Maine Term Sheet — Series A Preferred Stock Financing of a Company is a legal document that outlines the terms and conditions agreed upon between an investor and a company during a Series A funding round. This financing option is commonly used by startups and early-stage companies to raise capital for growth and expansion. The term sheet for Series A Preferred Stock Financing in Maine typically includes the following key elements: 1. Investment Amount: The main term sheet specifies the amount of investment sought by the company and the portion of that investment to be allocated to preferred stock. 2. Valuation: The term sheet outlines the pre-money valuation of the company, which determines the monetary worth of the business before the investment is made. This valuation helps determine the percentage of ownership the investor will have in the company. 3. Liquidation Preference: The preferred stockholders are typically given a liquidation preference, ensuring that they receive a specific amount of the proceeds from a sale or liquidation before common stockholders. 4. Dividend Provisions: The term sheet may detail the dividend arrangements for preferred stockholders, including any cumulative or non-cumulative dividends. 5. Anti-dilution Protection: This provision protects the investor from dilution of their ownership percentage in the event of future down-rounds, wherein the company receives capital at a lower valuation than the previous round. 6. Conversion Rights: Series A Preferred Stockholders often have the option to convert their preferred shares into common shares if certain predetermined conditions are met, such as an IPO or an acquisition. 7. Board of Directors: The term sheet may include provisions regarding the composition of the company's board of directors. Investors often seek representation or observer rights to participate in key decision-making processes. It's important to note that while these elements are generally found in most Series A Preferred Stock Financing term sheets in Maine, each agreement can be unique and tailored to the specific needs and goals of the investors and the company. Other variations of term sheets related to preferred stock financing may include: 1. Maine Term Sheet — Series Seed Preferred Stock Financing: This is an earlier stage financing round compared to Series A, typically undertaken by startups raising their first significant round of external funding. The terms and conditions of a Series Seed term sheet are usually more founder-friendly and less complex than those of a Series A term sheet. 2. Maine Term Sheet — Series B Preferred Stock Financing: This type of term sheet relates to subsequent funding rounds after Series A. Series B financing usually occurs when a company has shown growth and needs additional capital to expand its operations, develop new products, or enter new markets. 3. Maine Term Sheet — Series C Preferred Stock Financing: This type of term sheet represents additional funding rounds after Series B financing. Series C can happen when a company aims to achieve certain milestones, explore mergers and acquisitions, or expand into new territories. It is crucial for both parties involved, the company and the investor, to carefully review and negotiate the terms of the term sheet before moving forward with the preferred stock financing round. Consulting legal professionals well-versed in corporate finance is highly recommended ensuring compliance with applicable laws and to protect the interests of both parties.

Maine Term Sheet - Series A Preferred Stock Financing of a Company

Description

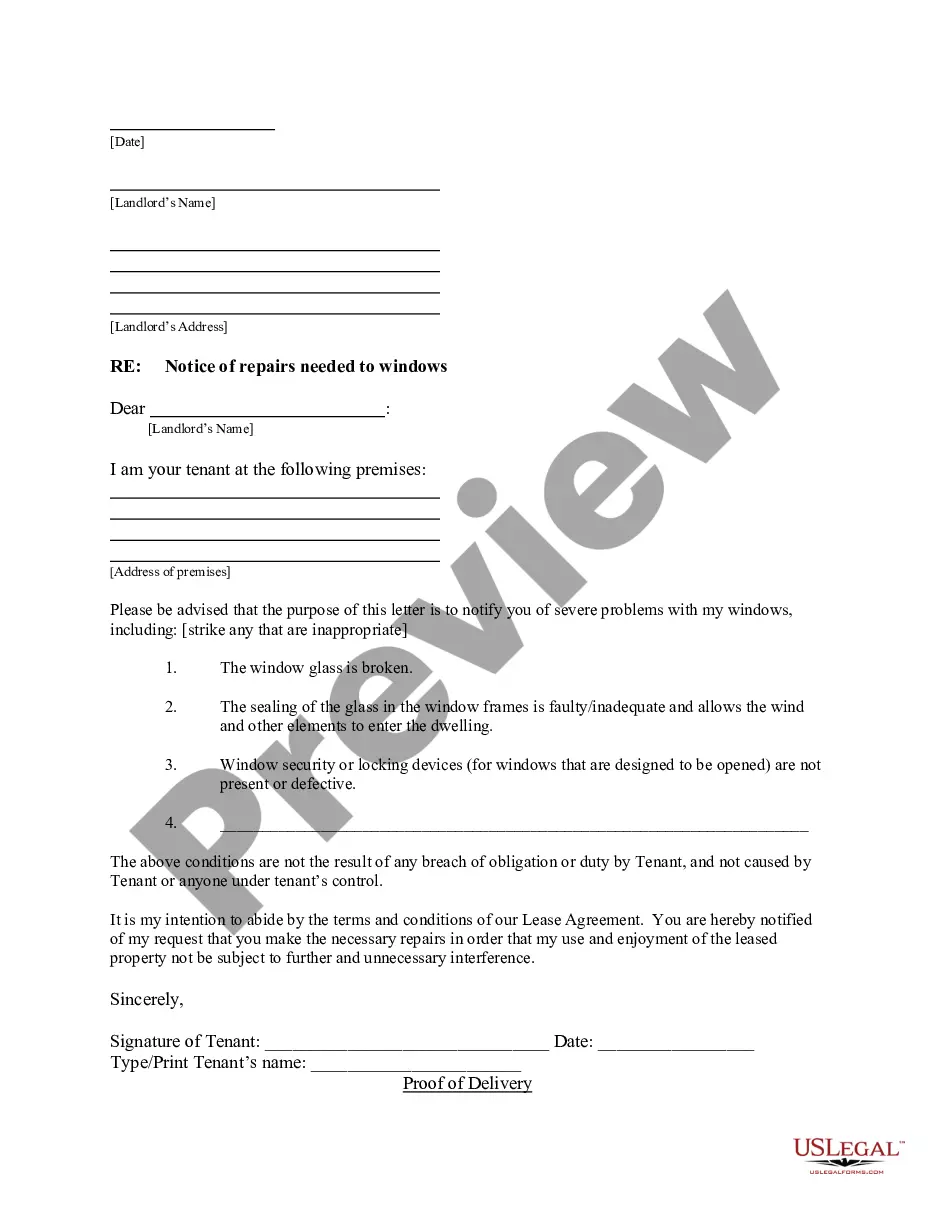

How to fill out Maine Term Sheet - Series A Preferred Stock Financing Of A Company?

You are able to spend hrs on-line searching for the lawful document template that meets the federal and state specifications you need. US Legal Forms provides a huge number of lawful varieties which can be evaluated by experts. You can actually download or print out the Maine Term Sheet - Series A Preferred Stock Financing of a Company from your services.

If you have a US Legal Forms account, it is possible to log in and then click the Down load switch. Next, it is possible to full, edit, print out, or sign the Maine Term Sheet - Series A Preferred Stock Financing of a Company. Every lawful document template you get is yours permanently. To acquire yet another duplicate associated with a acquired type, proceed to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms web site initially, follow the basic recommendations listed below:

- Very first, be sure that you have selected the best document template for that state/area that you pick. Read the type description to ensure you have selected the proper type. If readily available, take advantage of the Preview switch to look from the document template as well.

- If you would like find yet another variation from the type, take advantage of the Lookup area to find the template that meets your needs and specifications.

- Upon having located the template you desire, simply click Get now to carry on.

- Find the prices strategy you desire, type in your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You can utilize your credit card or PayPal account to fund the lawful type.

- Find the structure from the document and download it to your device.

- Make modifications to your document if needed. You are able to full, edit and sign and print out Maine Term Sheet - Series A Preferred Stock Financing of a Company.

Down load and print out a huge number of document layouts utilizing the US Legal Forms Internet site, which offers the most important collection of lawful varieties. Use expert and state-specific layouts to handle your organization or specific requirements.