Maine Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Maine Drafting Agreement - Self-Employed Independent Contractor?

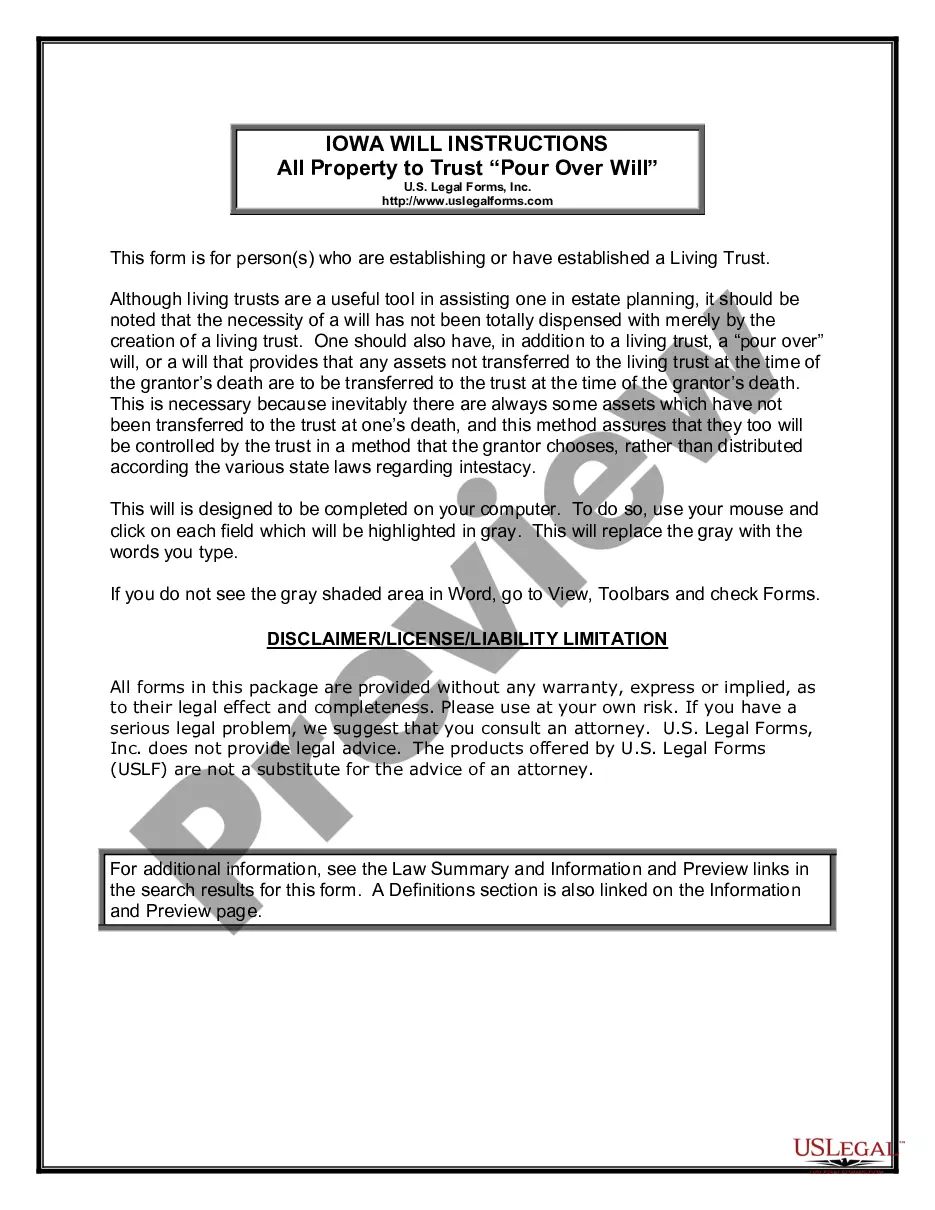

Discovering the right legitimate document template could be a battle. Naturally, there are plenty of layouts available on the Internet, but how will you find the legitimate type you want? Take advantage of the US Legal Forms web site. The support delivers a huge number of layouts, such as the Maine Drafting Agreement - Self-Employed Independent Contractor, which can be used for organization and personal demands. Every one of the kinds are inspected by professionals and satisfy state and federal specifications.

In case you are presently listed, log in to the accounts and click on the Obtain key to find the Maine Drafting Agreement - Self-Employed Independent Contractor. Use your accounts to look through the legitimate kinds you possess bought previously. Check out the My Forms tab of your respective accounts and acquire another backup of the document you want.

In case you are a brand new consumer of US Legal Forms, listed here are basic directions that you should follow:

- Initial, ensure you have selected the appropriate type for your town/county. You may check out the form while using Review key and browse the form outline to guarantee this is the right one for you.

- In the event the type does not satisfy your needs, make use of the Seach discipline to get the right type.

- When you are sure that the form would work, select the Buy now key to find the type.

- Opt for the pricing strategy you desire and type in the essential information. Create your accounts and pay money for the transaction utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the submit file format and download the legitimate document template to the product.

- Comprehensive, change and printing and indication the received Maine Drafting Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the largest catalogue of legitimate kinds in which you can see numerous document layouts. Take advantage of the service to download appropriately-produced files that follow status specifications.

Form popularity

FAQ

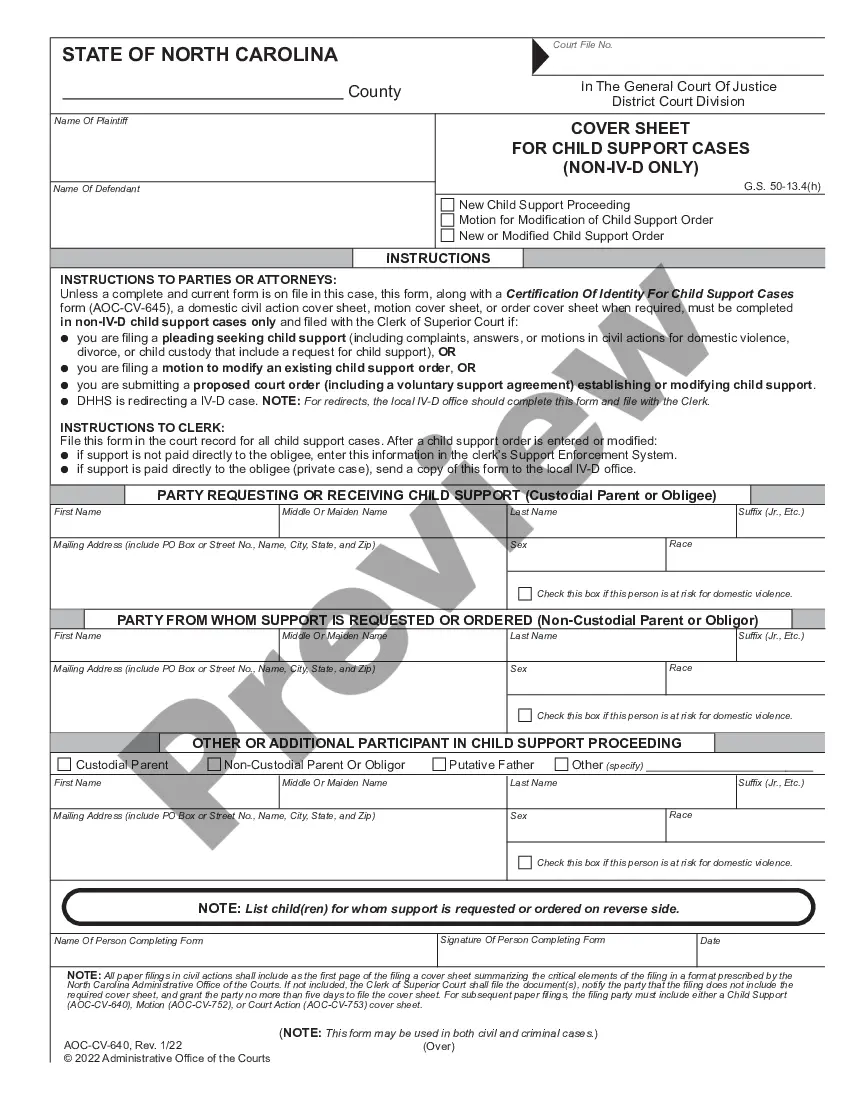

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

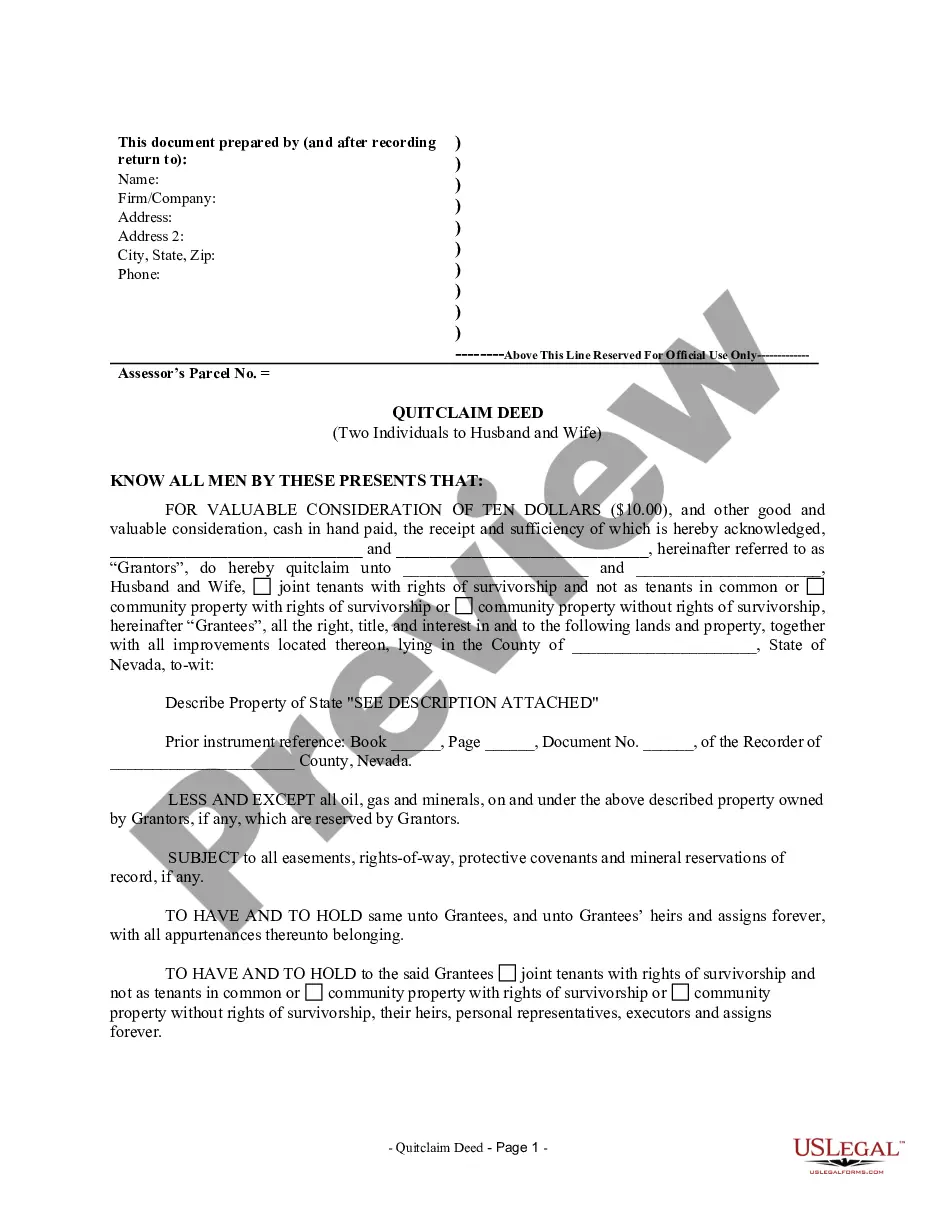

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.