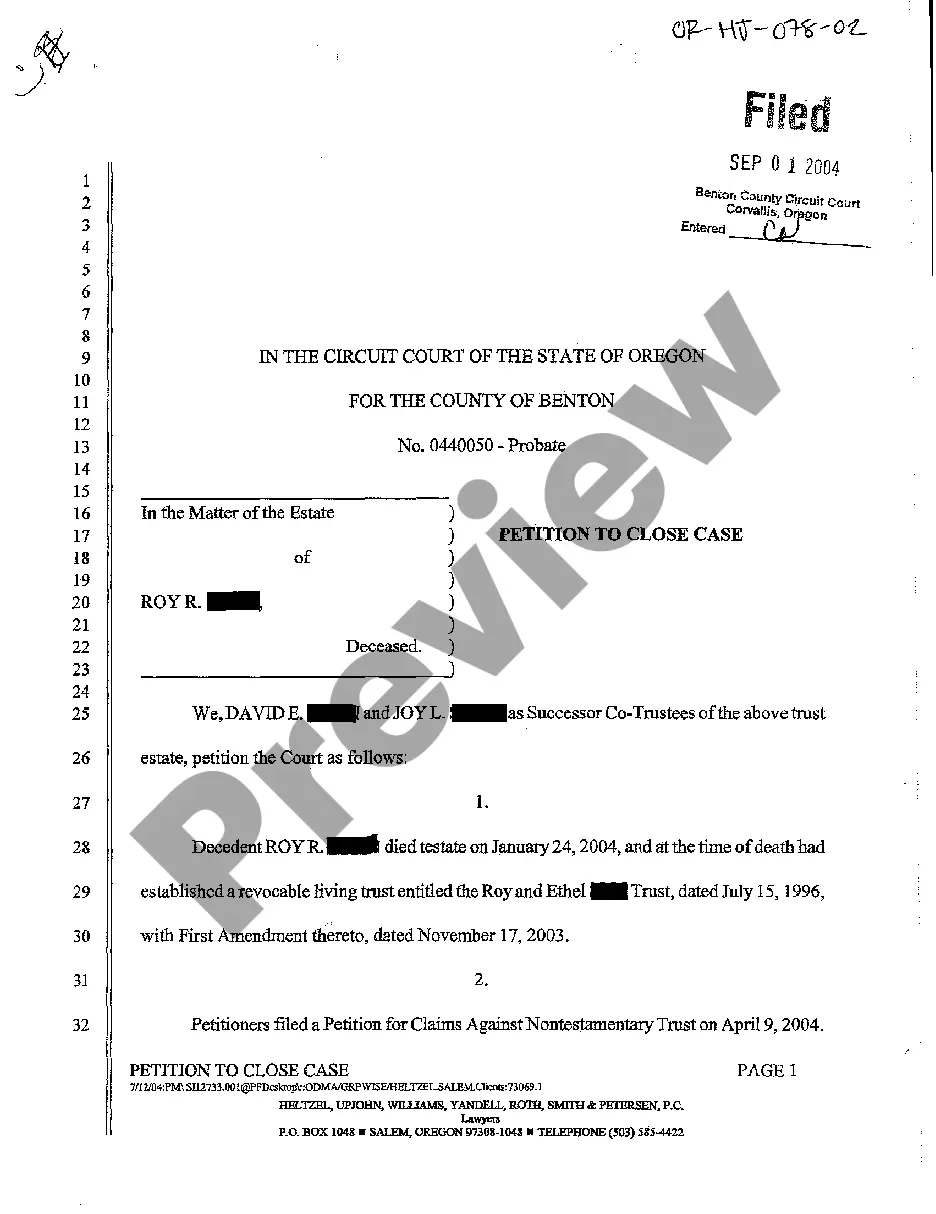

UCC3 - Financing Statement Amendment Addendum - Maine - For use after July 1, 2001. This form is to be used as an addendum to the financing statement amendment. This form is to be filed in the real estate records.

Maine UCC3 Financing Statement Amendment Addendum

Description

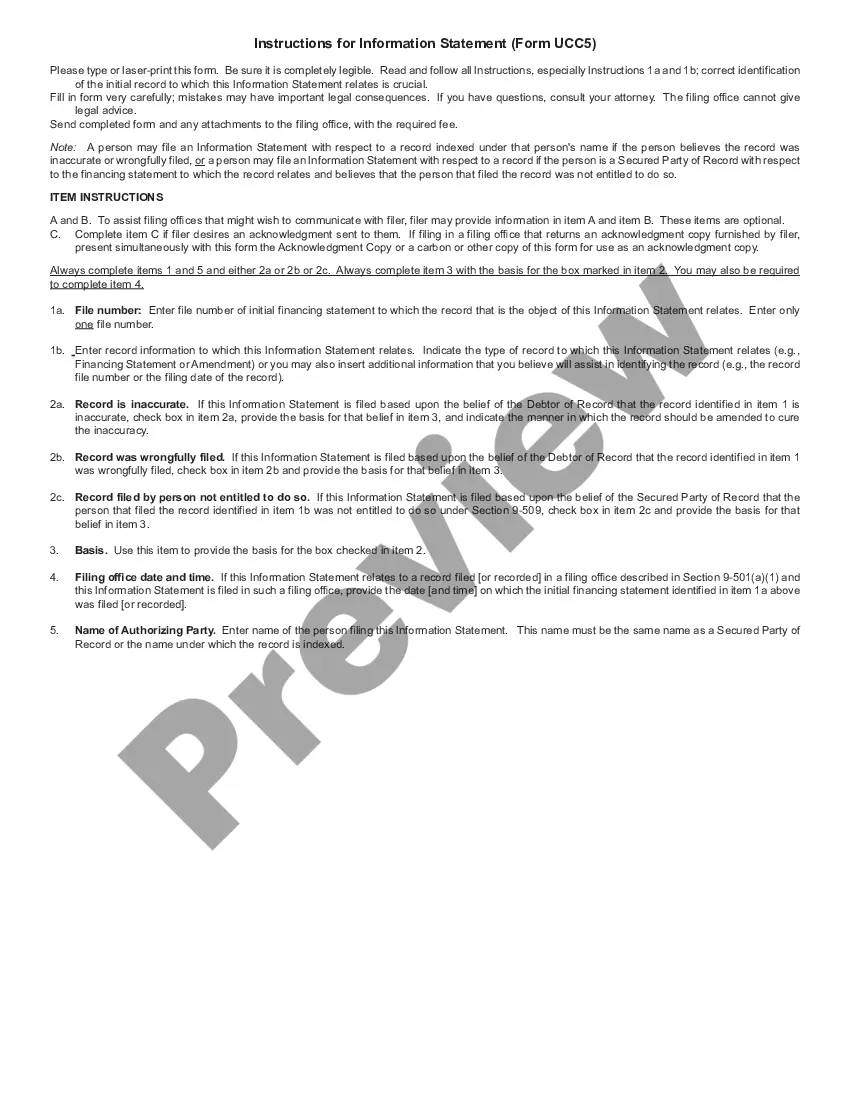

How to fill out Maine UCC3 Financing Statement Amendment Addendum?

Have any form from 85,000 legal documents including Maine UCC3 Financing Statement Amendment Addendum online with US Legal Forms. Every template is prepared and updated by state-accredited legal professionals.

If you have already a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the steps below:

- Check the state-specific requirements for the Maine UCC3 Financing Statement Amendment Addendum you would like to use.

- Read description and preview the sample.

- Once you are sure the template is what you need, simply click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you’ll always have immediate access to the proper downloadable template. The platform provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to obtain your Maine UCC3 Financing Statement Amendment Addendum easy and fast.

Form popularity

FAQ

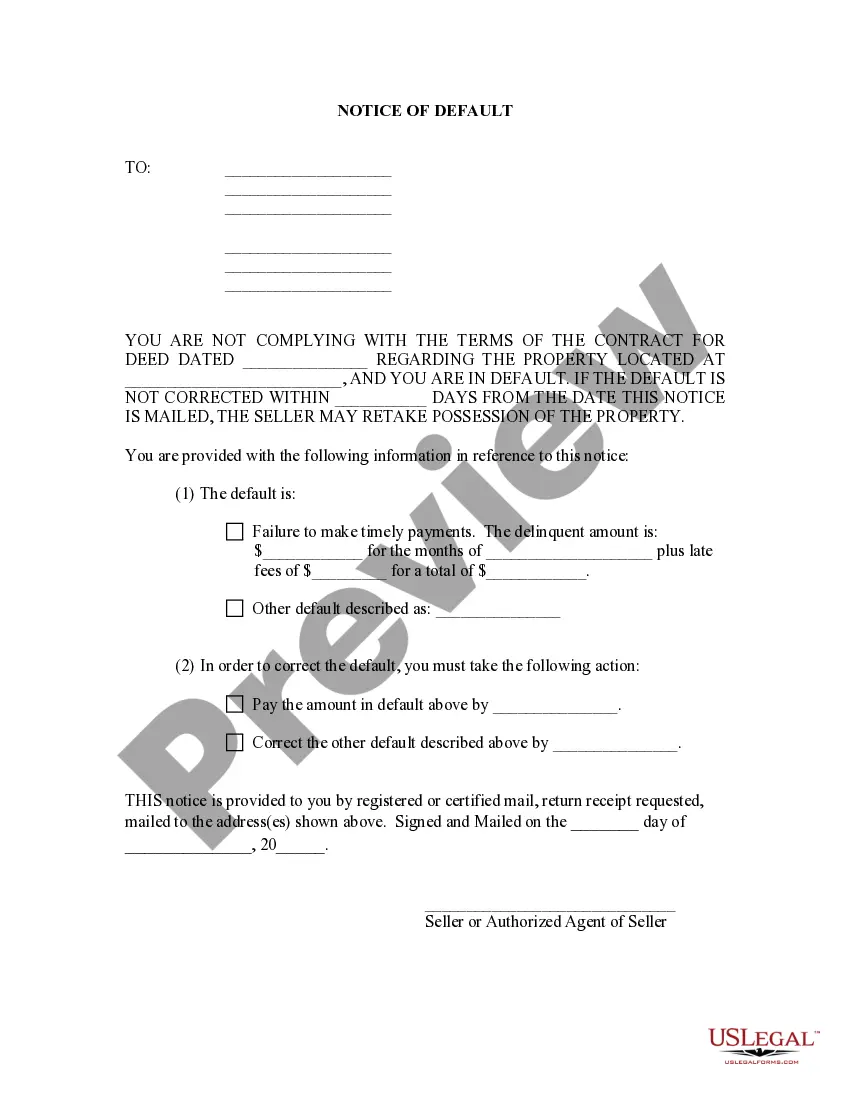

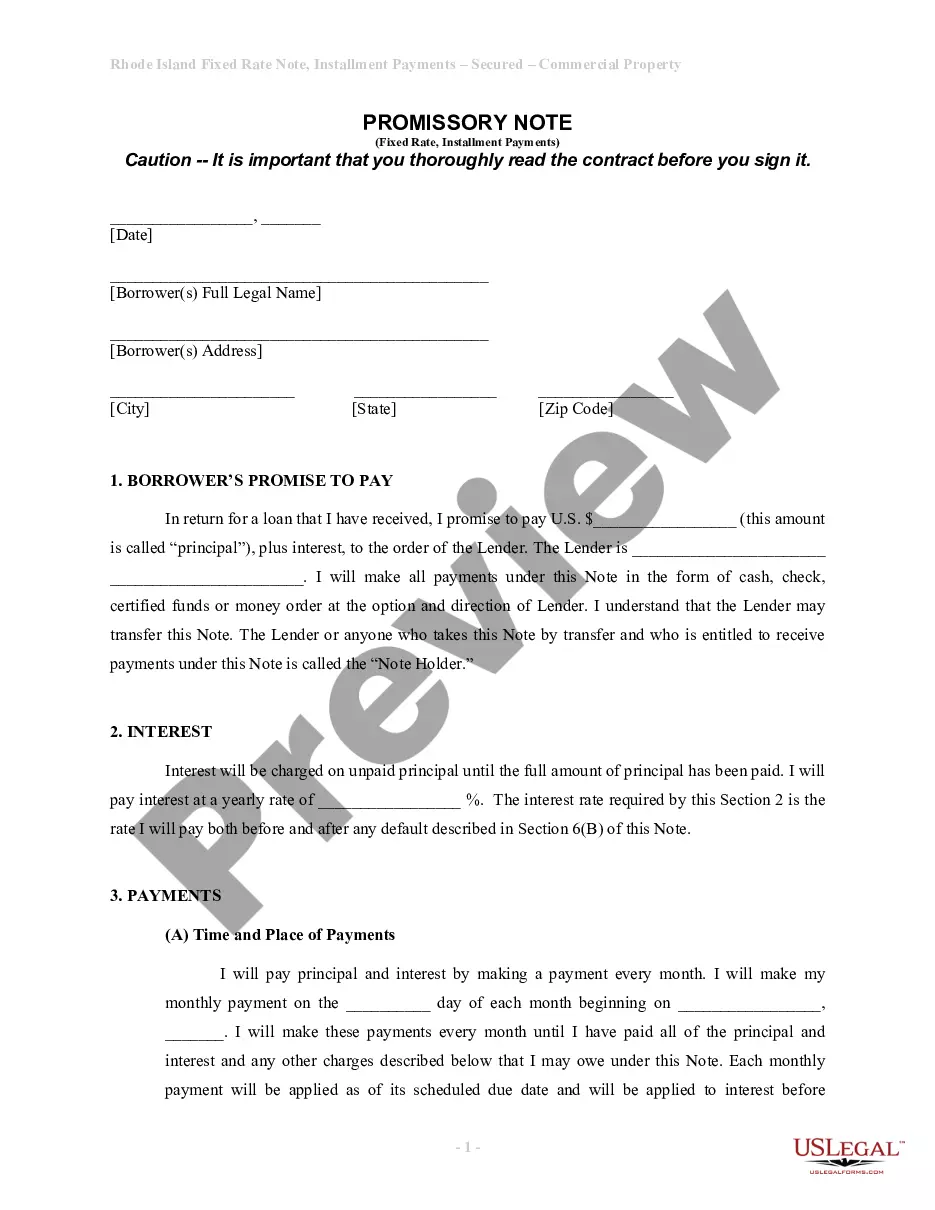

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

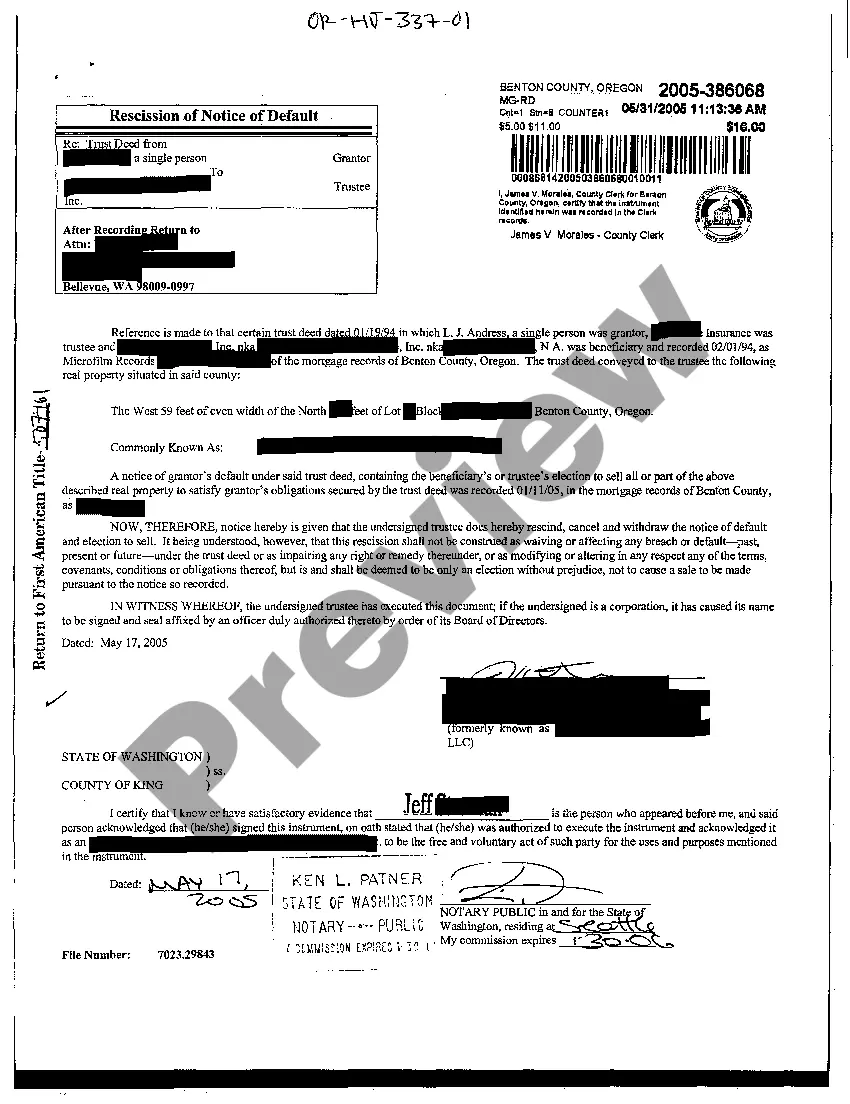

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

After receiving your request, the lender has 20 days to terminate the UCC filing.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.