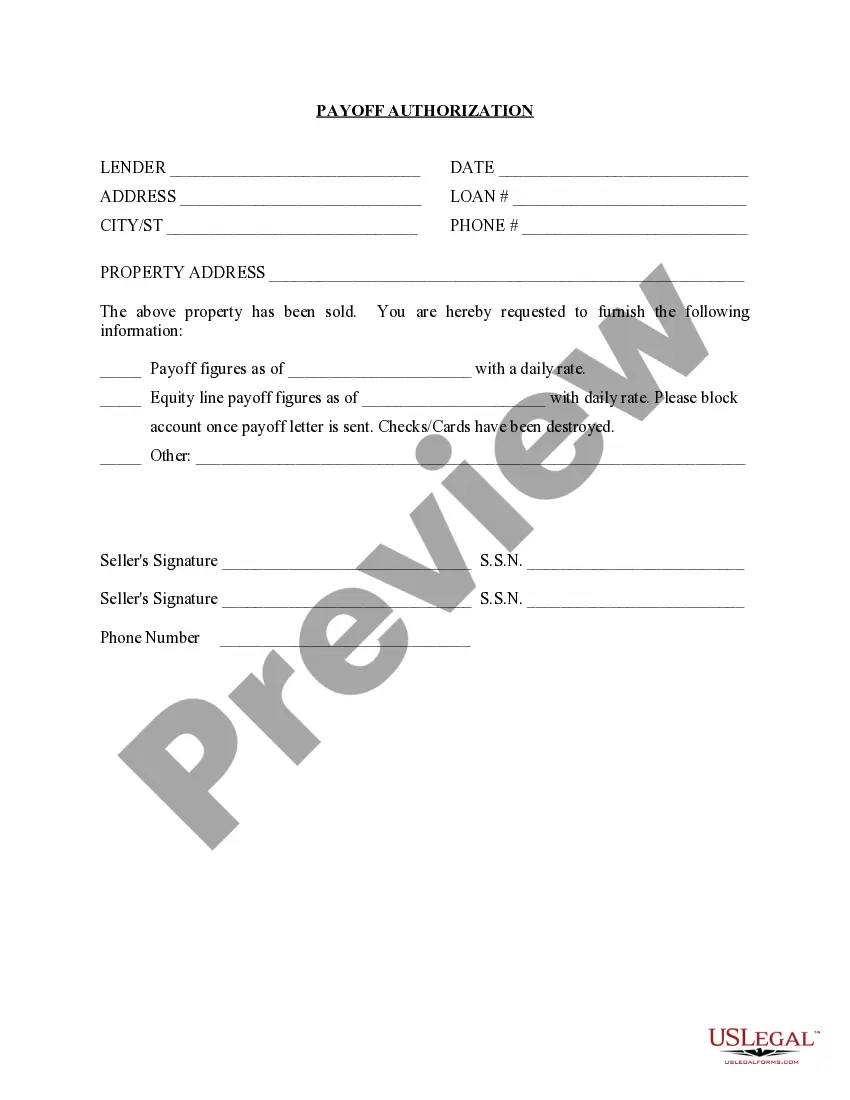

Michigan Payoff Authorization is a legal document used by a lender to transfer a mortgage loan from one party to another. It is commonly used when a borrower refinances their home loan or sells the property. The document authorizes the lender to disburse the remaining balance of the loan to the new lender or to the borrower. It is signed by the borrower, the lender, and the title company. There are two types of Michigan Payoff Authorization: an original Payoff Authorization and a Partial Payoff Authorization. The original Payoff Authorization is used when the borrower pays off the full balance of the loan, while the Partial Payoff Authorization is used when the borrower pays off a portion of the loan balance.

Michigan Payoff Authorization

Description Payoff Authorization Form

How to fill out Michigan Payoff Authorization?

How much time and resources do you normally spend on drafting official documentation? There’s a greater option to get such forms than hiring legal experts or spending hours browsing the web for a proper template. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Michigan Payoff Authorization.

To acquire and prepare a suitable Michigan Payoff Authorization template, follow these simple steps:

- Examine the form content to ensure it complies with your state requirements. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your needs, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Michigan Payoff Authorization. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally safe for that.

- Download your Michigan Payoff Authorization on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web services. Join us now!

Authorization Of Payoff Form popularity

FAQ

The Michigan State Housing Development Authority (MSHDA) offers Down Payment Assistance (DPA) to specifically help repeat homebuyers purchase a home. The assistance is provided with a zero-interest, non-amortizing loan with no monthly payments.

To qualify, you must meet the following requirements: Complete Homebuyer Education classes. Have a minimum credit score of 640-660 (depending on the type of home). Meet household income limits based on area and household size.

Michigan First Home Down Payment Assistance One of the programs that MSHDA offers is the MI First Home Down Payment Assistance (DPA). The maximum DPA under this program is $7,500. This down payment assistance is a zero-interest, non-amortizing loan with no monthly payments.

MSHDA HHF (StepForward) LOAN SERVICING The balance of the loan may be fully forgiven and lien discharged after five years, if the borrower complies with the terms of the mortgage and note.

The Michigan State Housing Development Authority (MSHDA) offers Down Payment Assistance (DPA) to specifically help repeat homebuyers purchase a home. The assistance is provided with a zero-interest, non-amortizing loan with no monthly payments.

Since people often refer to a MSHDA loan as a first time home buyer grant, it's often mistaken as free money with no pay back requirement. That's not true. You will have to pay it back. For example, if you sell your home or refinance your mortgage, the down payment assistance will need to be paid back.

MSHDA Details: Michigan Down Payment loan: up to $10,000 Cash asset restriction of $20,000. Maximum home purchase price of $224,500. Income limits vary statewide from $64,100 to $123,620, total household income, determined by location and family size.