The Maine Stock Exchange Agreement and Plan of Reorganization by Benson International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders is an important legal document that outlines the terms and conditions of a merger or acquisition between these entities. This agreement aims to facilitate the seamless transfer of stock ownership and ensure the smooth integration of operations. In its simplest form, the Maine Stock Exchange Agreement and Plan of Reorganization involves the exchange of stock between Benson International, Inc. and Multimedia K.I.D. Intelligence in Education, Ltd., with the approval and participation of the respective stockholders. This transaction can take various forms, each with its own specific characteristics: 1. Cash-for-Stock Agreement: This type of agreement entails one party exchanging cash for stocks of the other party. It is usually utilized when either Benson International, Inc. or Multimedia K.I.D. Intelligence in Education, Ltd. wishes to acquire a majority ownership stake in the other. 2. Stock-for-Stock Agreement: In this scenario, both entities agree to exchange their stocks based on a predetermined ratio. This type of agreement is often employed when both Benson International, Inc. and Multimedia K.I.D. Intelligence in Education, Ltd. aim to merge and create a stronger combined entity. 3. Stock-for-Assets Agreement: This type of agreement involves the exchange of stocks by Benson International, Inc. and/or Multimedia K.I.D. Intelligence in Education, Ltd. in return for certain assets owned by either party. This arrangement may be beneficial when one entity possesses valuable assets that the other desires to acquire. The Maine Stock Exchange Agreement and Plan of Reorganization is a complex legal document that includes detailed provisions regarding stock valuation, exchange ratios, stockholder approval processes, and the governance structure of the newly formed entity. This agreement aims to protect the interests of both Benson International, Inc. and Multimedia K.I.D. Intelligence in Education, Ltd., as well as their respective stockholders, by ensuring a fair and transparent transaction. It is important that all parties involved thoroughly understand the terms of the Maine Stock Exchange Agreement and Plan of Reorganization before entering into such a transaction. It is advisable to seek legal expertise to facilitate the drafting and review of this agreement, as it plays a crucial role in shaping the future of the entities involved and their stockholders.

Maine Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders

Description

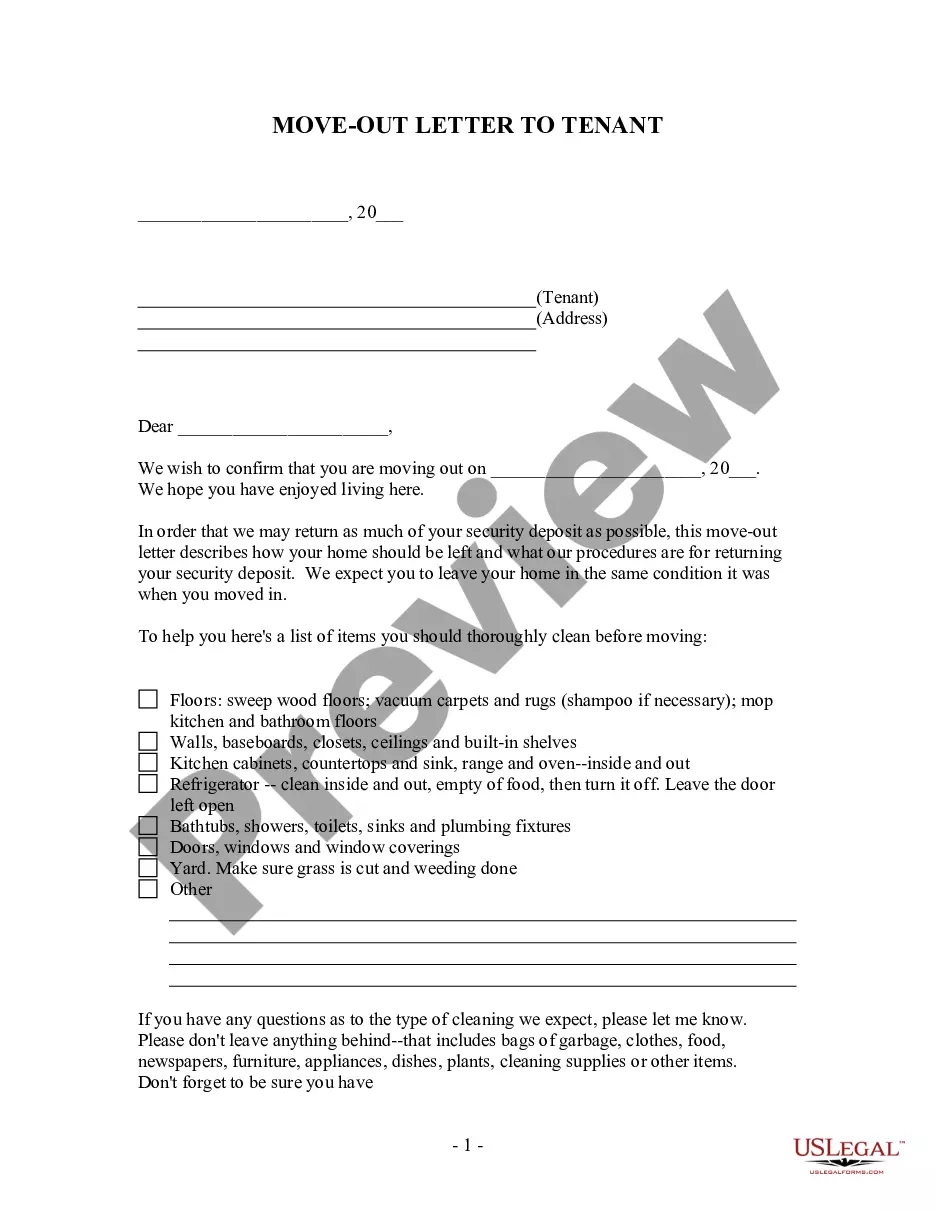

How to fill out Stock Exchange Agreement And Plan Of Reorganization By Jenkon International, Inc., Multimedia K.I.D. Intelligence In Education, Ltd., And Stockholders?

Are you within a situation where you need to have paperwork for possibly organization or personal reasons virtually every working day? There are tons of authorized document layouts available on the Internet, but locating kinds you can rely is not straightforward. US Legal Forms provides a large number of develop layouts, like the Maine Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders, which are written to satisfy state and federal specifications.

Should you be already familiar with US Legal Forms site and possess an account, merely log in. Following that, it is possible to down load the Maine Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders format.

If you do not provide an bank account and need to start using US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is for that appropriate metropolis/region.

- Make use of the Preview key to analyze the form.

- Look at the explanation to actually have selected the proper develop.

- When the develop is not what you`re seeking, make use of the Look for field to discover the develop that suits you and specifications.

- When you discover the appropriate develop, simply click Get now.

- Choose the costs program you need, fill out the necessary details to produce your money, and buy your order with your PayPal or Visa or Mastercard.

- Select a practical document structure and down load your version.

Get all of the document layouts you possess purchased in the My Forms menu. You can obtain a additional version of Maine Stock Exchange Agreement and Plan of Reorganization by Jenkon International, Inc., Multimedia K.I.D. Intelligence in Education, Ltd., and Stockholders at any time, if needed. Just click the essential develop to down load or produce the document format.

Use US Legal Forms, the most comprehensive collection of authorized types, in order to save efforts and avoid mistakes. The assistance provides expertly created authorized document layouts which can be used for a variety of reasons. Produce an account on US Legal Forms and commence producing your daily life a little easier.