Maine Self-Employed Wait Staff Services Contract

Description

How to fill out Maine Self-Employed Wait Staff Services Contract?

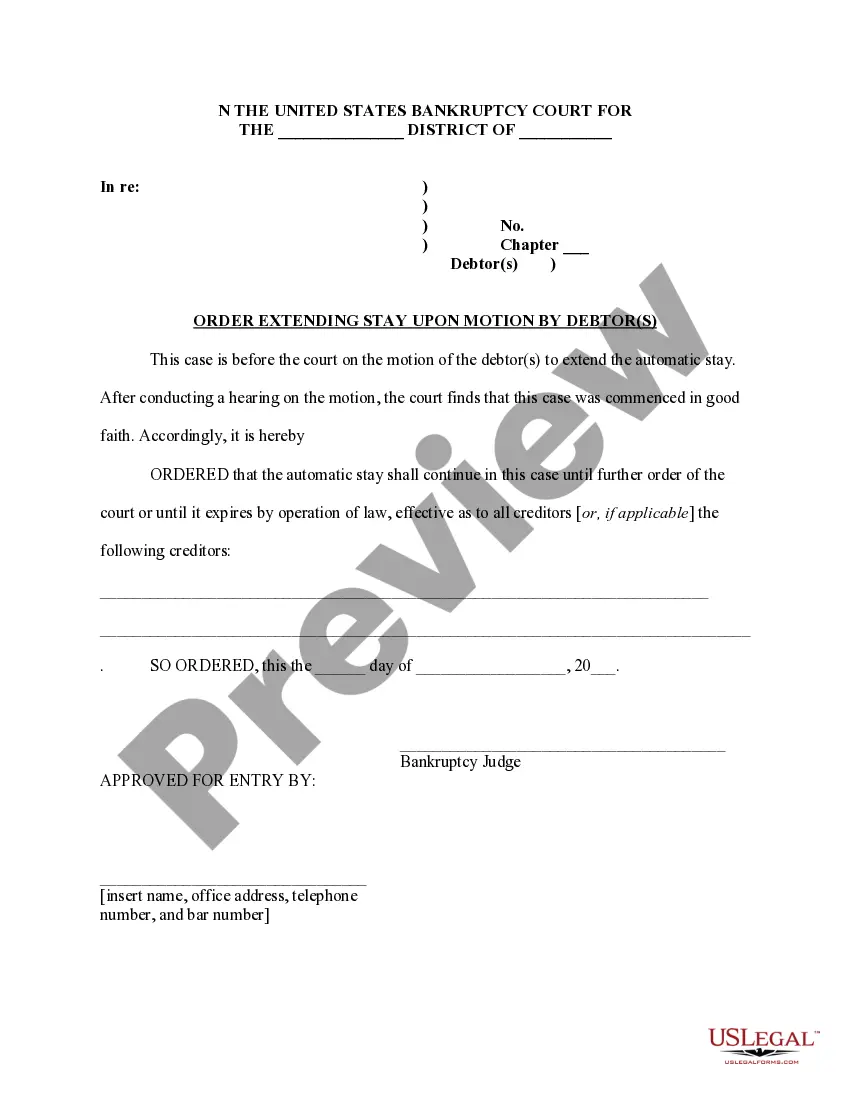

Choosing the right legitimate papers template could be a have a problem. Of course, there are plenty of templates available on the net, but how will you discover the legitimate kind you require? Make use of the US Legal Forms internet site. The service gives thousands of templates, like the Maine Self-Employed Wait Staff Services Contract, which you can use for business and personal requires. All of the kinds are examined by specialists and fulfill state and federal specifications.

In case you are presently registered, log in in your bank account and click the Down load key to find the Maine Self-Employed Wait Staff Services Contract. Make use of your bank account to check through the legitimate kinds you have ordered earlier. Proceed to the My Forms tab of your bank account and acquire another backup of the papers you require.

In case you are a new end user of US Legal Forms, allow me to share basic directions so that you can follow:

- First, be sure you have chosen the right kind for your personal town/county. It is possible to examine the shape using the Review key and study the shape outline to ensure this is the best for you.

- When the kind does not fulfill your needs, take advantage of the Seach discipline to discover the proper kind.

- Once you are sure that the shape would work, select the Get now key to find the kind.

- Choose the prices program you need and enter the needed info. Create your bank account and buy the transaction using your PayPal bank account or Visa or Mastercard.

- Choose the file structure and obtain the legitimate papers template in your gadget.

- Complete, edit and print out and indication the obtained Maine Self-Employed Wait Staff Services Contract.

US Legal Forms may be the largest catalogue of legitimate kinds that you will find different papers templates. Make use of the service to obtain skillfully-manufactured papers that follow state specifications.

Form popularity

FAQ

Like other small business owners, sole proprietors do have the ability to hire employees. As per the IRS, any time a sole proprietor hires an employee other than an independent contractor, the sole proprietorship will need to obtain an Employer Identification Number (EIN).

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.

Sole traders are always self employed. Although they can employ other people, they cannot employ themselves. The reason being that a limited company is classified as a separate legal entity in its own right. This means that a company can have a contract of employment with its own director(s).

So, can independent contractors hire employees? Yes! As a self-employed person, you are your own businessand businesses are allowed to hire employees.

Yes. You can be employed and self-employed at the same time. This would usually be the case if you were doing two jobs. For example, if you work for yourself as a hairdresser during the day but in the evenings you work as a receptionist in a hotel, you will be both self-employed and employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Step 3: Last Employer Self-employed individuals may enter "self-employed" for the last employer's name and include his/her own address and contact information in lieu of the "last employer's address and contact information."

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.