This guide provides an overview of the Fair Credit and Reporting Act Red Flags rule and gives step-by-step guidance on how businesses may develop a program to comply with the law's requirements. Links to additional resources for developing an Identity Theft Prevention Program are included.

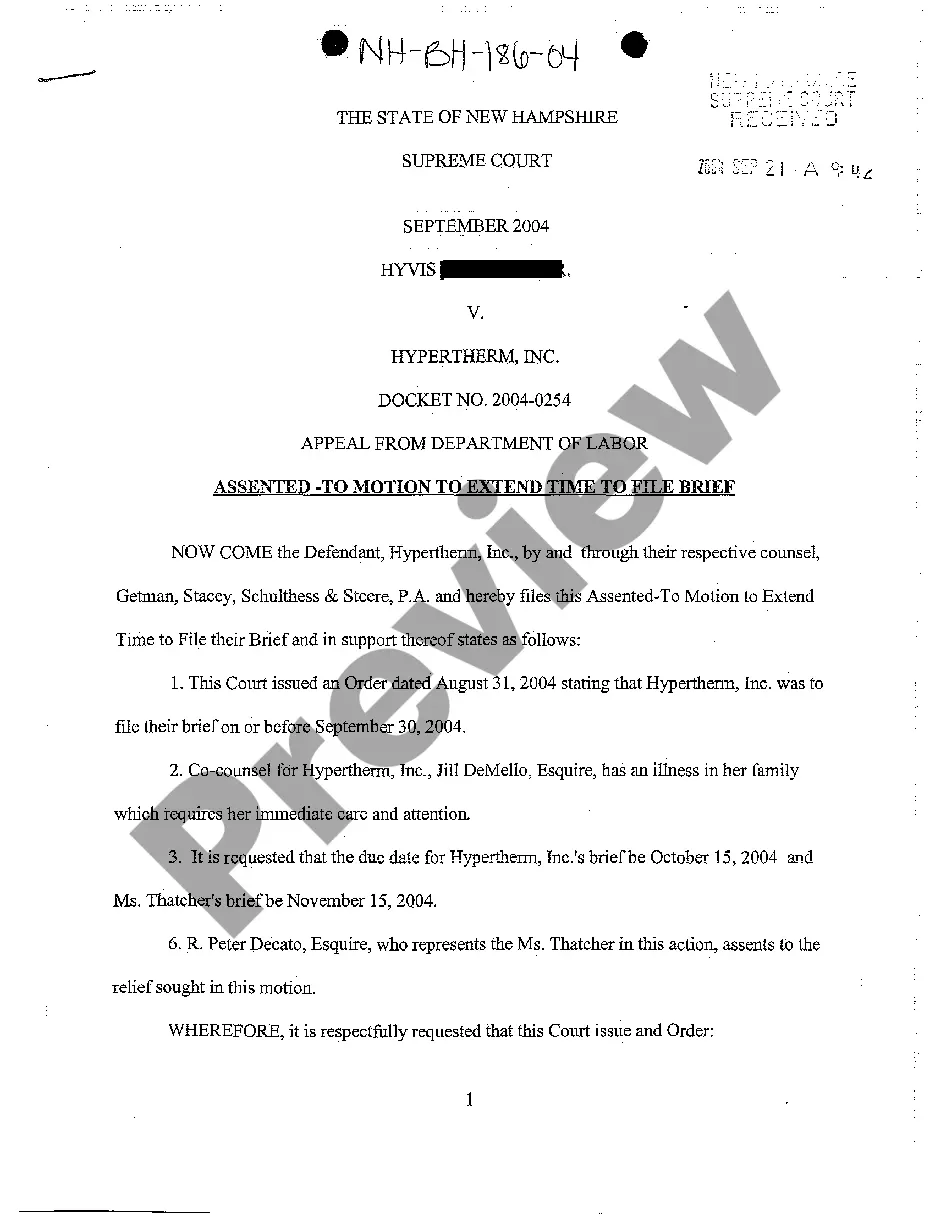

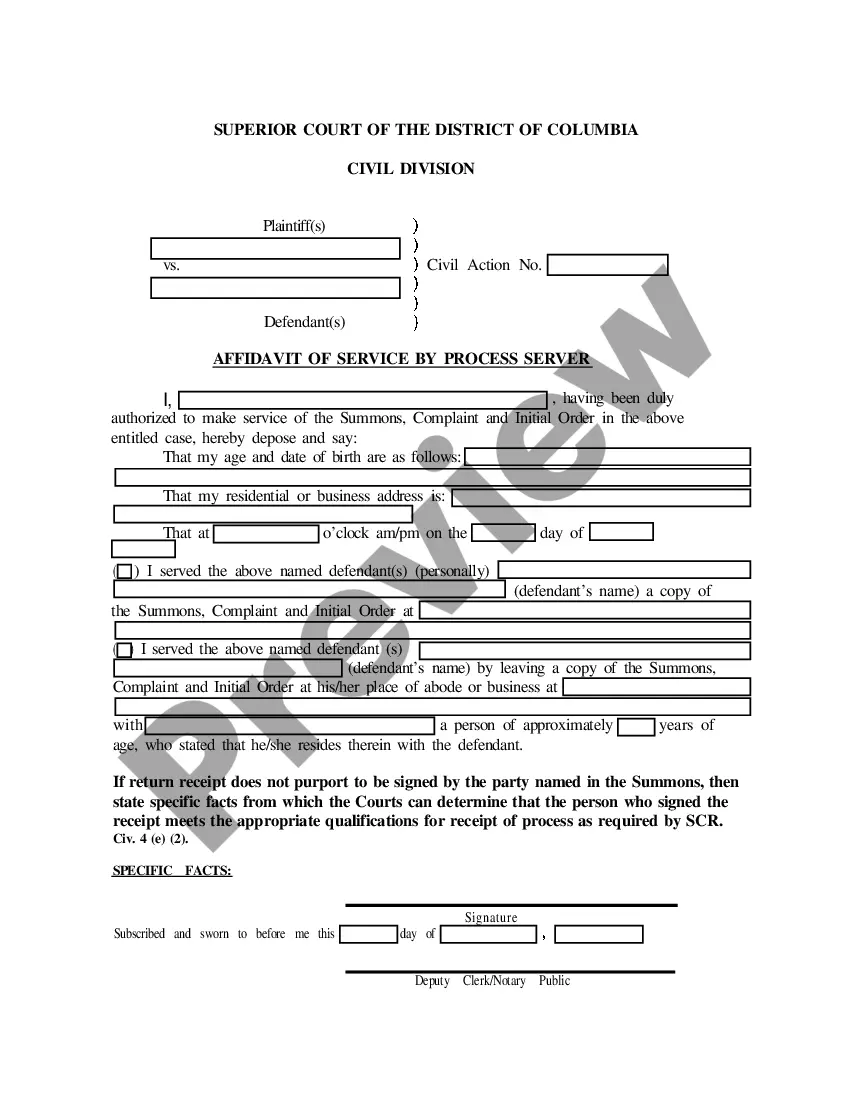

Note: The preview only shows the 1st two pages of the document.

Title: Maine's Comprehensive Guide: Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule Introduction: In an increasingly digital world, the risk of fraud and identity theft has grown exponentially. To protect its residents, the state of Maine has implemented powerful measures, including the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) Red Flags Rule. This comprehensive guide will provide you with the knowledge and tools necessary to combat fraud and identity theft effectively, empowering you to safeguard your personal and financial information. Table of Contents: 1. Understanding Fraud and Identity Theft — Definition and Examples of Frau— - Definition and Examples of Identity Theft — The Consequences of Fraud and Identity Theft 2. Maine's Response: FCRA and FACT Red Flags Rule — Overview of the Fair Credit Reporting Act (FCRA) in Maine — Understanding the Fair and Accurate Credit Transactions Act (FACT) Red Flags Rule — The Importance of Compliance 3. Identifying Red Flags — Identifying Warning Signs of Potential Fraud or Identity Theft — Common Red Flags in Different Sectors (e.g., Financial, Healthcare, Utility, etc.) — How to Stay Vigilant in Detecting Suspicious Activities 4. Creating a Fraud Prevention Program — Constructing an Effective Fraud Prevention Program — Establishing Policies and Procedure— - Employee Training on Recognizing Red Flags — Conducting Regular Audits and Reviews 5. Reporting and Responding to Incidents — Steps to Take when Discovering Fraud or Identity Theft — Reporting the Incident to Authorities and Credit Bureaus — Effective Communication with Financial Institutions and Creditors — Recovering and Restoring Your Identity 6. Additional Measures for Enhanced Security — Safeguarding Your Personal Information — Online Security Best Practice— - Two-Factor Authentication and Encryption — Identity Theft Protection Services Conclusion: Maine's dedication to fighting fraud and identity theft is evident through the enactment of the FCRA and FACT Red Flags Rule. By understanding the risks, recognizing red flags, and implementing preventive measures, you can fortify your defenses against these malicious activities. Remember, staying informed and proactive are key to maintaining your personal and financial security. Stay vigilant, adopt best practices, and utilize the resources available to protect yourself from fraud and identity theft in Maine. Other Potential Types of Maine How-To Guides for Fighting Fraud and Identity Theft: — Specific Industry Guide: Fighting Fraud and Identity Theft in the Healthcare Sector With the FCRA and FACT Red Flags Rule — Consumer Guide: Protecting Your Finances from Fraud and Identity Theft in Maine Using the FCRA and FACT Red Flags Rule — Business Owner's Guide: Preventing Fraud and Identity Theft in Your Maine-Based Business with the FCRA and FACT Red Flags Rule.

Title: Maine's Comprehensive Guide: Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule Introduction: In an increasingly digital world, the risk of fraud and identity theft has grown exponentially. To protect its residents, the state of Maine has implemented powerful measures, including the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) Red Flags Rule. This comprehensive guide will provide you with the knowledge and tools necessary to combat fraud and identity theft effectively, empowering you to safeguard your personal and financial information. Table of Contents: 1. Understanding Fraud and Identity Theft — Definition and Examples of Frau— - Definition and Examples of Identity Theft — The Consequences of Fraud and Identity Theft 2. Maine's Response: FCRA and FACT Red Flags Rule — Overview of the Fair Credit Reporting Act (FCRA) in Maine — Understanding the Fair and Accurate Credit Transactions Act (FACT) Red Flags Rule — The Importance of Compliance 3. Identifying Red Flags — Identifying Warning Signs of Potential Fraud or Identity Theft — Common Red Flags in Different Sectors (e.g., Financial, Healthcare, Utility, etc.) — How to Stay Vigilant in Detecting Suspicious Activities 4. Creating a Fraud Prevention Program — Constructing an Effective Fraud Prevention Program — Establishing Policies and Procedure— - Employee Training on Recognizing Red Flags — Conducting Regular Audits and Reviews 5. Reporting and Responding to Incidents — Steps to Take when Discovering Fraud or Identity Theft — Reporting the Incident to Authorities and Credit Bureaus — Effective Communication with Financial Institutions and Creditors — Recovering and Restoring Your Identity 6. Additional Measures for Enhanced Security — Safeguarding Your Personal Information — Online Security Best Practice— - Two-Factor Authentication and Encryption — Identity Theft Protection Services Conclusion: Maine's dedication to fighting fraud and identity theft is evident through the enactment of the FCRA and FACT Red Flags Rule. By understanding the risks, recognizing red flags, and implementing preventive measures, you can fortify your defenses against these malicious activities. Remember, staying informed and proactive are key to maintaining your personal and financial security. Stay vigilant, adopt best practices, and utilize the resources available to protect yourself from fraud and identity theft in Maine. Other Potential Types of Maine How-To Guides for Fighting Fraud and Identity Theft: — Specific Industry Guide: Fighting Fraud and Identity Theft in the Healthcare Sector With the FCRA and FACT Red Flags Rule — Consumer Guide: Protecting Your Finances from Fraud and Identity Theft in Maine Using the FCRA and FACT Red Flags Rule — Business Owner's Guide: Preventing Fraud and Identity Theft in Your Maine-Based Business with the FCRA and FACT Red Flags Rule.