Maine Accredited Investor Suitability

Description

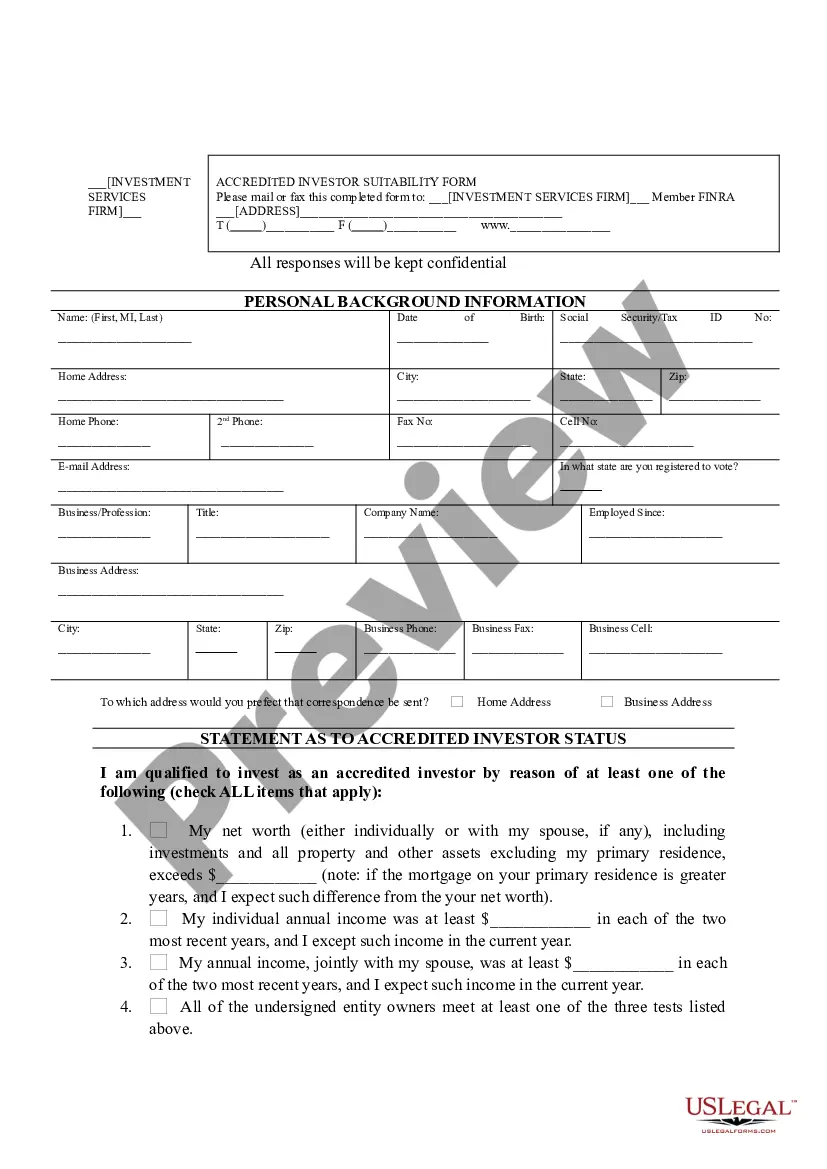

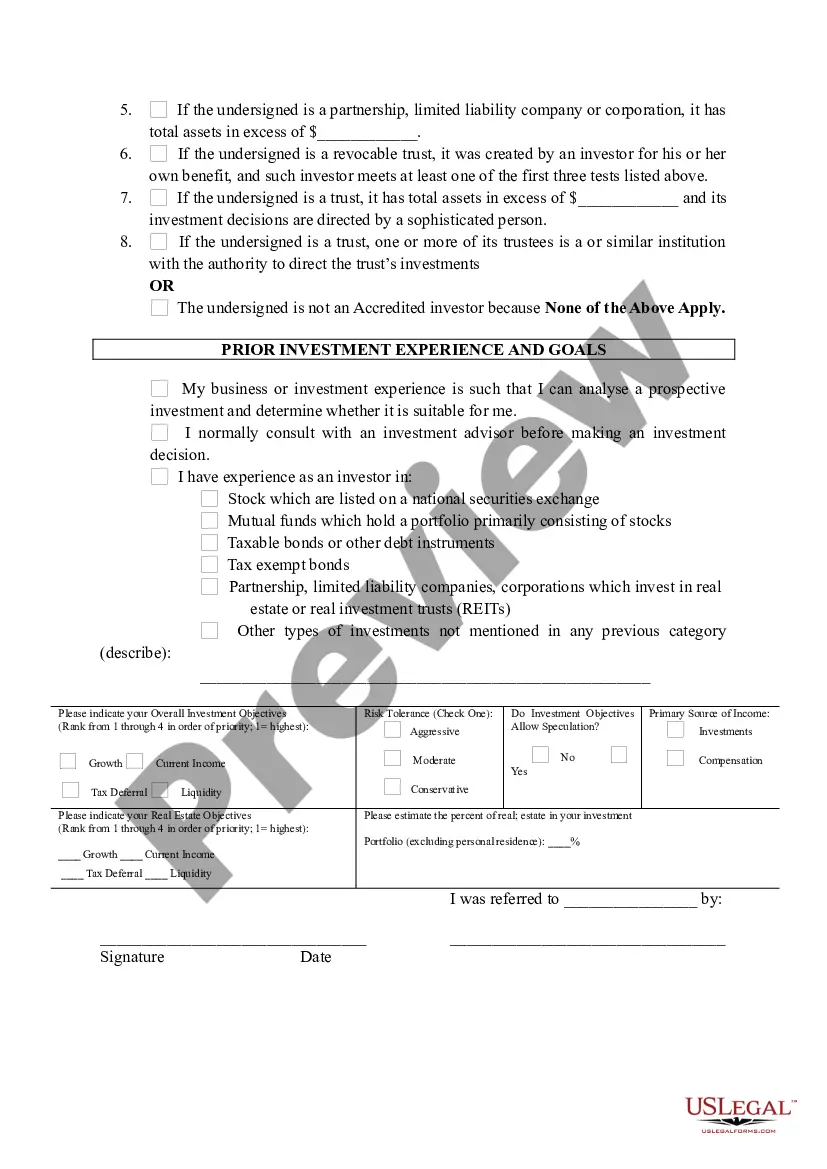

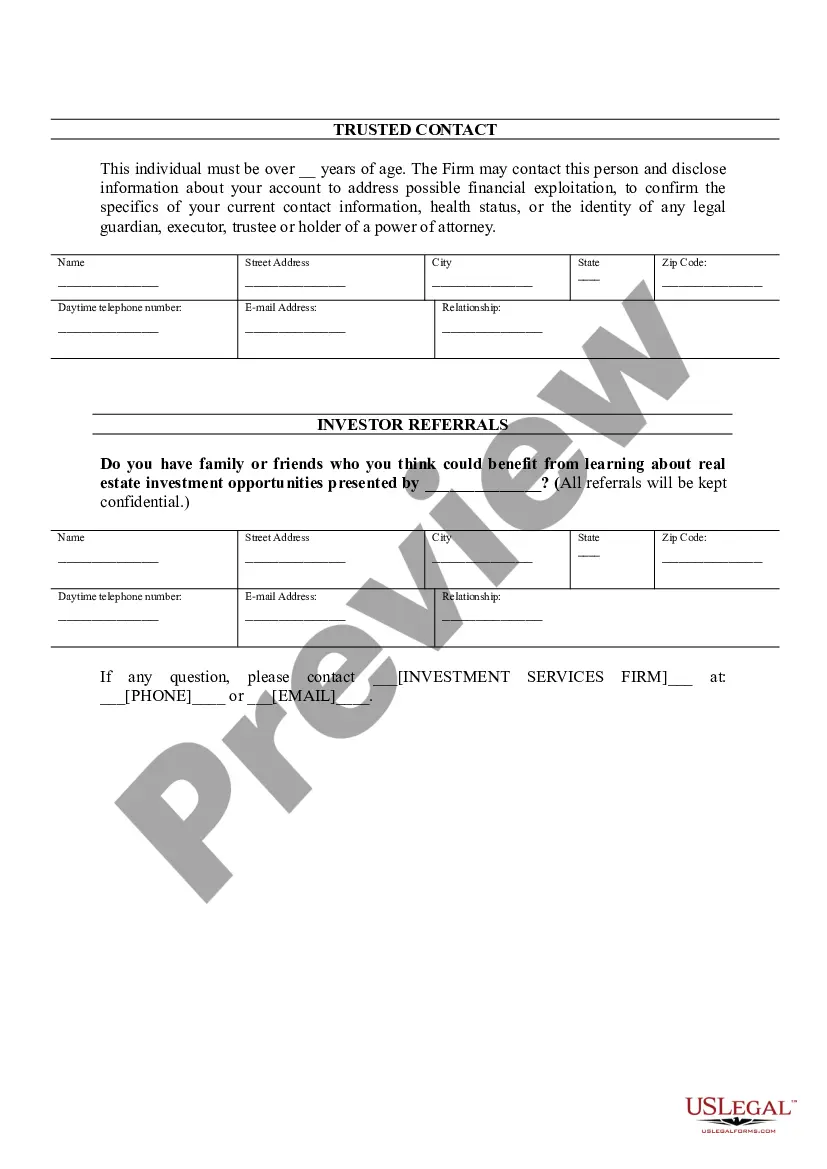

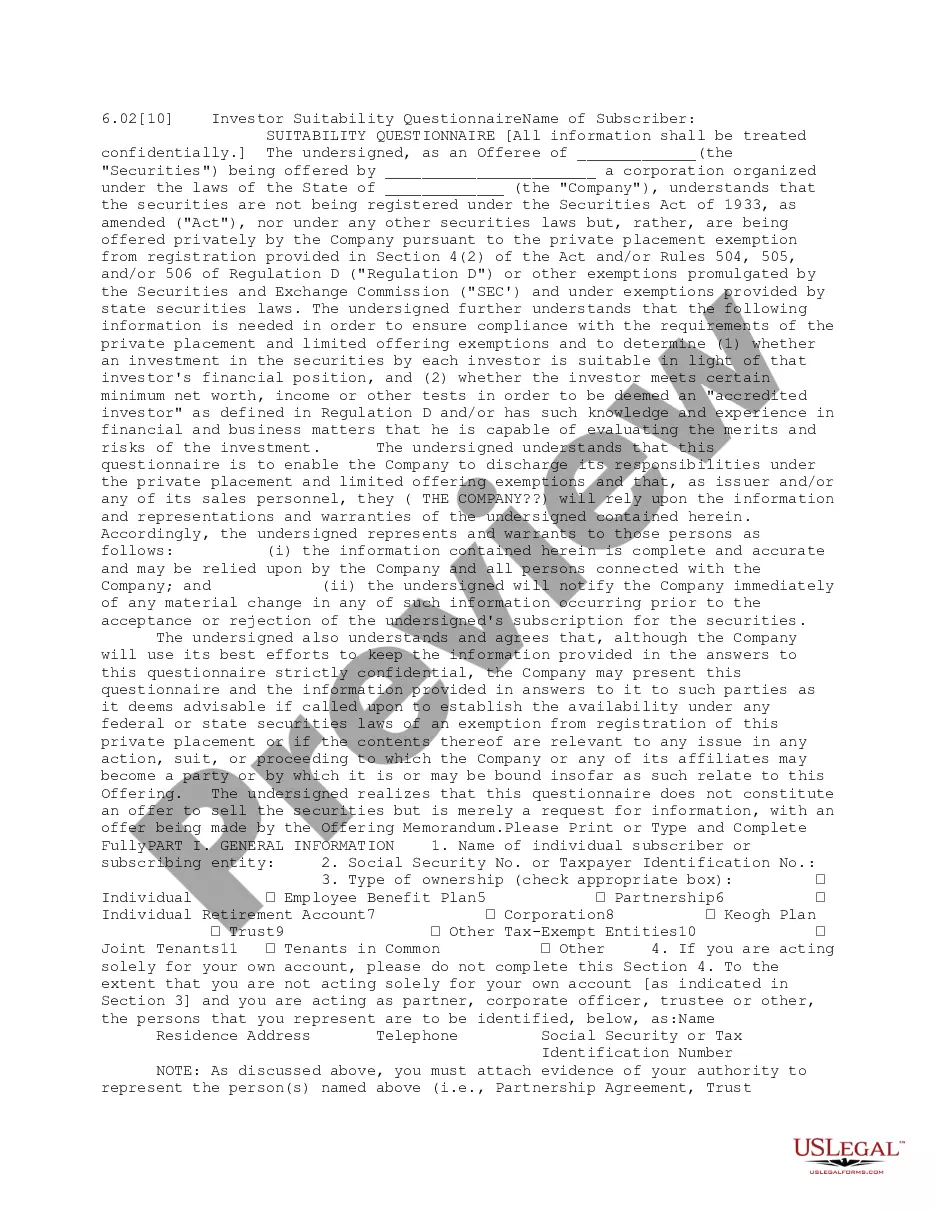

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

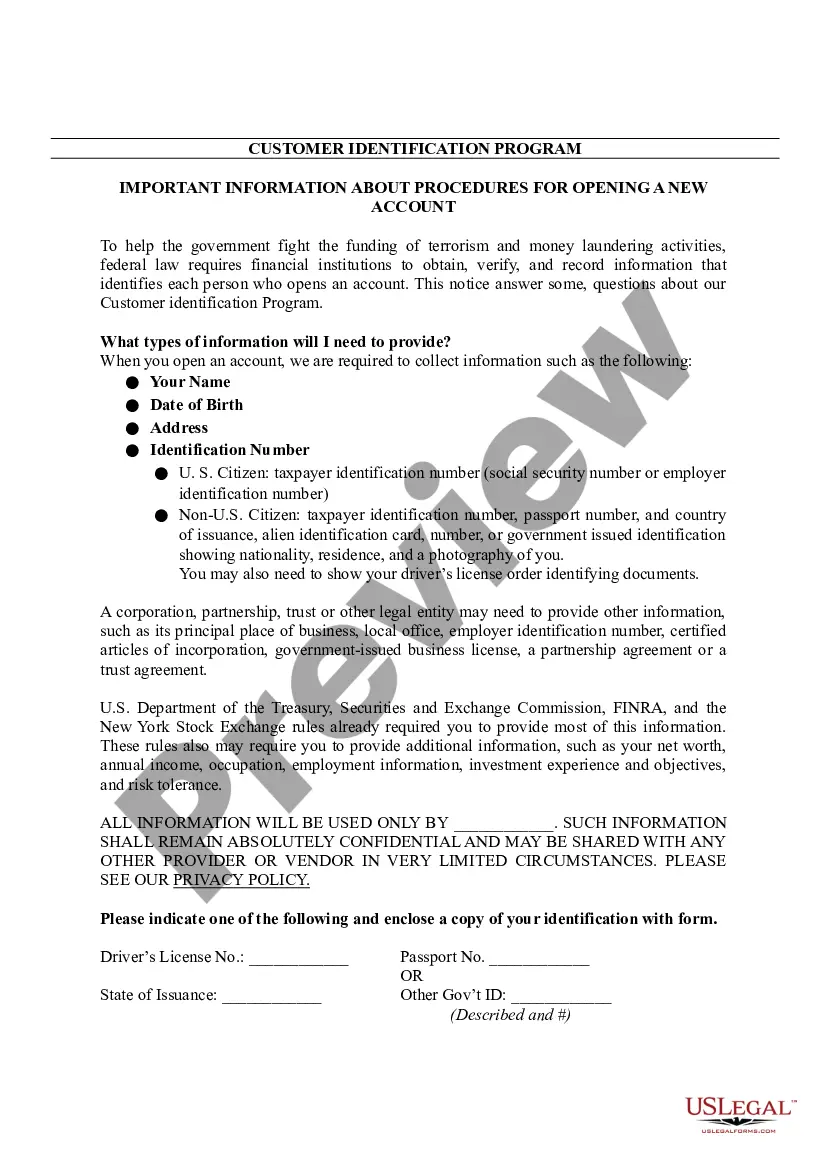

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

If you want to comprehensive, download, or produce authorized record themes, use US Legal Forms, the most important collection of authorized kinds, that can be found on the web. Take advantage of the site`s basic and practical look for to find the documents you will need. Numerous themes for business and personal purposes are categorized by classes and claims, or key phrases. Use US Legal Forms to find the Maine Accredited Investor Suitability with a couple of clicks.

If you are presently a US Legal Forms client, log in in your profile and then click the Download switch to find the Maine Accredited Investor Suitability. You may also gain access to kinds you earlier saved from the My Forms tab of your profile.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have selected the form for the appropriate town/land.

- Step 2. Use the Preview choice to check out the form`s content. Don`t forget about to see the explanation.

- Step 3. If you are unhappy using the form, take advantage of the Lookup discipline on top of the monitor to discover other versions in the authorized form web template.

- Step 4. After you have found the form you will need, click the Buy now switch. Select the rates program you like and add your references to sign up to have an profile.

- Step 5. Approach the financial transaction. You can use your bank card or PayPal profile to complete the financial transaction.

- Step 6. Choose the structure in the authorized form and download it on the gadget.

- Step 7. Full, change and produce or signal the Maine Accredited Investor Suitability.

Each and every authorized record web template you acquire is your own property forever. You possess acces to every form you saved within your acccount. Click on the My Forms area and pick a form to produce or download once more.

Contend and download, and produce the Maine Accredited Investor Suitability with US Legal Forms. There are millions of specialist and status-specific kinds you can use for the business or personal demands.

Form popularity

FAQ

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

This criteria requires that an individual have net assets that count for at least $5 million, with liabilities subtracted. This means that an investor with $4.5 million in real estate and $500,000 in cash may be considered an accredited investor.

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

Anyone can buy securities under this exemption, but there are limits depending on whether they are an eligible or non-eligible investor. To qualify as an eligible investor, you must have: Net assets, alone or with a spouse, exceeding $400,000. Net income before tax.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

This criteria requires that an individual have net assets that count for at least $5 million, with liabilities subtracted. This means that an investor with $4.5 million in real estate and $500,000 in cash may be considered an accredited investor.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.