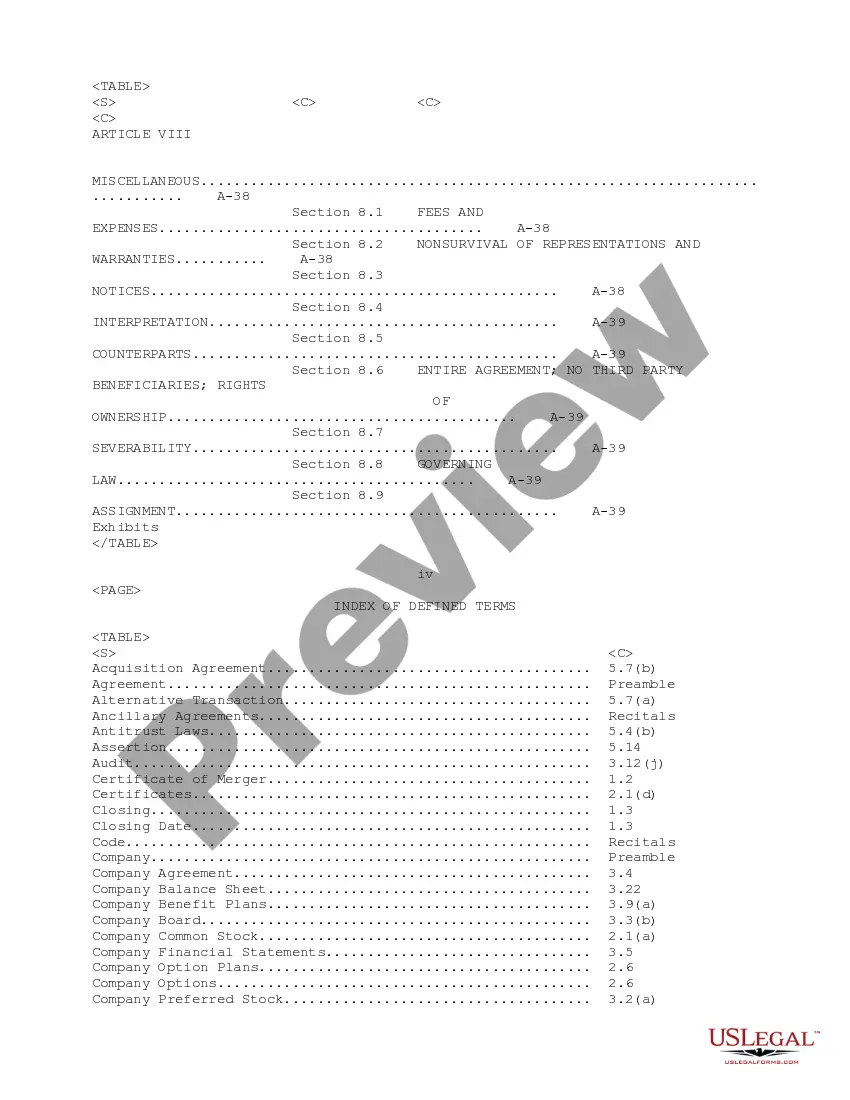

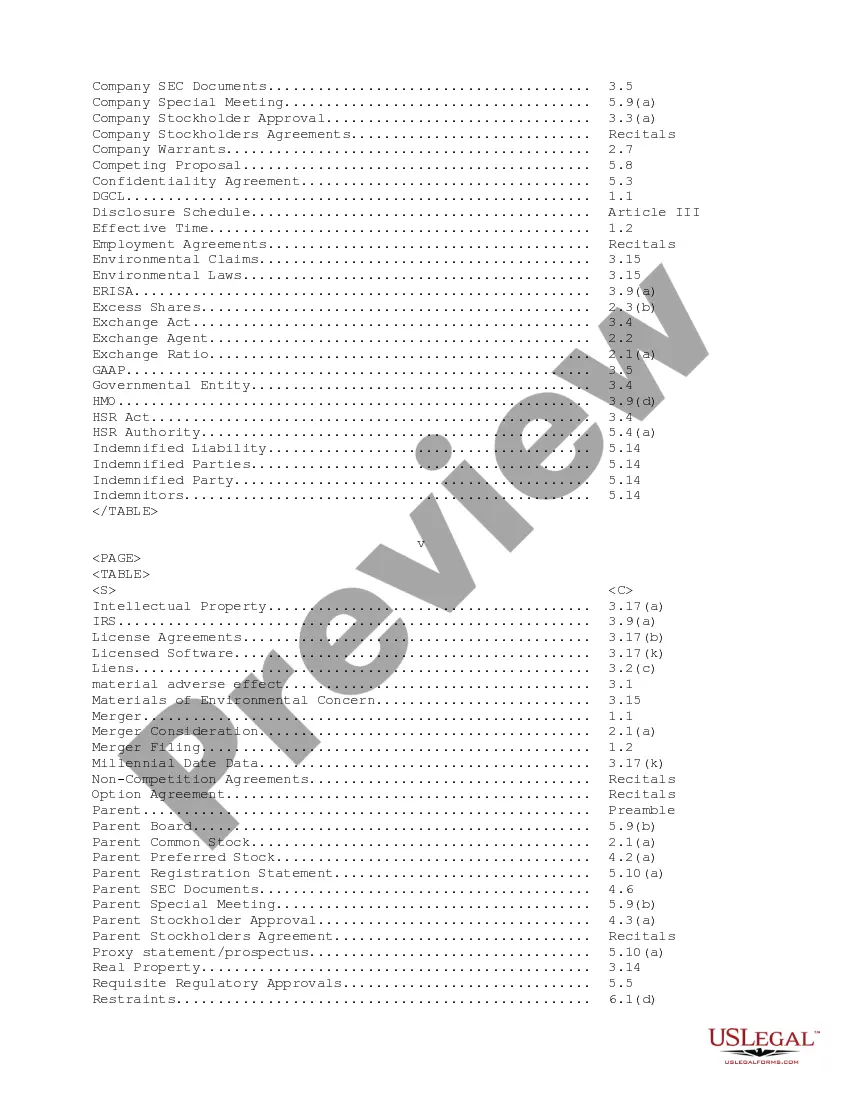

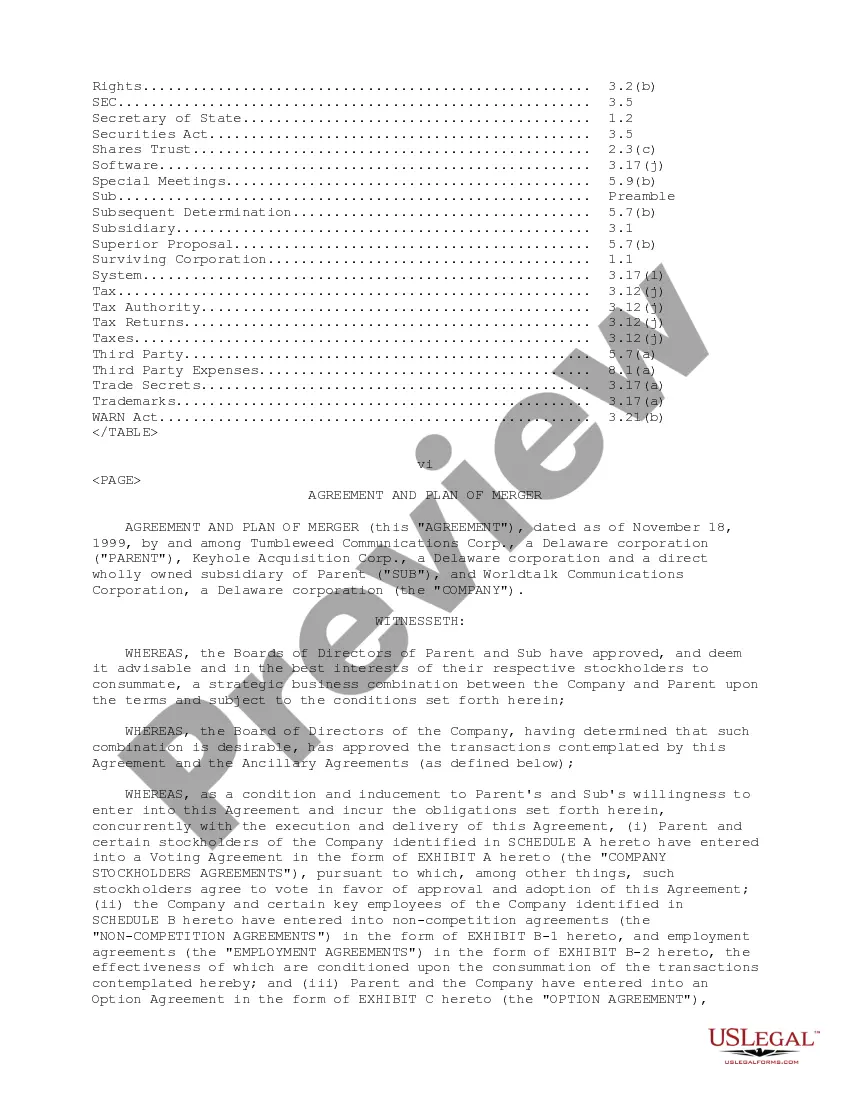

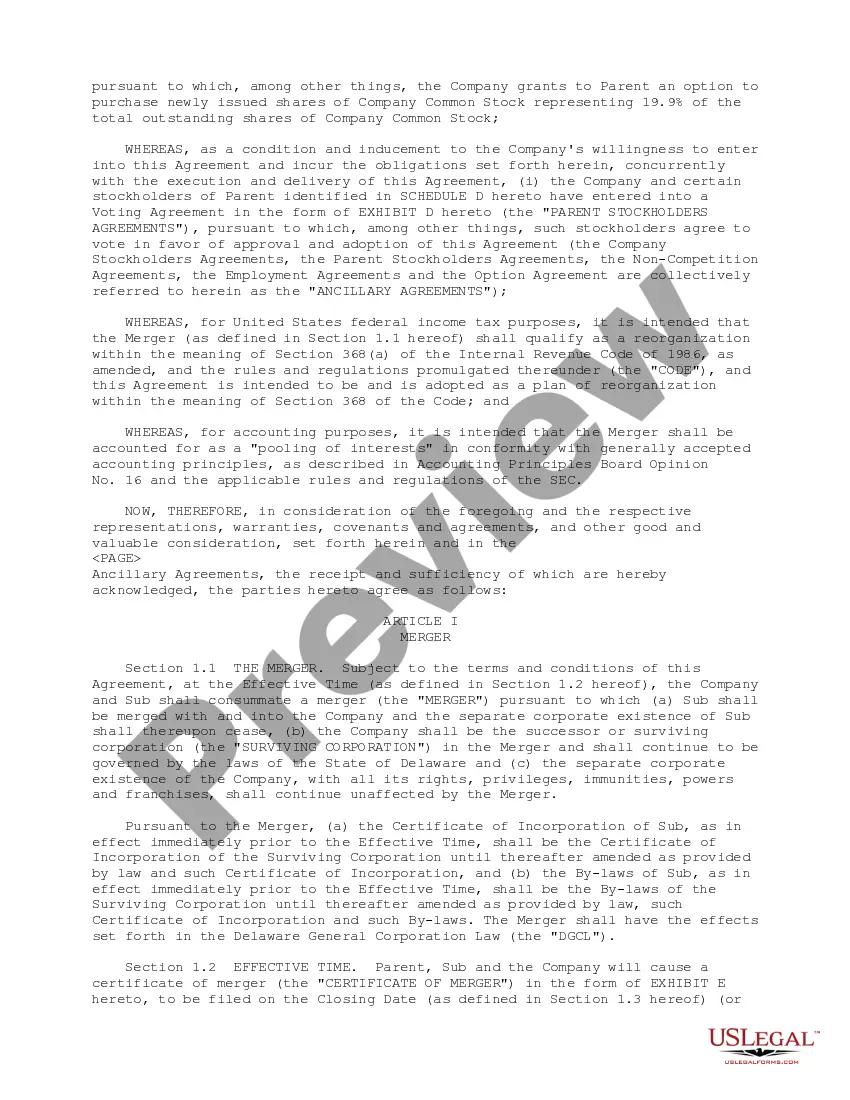

Maine Plan of Merger between Tumbleweed Communications Corp., Keyhole Acquisition Corp. and Worldtalk Communications Corp.

Description

How to fill out Plan Of Merger Between Tumbleweed Communications Corp., Keyhole Acquisition Corp. And Worldtalk Communications Corp.?

Are you within a place that you need to have papers for sometimes business or individual uses almost every working day? There are plenty of lawful record themes available on the net, but discovering kinds you can depend on isn`t simple. US Legal Forms delivers thousands of develop themes, much like the Maine Plan of Merger between Tumbleweed Communications Corp., Keyhole Acquisition Corp. and Worldtalk Communications Corp., that are composed in order to meet federal and state specifications.

When you are currently acquainted with US Legal Forms site and get an account, simply log in. Following that, you are able to obtain the Maine Plan of Merger between Tumbleweed Communications Corp., Keyhole Acquisition Corp. and Worldtalk Communications Corp. template.

Unless you come with an bank account and would like to start using US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is to the right metropolis/state.

- Use the Preview option to analyze the shape.

- Read the outline to ensure that you have chosen the proper develop.

- In case the develop isn`t what you`re seeking, take advantage of the Look for discipline to get the develop that fits your needs and specifications.

- Whenever you get the right develop, click on Buy now.

- Choose the prices prepare you desire, submit the desired info to make your money, and pay money for an order using your PayPal or credit card.

- Decide on a handy document structure and obtain your copy.

Locate each of the record themes you might have purchased in the My Forms food list. You can obtain a extra copy of Maine Plan of Merger between Tumbleweed Communications Corp., Keyhole Acquisition Corp. and Worldtalk Communications Corp. anytime, if possible. Just select the required develop to obtain or print out the record template.

Use US Legal Forms, probably the most substantial variety of lawful varieties, to save time and avoid errors. The services delivers appropriately made lawful record themes which you can use for an array of uses. Generate an account on US Legal Forms and initiate making your daily life easier.