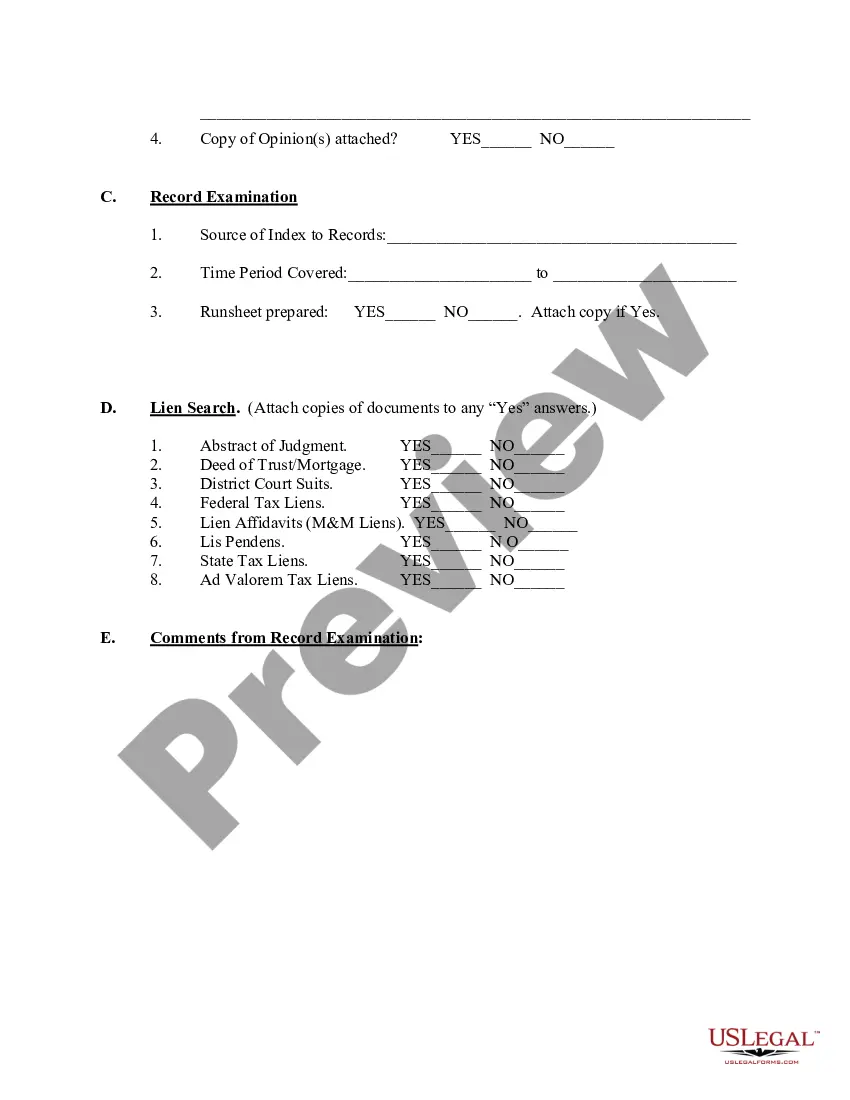

Maine Due Diligence Field Review and Checklist

Description

How to fill out Due Diligence Field Review And Checklist?

US Legal Forms - one of the biggest libraries of legitimate types in America - offers a wide array of legitimate papers themes you can down load or printing. Making use of the website, you may get thousands of types for enterprise and individual purposes, sorted by groups, says, or search phrases.You will find the latest versions of types just like the Maine Due Diligence Field Review and Checklist in seconds.

If you currently have a registration, log in and down load Maine Due Diligence Field Review and Checklist from the US Legal Forms library. The Obtain option can look on each type you see. You gain access to all earlier acquired types within the My Forms tab of your own bank account.

If you wish to use US Legal Forms the very first time, here are simple guidelines to help you began:

- Ensure you have chosen the proper type for your personal town/area. Go through the Preview option to check the form`s content material. Look at the type information to ensure that you have selected the right type.

- If the type doesn`t fit your needs, make use of the Research industry towards the top of the display to find the one who does.

- In case you are satisfied with the form, affirm your option by simply clicking the Purchase now option. Then, pick the prices plan you like and supply your credentials to register on an bank account.

- Approach the purchase. Use your bank card or PayPal bank account to finish the purchase.

- Pick the structure and down load the form in your system.

- Make alterations. Fill up, edit and printing and signal the acquired Maine Due Diligence Field Review and Checklist.

Each and every web template you put into your money does not have an expiration day and is your own property permanently. So, in order to down load or printing another version, just proceed to the My Forms section and then click around the type you will need.

Get access to the Maine Due Diligence Field Review and Checklist with US Legal Forms, probably the most extensive library of legitimate papers themes. Use thousands of specialist and status-particular themes that meet your small business or individual requirements and needs.

Form popularity

FAQ

Complete Due Diligence Documents Checklist Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

The 4 customer due diligence requirements are: Customer identification and verification. Ascertaining the nature and purpose of the business relationship. Ultimate Beneficial Owner (UBO) identification and verification. PEP identification and verification. Ongoing transaction monitoring.

In this article, we will guide you through the essential steps to prepare for due diligence effectively. Introduction. ... Understanding Due Diligence. ... Defining Objectives and Scope. ... Assembling a Due Diligence Team. ... Organizing Documentation and Information. ... Financial Analysis and Documentation. ... Legal Review and Compliance.

The due diligence guidelines for third parties involve gathering information about the third party's background, financial stability, legal and compliance history, business practices, and overall reputation.

A legal due diligence report typically includes the following information: Company structure and governance. ... Contracts and agreements. ... Litigation history. ... Intellectual Property. ... Compliance documents. ... Real estate and land use. ... Data privacy and security. ... Taxation.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

How To Prepare For Due Diligence - kagaar Introduction. ... Understanding Due Diligence. ... Defining Objectives and Scope. ... Assembling a Due Diligence Team. ... Organizing Documentation and Information. ... Financial Analysis and Documentation. ... Legal Review and Compliance. ... Operational Assessment.

Here are four steps to prepare you for the due diligence process: 1 Be honest. Get used to having honest conversations. ... 2 Record & store information from the start. ... 3 Ask questions. ... 4 Consider it as an opportunity to find the best match.