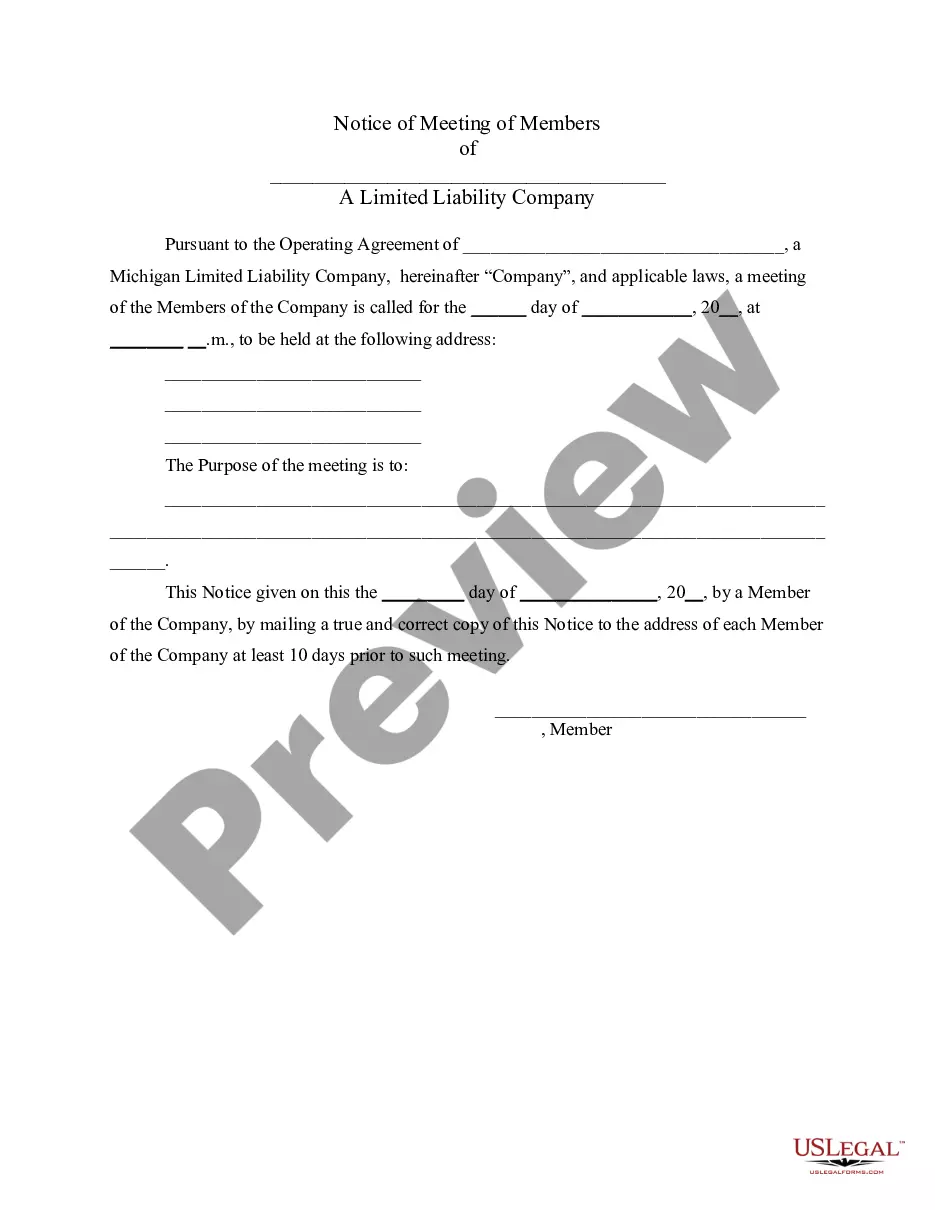

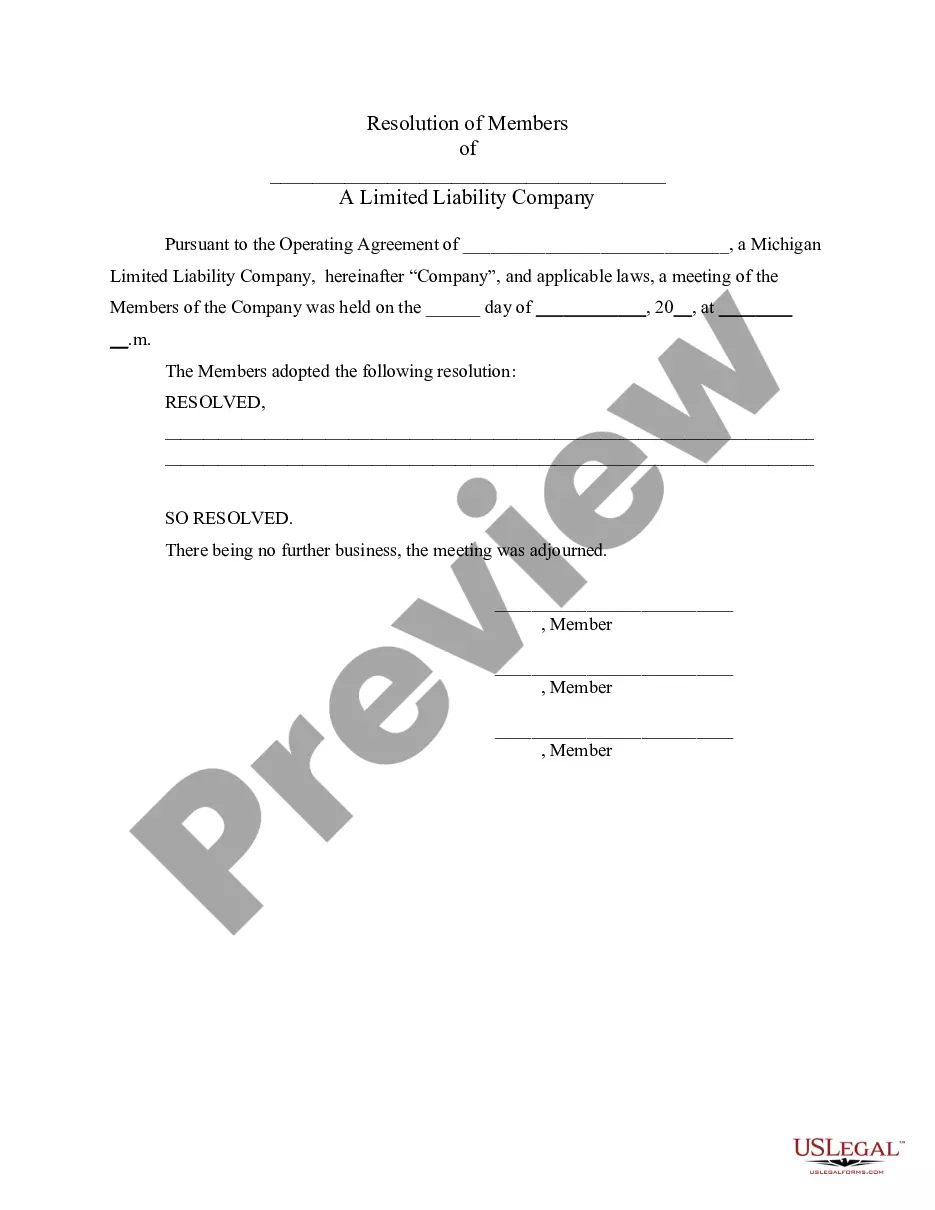

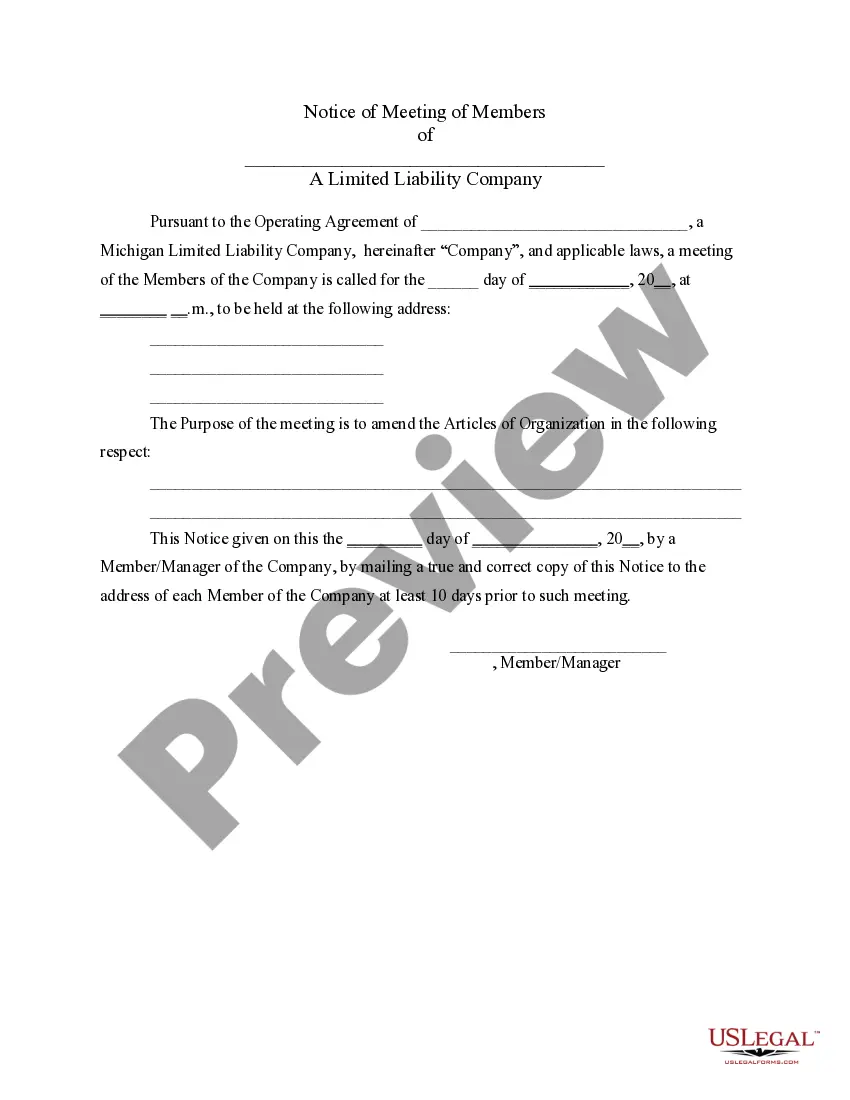

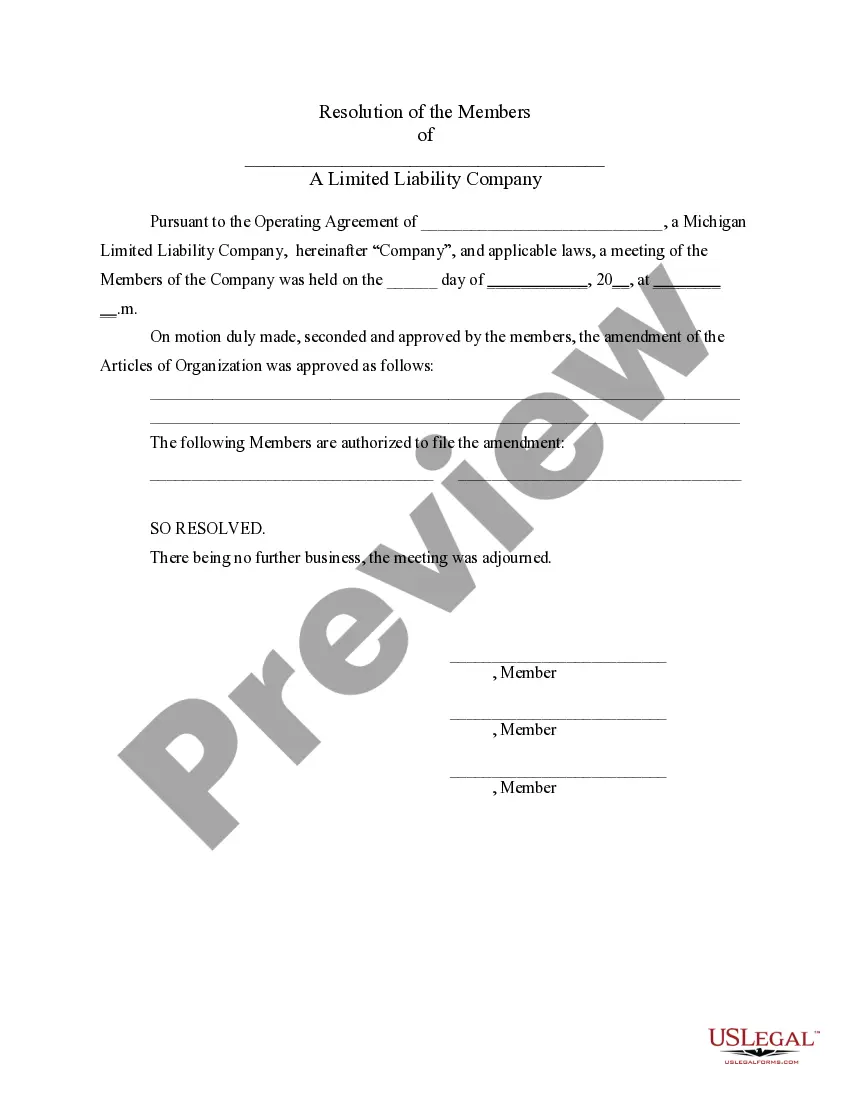

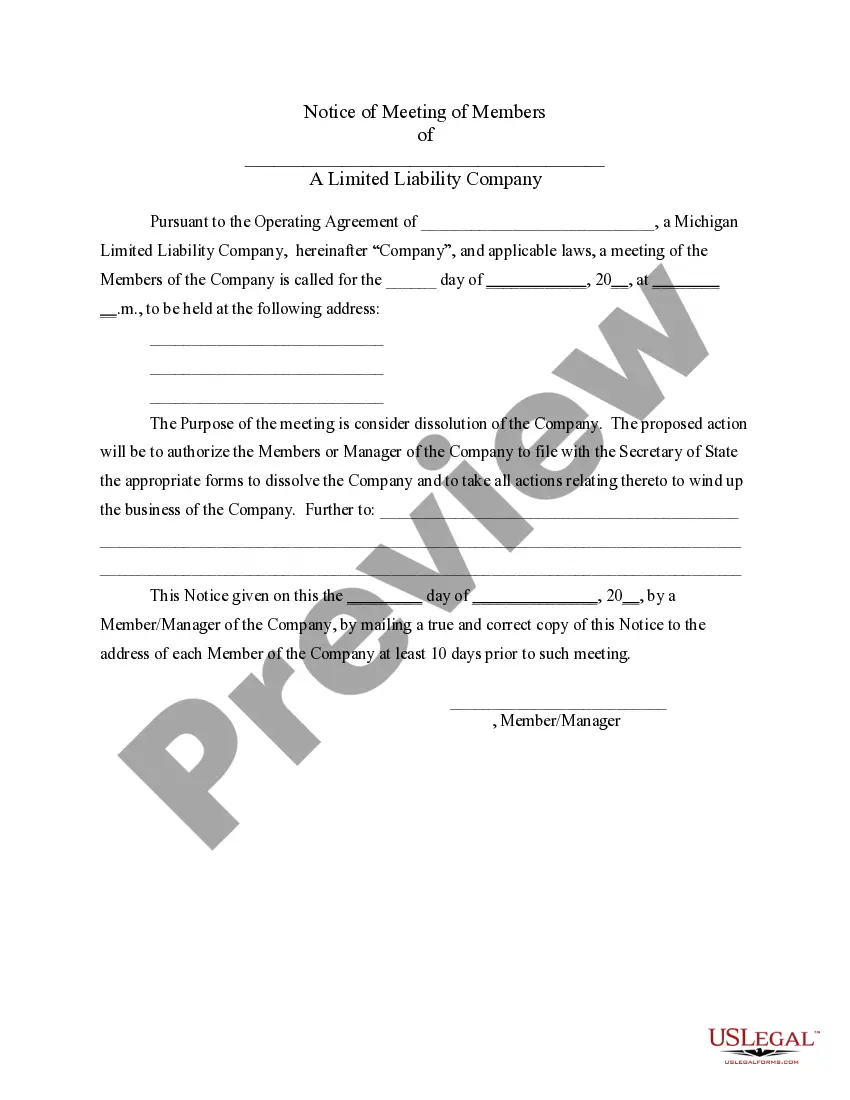

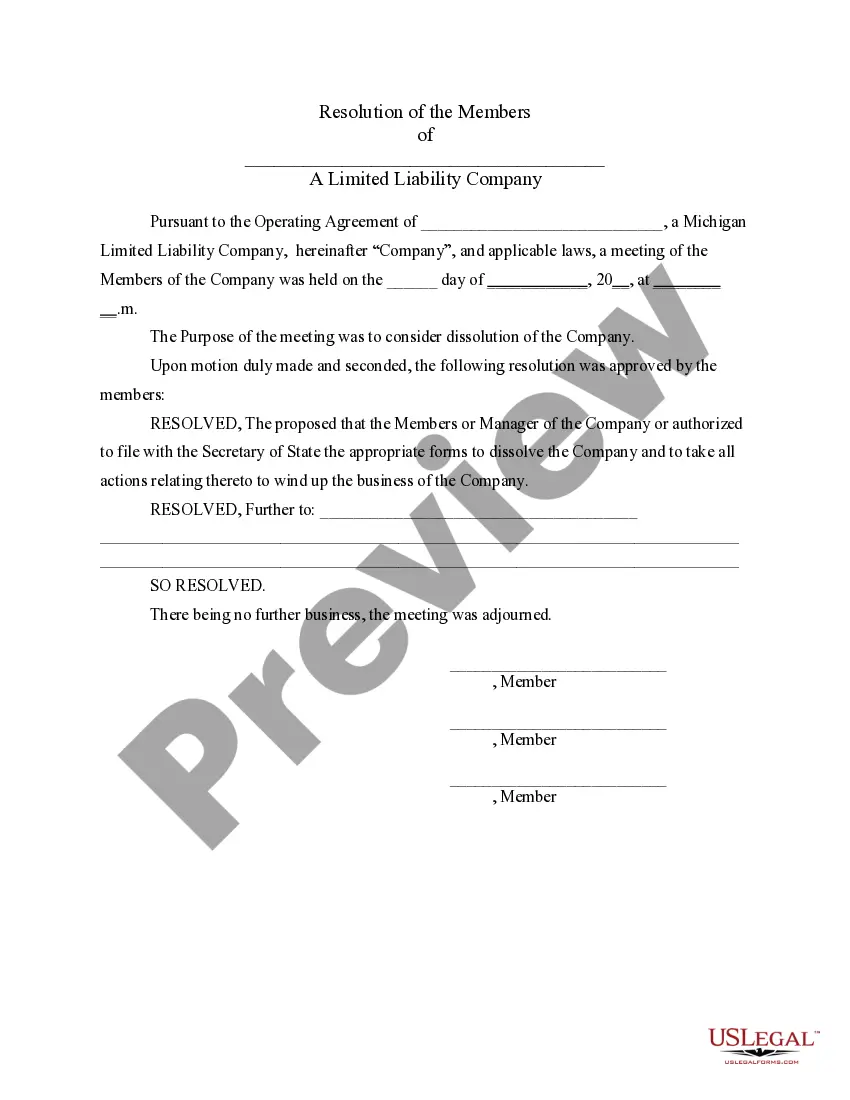

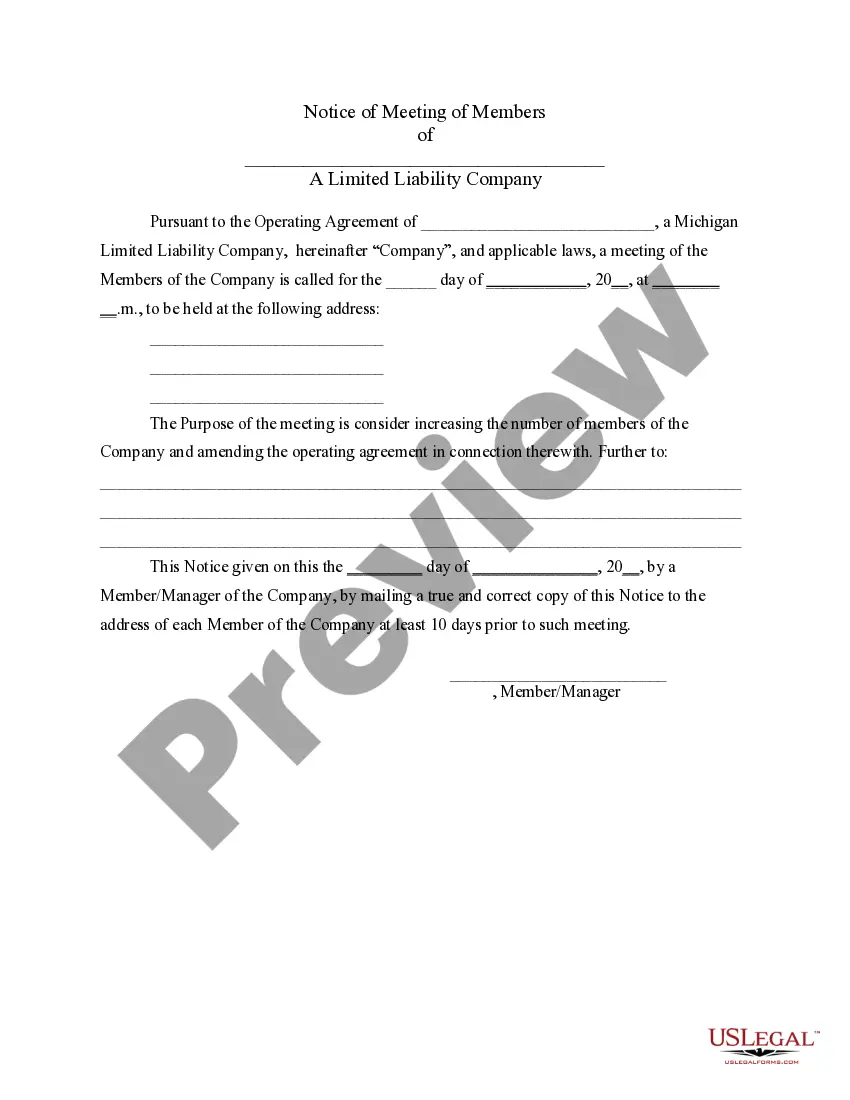

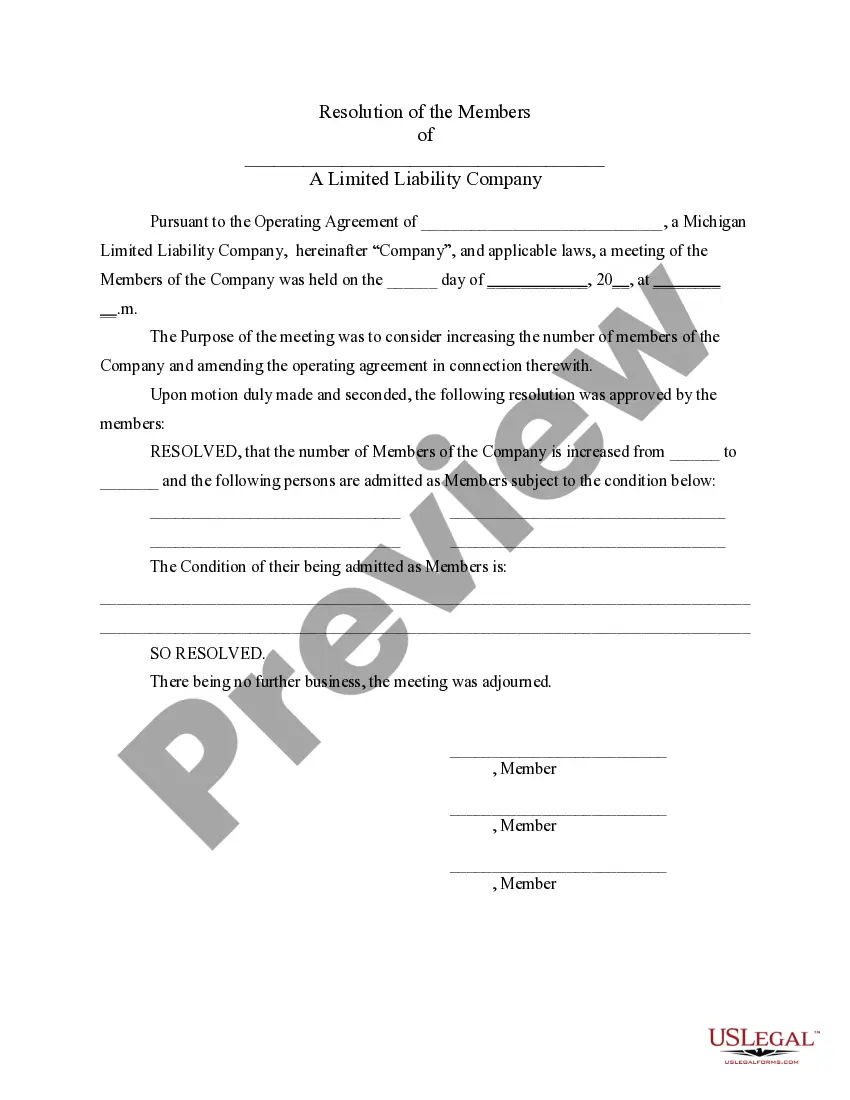

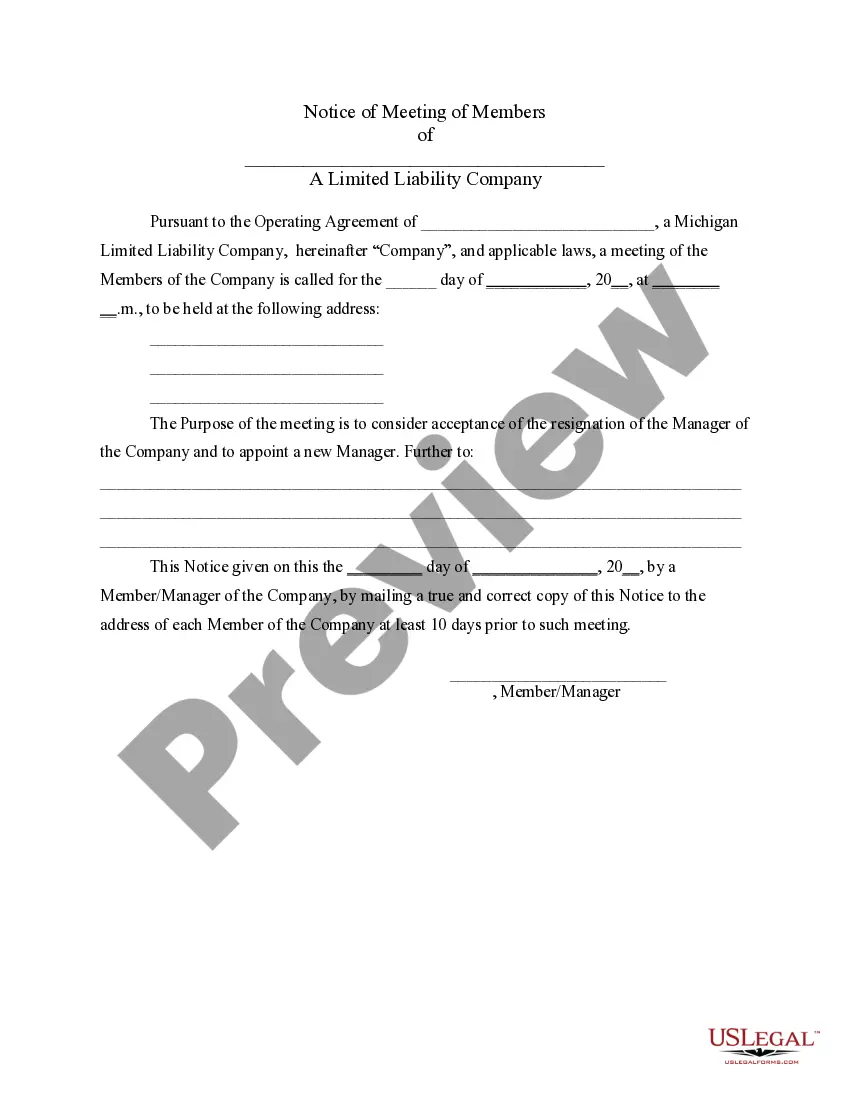

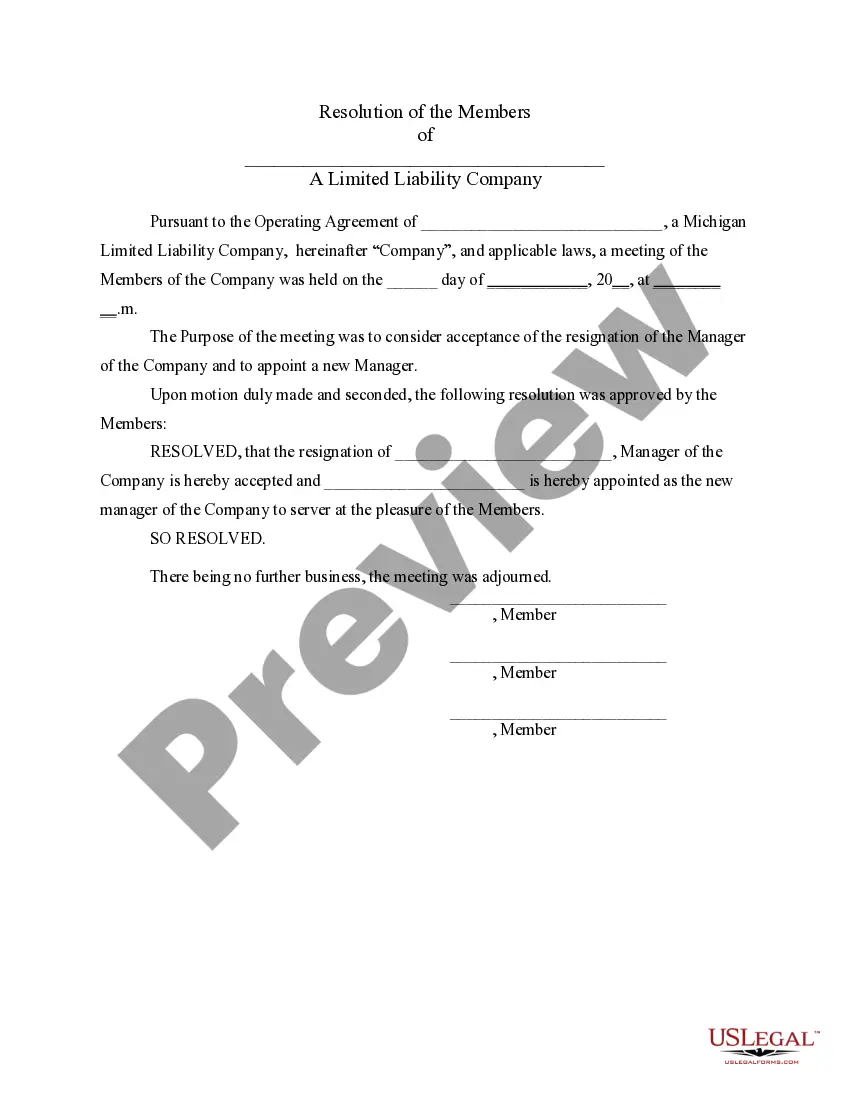

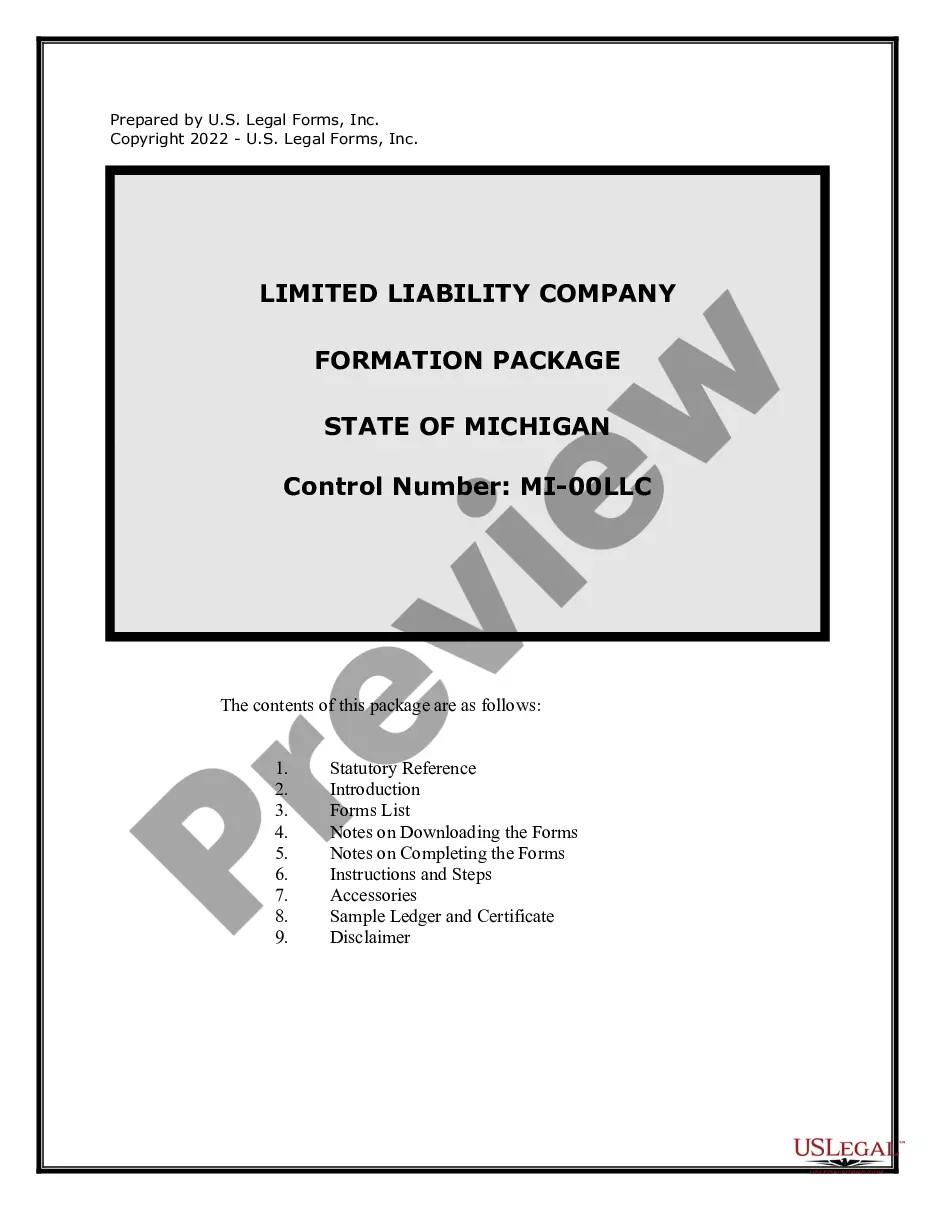

Michigan LLC Notices, Resolutions and other Operations Forms Package

Description Michigan Limited Liability Company Forms

How to fill out Michigan Llc Other?

Have any template from 85,000 legal documents including Michigan LLC Notices, Resolutions and other Operations Forms Package online with US Legal Forms. Every template is drafted and updated by state-certified attorneys.

If you have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan LLC Notices, Resolutions and other Operations Forms Package you want to use.

- Read through description and preview the template.

- As soon as you are confident the sample is what you need, click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the right downloadable template. The platform provides you with access to documents and divides them into categories to simplify your search. Use US Legal Forms to get your Michigan LLC Notices, Resolutions and other Operations Forms Package easy and fast.

Michigan Llc Forms Form popularity

Michigan Llc Resolutions Other Form Names

Mi Llc Pack FAQ

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Statements.

How much does it cost to form an LLC in Michigan? The Michigan Department of Licensing and Regulatory Affairs charges $50 for regular service and $100 for priority rush filing. It will cost $25 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.

Option 1: File your Articles of Organization on the Michigan Department of Licensing and Regulatory Affairs website. Select 700 - Articles of Organization under Domestic Limited Liability Company and fill out the required fields.

State LLC taxes and feeMichigan taxes LLC profits the same way as the IRS: the LLC's owners pay taxes to the state on their personal tax returns. The LLC itself does not pay a state tax, but Michigan does require LLCs to file an annual report, due February 15 each year, with a filing fee of $25.

Michigan does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state. Please see the Operating Agreement page for details.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

The usual processing time for LLC documents and filings is between three to five working days. Expedited services are available.

Filing the LLC Renewal Form You can file by mail if you include a check or money order, or you can file in person using a check, money order, or credit card featuring either the VISA or MasterCard logo. If you file by mail, be sure to add your corporation name and ID number and make it out to the State of Michigan.