Maine Special Delivery - Special Offer Agreement

Description

How to fill out Special Delivery - Special Offer Agreement?

Have you been in the placement the place you need to have documents for possibly company or personal purposes almost every day time? There are tons of legitimate document layouts available online, but finding kinds you can depend on is not straightforward. US Legal Forms gives 1000s of form layouts, such as the Maine Special Delivery - Special Offer Agreement, that are published to meet state and federal specifications.

When you are currently familiar with US Legal Forms site and have your account, just log in. Afterward, you are able to obtain the Maine Special Delivery - Special Offer Agreement design.

Unless you provide an profile and need to begin using US Legal Forms, follow these steps:

- Discover the form you require and make sure it is to the proper area/area.

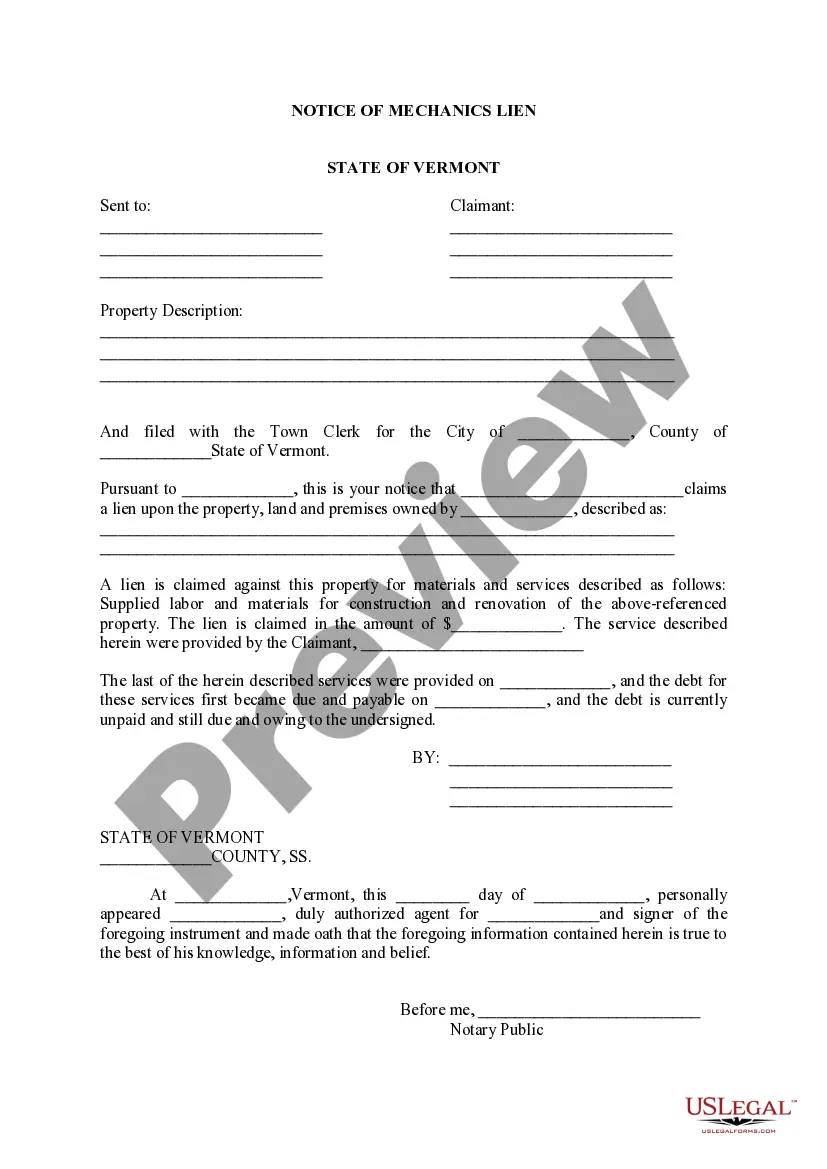

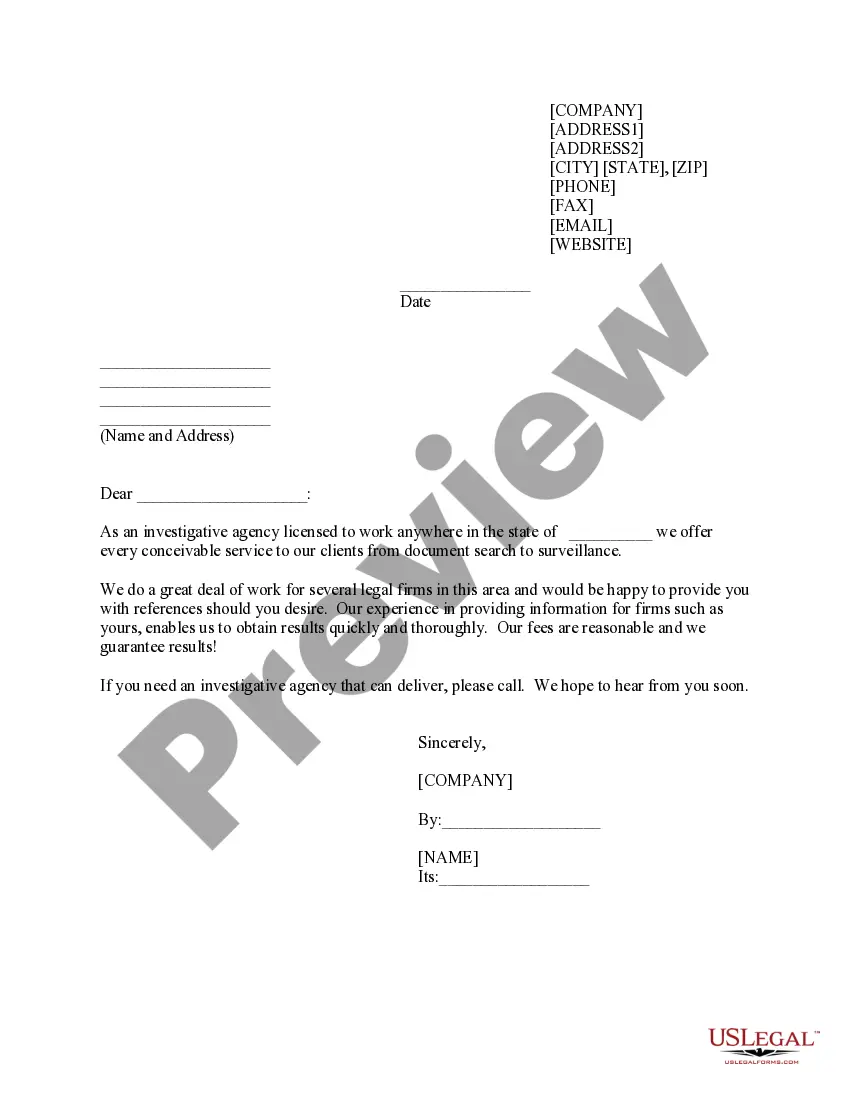

- Utilize the Preview key to analyze the shape.

- Read the outline to actually have selected the proper form.

- In the event the form is not what you`re looking for, make use of the Search area to get the form that suits you and specifications.

- Once you find the proper form, click on Acquire now.

- Choose the prices program you need, fill out the required details to make your bank account, and purchase the order making use of your PayPal or credit card.

- Select a practical paper structure and obtain your copy.

Get every one of the document layouts you possess purchased in the My Forms food list. You may get a additional copy of Maine Special Delivery - Special Offer Agreement whenever, if possible. Just select the required form to obtain or print out the document design.

Use US Legal Forms, probably the most substantial selection of legitimate varieties, in order to save time and stay away from errors. The assistance gives professionally made legitimate document layouts which can be used for a range of purposes. Create your account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

The majority of states (Arkansas, Connecticut, Georgia, Illinois, Kansas, Kentucky, Michigan, Mississippi, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Washington, West Virginia and ...

In addition, Maine has a service provider tax, which is imposed at a rate of 6%. Here are some examples of taxable services in Maine: Lodging rentals in a hotel, rooming house, tourist or trailer camp. Car rentals or leases, including trucks or vans with a gross weight of less than 26,000 pounds.

Maine considers ?grocery staples? to be exempt from sales tax. Maine law defines grocery staples as ?food products ordinarily consumed for human nourishment.? Examples of food staples under Maine law include: fruit, vegetables, fish, meat, dairy, bread, breakfast cereal, canned and boxed food products, and condiments.

Maine resale certificates are only to be used when a purchaser intends to resell tangible property. A valid certificate must include the name and address of the purchaser. It should also include the purchaser's account ID or federal employer identification number (EIN).

Delivery charges for orders you haul to your customers with your own vehicle may be subject to sales tax if the order is paid for on receipt at the customer's address. If the customer has taken possession at your location (i.e., prepaid), the delivery charges are not subject to sales tax.

Sourcing sales tax: understanding which rate to apply California is a modified origin-based state: State, county, and city taxes are based on the ship-from address, but district taxes are based on the ship-to address.

Taxable and exempt shipping charges Maine sales tax may apply to charges for shipping, handling, delivery, freight, and postage. For the most part, separately stated charges are exempt if the shipment goes straight to the buyer via common carrier, contract carrier, or USPS.

You can apply for a Maine Sales Tax Exemption in the Maine Tax Portal by clicking here, navigate to the Business panel, and selecting the Exemptions link. If you are unable to apply using the Maine Tax Portal, you can click on the application number next to the type of organization to download an application form.