Maine Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan: A Maine Retirement Plan Transfer Agreement is a legal document that outlines the process, terms, and conditions for transferring retirement assets between parties involved in the Motorola, Inc. Pension Plan based in Maine. This agreement ensures a smooth transfer of pension benefits and helps safeguard the interests of the plan participants. In the context of the Motorola, Inc. Pension Plan, there are a few different types of retirement plan transfer agreements that may be relevant: 1. Lump Sum Transfer Agreement: This agreement allows eligible employees to transfer their pension benefits from the Motorola, Inc. Pension Plan into a lump sum cash payment. This option grants plan participants greater flexibility in managing their retirement funds, ensuring they can direct the money as they see fit. 2. Direct Rollover Transfer Agreement: This type of agreement enables plan participants to transfer the funds from their Motorola, Inc. Pension Plan to another eligible retirement account, such as an Individual Retirement Account (IRA) or another employer-sponsored pension plan. This transfer method allows individuals to continue growing their retirement savings while maintaining tax advantages. 3. Annuity Transfer Agreement: With this transfer agreement, plan participants can use their pension benefits from the Motorola, Inc. Pension Plan to purchase an annuity. An annuity offers a guaranteed income stream for the individual's retirement years, providing financial security and peace of mind. The Maine Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan ensures that any transfer of funds or benefits complies with the relevant state laws, federal regulations, and the plan's provisions. The agreement outlines the responsibilities of both the plan participant and the receiving entity, ensuring transparency and accountability throughout the transfer process. Additionally, the agreement may cover details regarding the calculation of benefits, withdrawal options, survivorship benefits, and any conditions that may impact the transfer, such as early retirement provisions or penalties. It is crucial for plan participants to carefully review and understand the Maine Retirement Plan Transfer Agreement before proceeding with any transfer of their retirement funds. Seeking professional advice from financial advisors, attorneys, or pension experts may be beneficial to ensure the transfer aligns with their long-term retirement goals and maximizes their financial well-being. By employing a Maine Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan, both plan participants and receiving entities can mitigate financial risks, protect retirement assets, and enable individuals to make informed decisions about their retirement funds.

Maine Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan

Description

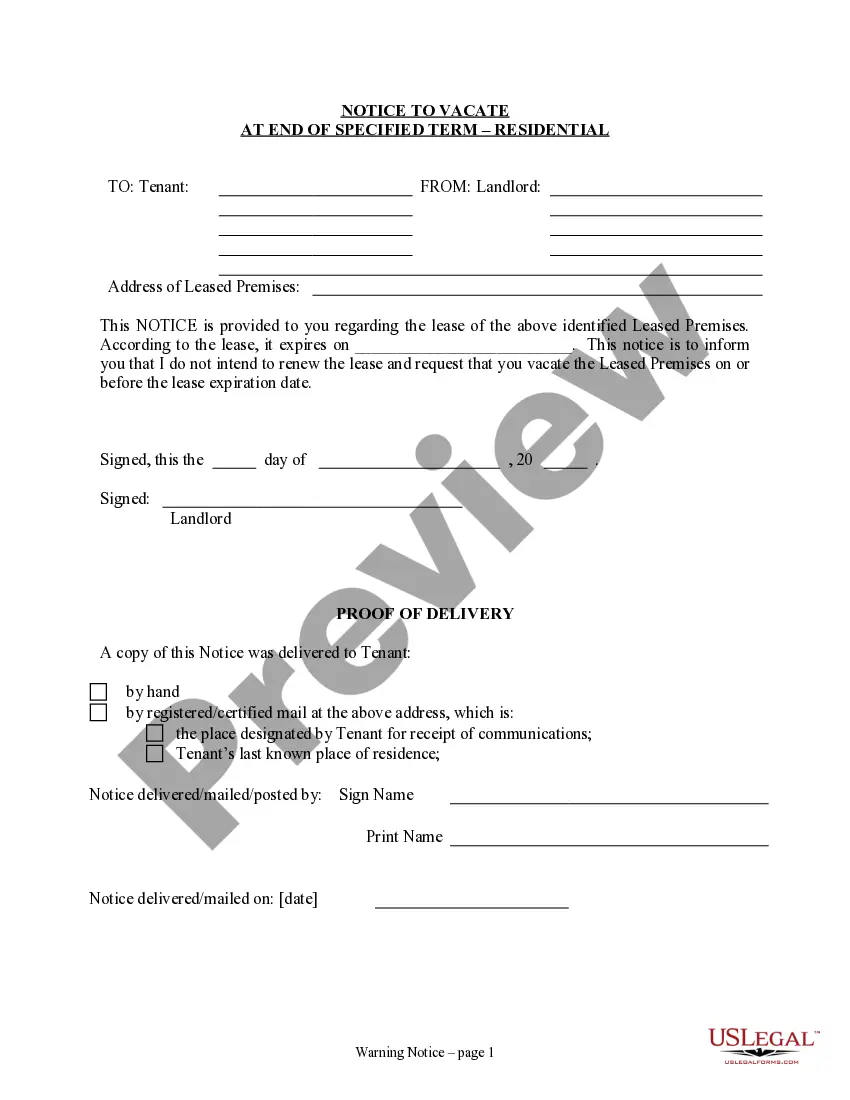

How to fill out Retirement Plan Transfer Agreement For The Motorola, Inc. Pension Plan?

You can spend hours on the web trying to find the legitimate papers format that suits the state and federal requirements you need. US Legal Forms offers 1000s of legitimate varieties which are examined by experts. You can actually download or produce the Maine Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan from our services.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Download button. Next, you are able to full, modify, produce, or sign the Maine Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan. Every single legitimate papers format you get is your own property forever. To get yet another duplicate of the acquired kind, visit the My Forms tab and then click the related button.

If you are using the US Legal Forms web site initially, keep to the basic directions below:

- Very first, make certain you have selected the proper papers format for your region/metropolis that you pick. Read the kind description to make sure you have selected the appropriate kind. If available, take advantage of the Review button to check with the papers format as well.

- If you want to locate yet another model in the kind, take advantage of the Look for industry to get the format that fits your needs and requirements.

- After you have identified the format you would like, click on Acquire now to proceed.

- Pick the rates strategy you would like, key in your qualifications, and register for a free account on US Legal Forms.

- Complete the transaction. You should use your Visa or Mastercard or PayPal bank account to pay for the legitimate kind.

- Pick the structure in the papers and download it to your gadget.

- Make modifications to your papers if necessary. You can full, modify and sign and produce Maine Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan.

Download and produce 1000s of papers themes while using US Legal Forms website, that provides the most important selection of legitimate varieties. Use specialist and condition-particular themes to deal with your company or individual demands.

Form popularity

FAQ

Saving Matters! Start saving, keep saving, and stick to. Know your retirement needs. ... Contribute to your employer's retirement. Learn about your employer's pension plan. ... Consider basic investment principles. ... Don't touch your retirement savings. ... Ask your employer to start a plan. ... Put money into an Individual Retirement.

The Employee Benefits Security Administration of the Department of Labor is responsible for administering and enforcing the provisions of Employee Retirement Income Security Act. ERISA covers most private sector pension plans.

Prudential then became responsible for providing retirement benefits to approximately 30,000 Motorola retirees.

Both the employer and employee usually contribute to the pension plan, though the employer is the pension plan administrator who manages the fund.

Retirement Income Varies Widely By State StateAverage Retirement IncomeCalifornia$34,737Colorado$32,379Connecticut$32,052Delaware$31,28347 more rows ?

Retirement planning starts with thinking about your retirement goals and how long you have to meet them. Then you need to look at the types of retirement accounts that can help you raise the money to fund your future. As you save that money, you have to invest it to enable it to grow.

The board of administration is responsible for the management and control of CalPERS. The board has exclusive control of the administration and investment of funds, including and not limited to: Public Employees' Retirement Fund (PERF) California Employers' Pension Prefunding Trust Fund (CEPPT)

In the augmented balance sheet model of pension finance, the stockholders own the assets in the pension plan. In the group model, the employees and the stockholders share ownership of these assets.

Let's say you consider yourself the typical retiree. Between you and your spouse, you currently have an annual income of $120,000. Based on the 80% principle, you can expect to need about $96,000 in annual income after you retire, which is $8,000 per month.

Simply put, the rule suggests that for every $1,000 of monthly income you wish for in retirement, you need to save $240,000.