Maine Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York

Description

How to fill out Trust Agreement Between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., And The Bank Of New York?

You can commit time on the web trying to find the legitimate record format which fits the state and federal requirements you will need. US Legal Forms provides a large number of legitimate types that happen to be evaluated by experts. You can actually download or print out the Maine Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York from the services.

If you already possess a US Legal Forms bank account, you are able to log in and then click the Download option. Afterward, you are able to comprehensive, modify, print out, or signal the Maine Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York. Each and every legitimate record format you purchase is your own for a long time. To acquire yet another version associated with a purchased kind, visit the My Forms tab and then click the related option.

Should you use the US Legal Forms site the first time, keep to the simple recommendations beneath:

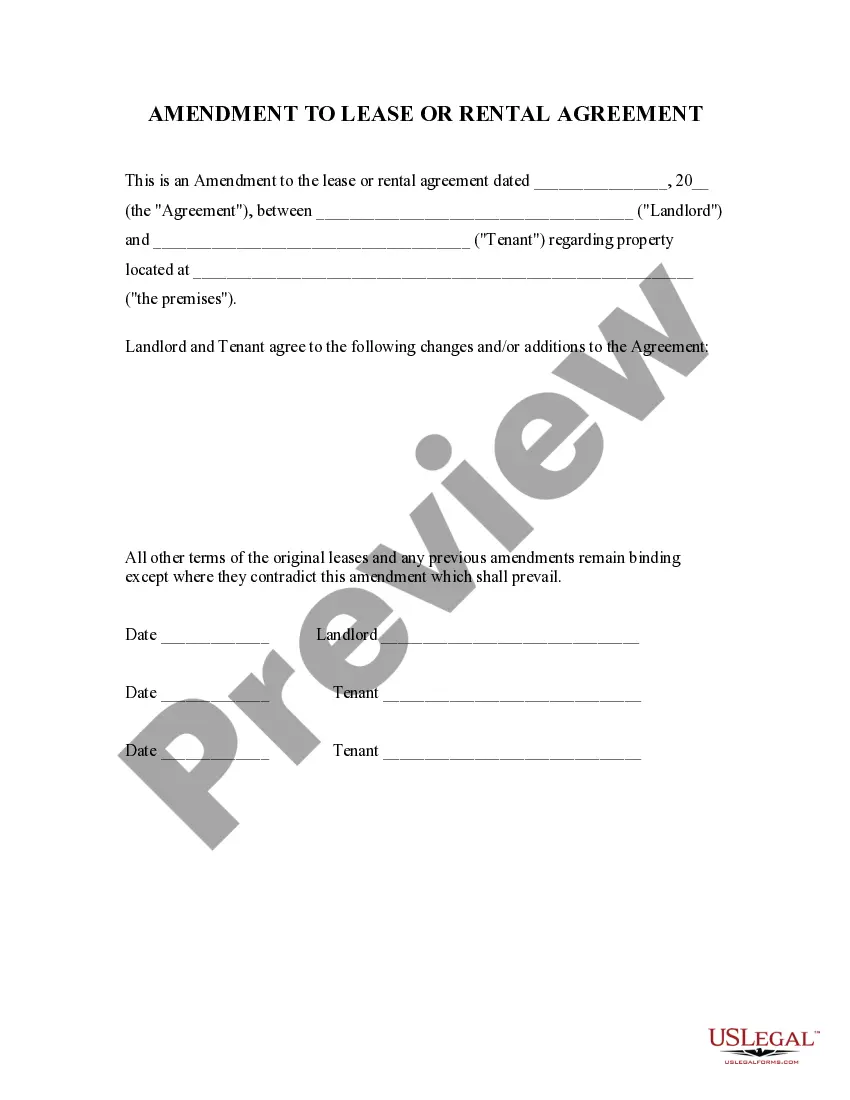

- Very first, be sure that you have chosen the best record format to the region/metropolis of your choosing. See the kind outline to ensure you have selected the appropriate kind. If readily available, utilize the Review option to look from the record format too.

- If you wish to get yet another model from the kind, utilize the Search industry to get the format that fits your needs and requirements.

- After you have identified the format you want, just click Acquire now to continue.

- Pick the pricing strategy you want, type your references, and register for your account on US Legal Forms.

- Complete the financial transaction. You can utilize your bank card or PayPal bank account to purchase the legitimate kind.

- Pick the structure from the record and download it for your gadget.

- Make adjustments for your record if necessary. You can comprehensive, modify and signal and print out Maine Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York.

Download and print out a large number of record web templates making use of the US Legal Forms Internet site, that offers the most important assortment of legitimate types. Use professional and status-particular web templates to take on your company or specific requires.