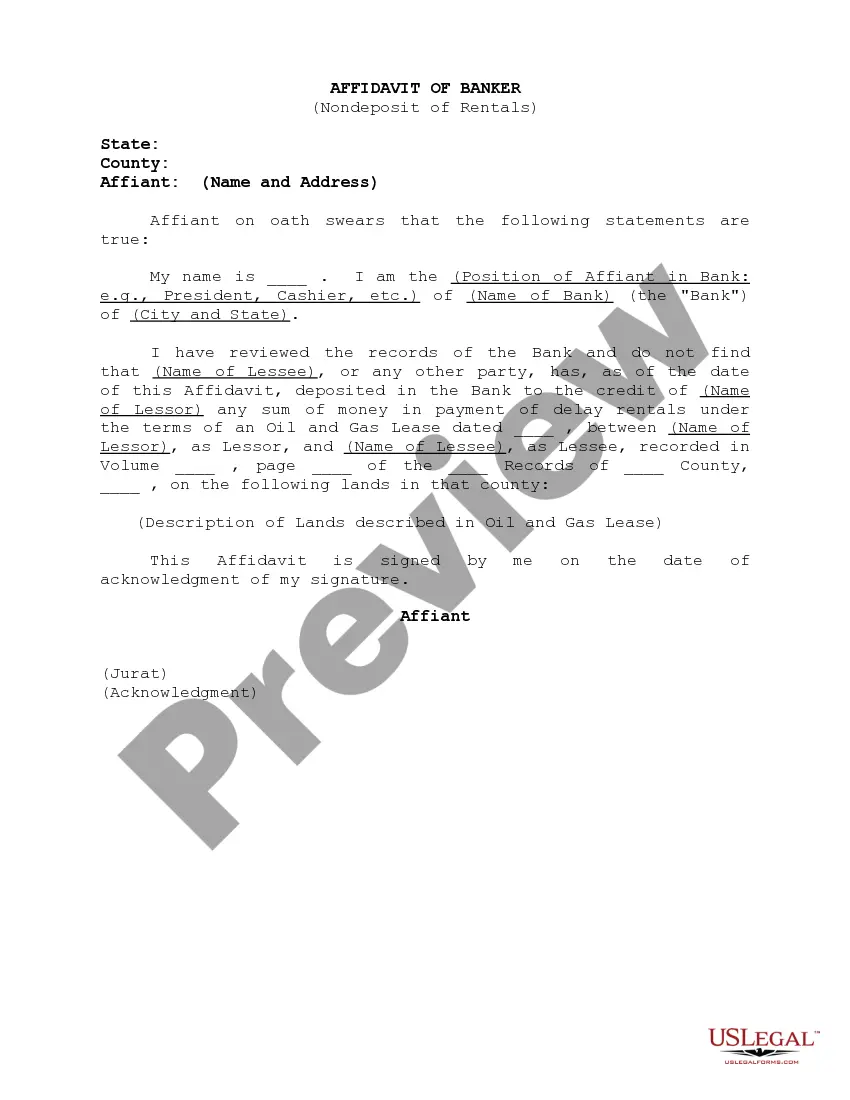

Maine Affidavit of Banker for Nondeposit of Rentals

Description

How to fill out Affidavit Of Banker For Nondeposit Of Rentals?

US Legal Forms - one of several most significant libraries of authorized types in the States - offers a wide range of authorized document themes you are able to download or print. Using the web site, you may get thousands of types for company and person purposes, categorized by categories, states, or search phrases.You can find the latest types of types much like the Maine Affidavit of Banker for Nondeposit of Rentals in seconds.

If you already possess a subscription, log in and download Maine Affidavit of Banker for Nondeposit of Rentals in the US Legal Forms library. The Acquire button will appear on every single form you see. You gain access to all formerly delivered electronically types in the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, allow me to share simple instructions to help you started:

- Be sure to have selected the correct form for your personal metropolis/state. Click the Review button to analyze the form`s content. Look at the form description to actually have selected the right form.

- If the form doesn`t match your requirements, take advantage of the Look for field near the top of the display screen to get the the one that does.

- In case you are content with the form, validate your option by clicking on the Buy now button. Then, choose the rates plan you prefer and supply your accreditations to register on an profile.

- Procedure the financial transaction. Make use of charge card or PayPal profile to complete the financial transaction.

- Pick the format and download the form on your device.

- Make modifications. Fill out, modify and print and indication the delivered electronically Maine Affidavit of Banker for Nondeposit of Rentals.

Every single design you added to your account does not have an expiration date which is your own property eternally. So, if you would like download or print an additional duplicate, just proceed to the My Forms section and then click around the form you require.

Get access to the Maine Affidavit of Banker for Nondeposit of Rentals with US Legal Forms, the most considerable library of authorized document themes. Use thousands of professional and status-particular themes that satisfy your organization or person requires and requirements.

Form popularity

FAQ

Many of our wedding couples ask about Maine taxes: there are just two taxes that apply to event venues: (1) prepared food & beverage sales tax (catering, bartending) and (2) lodging tax. To quote an official Maine.gov tax document (PDF):

Yes. Numerous short-term rental hosts in Maine file several state and local lodging tax returns every year. For many, filing solutions such as MyLodgeTax can relieve this burden.

The tax rate is 9% on certain rentals of living quarters. The tax rate is 10% on short-term rentals of automobiles and on short-term rentals of pickup trucks and vans with a gross vehicle weight of less than 26,000 pounds when rented from a person primarily engaged in the short-term rental of automobiles. USE TAX.

Vacation Rental-1 (VR-1): A dwelling unit, or portion thereof, that is the primary residence of the property owner or on the owner's primary residence property and is rented to a person or a group for less than 30 days and a minimum of two nights.

If you are a tenant at will (no lease): Your landlord must give you either a 30-day or 7-day written notice to leave, or they can combine both of these into one notice. Any notice must advise you of your right to contest the eviction in court. This is called a "Notice to Quit."

All short term rental owners or operators must register with the Maine Revenue Service and collect and remit Maine State Sales Tax. This amounts to 9% of the listing pricing including cleaning and guest fees and applies to casual rentals (fewer than 15 nights a year) as well as long term rentals (28 days or longer).

Lodging, including hotels, trailer camps, tourist camps, and rooming houses, are taxable at 9 percent. Exemptions to the lodging tax include: Casual rentals for less than 15 days. These include someone who rents out a single room or a single condo unit for less than 15 days in a calendar year.

Some goods are exempt from sales tax under Maine law. Examples include some groceries, prescription drugs, and medical devices. We recommend businesses review the bulletins and notices put forth by Maine Revenue Services to stay up to date on which goods are taxable and which are exempt, and under what conditions.