Maine Subordination of Lien (Deed of Trust/Mortgage): Understanding the Basics In the state of Maine, a Subordination of Lien, specifically for a Deed of Trust or Mortgage, is a legal document used to alter the priority of existing liens on a property. It allows the mortgage or deed of trust to be placed in a secondary position, allowing another lien to take precedence over it. Generally, a subordination of lien occurs when a property owner decides to refinance their existing mortgage or take out a home equity loan. In such cases, the original lien on the property is subordinated, meaning it becomes secondary to the new lien that is being created. This allows the lender of the new loan to have primary claim over the property in the event of foreclosure or sale. There can be different types of Maine Subordination of Lien (Deed of Trust/Mortgage), depending on the specific situation: 1. First Lien Subordination: This type of subordination occurs when the original mortgage or deed of trust is being subordinated to a new loan, making the new loan the primary lien holder. This is commonly seen when refinancing a property or taking out a home equity loan. 2. Second Lien Subordination: In this case, the second mortgage or equity loan lien is being subordinated to a new loan, making the newly created loan the primary lien on the property. This can happen when the property owner wants to access additional financing while retaining the existing loans. 3. Intercreditor Agreement: This is a type of subordination where multiple lenders agree to their respective positions and priority in case of default or foreclosure. It ensures that each lender's rights and interests are protected, outlining the order in which they will receive proceeds when the property is sold. The process of obtaining a Maine Subordination of Lien (Deed of Trust/Mortgage) involves several steps: 1. Application: The property owner or borrower interested in subordinating their lien must submit an application to the new lender they wish to work with. The application often includes details about the existing loan, the intended purpose of the new loan, and documentation such as property appraisals and proof of income. 2. Approval and Negotiations: The new lender will review the application and assess the borrower's creditworthiness. If approved, negotiations will take place between the involved parties to establish the terms of the subordination, including the time duration and any additional conditions. 3. Document Creation: Once the terms are agreed upon, a Subordination Agreement is drafted, including the specific details of the subordination, such as the lien positions and order of priority. This document must then be signed by all relevant parties, including the borrower, existing lender, and new lender. 4. Recording and Filing: The Subordination Agreement is typically recorded in the land records at the local county clerk's office to ensure it becomes part of the public record. This step serves to protect all parties involved by providing clear evidence of the prioritization change. In conclusion, a Maine Subordination of Lien (Deed of Trust/Mortgage) is a legal document used to modify the priority of liens on a property. It enables the creation of new loans while changing the order in which lenders are repaid in case of foreclosure or sale. Understanding the different types of subordination and following the necessary steps ensures a smooth and legally compliant process for all parties involved.

Maine Subordination of Lien (Deed of Trust/Mortgage)

Description

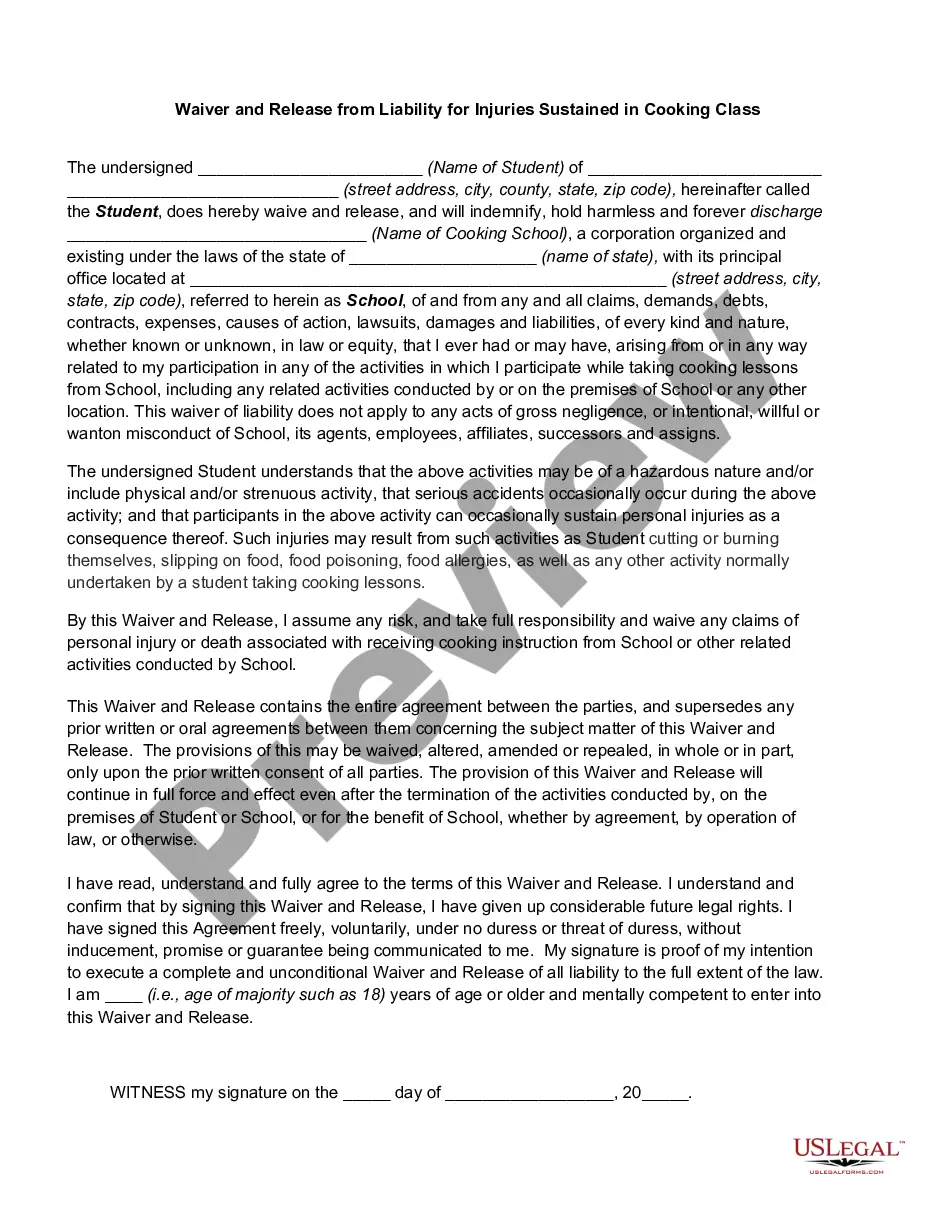

How to fill out Maine Subordination Of Lien (Deed Of Trust/Mortgage)?

If you wish to complete, acquire, or print out legal file web templates, use US Legal Forms, the greatest variety of legal forms, that can be found on-line. Utilize the site`s simple and easy handy research to discover the documents you require. A variety of web templates for business and specific functions are sorted by types and states, or keywords and phrases. Use US Legal Forms to discover the Maine Subordination of Lien (Deed of Trust/Mortgage) in just a few mouse clicks.

Should you be presently a US Legal Forms buyer, log in to the bank account and click the Obtain switch to obtain the Maine Subordination of Lien (Deed of Trust/Mortgage). You can also entry forms you previously downloaded inside the My Forms tab of the bank account.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for your appropriate metropolis/land.

- Step 2. Use the Review option to check out the form`s information. Don`t overlook to read through the description.

- Step 3. Should you be not satisfied with the type, use the Research area towards the top of the display to find other versions from the legal type template.

- Step 4. When you have found the form you require, select the Get now switch. Select the pricing plan you like and add your references to sign up for the bank account.

- Step 5. Approach the purchase. You can use your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Choose the structure from the legal type and acquire it on your gadget.

- Step 7. Full, revise and print out or indicator the Maine Subordination of Lien (Deed of Trust/Mortgage).

Each legal file template you buy is the one you have forever. You may have acces to each and every type you downloaded inside your acccount. Click on the My Forms segment and decide on a type to print out or acquire yet again.

Compete and acquire, and print out the Maine Subordination of Lien (Deed of Trust/Mortgage) with US Legal Forms. There are many professional and condition-particular forms you may use for the business or specific requirements.