Maine Woodworking Services Contract - Self-Employed

Description

How to fill out Maine Woodworking Services Contract - Self-Employed?

If you have to total, down load, or produce legal record themes, use US Legal Forms, the greatest selection of legal varieties, that can be found on the web. Take advantage of the site`s simple and practical research to obtain the papers you need. Numerous themes for company and individual reasons are sorted by types and claims, or search phrases. Use US Legal Forms to obtain the Maine Woodworking Services Contract - Self-Employed in just a number of click throughs.

Should you be currently a US Legal Forms consumer, log in to your accounts and click the Acquire key to have the Maine Woodworking Services Contract - Self-Employed. You may also entry varieties you earlier acquired in the My Forms tab of your respective accounts.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the form for that correct metropolis/region.

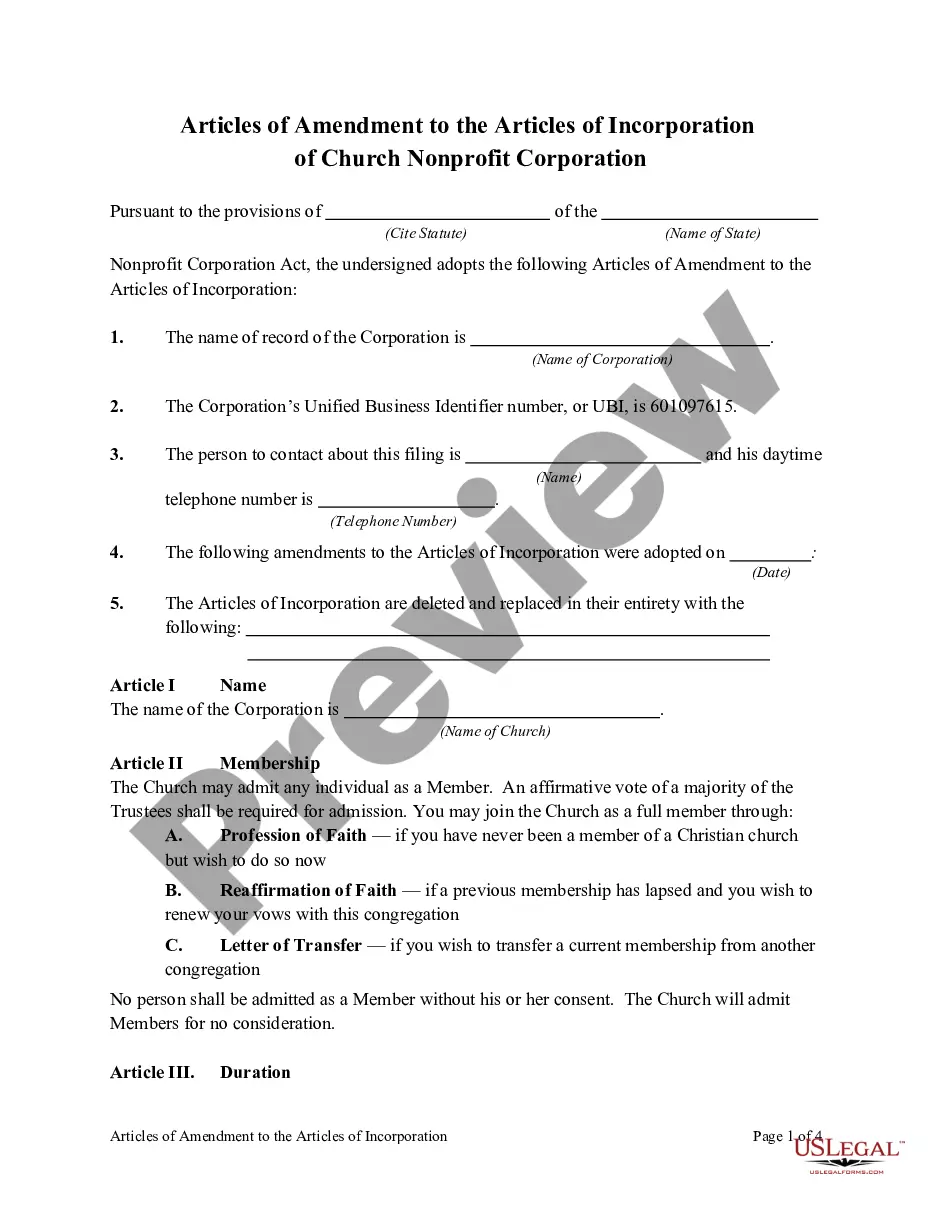

- Step 2. Take advantage of the Review choice to examine the form`s content material. Do not forget to learn the description.

- Step 3. Should you be not happy together with the kind, take advantage of the Lookup field near the top of the display to locate other types in the legal kind template.

- Step 4. After you have located the form you need, select the Purchase now key. Opt for the rates plan you like and include your credentials to sign up for the accounts.

- Step 5. Procedure the transaction. You may use your credit card or PayPal accounts to finish the transaction.

- Step 6. Choose the formatting in the legal kind and down load it on the product.

- Step 7. Comprehensive, modify and produce or signal the Maine Woodworking Services Contract - Self-Employed.

Each legal record template you buy is your own property eternally. You might have acces to each and every kind you acquired in your acccount. Click the My Forms section and decide on a kind to produce or down load once more.

Remain competitive and down load, and produce the Maine Woodworking Services Contract - Self-Employed with US Legal Forms. There are millions of skilled and state-certain varieties you can use to your company or individual needs.

Form popularity

FAQ

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Protect Yourself When Hiring a ContractorGet Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.Consider Hiring Specialized Pros for Additional Guidance.Go With Your Gut.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

You set your own schedule One of the best parts of being an independent contractor is that you can choose your own work hours. Most employees get schedules telling them when and how long they have to work. For hourly workers, schedules often change from week to week.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

General liability insurance is essential for independent contractors because: It protects you and your business. Independent contractors have the same legal obligations and liability exposures as larger firms. They can be sued for damaging client property, causing bodily harm, or advertising injury.

A basic rule of thumb that most people suggest would be to determine your hourly rate as a permanent employee, and then add 50-75%. If you were earning $65,000/year, that equates to $31.25/hr. By adding 50%, your rate would be $47/hr, and at 75%, your rate would be $55/hr.