Maine Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.

Description

How to fill out Sample Purchase And Sale Agreement Purchase And Sale Of Stock Between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.?

Are you presently within a place in which you need to have paperwork for either enterprise or specific functions almost every time? There are tons of lawful document templates available online, but locating types you can rely isn`t easy. US Legal Forms gives 1000s of form templates, like the Maine Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp., that are written to satisfy federal and state requirements.

If you are currently knowledgeable about US Legal Forms internet site and have an account, merely log in. Following that, you may acquire the Maine Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. format.

Unless you come with an bank account and need to begin using US Legal Forms, adopt these measures:

- Find the form you need and ensure it is to the right area/region.

- Use the Preview switch to review the form.

- See the information to actually have chosen the correct form.

- In case the form isn`t what you are searching for, make use of the Research discipline to get the form that meets your requirements and requirements.

- Whenever you get the right form, just click Purchase now.

- Choose the rates plan you want, fill in the necessary details to make your money, and buy the transaction utilizing your PayPal or bank card.

- Choose a practical file file format and acquire your duplicate.

Get every one of the document templates you possess purchased in the My Forms menus. You can obtain a more duplicate of Maine Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. whenever, if possible. Just select the required form to acquire or printing the document format.

Use US Legal Forms, probably the most substantial assortment of lawful kinds, to conserve some time and steer clear of errors. The services gives expertly produced lawful document templates which you can use for a range of functions. Generate an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

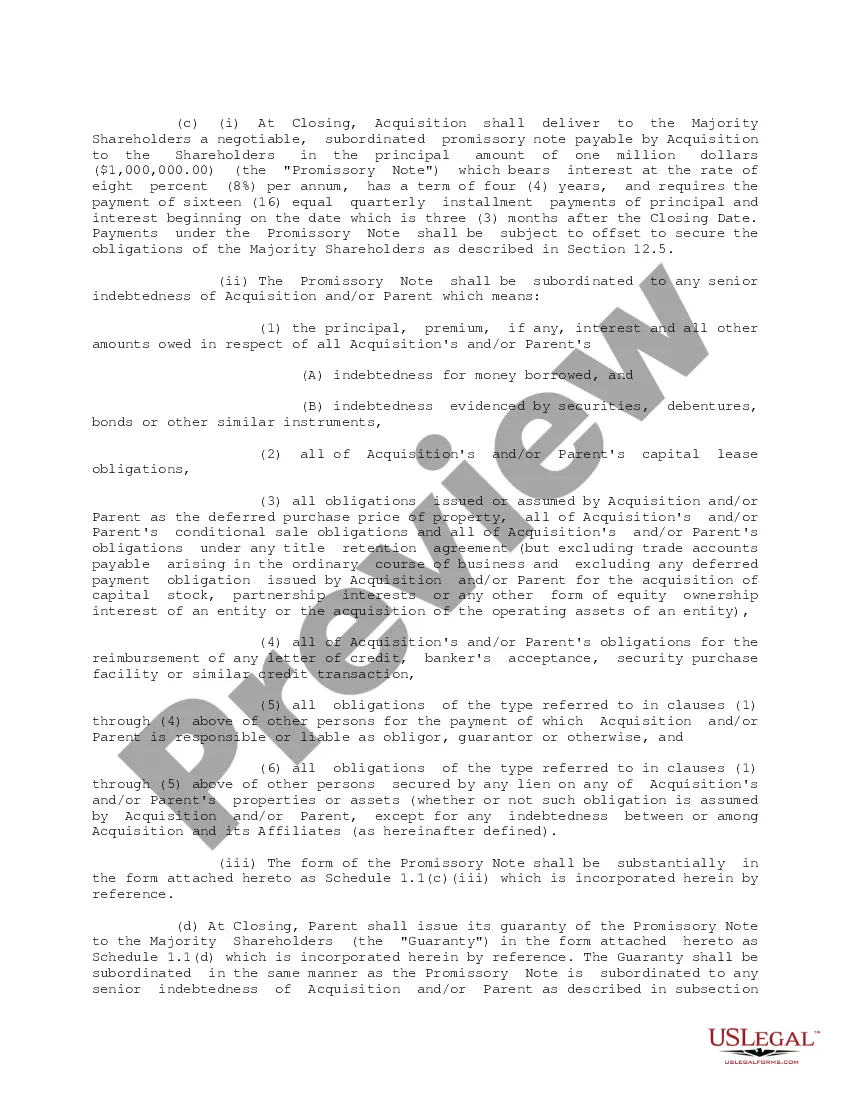

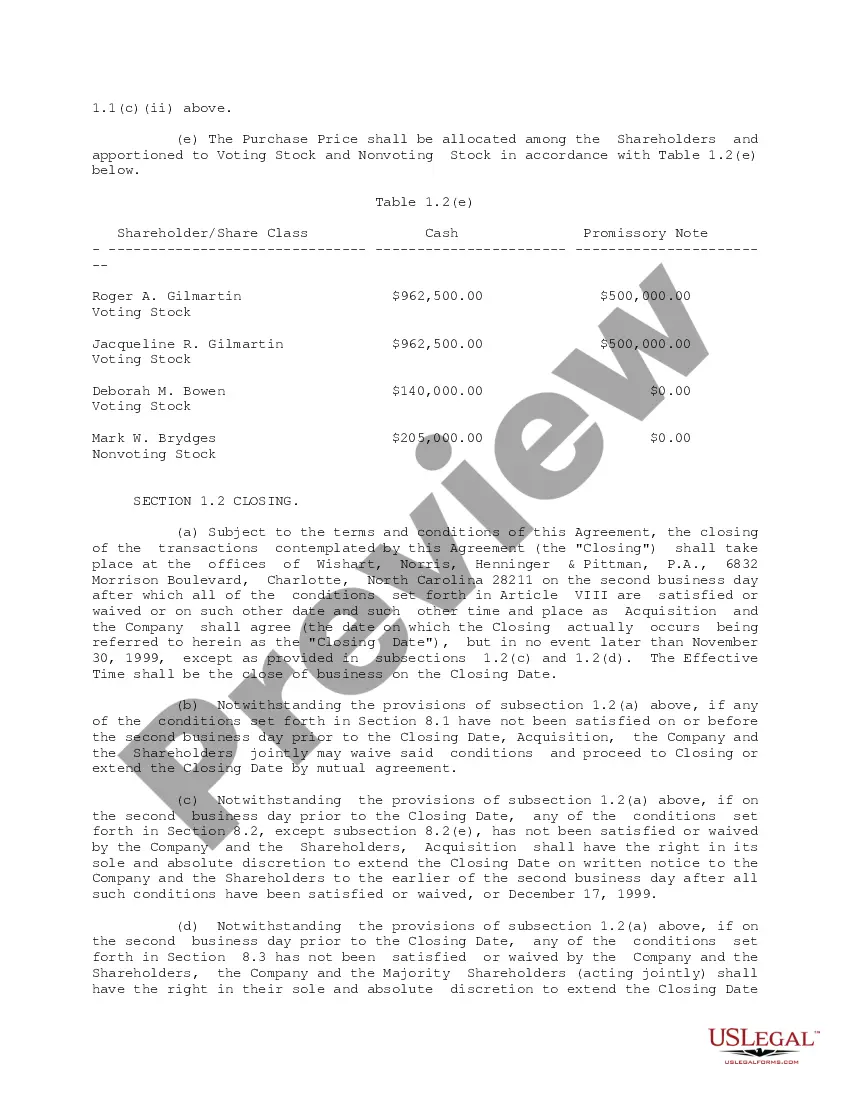

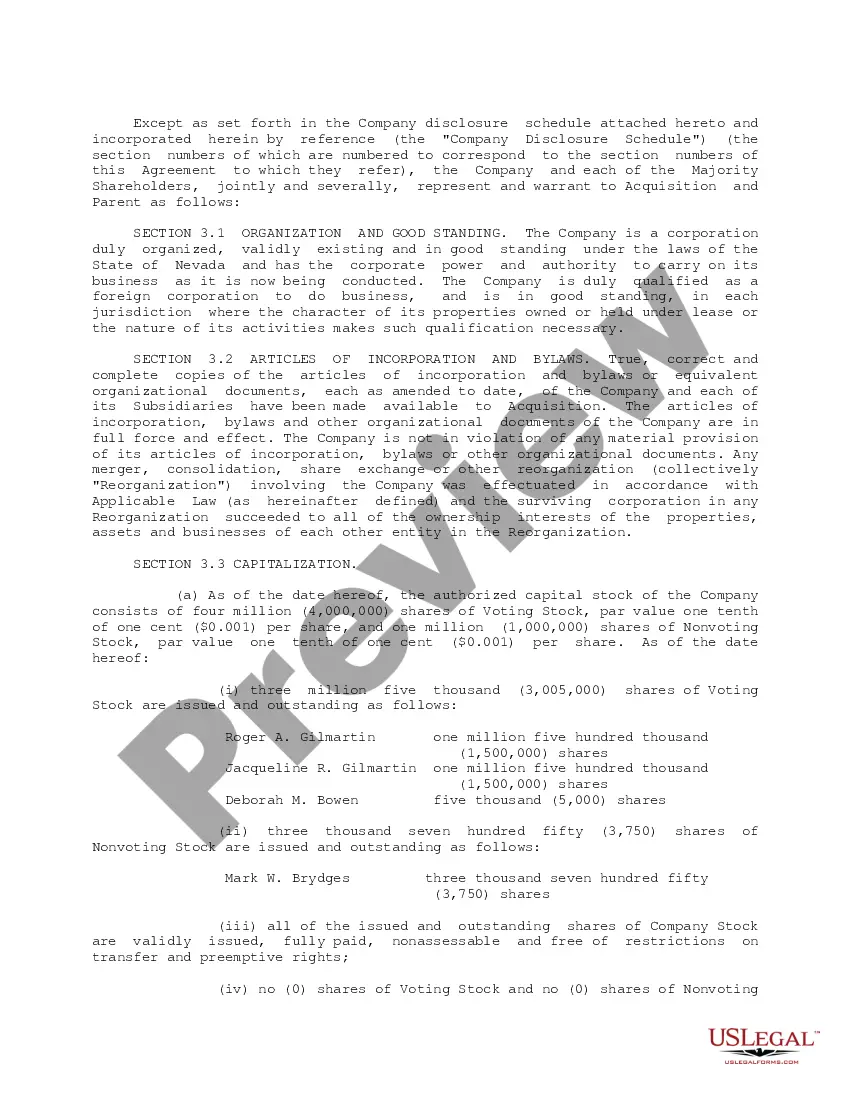

A purchase and sale agreement is used to document the parties' intentions and the terms they have agreed will govern the transaction. You can include specific terms like the product or property, the price of the product or property, conditions for the delivery of the product, and the date of product delivery.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

An Agreement of Purchase and Sale is a written contract between a seller and a buyer for the purchase and sale of a particular property. In the Agreement, the buyer agrees to purchase the property for a certain price, provided that a number of terms and conditions are satisfied.