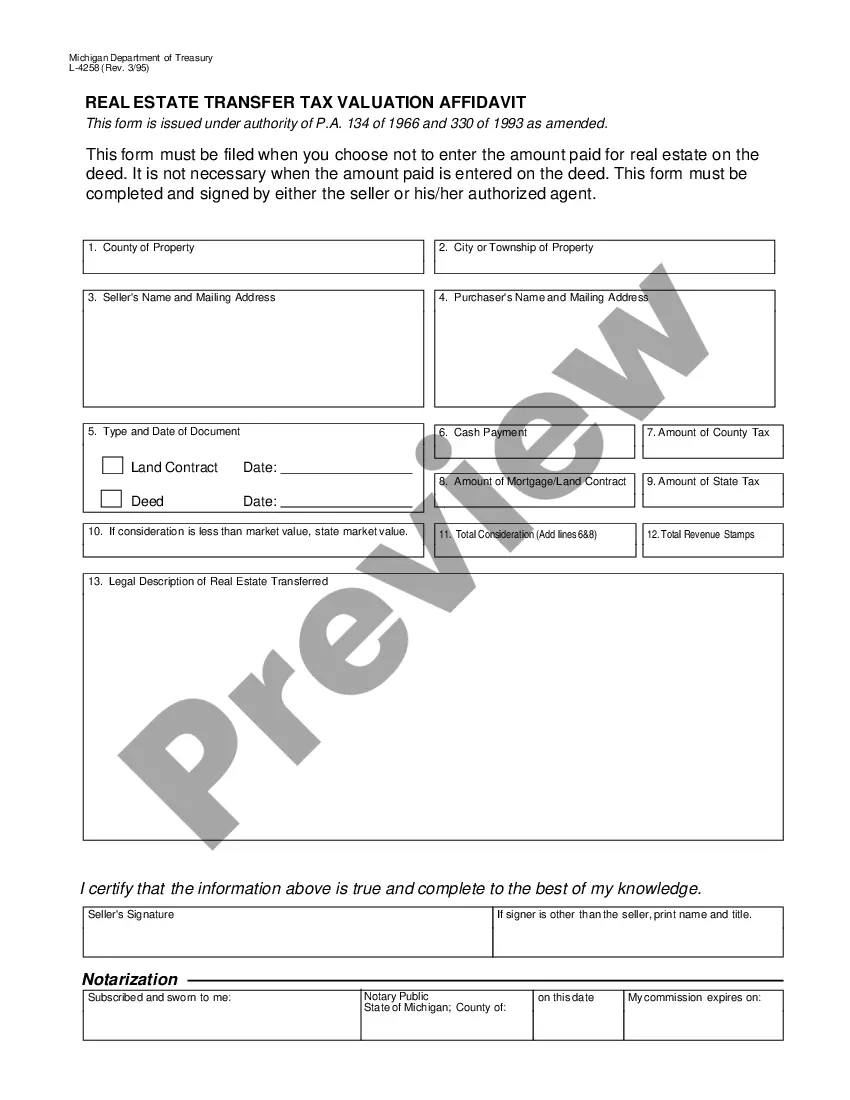

Michigan Application for Real Estate Transfer Tax Refund

Description

How to fill out Michigan Application For Real Estate Transfer Tax Refund?

Obtain any template from 85,000 legal documents including the Michigan Application for Real Estate Transfer Tax Refund online through US Legal Forms. All templates are prepared and revised by legally certified experts from the state.

If you are already a member, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to find it.

If you have not yet subscribed, follow these steps.

Once your reusable form is downloaded, you can print it or save it to your device. With US Legal Forms, you will always have immediate access to the correct downloadable template. The platform categorizes forms to facilitate your search. Use US Legal Forms to acquire your Michigan Application for Real Estate Transfer Tax Refund quickly and effortlessly.

- Review the state-specific requirements for the Michigan Application for Real Estate Transfer Tax Refund you need to utilize.

- Browse the description and examine the sample.

- When you are confident that the sample meets your needs, simply click Buy Now.

- Choose a subscription plan that fits your budget.

- Establish a personal account.

- Make a payment using one of two convenient methods: by card or via PayPal.

- Select a format for downloading the file; there are two options available (PDF or Word).

- Download the file to the My documents section.

Form popularity

FAQ

Can I deduct real estate transfer taxes? Real estate transfer taxes are not deductible.

Calculating the Michigan Real Estate Transfer TaxState Transfer Tax Rate $3.75 for every $500 of value transferred. County Transfer Tax Rate $0.55 for every $500 of value transferred.

Transfer taxes are paid at the closing of a deal, and in most cases are paid by the seller. So, when you're filing your taxes, sellers should be sure to deduct the transfer tax from their capital gain.

Expenses Added to Basis Expenses you must pay to obtain title to your home are added to the home's tax basis. This means the expenses will increase the value of the home for tax purposes, and reduce the amount of any taxable profit you realize when you sell the home. These expenses include:transfer taxes, and.

Closing costs are fees and expenses you pay when you close on your house, beyond the down payment. These costs can run 3 to 5 percent of the loan amount and may include title insurance, attorney fees, appraisals, taxes and more.

Property transfer tax is an assessment charged by both the State of Michigan and the individual county. When you transfer real estate, they charge a fee as a percentage of the sales price. The seller is responsible for this fee unless it is otherwise agreed to be paid by the buyer.

Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

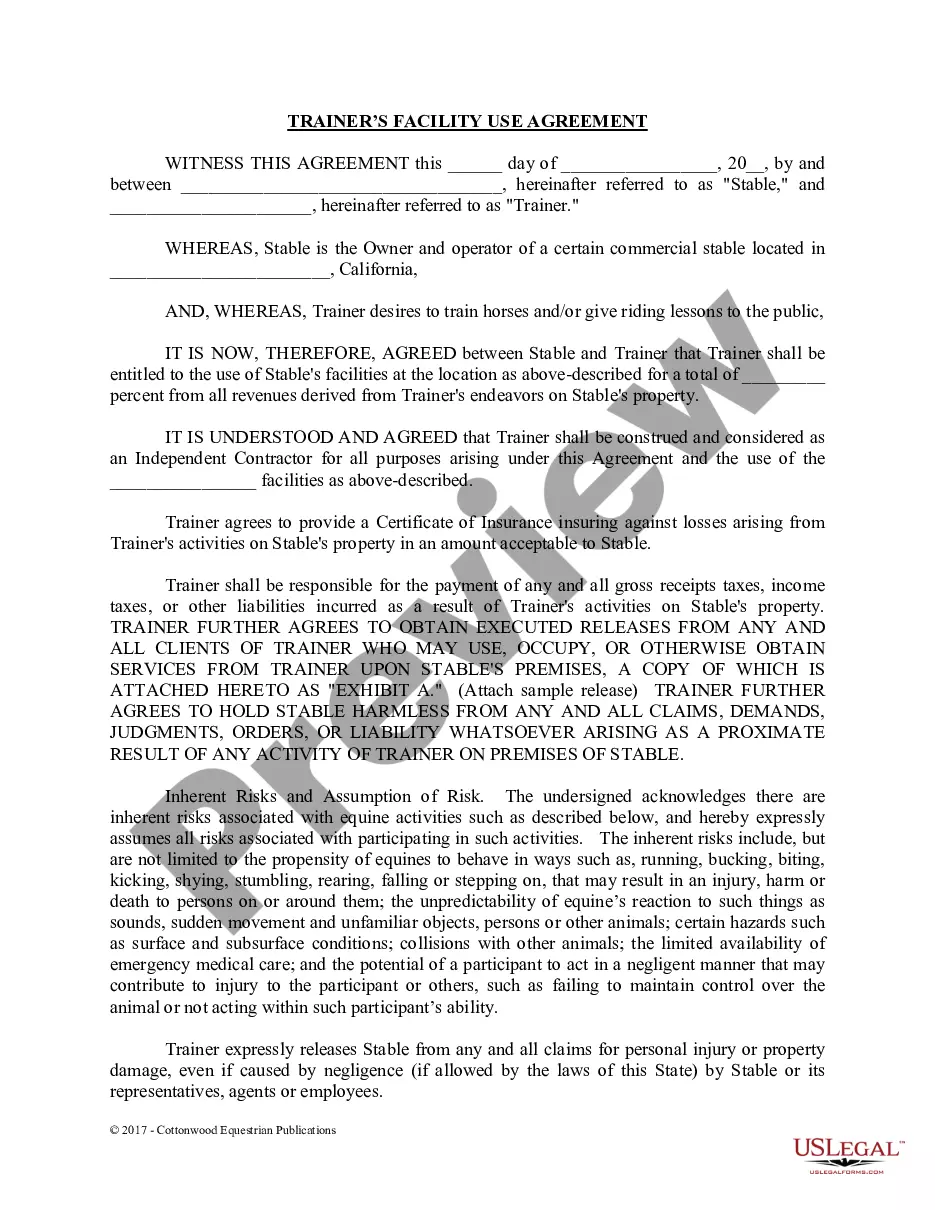

Part of the closing costs for a seller in California is city and county transfer taxes. These are also referred to as documentary transfer taxes.

Typically, the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes. Other closing costs are not. These include: Abstract fees.