Maine Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

If you wish to full, down load, or print out authorized file web templates, use US Legal Forms, the most important selection of authorized forms, that can be found on the web. Take advantage of the site`s simple and convenient research to discover the files you require. Various web templates for company and person purposes are categorized by classes and states, or key phrases. Use US Legal Forms to discover the Maine Complaint regarding Insurer's Failure to Pay Claim with a number of click throughs.

In case you are currently a US Legal Forms client, log in for your account and click the Download option to have the Maine Complaint regarding Insurer's Failure to Pay Claim. You can also entry forms you earlier delivered electronically inside the My Forms tab of your own account.

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the form to the proper city/nation.

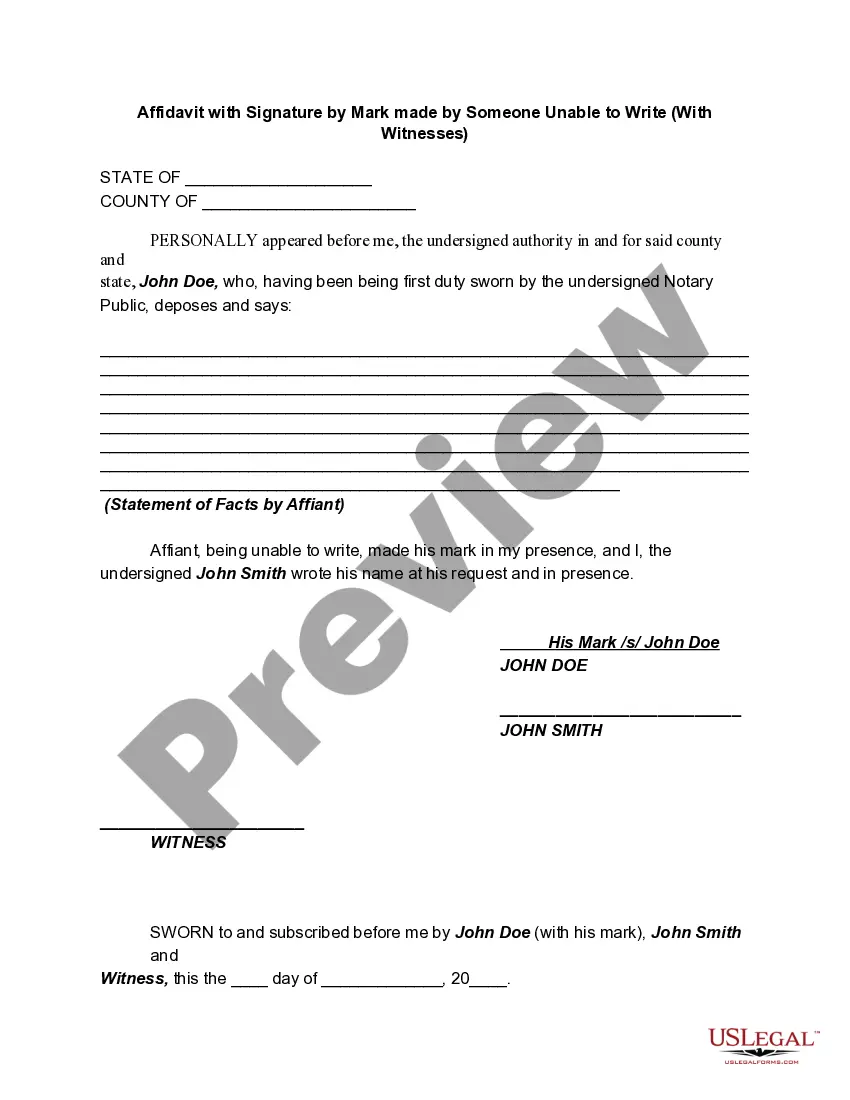

- Step 2. Take advantage of the Preview solution to look over the form`s content material. Never forget about to read the description.

- Step 3. In case you are not satisfied with all the type, use the Research area near the top of the display screen to get other types from the authorized type web template.

- Step 4. When you have discovered the form you require, click the Acquire now option. Select the prices program you favor and put your qualifications to sign up on an account.

- Step 5. Approach the deal. You may use your credit card or PayPal account to finish the deal.

- Step 6. Choose the structure from the authorized type and down load it on your gadget.

- Step 7. Full, revise and print out or indication the Maine Complaint regarding Insurer's Failure to Pay Claim.

Each authorized file web template you purchase is your own permanently. You possess acces to every type you delivered electronically with your acccount. Select the My Forms portion and decide on a type to print out or down load once more.

Contend and down load, and print out the Maine Complaint regarding Insurer's Failure to Pay Claim with US Legal Forms. There are millions of expert and state-particular forms you can utilize for your personal company or person requires.

Form popularity

FAQ

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.

Rental Vehicle If the other driver is at fault, his insurer may offer you a rental car. Some companies will set up a direct bill plan with the rental company but Maine law only requires them to reimburse you for reasonable rental costs you incurred for up to 45 days.

How long does a company have to settle my claim? Once you have supplied the insurer with proof of your loss, the insurer generally has thirty days to either pay or dispute your claim.

How to write an effective complaint letter Be clear and concise. ... State exactly what you want done and how long you're willing to wait for a response. ... Don't write an angry, sarcastic, or threatening letter. ... Include copies of relevant documents, like receipts, work orders, and warranties.

To write a complaint letter, you can start with the sender's address followed by the date, the receiver's address, the subject, salutation, body of the letter, complimentary closing, signature and name in block letters. Body of the Letter explaining the reason for your letter and the complaint.

Be honest and straightforward Write to the point, and in clear language. Do not include subjective opinions, except to the effect that your expectations were higher - for example, that you would have expected a better service from such a prominent company, or the product to be free of faults.

State what you feel should be done about the problem and how long you are willing to wait to get the problem resolved. Make sure that you are reasonable in requesting a specific action. Include copies of any documents regarding your problem, such as receipts, warranties, repair orders, contracts and so forth.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.