Maine Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Maine Temporary Worker Agreement - Self-Employed Independent Contractor?

Have you been inside a place in which you need to have files for possibly organization or individual purposes virtually every time? There are a variety of legal papers themes available on the Internet, but locating types you can rely on is not straightforward. US Legal Forms delivers thousands of form themes, just like the Maine Temporary Worker Agreement - Self-Employed Independent Contractor, which can be composed to satisfy federal and state requirements.

Should you be already familiar with US Legal Forms web site and have your account, just log in. Afterward, you may obtain the Maine Temporary Worker Agreement - Self-Employed Independent Contractor format.

Unless you offer an bank account and wish to start using US Legal Forms, follow these steps:

- Discover the form you need and ensure it is for your appropriate town/region.

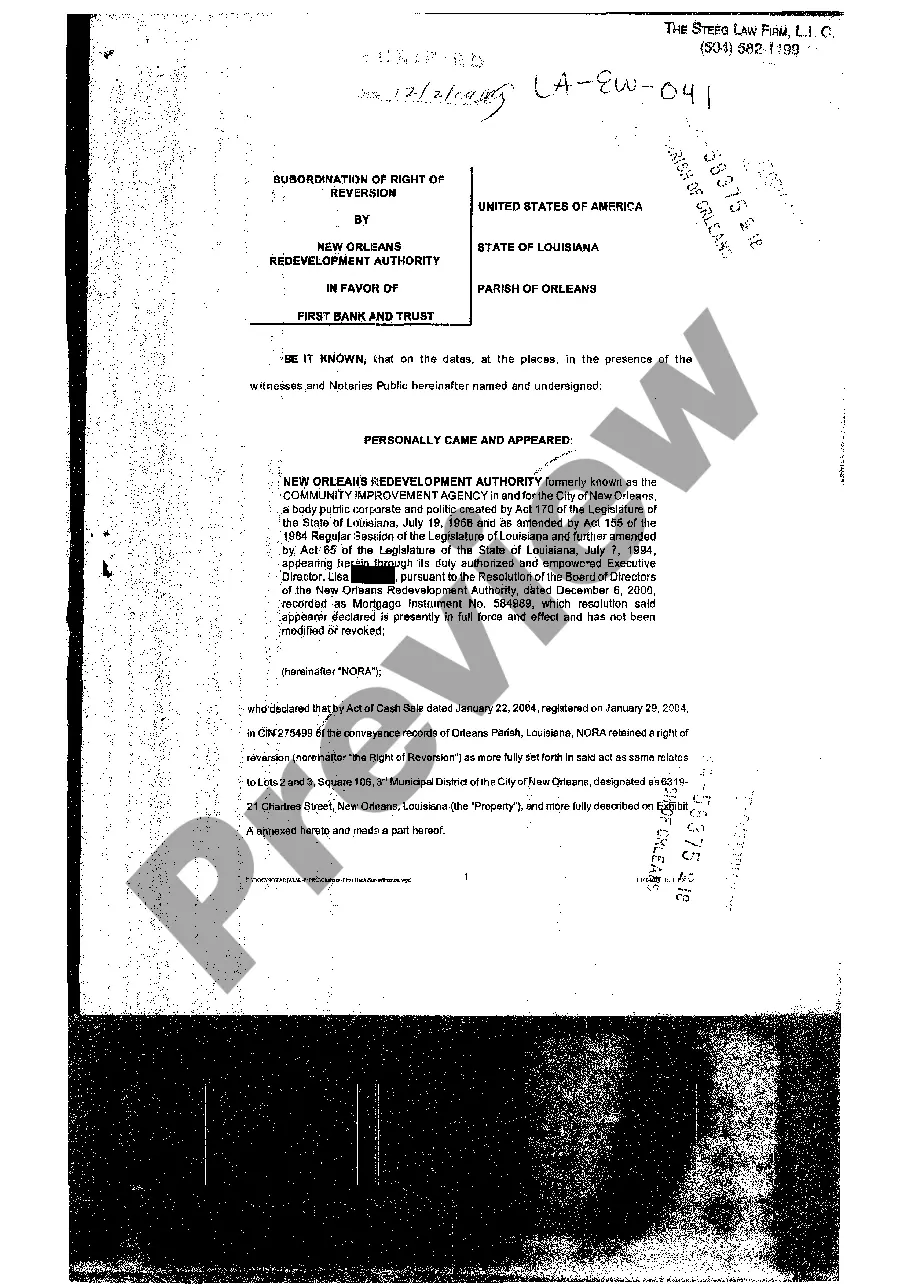

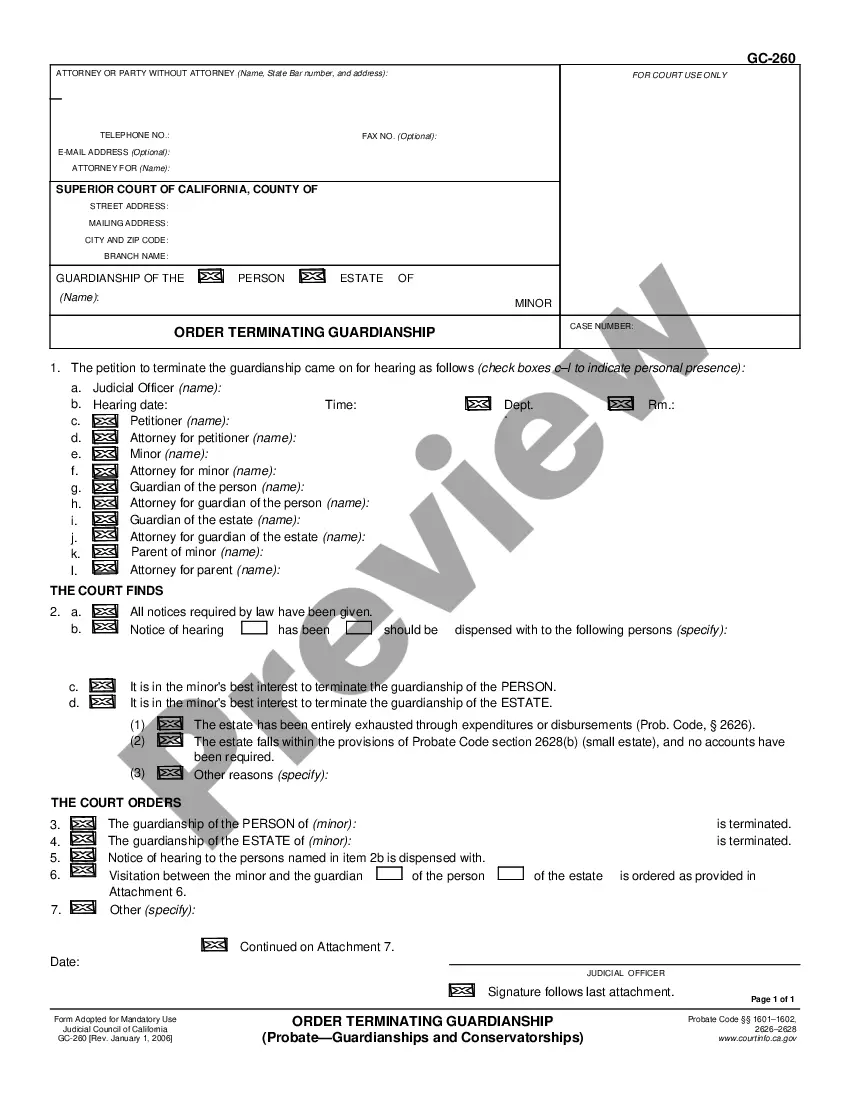

- Take advantage of the Preview option to check the shape.

- Browse the explanation to ensure that you have selected the right form.

- If the form is not what you`re searching for, use the Research discipline to obtain the form that suits you and requirements.

- If you discover the appropriate form, click Acquire now.

- Pick the costs program you want, fill out the necessary information and facts to create your bank account, and buy the order making use of your PayPal or charge card.

- Select a handy data file structure and obtain your backup.

Locate all of the papers themes you have bought in the My Forms menu. You can obtain a additional backup of Maine Temporary Worker Agreement - Self-Employed Independent Contractor at any time, if necessary. Just select the required form to obtain or print out the papers format.

Use US Legal Forms, one of the most substantial selection of legal kinds, to save efforts and steer clear of blunders. The support delivers appropriately created legal papers themes that you can use for a variety of purposes. Generate your account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Because you are an independent contractor, PRN ON Demand will not withhold or make payments for social security, make unemployment insurance or disability insurance contributions, or obtain workers' compensation insurance on your behalf.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed.

Pro Re Natathe Latin phrase meaning as necessary that's more commonly known in medical circles simply as PRN can strike fear into the heart of an RT looking for a full time position. New grads, especially, don't even want to think about accepting a job that's not permanent and doesn't offer benefits.

Nurse contractors and other clinicians who pick up PRN jobs are considered self-employed and receive 1099-MISC tax forms at the beginning of the year not W-2s.

PRN is an acronym for the Latin term pro re nata, which means as the situation demands, or simply, as needed. PRN nurses are fully licensed professionals who want to work on-call instead of as a full-time employee.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.