To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

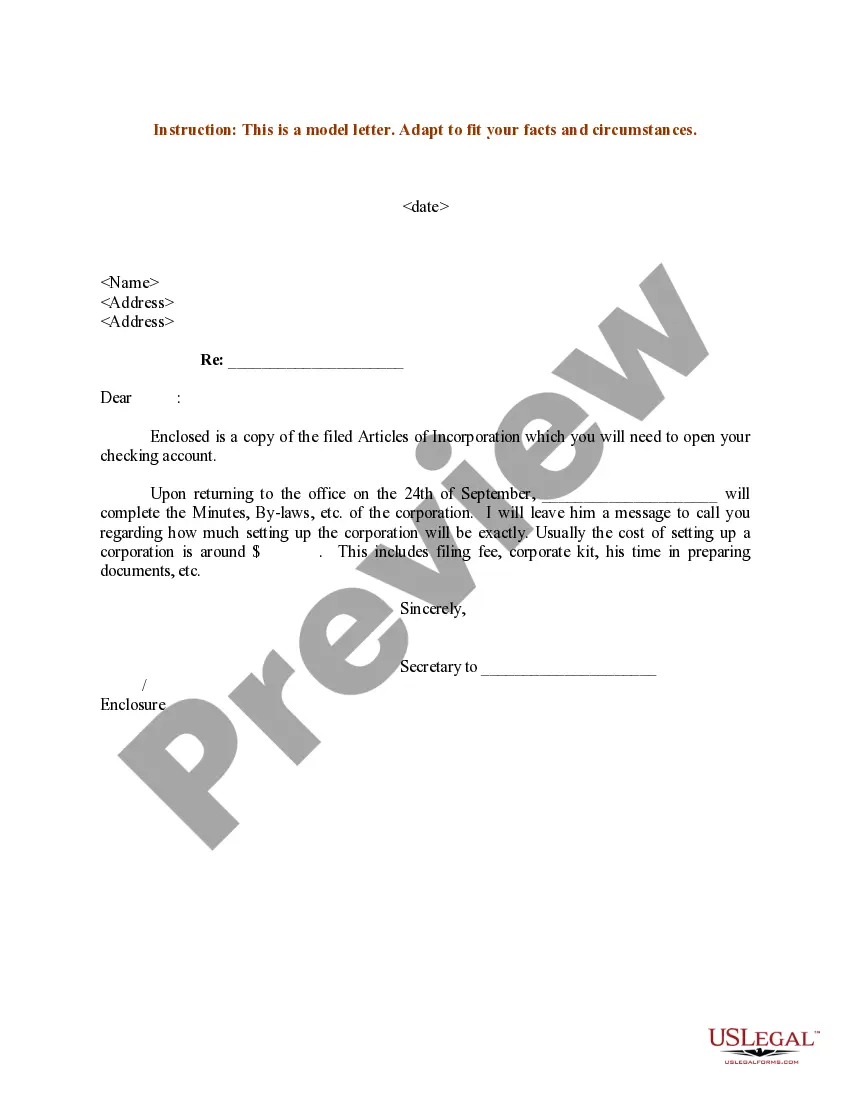

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

Maine Accredited Investor Certification is a designation issued by the state of Maine to individuals who meet the criteria as set forth by the Maine Office of Securities. This certification is essential for individuals who wish to invest in certain types of private securities offerings or participate in investment opportunities that are restricted to accredited investors. To obtain the Maine Accredited Investor Certification, individuals must meet specific requirements outlined by the Maine Uniform Securities Act (MUST). The main requirement is to meet the definition of an accredited investor as defined in Rule 501 of Regulation D under the Securities Act of 1933, imposed by the U.S. Securities and Exchange Commission (SEC). The certification process involves completing an application, providing relevant documentation, and meeting certain financial thresholds to demonstrate qualification as an accredited investor. Maine recognizes various types of accredited investors, including: 1. High Net Worth Individuals: Individuals with a net worth exceeding $1 million (excluding their primary residence) or an individual with an income of at least $200,000 ($300,000 if married) for the past two years and expected to maintain the same income level in the current year. 2. Entities: Certain entities, such as banks, insurance companies, registered investment companies, charitable organizations, corporations, partnerships, and limited liability companies, may also qualify as accredited investors based on their size or composition. 3. Knowledgeable Employees: Employees of a private fund who actively participate in its investment activities and possess knowledge and experience related to the fund's investment strategies. Once certified as an accredited investor in Maine, individuals gain the ability to participate in private offerings, venture capital investments, hedge funds, and other investment opportunities that are restricted to accredited investors. They may also receive additional investor protections, as these offerings often carry a higher degree of risk and are exempt from certain SEC registration requirements. It is crucial to note that the Maine Accredited Investor Certification is specific to the state of Maine and its regulations. While it aligns with the SEC's definition of an accredited investor, only individuals who meet the state's criteria can receive this certification. In summary, Maine Accredited Investor Certification provides individuals with the official recognition as an accredited investor under Maine's securities regulations. By meeting the necessary criteria and obtaining this certification, investors can access exclusive investment opportunities that are typically unavailable to the public.