The Maine Plan of Merger refers to a legal agreement between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. This plan outlines the terms and conditions of merging the companies to form a consolidated entity. Keywords: Maine, plan of merger, Trident Group, Inc., Finger Acquisition Corp., Finger Health Care Says., Inc., legal agreement, terms and conditions, merging, consolidated entity. The Maine Plan of Merger outlines the step-by-step process and various arrangements involved in the merger of The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. This agreement is a legally binding document that defines the terms, conditions, and obligations of each party involved in the merger. The purpose of this merger is to combine the resources, expertise, and capabilities of the three entities to create a more robust and competitive organization in the healthcare industry. By merging, the companies aim to enhance their market presence, expand their service offerings, improve operational efficiency, and achieve economies of scale. The Maine Plan of Merger includes provisions related to the valuation of each company, the exchange ratio of their shares, and the ownership structure of the consolidated entity. It also addresses the governance structure of the new organization, the composition of the board of directors, and the roles and responsibilities of key executives. Additionally, the plan covers the treatment of outstanding debts, liabilities, and obligations of the merging companies. It specifies how these liabilities will be assumed and managed by the merged entity. The plan also details any potential adjustments or contingencies that may arise during the merging process. There can be different types of Maine Plans of Merger, depending on the specific circumstances and objectives of the companies involved. Examples include: 1. Statutory Merger: This type of merger involves one company absorbing another, resulting in the consolidation of assets, liabilities, and operations. The acquired company ceases to exist as a separate legal entity, and its shareholders become shareholders of the acquiring company. 2. Reverse Merger: In a reverse merger, a private company acquires a publicly traded company to gain access to public markets without undergoing an initial public offering (IPO). The private company merges with the public company, and the shareholders of the private company become majority shareholders of the merged entity. 3. Conglomerate Merger: This type of merger occurs when companies operating in different industries or sectors merge to diversify their operations and create synergies. The merging companies may have complementary product lines or expertise, allowing them to expand into new markets or offer a comprehensive range of products and services. Overall, the Maine Plan of Merger between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. is a comprehensive agreement that facilitates the consolidation of these organizations, enabling them to achieve strategic and operational synergies in the healthcare sector.

Maine Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

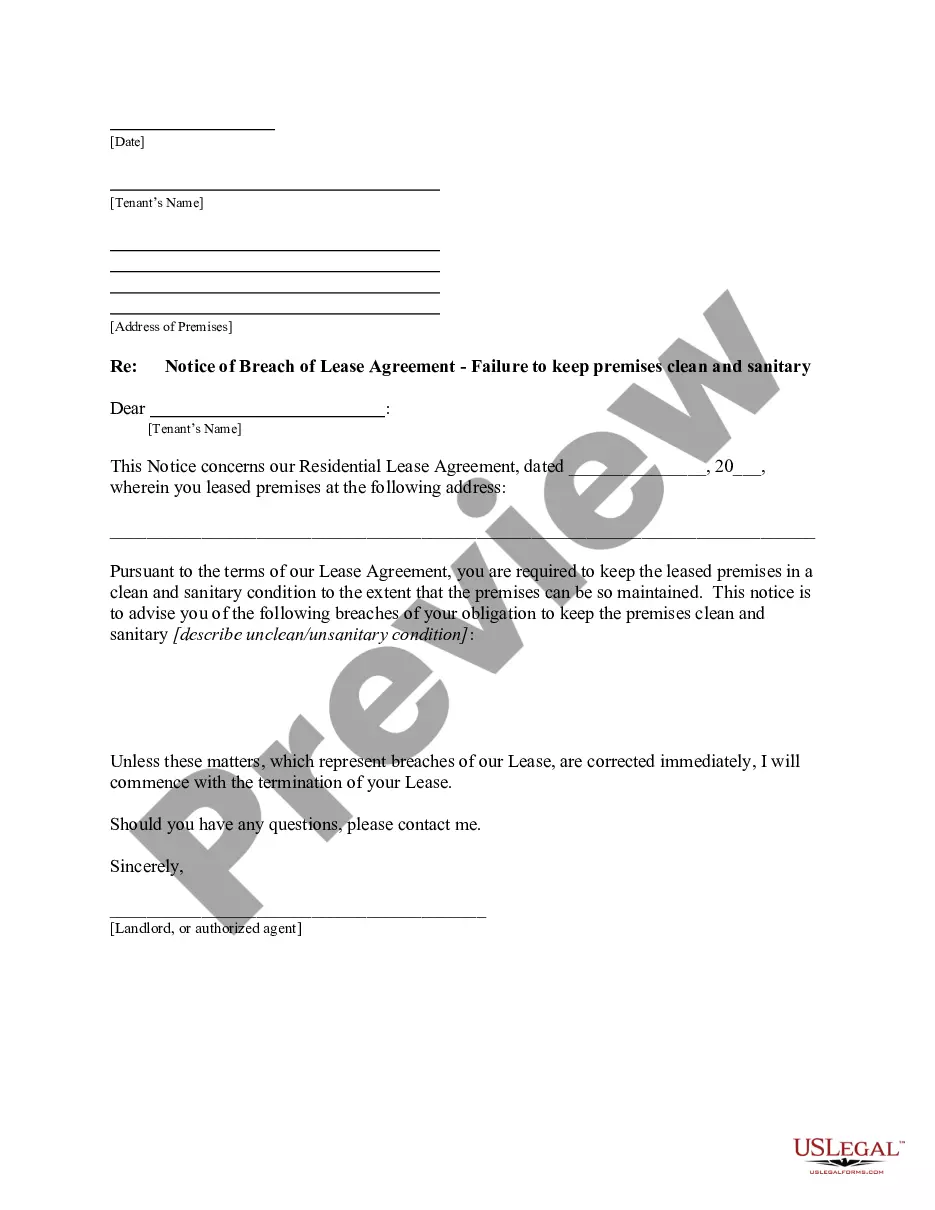

How to fill out Maine Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

Choosing the best lawful papers design might be a have difficulties. Naturally, there are a variety of templates available on the net, but how do you find the lawful type you need? Utilize the US Legal Forms web site. The services offers a huge number of templates, for example the Maine Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc, which can be used for company and personal requires. All of the forms are inspected by pros and satisfy state and federal specifications.

When you are currently signed up, log in for your account and click on the Obtain switch to obtain the Maine Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc. Use your account to appear from the lawful forms you have acquired in the past. Visit the My Forms tab of your own account and obtain another copy from the papers you need.

When you are a brand new user of US Legal Forms, here are simple instructions for you to follow:

- Initially, be sure you have selected the correct type to your metropolis/state. You may examine the shape while using Review switch and look at the shape information to make sure it is the right one for you.

- In the event the type does not satisfy your needs, utilize the Seach field to find the correct type.

- Once you are sure that the shape would work, click on the Purchase now switch to obtain the type.

- Pick the prices plan you desire and enter in the essential information and facts. Build your account and purchase your order using your PayPal account or bank card.

- Choose the submit file format and acquire the lawful papers design for your product.

- Total, revise and print out and signal the obtained Maine Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc.

US Legal Forms will be the largest collection of lawful forms where you can find different papers templates. Utilize the service to acquire expertly-created documents that follow express specifications.