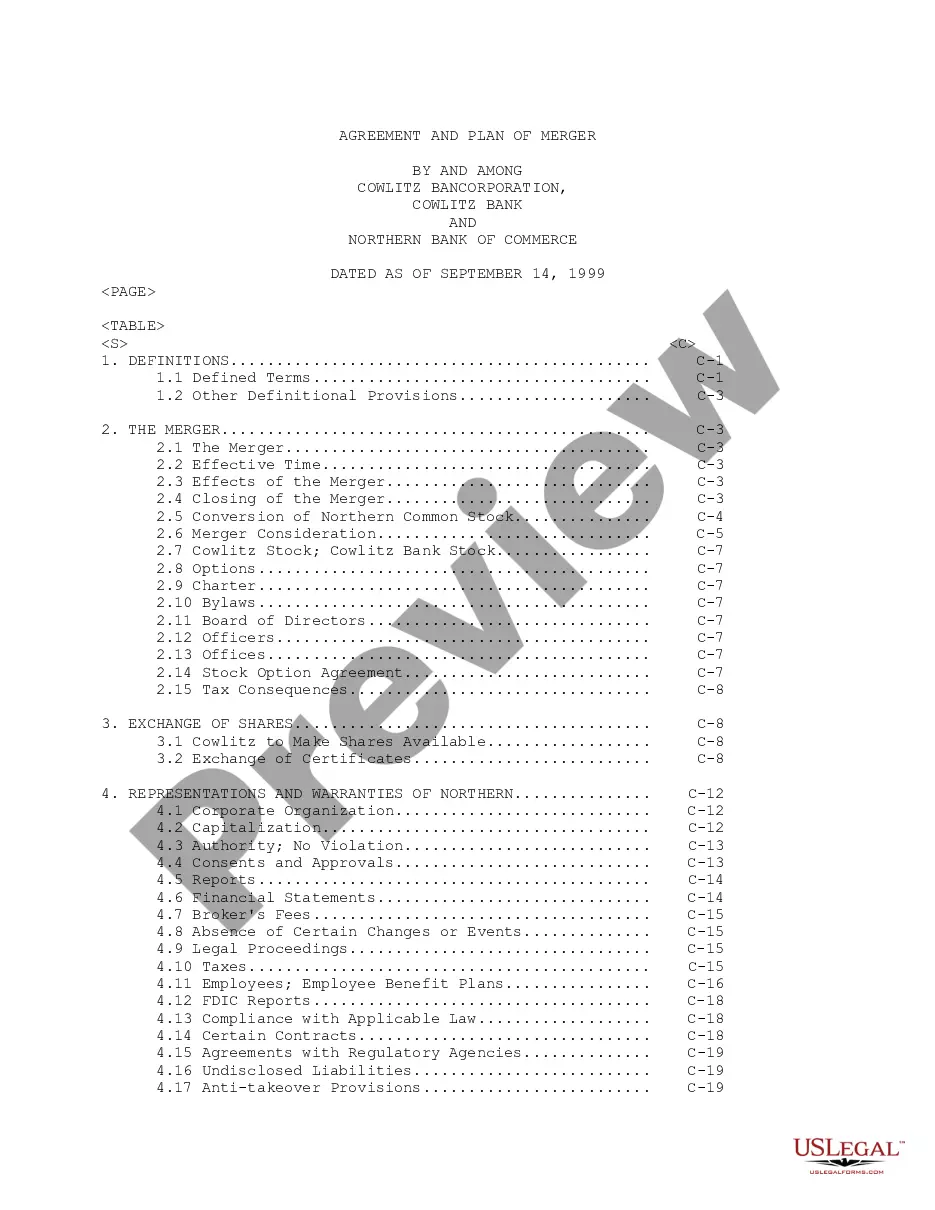

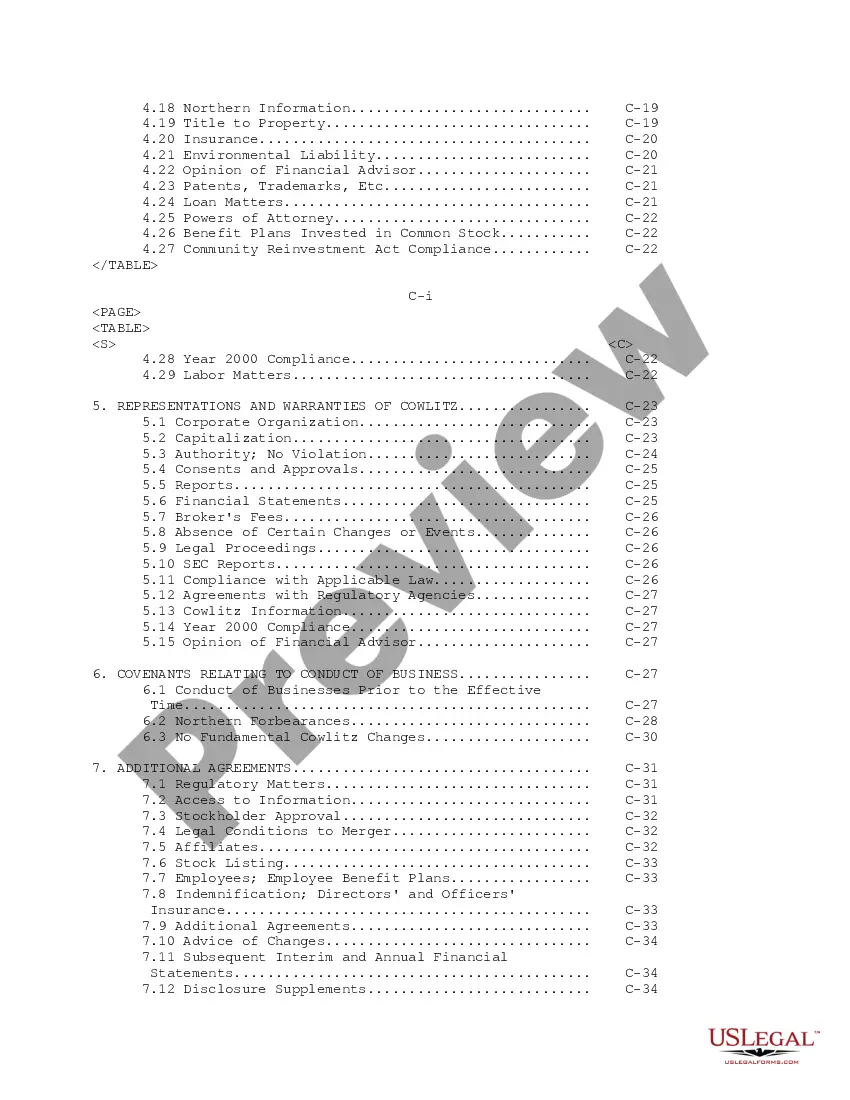

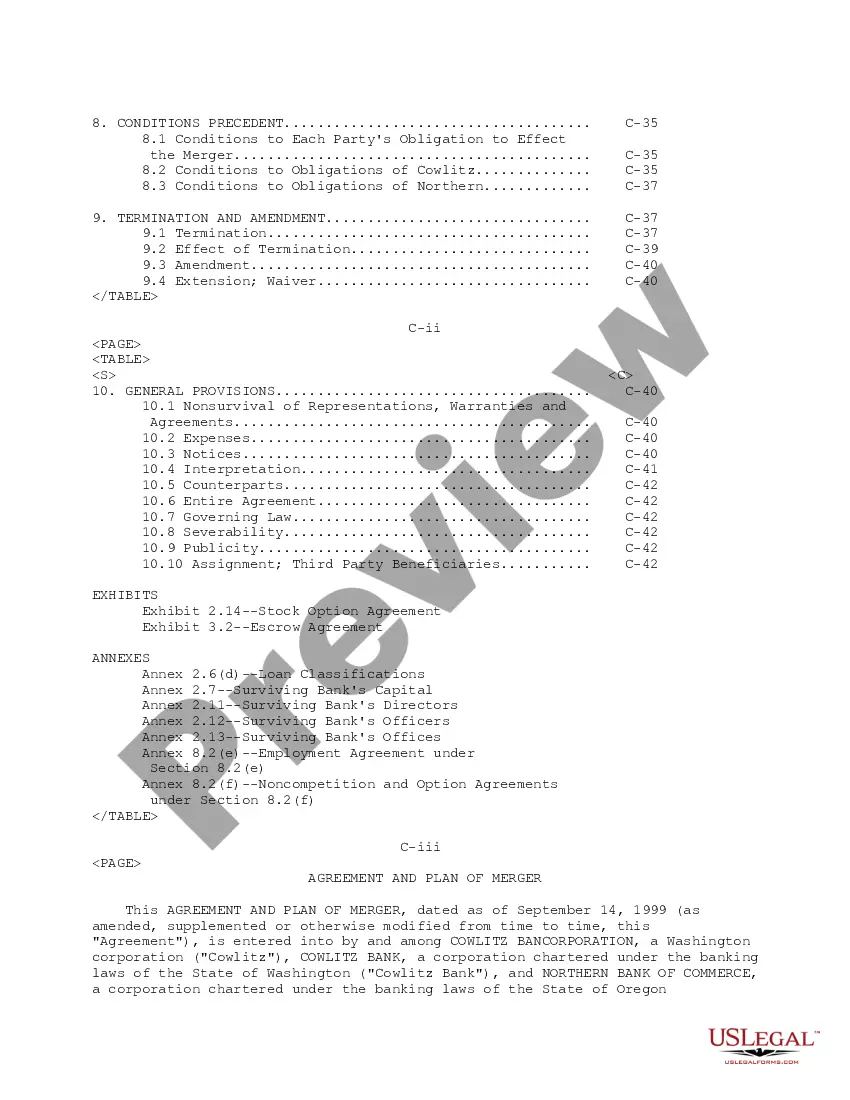

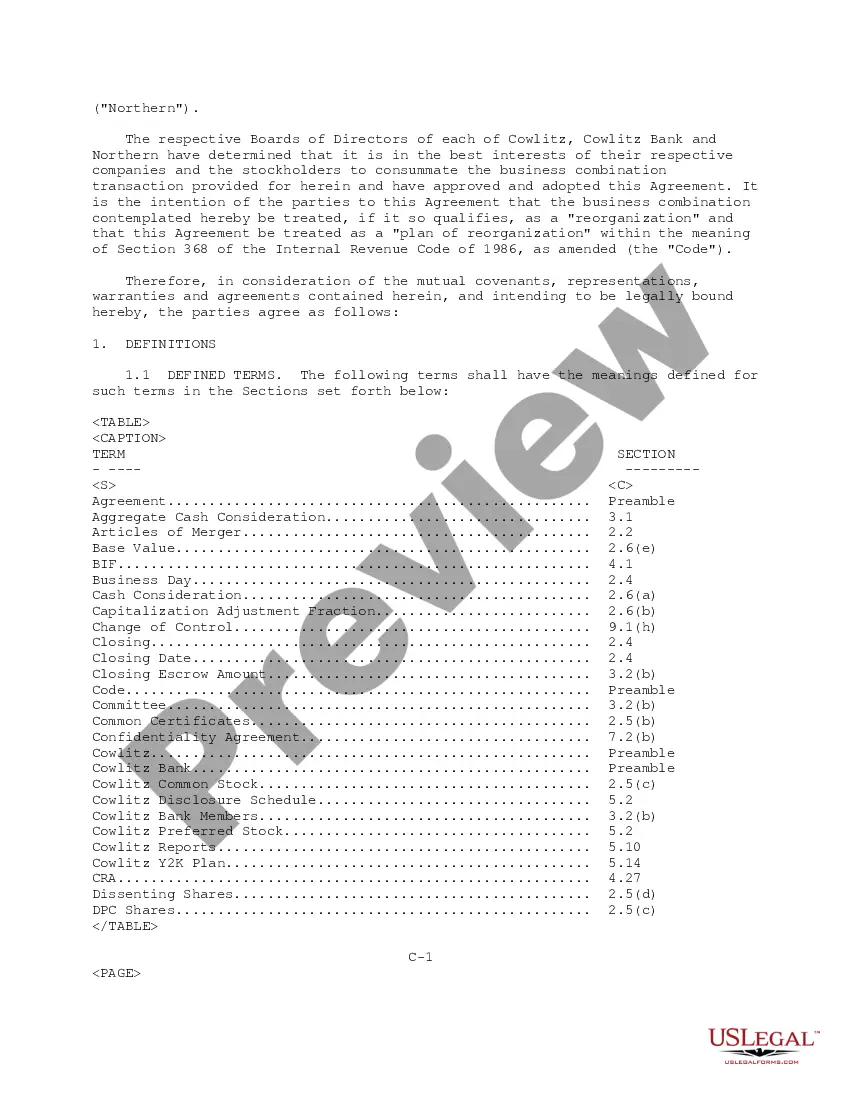

Maine Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce

Description

How to fill out Plan Of Merger Between Cowlitz Bancorporation, Cowlitz Bank And Northern Bank Of Commerce?

Are you presently in the placement where you require paperwork for either organization or personal purposes almost every day time? There are tons of authorized document layouts available on the net, but finding kinds you can depend on is not simple. US Legal Forms gives a huge number of develop layouts, much like the Maine Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce, which can be published to satisfy state and federal demands.

When you are currently knowledgeable about US Legal Forms site and possess a free account, merely log in. Afterward, it is possible to down load the Maine Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce template.

Unless you provide an bank account and would like to begin to use US Legal Forms, follow these steps:

- Find the develop you want and ensure it is for the appropriate city/county.

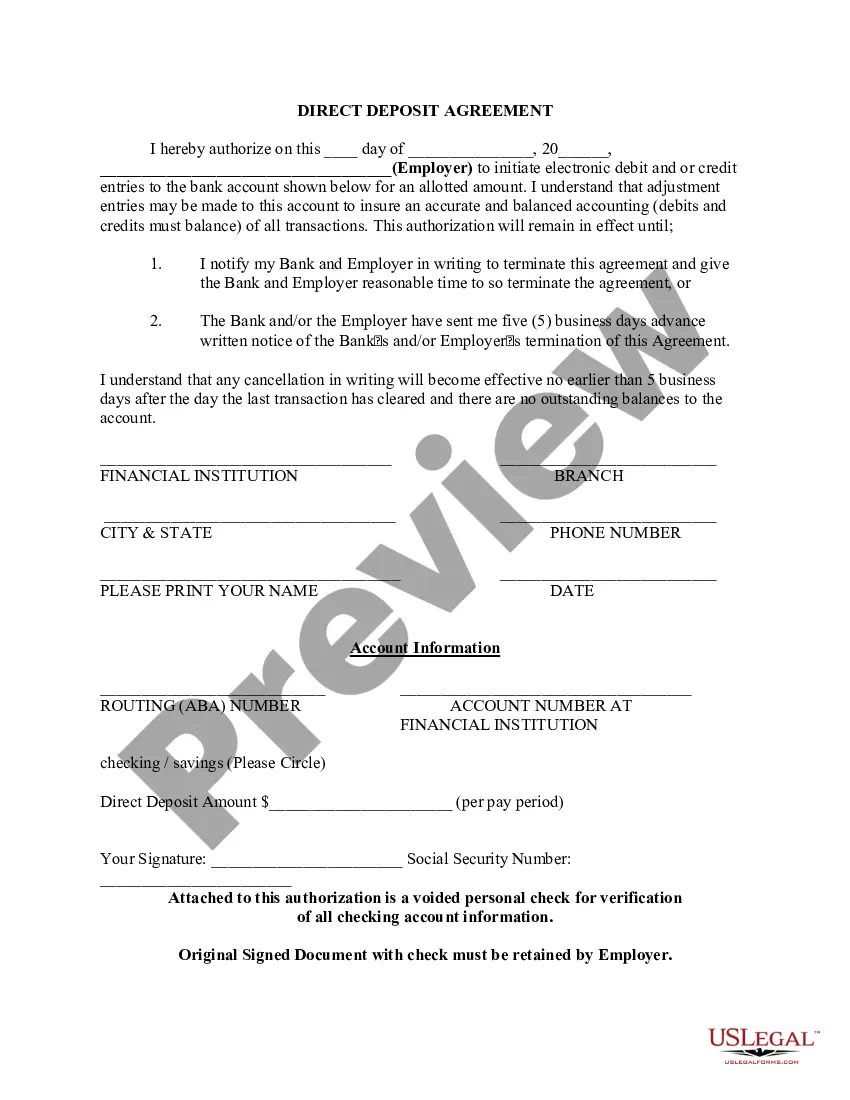

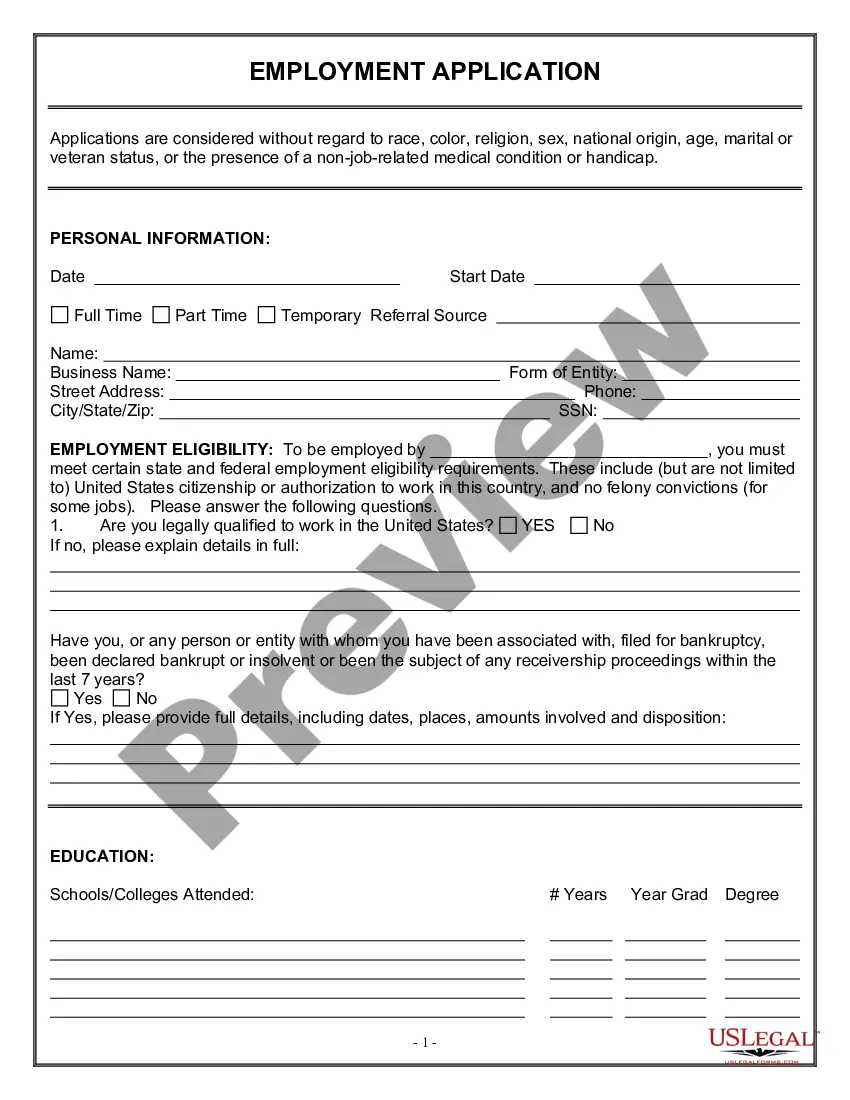

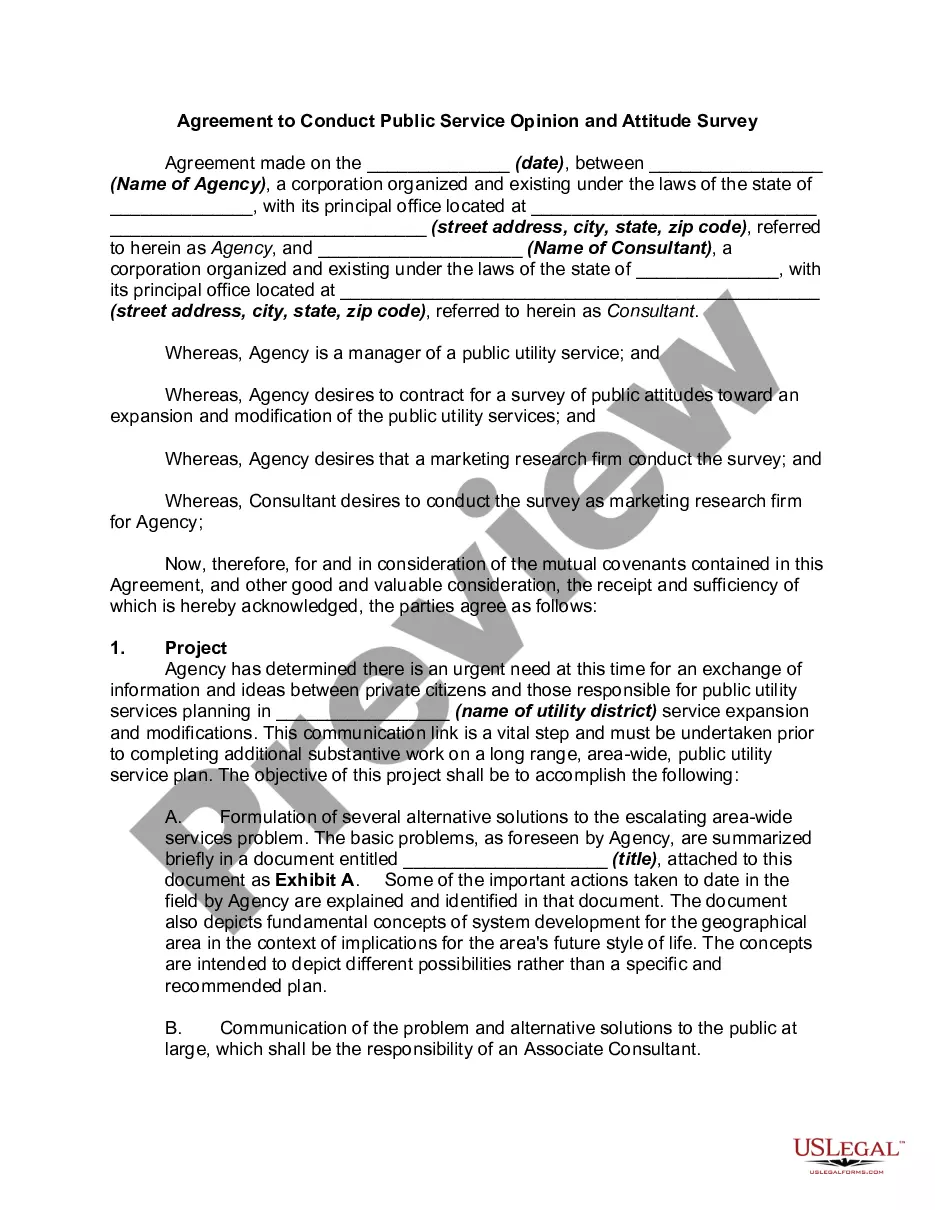

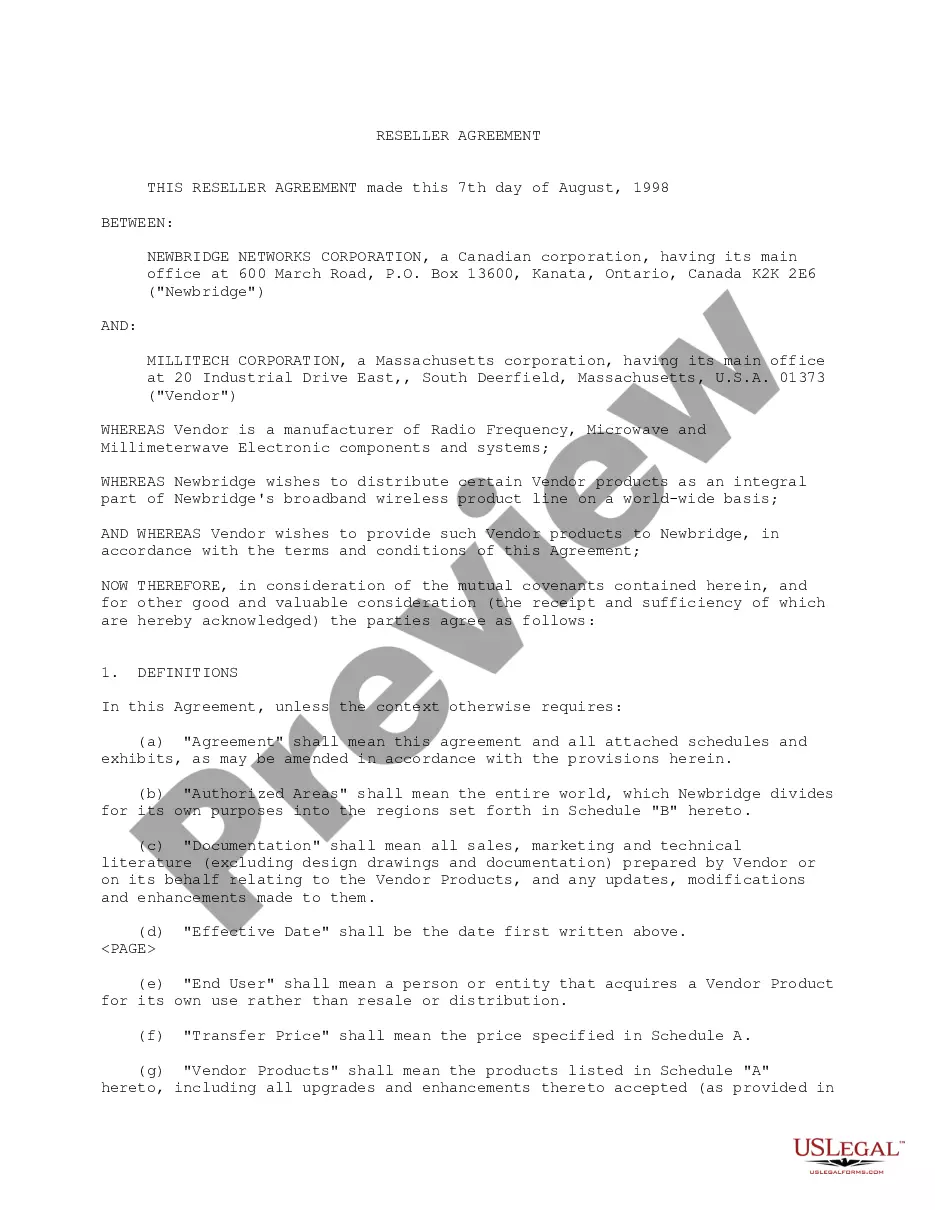

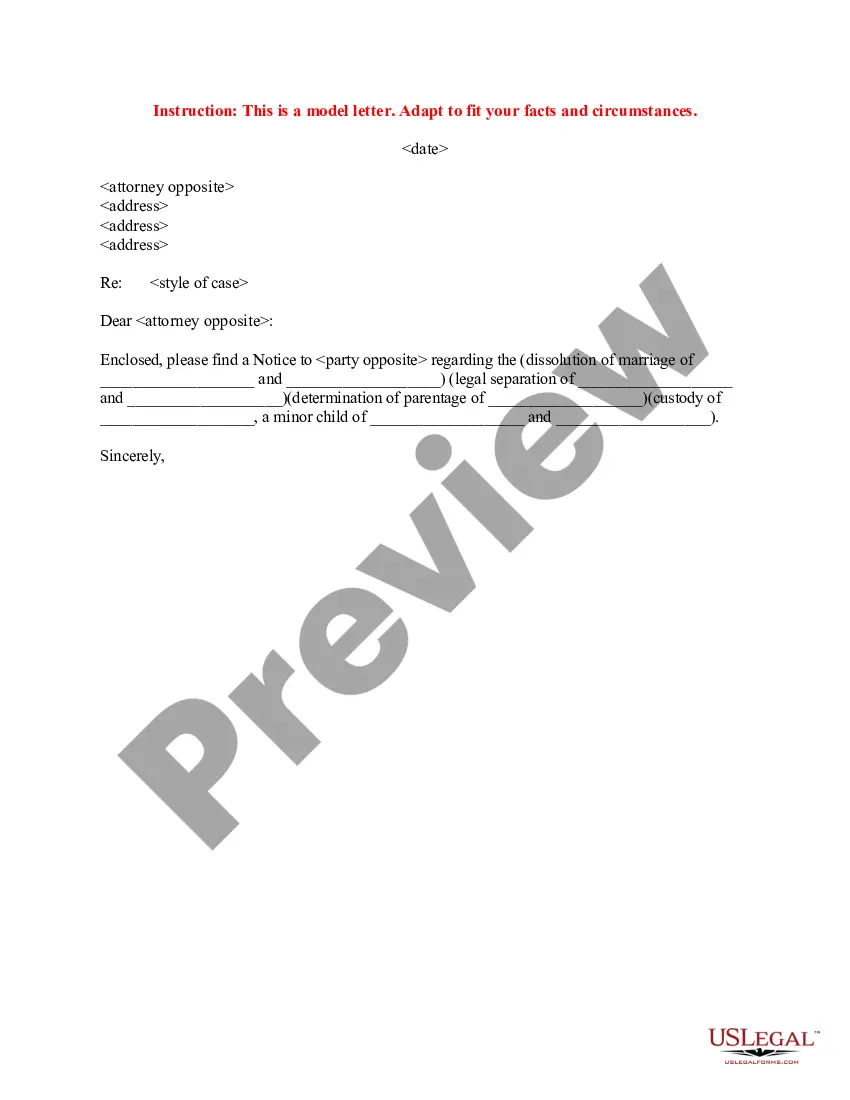

- Utilize the Review button to review the form.

- Read the outline to ensure that you have selected the proper develop.

- When the develop is not what you`re looking for, make use of the Search area to get the develop that meets your needs and demands.

- Whenever you find the appropriate develop, click on Buy now.

- Opt for the rates plan you need, submit the specified information and facts to create your money, and pay for the order with your PayPal or credit card.

- Choose a convenient paper file format and down load your duplicate.

Discover all of the document layouts you might have purchased in the My Forms menu. You can obtain a more duplicate of Maine Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce any time, if needed. Just click the required develop to down load or print the document template.

Use US Legal Forms, probably the most substantial variety of authorized forms, in order to save time and stay away from faults. The service gives expertly created authorized document layouts which you can use for a selection of purposes. Create a free account on US Legal Forms and initiate creating your daily life a little easier.