Maine Diver Services Contract - Self-Employed

Description

How to fill out Maine Diver Services Contract - Self-Employed?

If you have to comprehensive, down load, or printing legitimate papers templates, use US Legal Forms, the most important selection of legitimate types, that can be found online. Take advantage of the site`s easy and convenient search to find the files you want. Numerous templates for enterprise and personal purposes are categorized by types and says, or search phrases. Use US Legal Forms to find the Maine Diver Services Contract - Self-Employed within a few clicks.

In case you are already a US Legal Forms client, log in to the profile and click on the Download button to find the Maine Diver Services Contract - Self-Employed. You can even access types you in the past acquired from the My Forms tab of your respective profile.

If you are using US Legal Forms the very first time, refer to the instructions under:

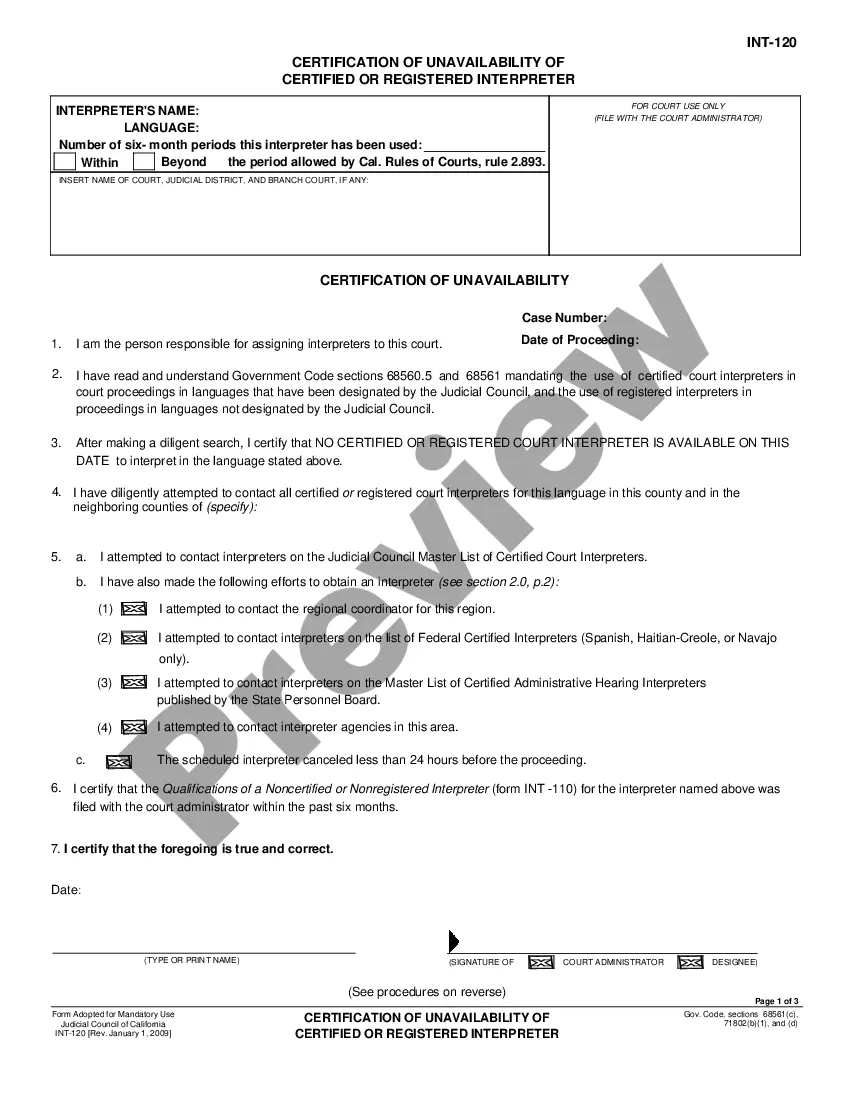

- Step 1. Ensure you have chosen the form for your appropriate area/land.

- Step 2. Use the Preview solution to check out the form`s information. Never neglect to see the outline.

- Step 3. In case you are unhappy together with the kind, make use of the Look for field at the top of the display screen to discover other types from the legitimate kind design.

- Step 4. When you have discovered the form you want, go through the Acquire now button. Select the costs plan you like and add your credentials to sign up for an profile.

- Step 5. Method the financial transaction. You can use your bank card or PayPal profile to perform the financial transaction.

- Step 6. Choose the formatting from the legitimate kind and down load it in your system.

- Step 7. Full, edit and printing or sign the Maine Diver Services Contract - Self-Employed.

Each and every legitimate papers design you acquire is your own forever. You may have acces to every single kind you acquired in your acccount. Select the My Forms area and decide on a kind to printing or down load yet again.

Be competitive and down load, and printing the Maine Diver Services Contract - Self-Employed with US Legal Forms. There are many specialist and condition-distinct types you can use for your personal enterprise or personal needs.

Form popularity

FAQ

First up: Get your tax forms in orderStep 1: Ask your independent contractor to fill out Form W-9.Step 2: Fill out two 1099-NEC forms (Copy A and B)Ask your independent contractor for invoices.Add your freelancer to payroll.Keep records like a boss.Tools to check out:

Independent contractors are not classified as employees by the Internal Revenue Service (IRS), so instead of being paid through your payroll system, they're paid separately as a business expense.

There are two main accounting methods that independent contractors can choose from when filing their first tax returns as a business.Cash basis is the most simple form of tax returns.Accrual basis will count your expenses and cash when it is earned, not when the money is received.

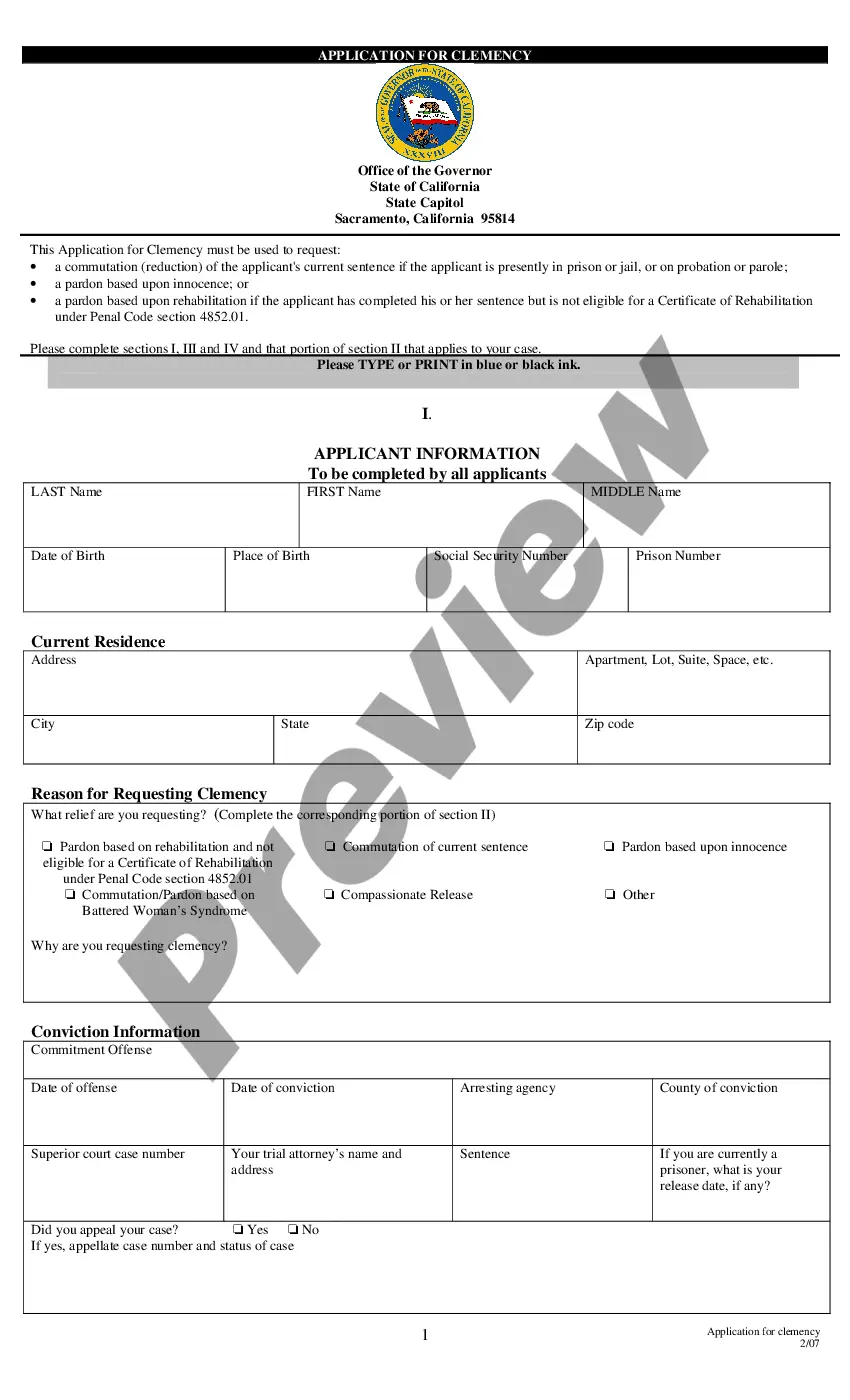

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Many process servers operate as independent contractors, and a number of process serving agencies might be confused about whether or not some of their staff qualify, in the eyes of the IRS, as 1099 independent contractors or employees.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Independent contractors usually offer their services to the general public, not just to one person or company. Government auditors will be impressed if you market your services to the public. Here are some ways to do this: Obtain a business card and letterhead.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

Write-Off Personal ExpensesBy writing off partial personal expenses, you can deduct the amount that is used for business. For example, if you use your personal phone for your delivery job and show that 50% of the usage on the phone is for work, you can deduct 50% of the phone bill on your 1099.