Maine Buy-Sell Clauses and Related Material are legal provisions used in real estate transactions in the state of Maine. These clauses serve as safeguards to protect both buyers and sellers during the buying and selling process. They outline specific terms and conditions that must be met before a sale can be finalized. One common type of Maine Buy-Sell Clause is the financing contingency clause. This clause allows the buyer to back out of the agreement if they are unable to secure financing for the purchase. It sets a specific timeframe for the buyer to obtain a loan commitment from a financial institution and include provisions for canceling the contract if financing is not obtained within the specified period. Another type of Maine Buy-Sell Clause is the home inspection contingency clause. This clause gives the buyer the right to have a professional home inspector thoroughly examine the property. If any major issues or defects are found during the inspection, the buyer can negotiate with the seller to address these problems or even withdraw from the contract if the issues are significant enough. Title contingency clauses are also commonly used in Maine real estate transactions. These clauses state that the buyer has the right to obtain a title search and title insurance to ensure that the property's ownership is clear and free from any liens or encumbrances. If any title defects are discovered, the buyer has the option to request that the seller resolves these issues before proceeding with the purchase. Maine Buy-Sell Clauses and Related Material are crucial elements in real estate contracts, as they protect the interests of both the buyer and the seller. Without these provisions, transactions could be subject to significant risks and legal challenges. It is essential for both parties to thoroughly understand these clauses and consult with a real estate attorney or professional to ensure their interests are adequately protected. To summarize, Maine Buy-Sell Clauses and Related Material are legal provisions that safeguard the interests of buyers and sellers in real estate transactions. They include financing contingencies, home inspection contingencies, and title contingencies, among others. Understanding and adhering to these clauses is vital for a smooth and secure real estate transaction process.

Maine Buy Sell Clauses and Related Material

Description

How to fill out Maine Buy Sell Clauses And Related Material?

Are you presently in a place the place you require files for both organization or personal purposes just about every working day? There are plenty of authorized record web templates available online, but discovering types you can rely is not easy. US Legal Forms gives thousands of type web templates, such as the Maine Buy Sell Clauses and Related Material, which can be created to fulfill state and federal specifications.

Should you be presently familiar with US Legal Forms internet site and also have an account, simply log in. After that, you are able to obtain the Maine Buy Sell Clauses and Related Material web template.

If you do not come with an accounts and want to start using US Legal Forms, adopt these measures:

- Discover the type you need and make sure it is for your correct area/state.

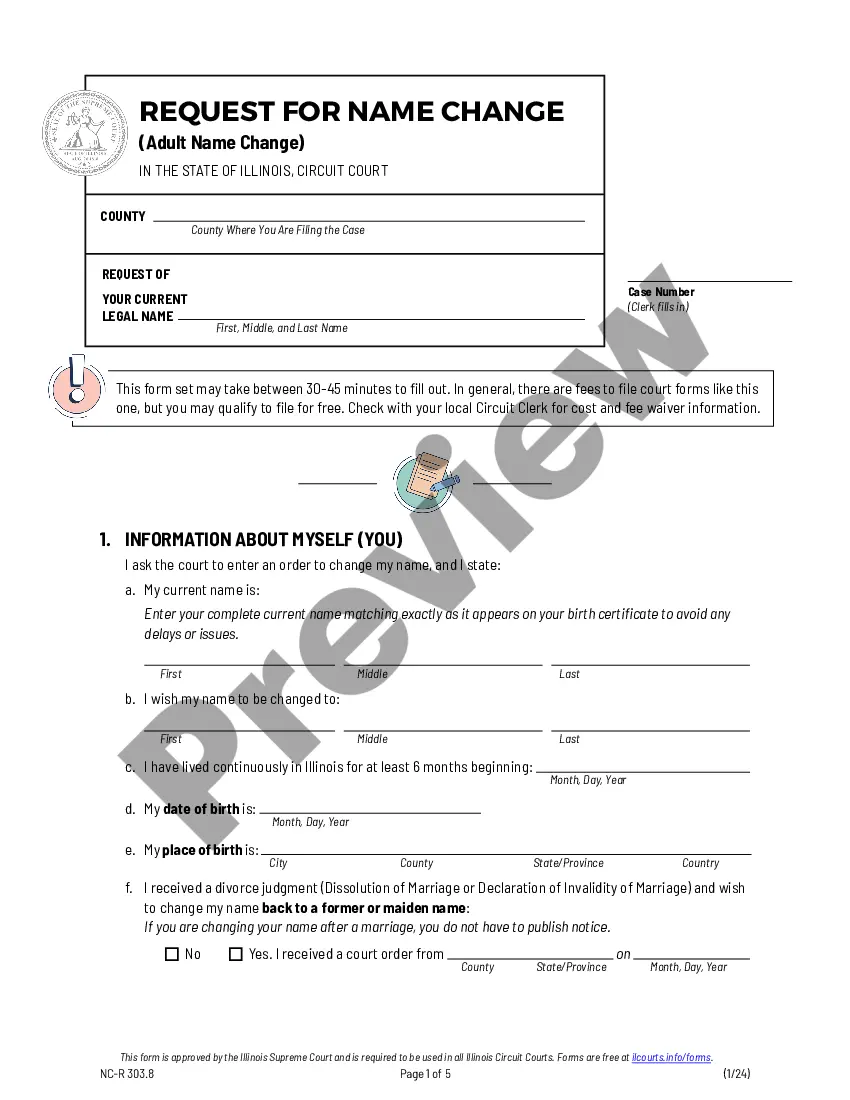

- Utilize the Review option to examine the form.

- Read the information to actually have chosen the appropriate type.

- If the type is not what you`re looking for, utilize the Look for industry to discover the type that meets your needs and specifications.

- Whenever you find the correct type, click Buy now.

- Opt for the pricing strategy you would like, fill out the specified information and facts to make your account, and pay for your order utilizing your PayPal or charge card.

- Select a handy file file format and obtain your duplicate.

Discover all of the record web templates you possess bought in the My Forms menus. You can get a more duplicate of Maine Buy Sell Clauses and Related Material at any time, if possible. Just select the essential type to obtain or printing the record web template.

Use US Legal Forms, one of the most considerable collection of authorized kinds, to save some time and stay away from blunders. The service gives skillfully manufactured authorized record web templates that you can use for a range of purposes. Make an account on US Legal Forms and commence generating your lifestyle easier.