Maine Percentage Exchange Agreement

Description

How to fill out Maine Percentage Exchange Agreement?

Choosing the best authorized papers web template might be a have a problem. Obviously, there are a variety of layouts available online, but how will you get the authorized form you need? Utilize the US Legal Forms site. The support offers thousands of layouts, like the Maine Percentage Exchange Agreement, which can be used for business and personal demands. All the forms are checked by pros and fulfill federal and state needs.

When you are previously signed up, log in for your accounts and then click the Down load option to obtain the Maine Percentage Exchange Agreement. Make use of accounts to check with the authorized forms you might have bought previously. Go to the My Forms tab of your own accounts and have yet another duplicate from the papers you need.

When you are a new customer of US Legal Forms, listed here are simple guidelines that you should adhere to:

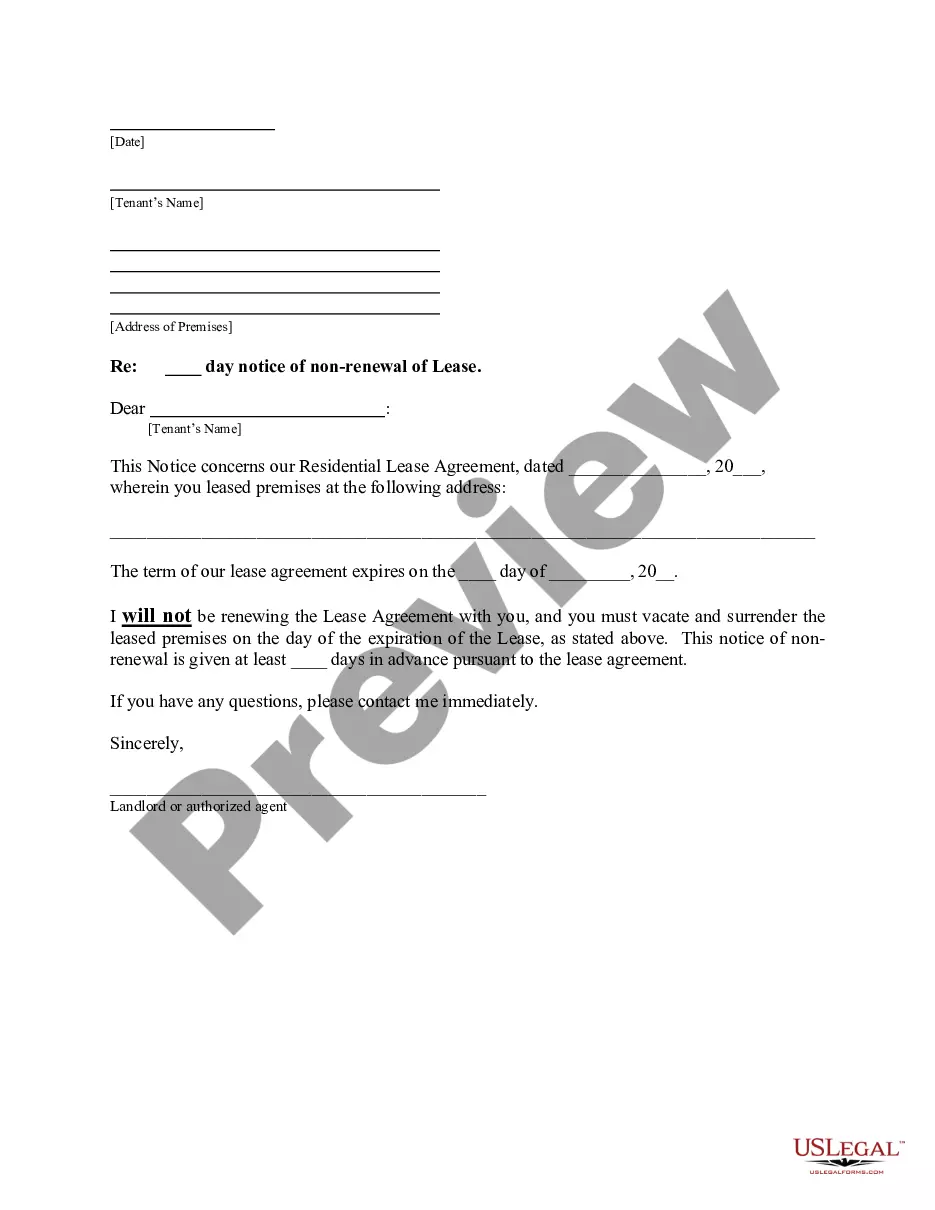

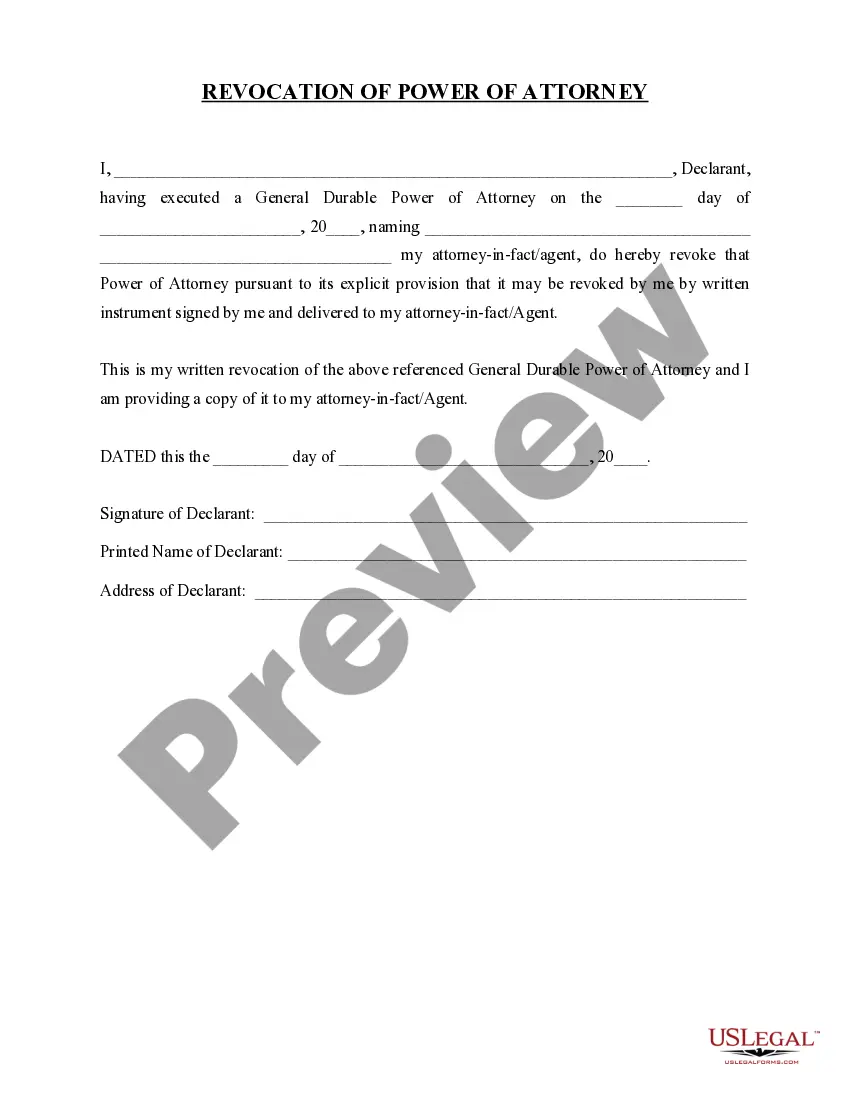

- Very first, make certain you have selected the right form to your area/region. You can examine the form utilizing the Review option and browse the form outline to make certain this is the right one for you.

- When the form fails to fulfill your needs, use the Seach industry to obtain the right form.

- Once you are certain the form would work, click the Get now option to obtain the form.

- Opt for the prices plan you would like and enter the needed details. Make your accounts and purchase an order making use of your PayPal accounts or charge card.

- Opt for the submit format and down load the authorized papers web template for your gadget.

- Complete, edit and printing and indicator the attained Maine Percentage Exchange Agreement.

US Legal Forms is the greatest collection of authorized forms that you can discover numerous papers layouts. Utilize the service to down load professionally-made files that adhere to express needs.

Form popularity

FAQ

Most homesellers in Maine, like all homesellers across the country, do not need to report the sale of their property. However, if you have capital gains of more than $250,000 or $500,000 as a couple filing a joint return, then the IRS will tax you on some of the gain.

The rate of tax is $2.20 for each $500 or fractional part of $500 of the value of the property being transferred. The tax is imposed ½ on the grantor, A½ on the grantee.

How Do I Avoid Paying Taxes When I Sell My House?Offset your capital gains with capital losses.Consider using the IRS primary residence exclusion.Also, under a 1031 exchange, you can roll the proceeds from the sale of a rental or investment property into a like investment within 180 days.

If you sell a house or property in less than one year of owning it, the short-term capital gains is taxed as ordinary income, which could be as high as 37 percent. Long-term capital gains for properties you owned over one year are taxed at 15 percent or 20 percent depending on your income tax bracket.

Note: Regardless of residency status, all individuals and entities are subject to Maine income tax on gains realized from the sale of real estate in Maine.

With respect to the sale of property, capital gains tax will be imposed on any capital gain realised with regards to property being sold. Part of the capital gain is included in the tax payer's taxable income for that tax year.

Maine taxes both long- and short-term capital gains at the full income tax rates described in the income tax section above. This means that income from capital gains can face a state rate of up to 7.15% in Maine.

Maine taxes both long- and short-term capital gains at the full income tax rates described in the income tax section above. This means that income from capital gains can face a state rate of up to 7.15% in Maine.

The states with no additional state tax on capital gains are: Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. These are the same states that do not tax personal income on wages, although they might tax interest and dividends from investments, depending on the state.