Maine Investment Agreement is a legally binding contract that outlines the terms and conditions regarding the purchase of shares of common stock in a company located in the state of Maine, USA. This agreement serves as a crucial document for both the investor and the company, providing a comprehensive framework for the investment transaction while safeguarding the rights and obligations of all parties involved. The Maine Investment Agreement typically contains essential information such as the names and addresses of the parties involved, the number and type of shares being purchased, the purchase price per share, and the total investment amount. It also specifies the closing date of the transaction and the methods of payment accepted. One crucial aspect of this agreement is the representation and warranties section, which outlines the assurances made by both the investor and the company. This section often covers aspects such as the company's legal status, authority to issue shares, absence of any conflicting agreements or obligations, and the accuracy of the provided information. Another critical component is the conditions precedent section, which lists the conditions that must be fulfilled by both parties before the investment can be completed. These conditions may include obtaining necessary regulatory approvals, conducting due diligence, or finalizing any required legal documentation. Additionally, the Maine Investment Agreement may include provisions related to the rights and obligations of the investor, including voting rights, information rights, restrictions on transferability of shares, and potential exit strategies. Different types of Maine Investment Agreements may exist based on the specific characteristics of the investment transaction or the parties involved. For example, an agreement may differentiate between an initial investment agreement and subsequent funding rounds, specifying different terms and conditions for each stage. It is also possible to have variations in agreements depending on whether the investment is made by an individual investor, a venture capital firm, or an institutional investor. In summary, a Maine Investment Agreement is a detailed document that outlines the terms and conditions regarding the purchase of shares of common stock in a Maine-based company. It plays a crucial role in providing legal protection and clarity for all parties involved in the investment transaction.

Maine Investment Agreement regarding the purchase of shares of common stock

Description

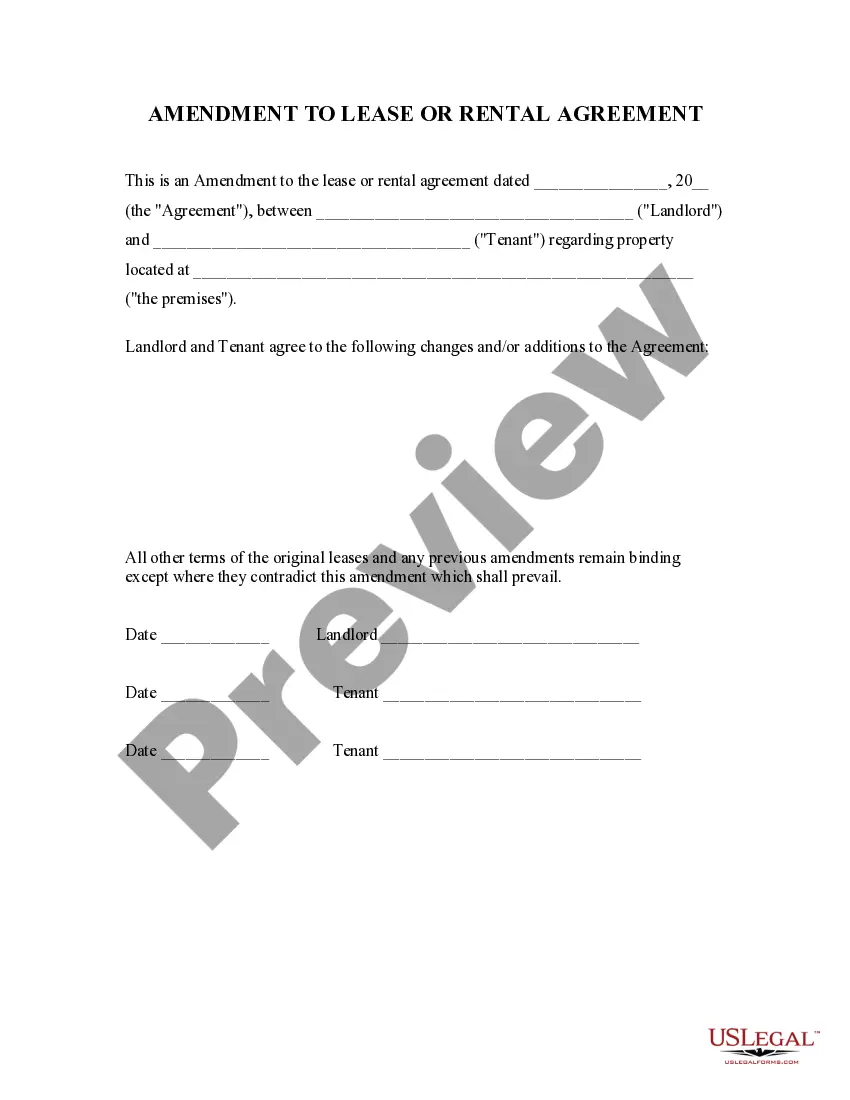

How to fill out Maine Investment Agreement Regarding The Purchase Of Shares Of Common Stock?

You may spend several hours on the Internet attempting to find the legitimate file format which fits the federal and state needs you will need. US Legal Forms gives a huge number of legitimate forms that are analyzed by experts. It is simple to acquire or print the Maine Investment Agreement regarding the purchase of shares of common stock from my assistance.

If you have a US Legal Forms profile, you are able to log in and click on the Acquire key. Next, you are able to complete, modify, print, or signal the Maine Investment Agreement regarding the purchase of shares of common stock. Every legitimate file format you acquire is your own for a long time. To have yet another version associated with a bought form, proceed to the My Forms tab and click on the corresponding key.

If you use the US Legal Forms internet site initially, keep to the simple recommendations beneath:

- First, make sure that you have selected the proper file format for that state/city of your choosing. Read the form description to ensure you have selected the correct form. If accessible, make use of the Preview key to appear from the file format too.

- If you would like find yet another variation of your form, make use of the Look for area to get the format that meets your requirements and needs.

- After you have located the format you need, just click Buy now to continue.

- Find the prices strategy you need, type your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can use your credit card or PayPal profile to purchase the legitimate form.

- Find the structure of your file and acquire it to your device.

- Make modifications to your file if required. You may complete, modify and signal and print Maine Investment Agreement regarding the purchase of shares of common stock.

Acquire and print a huge number of file templates making use of the US Legal Forms web site, which provides the largest variety of legitimate forms. Use specialist and express-specific templates to take on your organization or person requirements.

Form popularity

FAQ

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity.

An investment agreement is a legally binding contract between two or more parties that outlines the terms and conditions of an investment arrangement.

executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures.

How to draft a contract agreement Check out the parties. Come to an agreement on the terms. Specify the length of the contract. Spell out the consequences. Determine how you would resolve any disputes. Think about confidentiality. Check the contract's legality. Open it up to negotiation.

Writing an investment contract can be simplified by examining related samples and including all the content listed below: The names and addresses of interested parties. The general investment structure. Purpose of the investment. Effective date agreed upon. Signatures by both/all parties.

How to buy a common stock Step 1 ? select an online broker. One of the easiest ways to buy common stocks is through an online broker. ... Step 2 ? choose an account. ... Step 3 ? research the company(s) you want to invest in. ... Step 4 ? place the trade.

Here are some common stock market investing strategies: Buy-and-hold investing. Buy-and-hold investing is the simplest and lowest-risk strategy for long-term investors. ... Swing trading. ... Day trading. ... Dividend stocks. ... Stock funds.

An example would be if Dexter gives $100,000 to ABC (company) in exchange for a convertible debt note that will either be repaid in 1 year with 50% gain or converted into 100,000 shares of the company's stock.