabilities arising out of each other's acts or omissions.

Definition: Indemnity means making compensation payments to one party by the other for the loss occurred. Description: Indemnity is based on a mutual contract between two parties (one insured and the other insurer) where one promises the other to compensate for the loss against payment of premiums. Indemnity - Definition - The Economic Times - IndiaTimes indiatimes.com ? definition ? inde... indiatimes.com ? definition ? inde...