This Limited Liability Company LLC Formation Package includes Step by Step Instructions, Articles of Formation, Operating Agreement, Resolutions and other forms for formation of a Limited Liability Company in the State of Michigan.

Michigan Limited Liability Company LLC Formation Package

Description Operating Agreement Llc Michigan

How to fill out Llc Registration Michigan?

Have any template from 85,000 legal documents including Michigan Limited Liability Company LLC Formation Package online with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you already have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Michigan Limited Liability Company LLC Formation Package you need to use.

- Look through description and preview the sample.

- When you are sure the sample is what you need, click on Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by credit card or via PayPal.

- Pick a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the proper downloadable sample. The service will give you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Michigan Limited Liability Company LLC Formation Package fast and easy.

Michigan Llc Formation Form popularity

Llc Formation Michigan Other Form Names

Becoming An Llc In Michigan FAQ

Profits subject to social security and medicare taxes. In some circumstances, owners of an LLC may end up paying more taxes than owners of a corporation. Salaries and profits of an LLC are subject to self-employment taxes, currently equal to a combined 15.3%.

So, do you need to incorporate LLC in your logo? In short, the answer is no. In fact, none of your branding/marketing needs to include LLC, Inc. or Ltd. If it is included, this may look amateur.Logos are an extension of a company's trade name, so marketing departments don't need to include legal designation.

Choose your management structure. There are two forms of management for LLCs: member-managed and manager-managed. Choose your title. In a single-member LLC, you have the freedom to choose whatever title best reflects your role. Create an Operating Agreement.

You should always include LLC on all invoices, contracts, leases, legal records, tax returns, letterheads and other purposes. In most states, it is required to add LLC to your business name when forming your business, filing for an EIN or paying taxes.

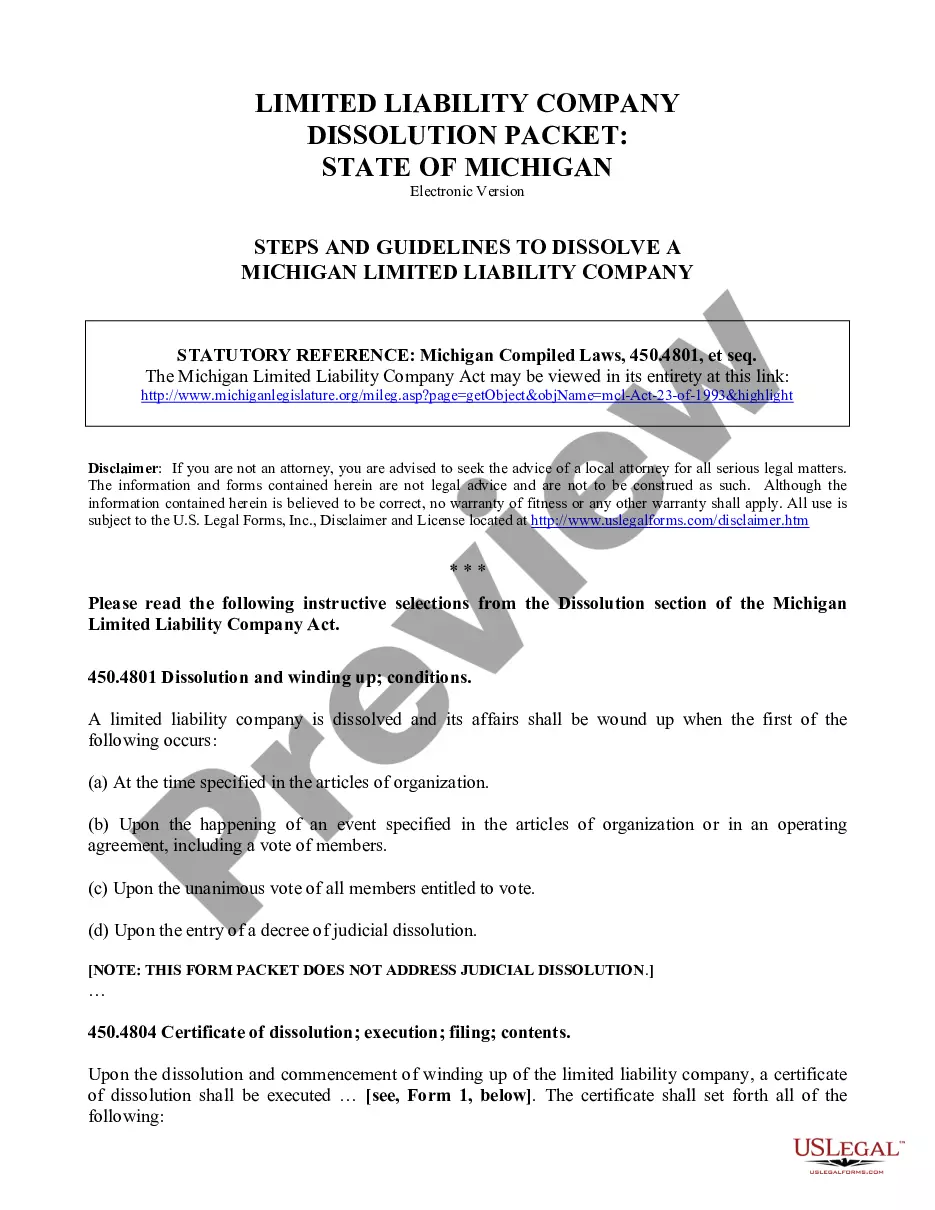

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

Have the state license for each professional who will be a member of the company, and. check with the state licensing board for your profession to see if its prior approval is required, (and, if so, obtain the necessary documentation showing that approval), and.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

The answer is yes--it is possible and permissible to operate multiple businesses under one LLC. Many entrepreneurs who opt to do this use what is called a "Fictitious Name Statement" or a "DBA" (also known as a "Doing Business As") to operate an additional business under a different name.

Who Should Form an LLC? Any person starting a business, or currently running a business as a sole proprietor, should consider forming an LLC. This is especially true if you're concerned with limiting your personal legal liability as much as possible. LLCs can be used to own and run almost any type of business.