Maine Employment of Independent Contractors Package

Description

How to fill out Employment Of Independent Contractors Package?

Have you been in the placement in which you will need files for sometimes company or specific purposes nearly every day? There are plenty of legitimate papers templates accessible on the Internet, but getting ones you can trust is not straightforward. US Legal Forms provides thousands of type templates, such as the Maine Employment of Independent Contractors Package, which are written to fulfill federal and state requirements.

In case you are presently knowledgeable about US Legal Forms website and also have a merchant account, merely log in. Following that, you can obtain the Maine Employment of Independent Contractors Package web template.

Should you not provide an account and wish to begin using US Legal Forms, adopt these measures:

- Obtain the type you require and ensure it is for your right town/region.

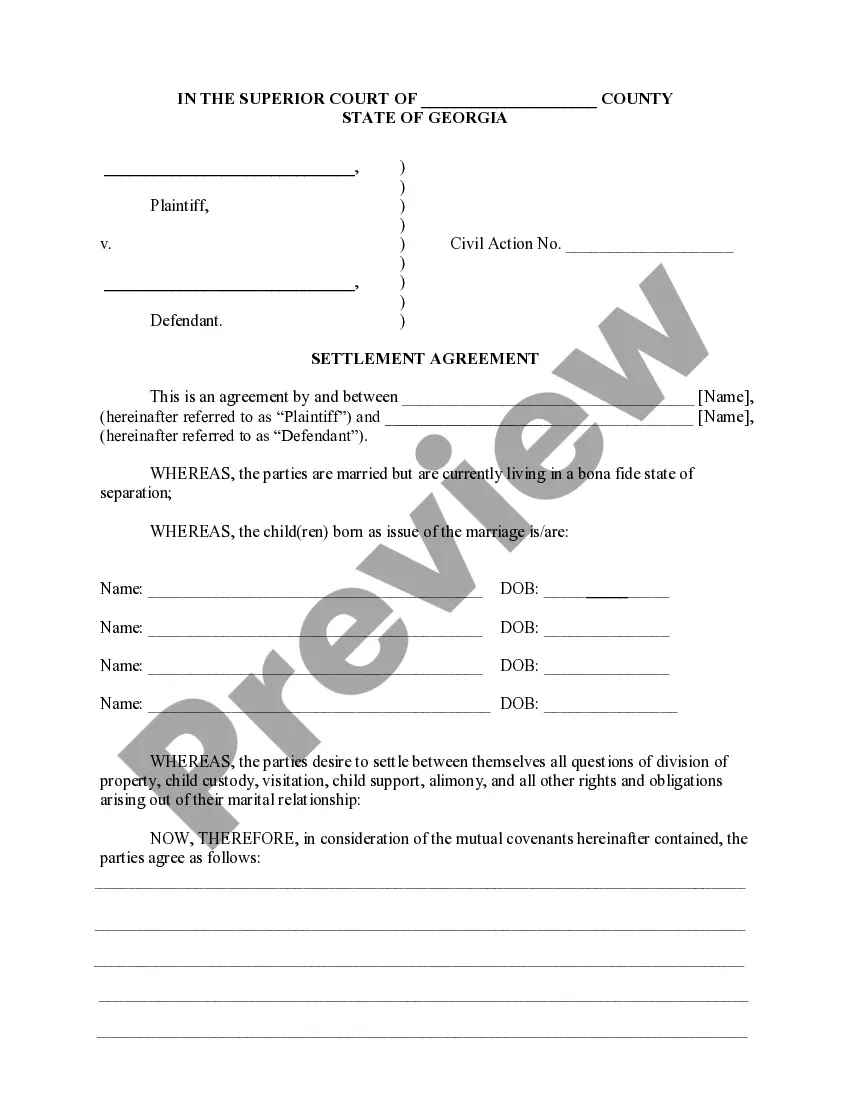

- Take advantage of the Preview key to examine the form.

- Read the explanation to actually have chosen the correct type.

- In case the type is not what you are seeking, utilize the Research discipline to obtain the type that fits your needs and requirements.

- Whenever you discover the right type, click on Get now.

- Choose the costs strategy you would like, complete the required info to produce your money, and purchase the transaction using your PayPal or credit card.

- Select a convenient file structure and obtain your version.

Find all the papers templates you possess purchased in the My Forms food selection. You may get a further version of Maine Employment of Independent Contractors Package whenever, if required. Just click on the essential type to obtain or print out the papers web template.

Use US Legal Forms, by far the most extensive collection of legitimate types, to save lots of time and steer clear of errors. The services provides skillfully made legitimate papers templates which can be used for a selection of purposes. Produce a merchant account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

An independent contractor provides service(s) to employers under agreements with employers. In determining independent contractor status, all government agencies con- sider the amount of direction and control the business has on the individuals performing work.

Independent contractors typically do not receive the same rights afforded to employees and are responsible for their own retirement plans, insurance and other benefits. When you work as an independent contractor, you are an individual entity.

Typically, a contractor will get Form 1099 from a client in January?the beginning of tax season. The client also sends a copy to the IRS. The IRS looks at the Form 1099s from all the contractor's clients to see how much money they've made during the year.

Form 1099-NEC & Independent Contractors | Internal Revenue Service.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

9s and 1099s are tax forms that are required when employers work with an independent contractor. Form 9 is completed by the independent contractor and provides details on who they are. Form 1099NEC is completed by the employer and details the wages paid to the contractor.

Most independent contractors report their gig income on: IRS Schedule C, and. FTB Form 540.

Gig workers and independent contractors are often paid on an hourly or project-based basis. At the federal level, the IRS does not distinguish between the two?meaning that they receive 1099-NEC forms from the companies they work with when they earn $600 or more.