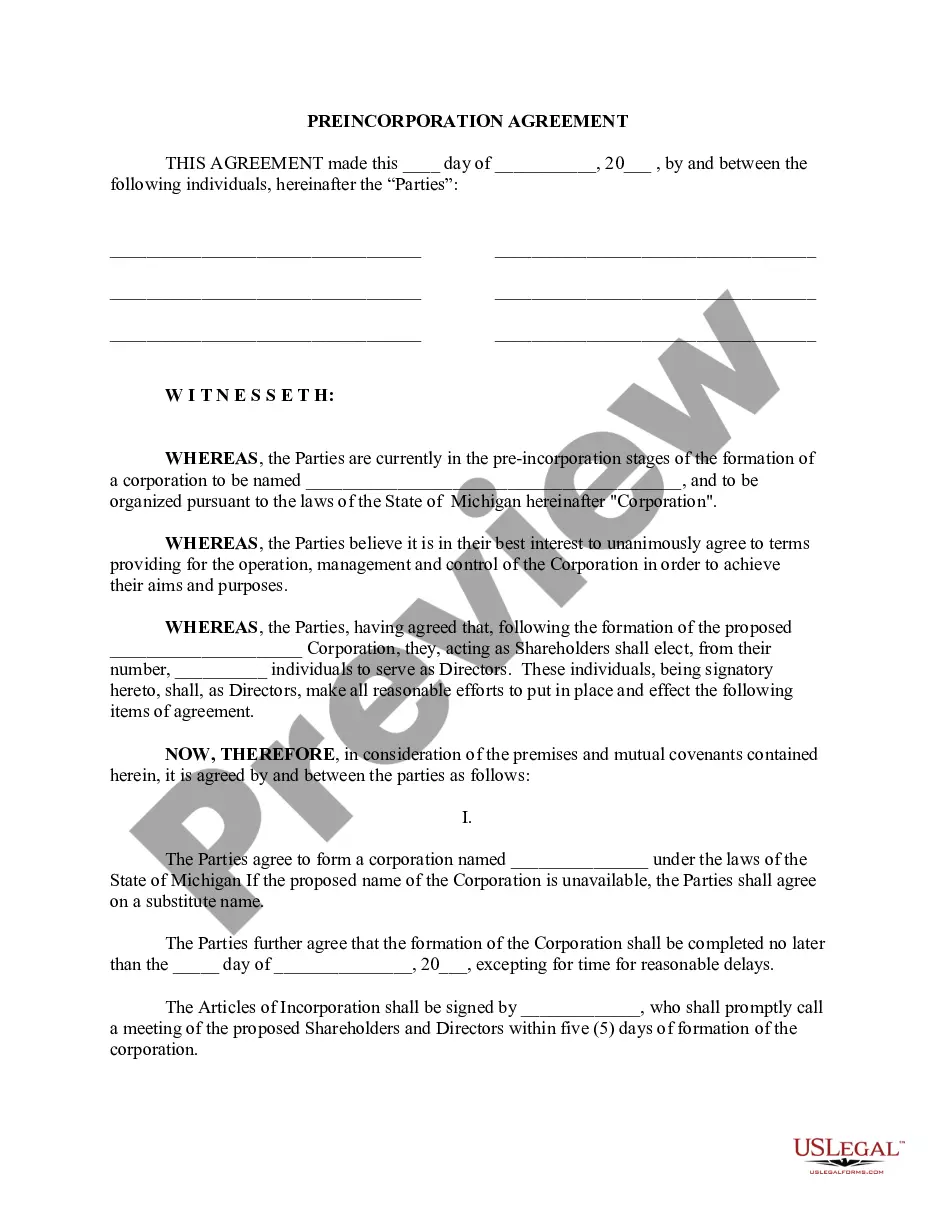

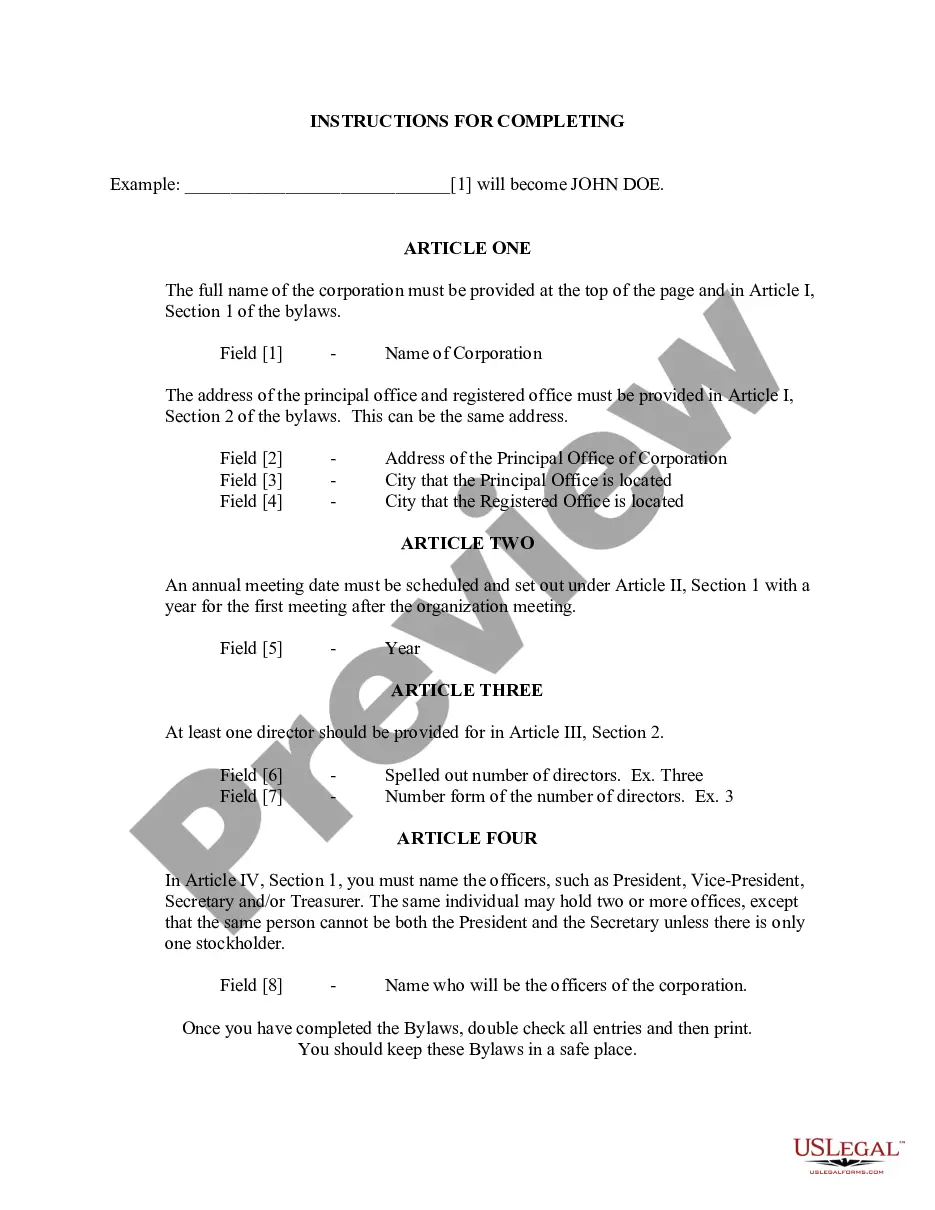

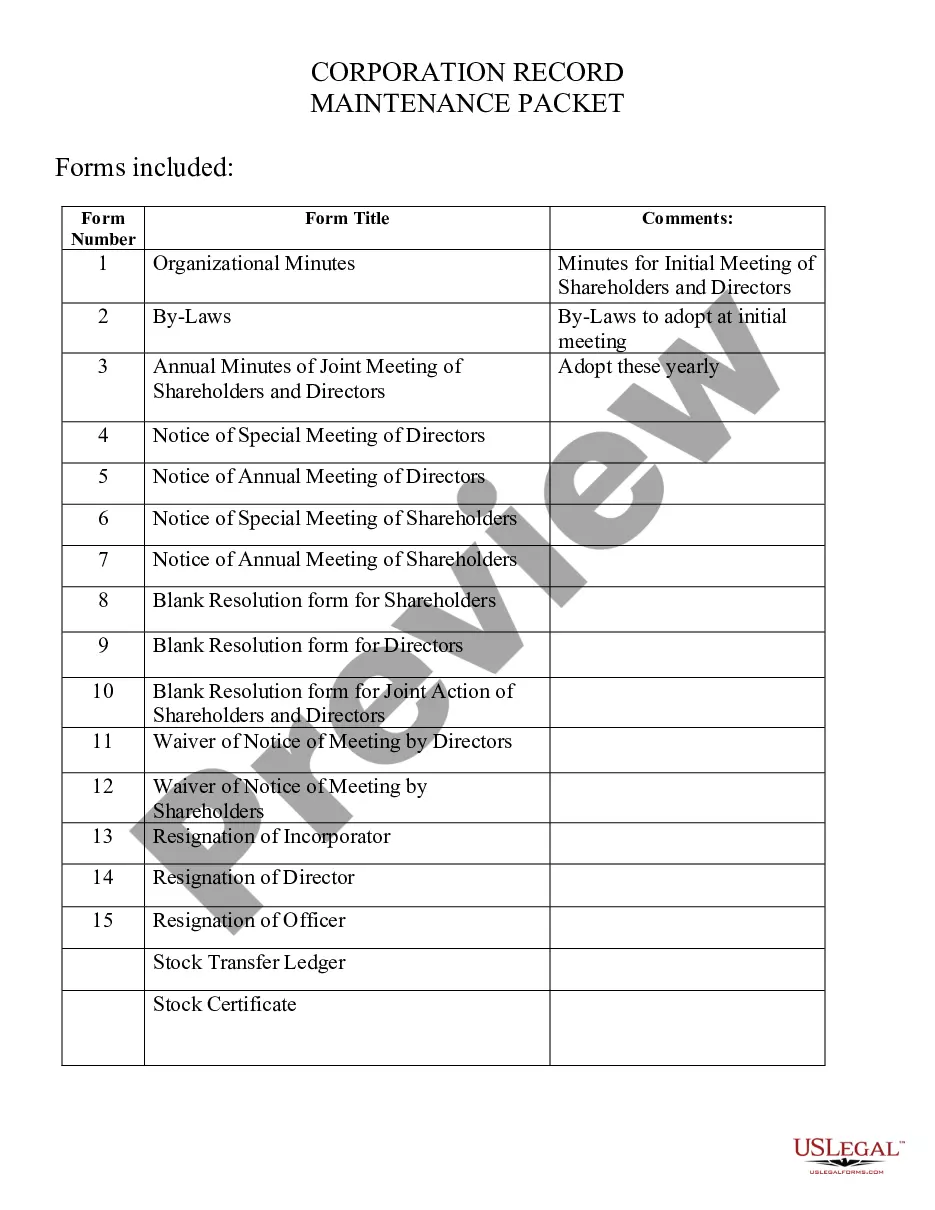

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Michigan Business Incorporation Package to Incorporate Corporation

Description

How to fill out Michigan Business Incorporation Package To Incorporate Corporation?

Have any form from 85,000 legal documents such as Michigan Business Incorporation Package to Incorporate Corporation on-line with US Legal Forms. Every template is prepared and updated by state-certified lawyers.

If you have already a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to access it.

If you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Michigan Business Incorporation Package to Incorporate Corporation you would like to use.

- Read description and preview the sample.

- Once you are sure the sample is what you need, just click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in a single of two appropriate ways: by card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform provides you with access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Michigan Business Incorporation Package to Incorporate Corporation easy and fast.

Form popularity

FAQ

If you want sole or primary control of the business and its activities, a sole proprietorship or an LLC might be the best choice for you. You can negotiate such control in a partnership agreement as well. A corporation is constructed to have a board of directors that makes the major decisions that guide the company.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

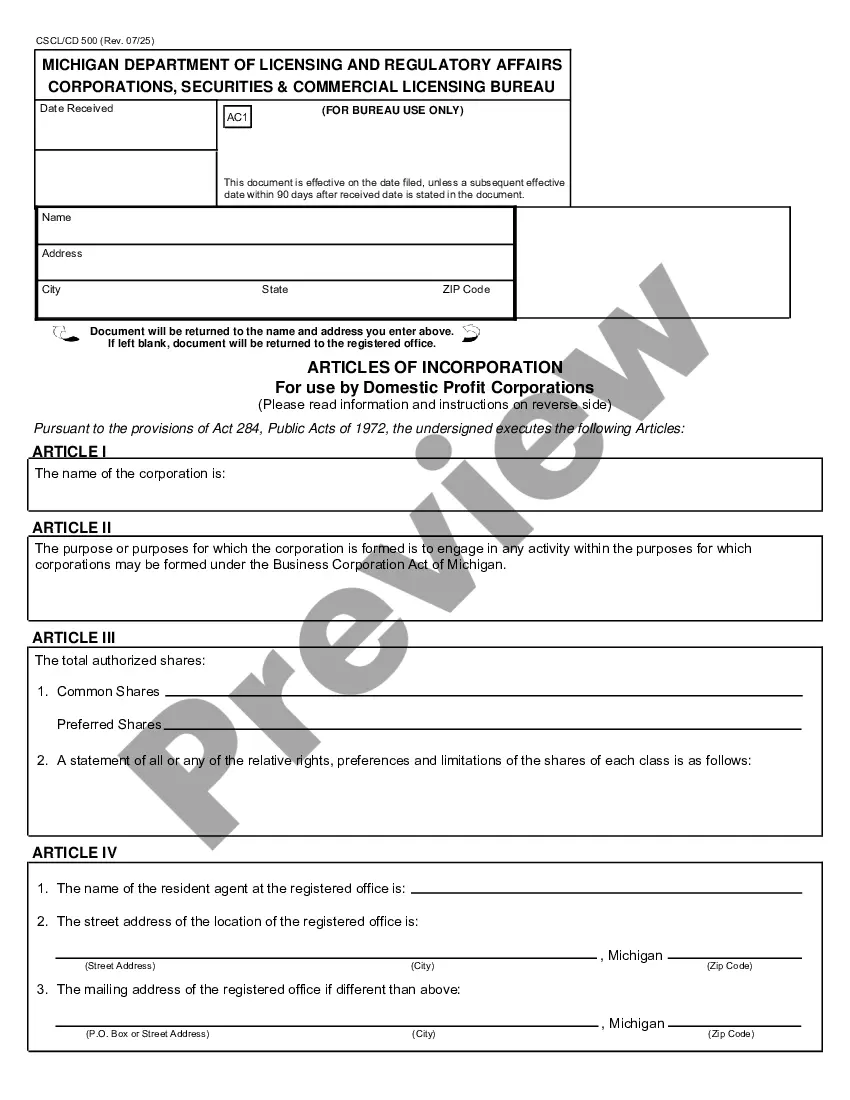

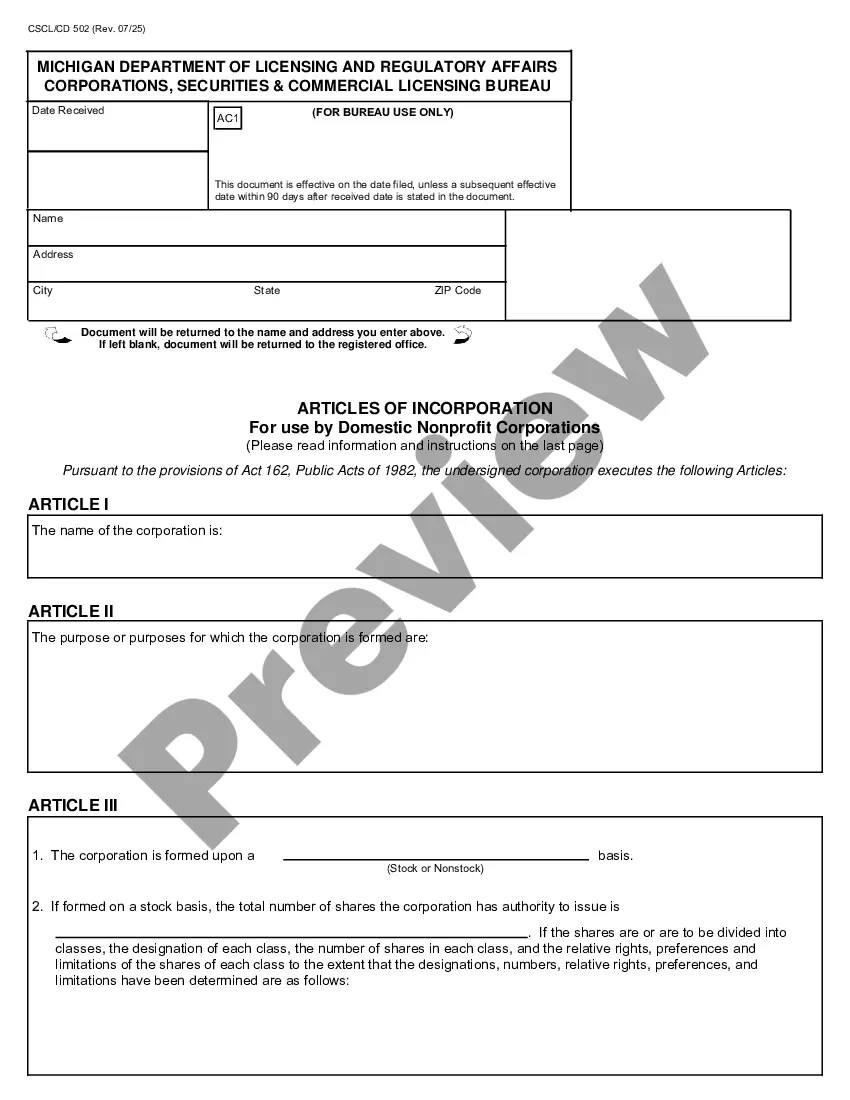

How much does it cost to form a corporation in Michigan? You can reserve your business name with the Michigan Department of Licensing and Regulatory Affairs for $10. To file your Articles of Incorporation, the Michigan Department of Licensing and Regulatory Affairs charges a $50 filing fee.

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

If you incorporate your small business, you can determine when and how you receive income from the business, which is a real tax advantage. Instead of taking a salary from the business when the business receives income, being incorporated allows you to take your income at a time when you'll pay less in tax.

Income tax rates are lower for corporations than for the personal income received by sole proprietors. Using tax planning, the tax burden can be reduced by earning income through your corporation as an incorporated contractors, due to the lower corporate tax rates.

Inc. is the abbreviation for incorporated. An incorporated company, or corporation, is a separate legal entity from the person or people forming it. Directors and officers purchase shares in the business and have responsibility for its operation. Incorporation limits an individual's liability in case of a lawsuit.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

The word "incorporated" indicates that a business entity is a corporation.A corporation or "Inc." is an entirely separate entity from its owners and shareholders. This is an important legal distinction since an incorporated business essentially becomes a separate "person" under the law.