Maine Investment Agreement

Description

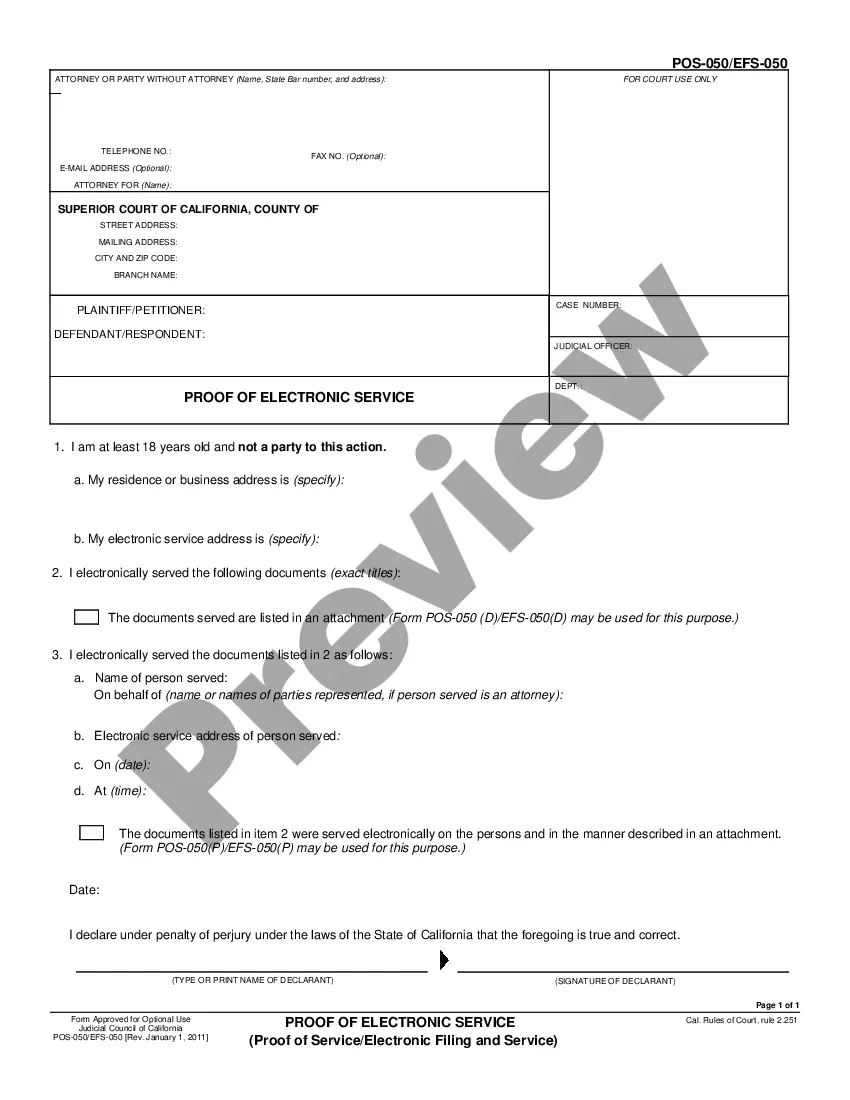

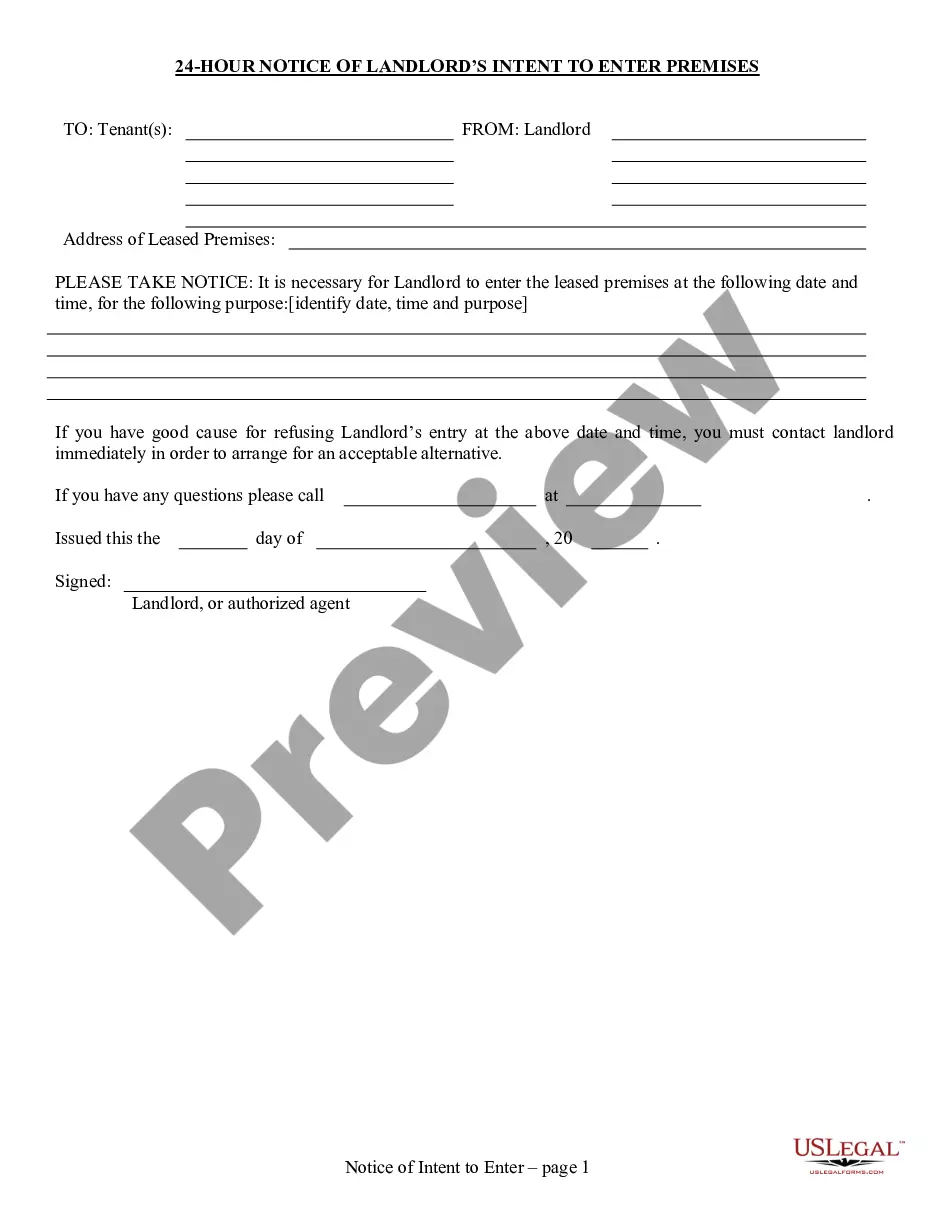

How to fill out Investment Agreement?

Finding the right legal record format might be a have a problem. Needless to say, there are a variety of themes available on the Internet, but how do you obtain the legal type you need? Make use of the US Legal Forms website. The assistance offers thousands of themes, such as the Maine Investment Agreement, that you can use for organization and private requires. All of the kinds are checked out by specialists and meet up with federal and state requirements.

When you are previously registered, log in to your profile and then click the Down load option to find the Maine Investment Agreement. Utilize your profile to look from the legal kinds you have acquired formerly. Check out the My Forms tab of your own profile and obtain an additional duplicate in the record you need.

When you are a brand new end user of US Legal Forms, here are straightforward guidelines so that you can comply with:

- First, be sure you have selected the appropriate type for the city/county. It is possible to look through the shape making use of the Preview option and look at the shape description to guarantee it will be the right one for you.

- When the type fails to meet up with your needs, utilize the Seach discipline to find the correct type.

- When you are certain that the shape is acceptable, go through the Get now option to find the type.

- Select the pricing strategy you desire and enter in the required information and facts. Make your profile and buy an order with your PayPal profile or bank card.

- Choose the file formatting and download the legal record format to your product.

- Total, change and print and indicator the received Maine Investment Agreement.

US Legal Forms is definitely the most significant library of legal kinds for which you will find a variety of record themes. Make use of the service to download expertly-produced paperwork that comply with status requirements.

Form popularity

FAQ

Investment agreements are legal contracts between an investor and a company. The investor supplies funds with the intent of receiving a return. In turn, the company protects the individual's financial investment in the business. The Securities Act of 1933 governs investment contracts.

An investment agreement is a legal agreement between a company and an investor that summarizes the terms and conditions of an investment in the company. It helps to define the terms and conditions of an asset between a company and an investor. Investment Agreement - Definition, Examples, How To Write? wallstreetmojo.com ? investment-agreement wallstreetmojo.com ? investment-agreement

In the investing sense, securities are broadly defined as financial instruments that hold value and can be traded between parties. In other words, security is a catch-all term for stocks, bonds, mutual funds, exchange-traded funds or other types of investments you can buy or sell.

The term "security" is defined broadly to include a wide array of investments, such as stocks, bonds, notes, debentures, limited partnership interests, oil and gas interests, and investment contracts. What is a Security? - TN.gov tn.gov ? commerce ? securities ? investors tn.gov ? commerce ? securities ? investors

Investment agreements are legal contracts between an investor and a company. The investor supplies funds with the intent of receiving a return. In turn, the company protects the individual's financial investment in the business. The Securities Act of 1933 governs investment contracts. How to Write an Investor Agreement - U.S. Chamber of Commerce uschamber.com ? run ? finance ? how-to-wr... uschamber.com ? run ? finance ? how-to-wr...

security is an alternative investment that is not traded on a public exchange as stocks and bonds are. Assets such as art, rare coins, life insurance, gold, and diamonds all are nonsecurities.

The four types of security are debt, equity, derivative, and hybrid securities. Holders of equity securities (e.g., shares) can benefit from capital gains by selling stocks.