The Maine Administration Agreement between EPSF Advisors, Inc. and Third Avenue Trust establishes a comprehensive framework for the retention of EPSF Advisors, Inc. to provide administrative services related to investment. This agreement outlines the terms and conditions under which EPSF will render its services, ensuring a smooth and efficient handling of the investment process. With the keywords "Maine Administration Agreement," "EPSF Advisors, Inc.," "Third Avenue Trust," "retaining," "administrative services," and "investment," let's dive into the detailed description of this agreement. The purpose of the Maine Administration Agreement is to define the responsibilities, obligations, and rights of both parties involved. EPSF Advisors, Inc. is a reputable firm specializing in investment administration, while Third Avenue Trust acts as the beneficiary of EPSF's administrative services. As per the agreement, EPSF Advisors, Inc. undertakes various administrative functions to support Third Avenue Trust's investment activities. These include, but are not limited to, custodial services, documentation management, record-keeping, compliance monitoring, data reporting, transaction processing, and assisting with regulatory filings. The agreement ensures that EPSF Advisors, Inc. maintains a high level of professionalism, competence, and diligence in delivering administrative services to Third Avenue Trust. EPSF commits to employing qualified personnel with expertise in investment administration, ensuring that all tasks are executed accurately and efficiently within agreed-upon timelines. Under the Maine Administration Agreement, clear guidelines are established regarding the fees and compensation for EPSF's services. The agreement lays out the payment structure, including the frequency and manner of remuneration. It also outlines the conditions and terms for any changes in fees, adjustments, or modifications to the compensation arrangement. Additionally, the agreement highlights the mechanisms for resolving disputes that may arise between the parties. It may include provisions for mediation, arbitration, or other forms of alternative dispute resolution to ensure a fair and efficient resolution process. Different types of Maine Administration Agreements between EPSF Advisors, Inc. and Third Avenue Trust may be classified based on specific investment strategies, asset classes, or geographical locations. For instance, there could be separate agreements governing equity investments, fixed-income portfolios, real estate assets, international investments, or alternative investment strategies. In summary, the Maine Administration Agreement between EPSF Advisors, Inc. and Third Avenue Trust enables the efficient and effective delivery of administrative services relating to investment. It establishes a strong foundation for collaboration, ensuring that both parties fulfill their obligations to maintain a successful investment management process.

Maine Administration Agreement between EQSF Advisors, Inc. and Third Avenue Trust regarding retaining EQSF to render administrative services with respect to investment

Description

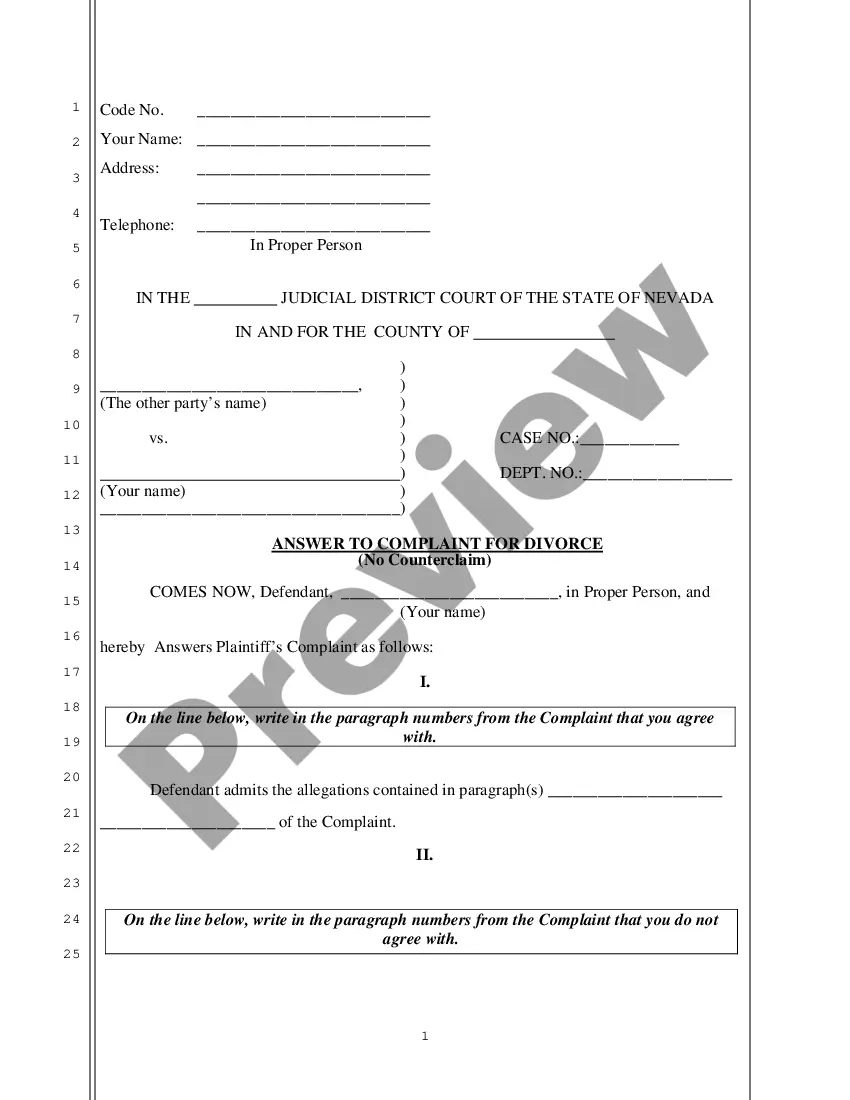

How to fill out Administration Agreement Between EQSF Advisors, Inc. And Third Avenue Trust Regarding Retaining EQSF To Render Administrative Services With Respect To Investment?

Choosing the best legal file design might be a have a problem. Naturally, there are a variety of themes accessible on the Internet, but how will you obtain the legal kind you require? Use the US Legal Forms site. The support provides a large number of themes, for example the Maine Administration Agreement between EQSF Advisors, Inc. and Third Avenue Trust regarding retaining EQSF to render administrative services with respect to investment, that you can use for organization and private requirements. All of the types are examined by professionals and fulfill federal and state specifications.

In case you are currently signed up, log in to your accounts and click on the Obtain option to have the Maine Administration Agreement between EQSF Advisors, Inc. and Third Avenue Trust regarding retaining EQSF to render administrative services with respect to investment. Utilize your accounts to check through the legal types you might have bought in the past. Proceed to the My Forms tab of the accounts and have an additional duplicate of the file you require.

In case you are a fresh customer of US Legal Forms, here are basic instructions that you can comply with:

- Very first, make certain you have chosen the correct kind for your personal city/state. You may check out the form making use of the Preview option and study the form outline to guarantee it will be the right one for you.

- When the kind will not fulfill your preferences, take advantage of the Seach field to get the right kind.

- When you are certain that the form is suitable, select the Buy now option to have the kind.

- Pick the pricing program you need and type in the required info. Make your accounts and pay money for the transaction utilizing your PayPal accounts or credit card.

- Pick the document format and down load the legal file design to your device.

- Comprehensive, revise and print and sign the acquired Maine Administration Agreement between EQSF Advisors, Inc. and Third Avenue Trust regarding retaining EQSF to render administrative services with respect to investment.

US Legal Forms may be the greatest catalogue of legal types where you can find various file themes. Use the company to down load skillfully-manufactured documents that comply with status specifications.