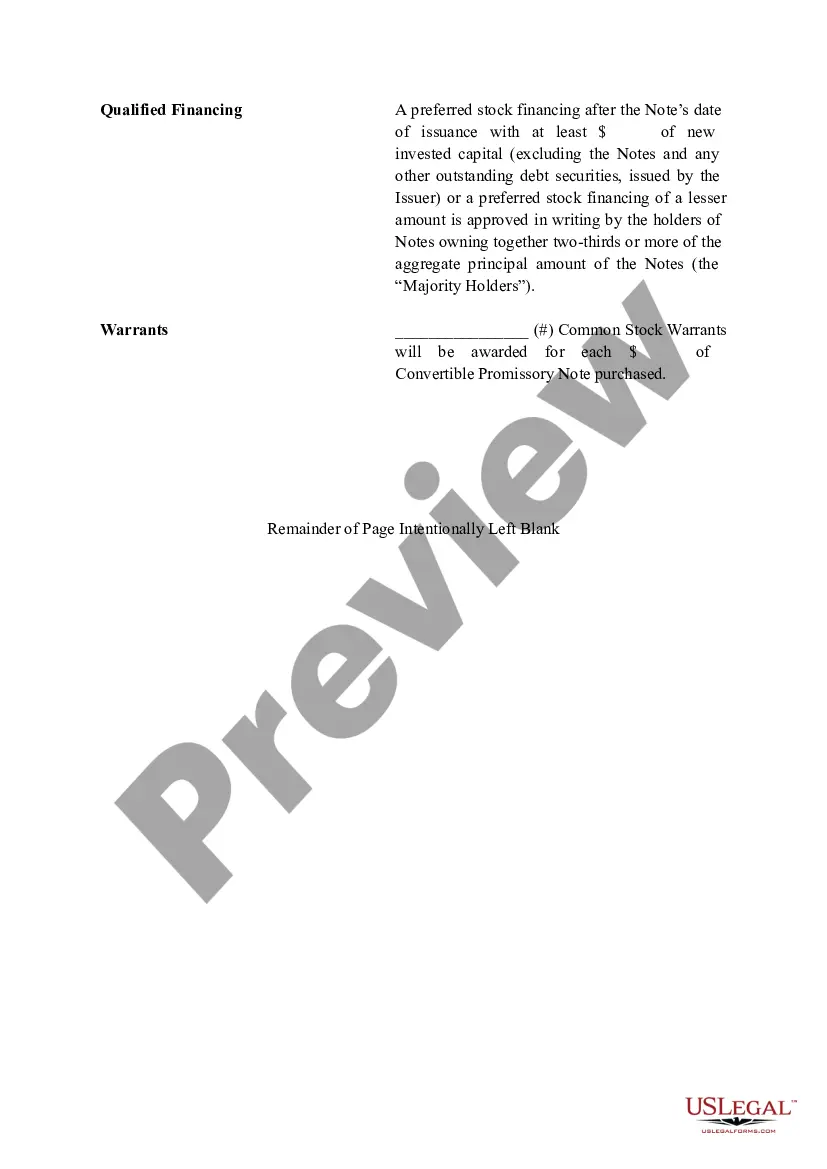

Maine Term Sheet - Six Month Promissory Note

Description

How to fill out Term Sheet - Six Month Promissory Note?

If you have to total, down load, or printing authorized papers templates, use US Legal Forms, the greatest collection of authorized forms, which can be found on-line. Take advantage of the site`s easy and hassle-free search to obtain the files you require. Different templates for company and individual reasons are categorized by classes and says, or key phrases. Use US Legal Forms to obtain the Maine Term Sheet - Six Month Promissory Note in just a couple of click throughs.

Should you be presently a US Legal Forms buyer, log in for your profile and click the Down load button to have the Maine Term Sheet - Six Month Promissory Note. You may also accessibility forms you formerly saved within the My Forms tab of the profile.

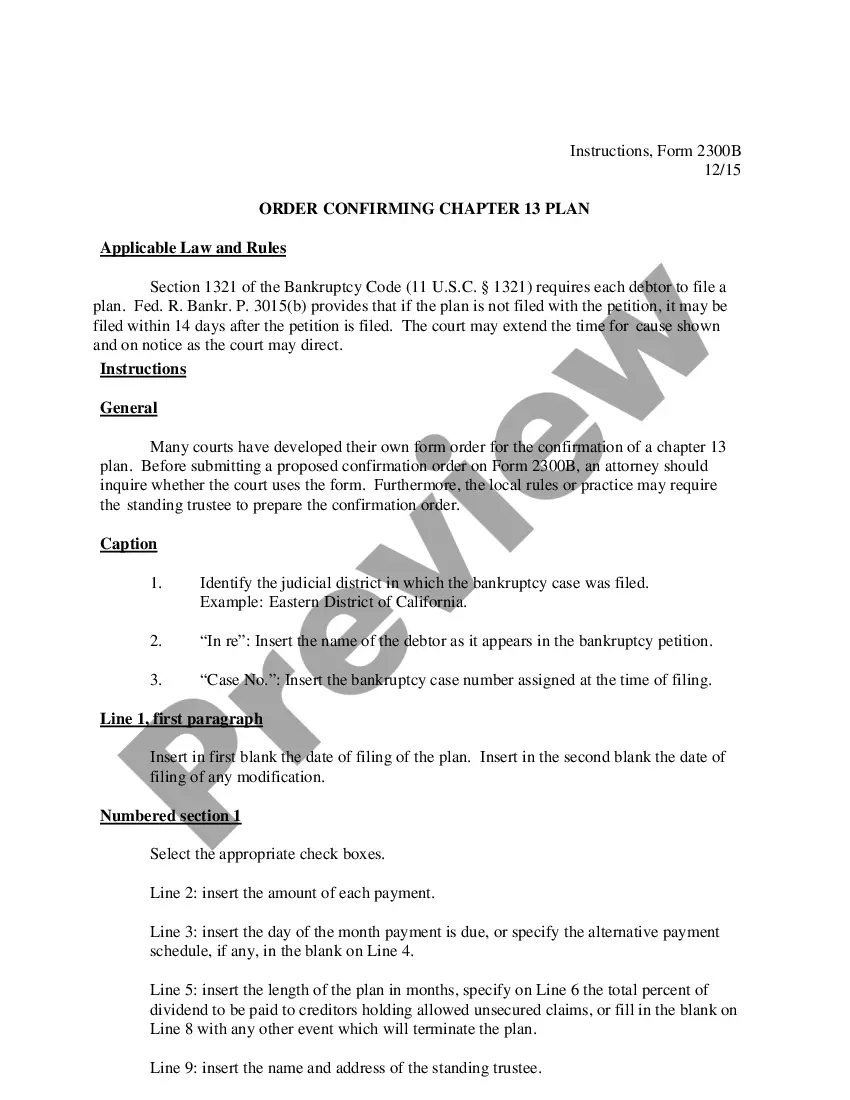

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for the appropriate city/land.

- Step 2. Make use of the Preview choice to look over the form`s content material. Do not forget about to read the description.

- Step 3. Should you be unhappy using the form, make use of the Research field at the top of the screen to discover other models in the authorized form design.

- Step 4. Upon having located the form you require, go through the Purchase now button. Pick the prices program you prefer and add your qualifications to sign up for the profile.

- Step 5. Approach the deal. You can utilize your charge card or PayPal profile to perform the deal.

- Step 6. Pick the structure in the authorized form and down load it on your own system.

- Step 7. Complete, modify and printing or sign the Maine Term Sheet - Six Month Promissory Note.

Each authorized papers design you buy is the one you have eternally. You have acces to each form you saved within your acccount. Click the My Forms section and decide on a form to printing or down load again.

Contend and down load, and printing the Maine Term Sheet - Six Month Promissory Note with US Legal Forms. There are millions of specialist and express-certain forms you may use for the company or individual requires.

Form popularity

FAQ

What Does a Promissory Note Contain? A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

For example, if the promissory note is drafted as a demand promissory note?one which gives the payee the right to ask for payment at any time?but there is an agreement between you and the payee that stipulates when such a demand for payment can be made, you may not want the promissory note to be negotiable.

For instance, if the terms of the note are unclear or if there is evidence that the maker did not intend to repay the debt, a court may find that the note is invalid. Additionally, if the payee knew that the maker could not repay the debt when they signed the promissory note, this may also render the agreement invalid.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days' notice before the payment is due. Promissory notes may be used in combination with security agreements.

Sample promissory note for loans to family, friends PROMISSORY NOTE. FOR VALUE RECEIVED, the undersigned, (the "Maker"), hereby promises to pay to the order of ____________________ (LENDER NAME) ("Payee"), the principal sum of $ ____________ pursuant to the terms and conditions set forth herein. PAYMENT OF PRINCIPAL.

A promissory note payable on demand is a way to get repaid when you loan money to someone. It is a document that states the terms of the loan and includes the ?payable on demand? notation on it. This means that you can demand full payment of the loan at any time you deem necessary.

If the demand feature is checked "yes," the lender can require that you immediately pay the entire loan balance (principal and interest) at any time. The lender can make this demand on you for any reason or for no reason.