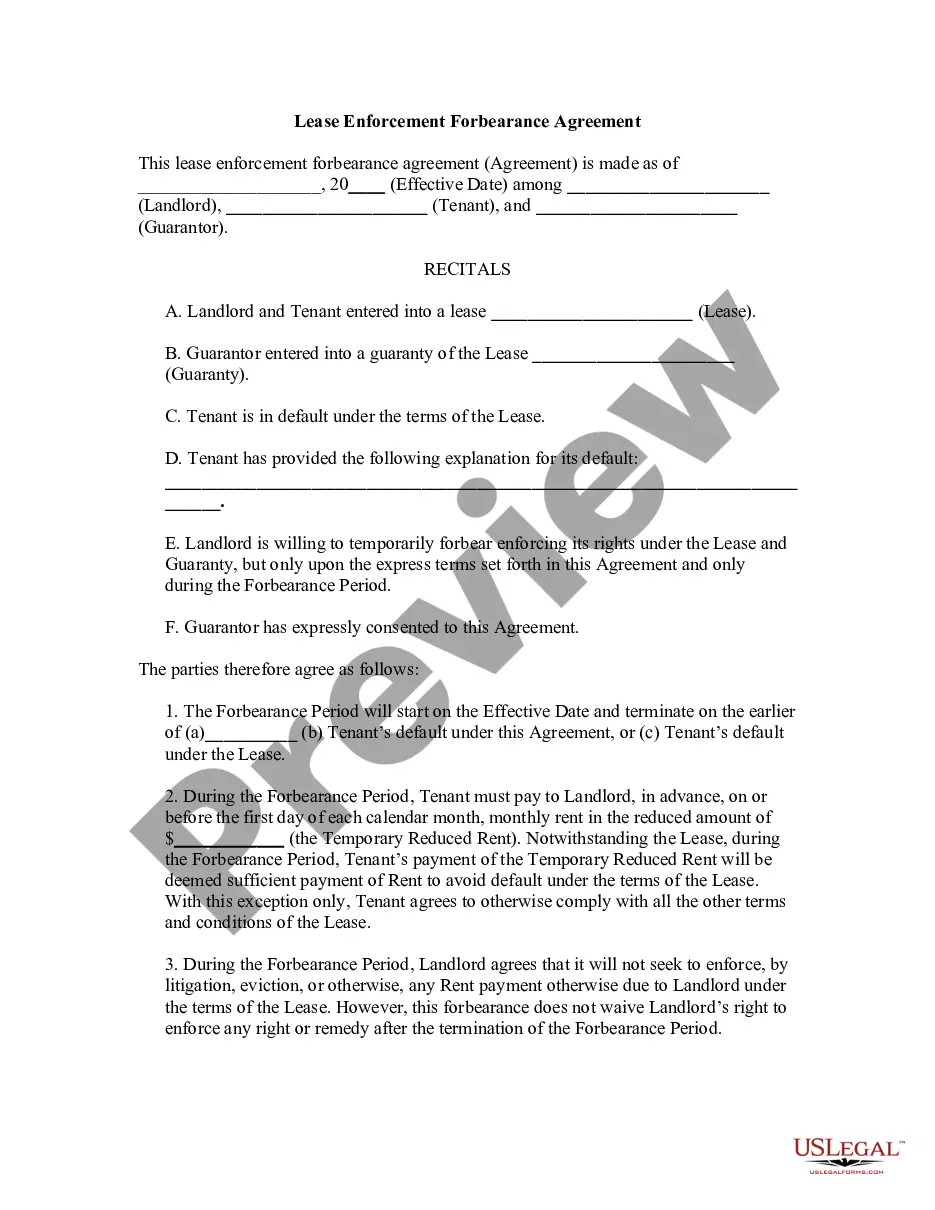

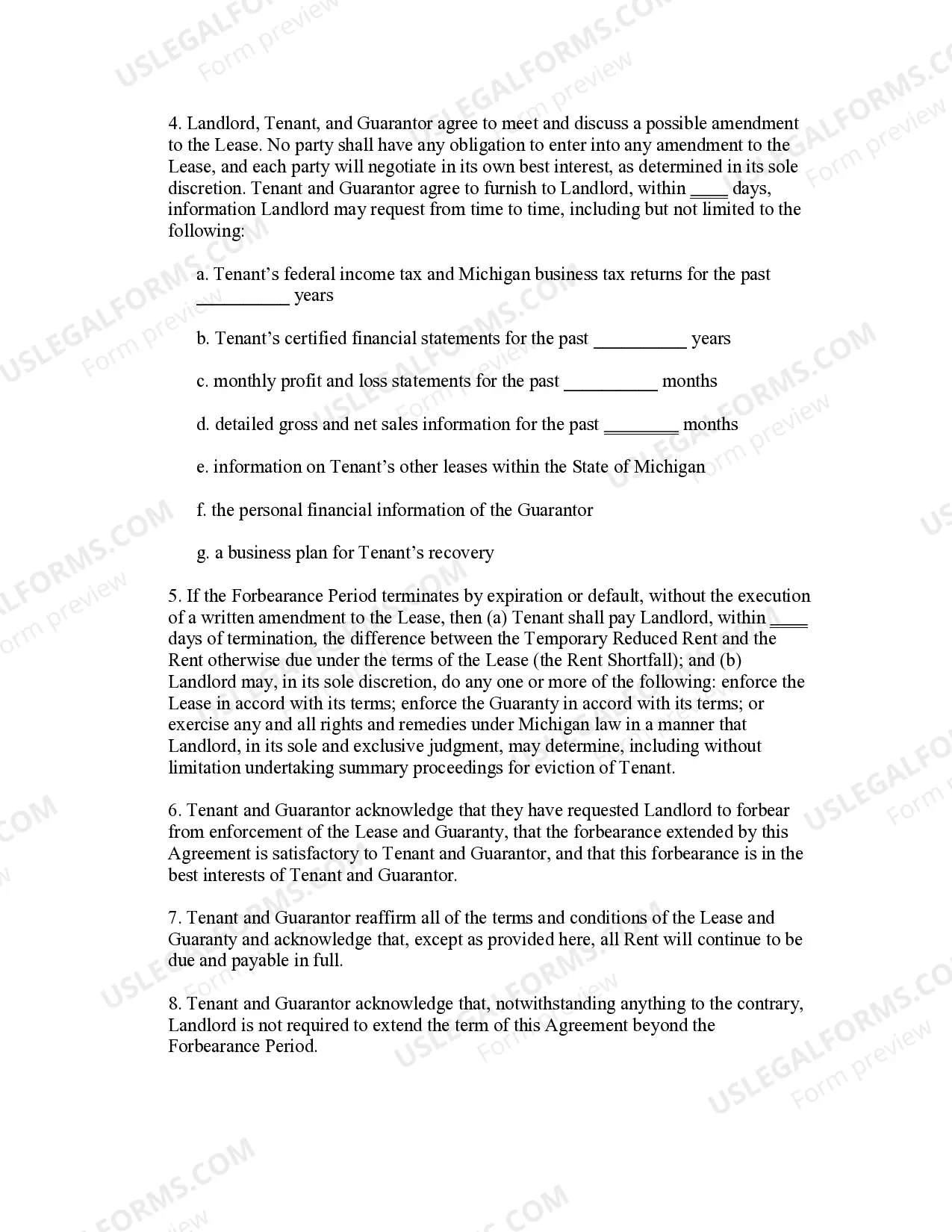

Michigan Lease Enforcement Forbearance Agreement is a legal document that is used to modify the terms of a lease in order to avoid eviction by the landlord. This agreement is typically used when a tenant is unable to keep up with payments due to financial hardship, such as the loss of a job or an unexpected medical bill. The agreement allows the tenant to remain in the property while payment is delayed or reduced. The agreement may also include provisions for the tenant to make up any missed payments at a later date. There are three types of Michigan Lease Enforcement Forbearance Agreements: Partial Payment Agreement, Temporary Hardship Agreement, and Renewable Hardship Agreement. A Partial Payment Agreement allows the tenant to make reduced payments until their financial situation improves. A Temporary Hardship Agreement allows the tenant to remain in the property without making payments until their financial situation improves. A Renewable Hardship Agreement is an agreement that is renewable on a monthly basis and allows the tenant to remain in the property, making reduced payments until their financial situation improves.

Michigan Lease Enforcement Forbearance Agreement

Description

How to fill out Michigan Lease Enforcement Forbearance Agreement ?

If you’re searching for a way to properly prepare the Michigan Lease Enforcement Forbearance Agreement without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business situation. Every piece of documentation you find on our online service is created in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to acquire the ready-to-use Michigan Lease Enforcement Forbearance Agreement :

- Ensure the document you see on the page complies with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and choose your state from the dropdown to find an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Michigan Lease Enforcement Forbearance Agreement and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

term lease ends on its own without further action. However, many leases include the provision that the lease converts to a monthtomonth tenancy at the end of the fixed term.

Once you get a Notice to Quit, you have a certain amount of time to move out or fix what you did wrong. If you don't move out or correct what you did wrong, your landlord can go to court to evict you. 30 days, if it's been more than 30 days since the lease ended.

Before a landlord can start the eviction process, they must give the tenant an official written 7-Day Notice to Pay or Quit. The filing for eviction does not continue if the rent is paid within the 7 days. If they cannot pay and remain on the property, the landlord reserves the right to continue filing for eviction.

A Demand for Possession is used when the tenant has violated the lease agreement, while a Notice to Quit is used when the initial rental or lease term has ended ing to the lease or rental agreement and the landlord now wants the tenant to move out.

If a tenant violates any terms of the lease agreement, the landlord must issue a 30-Day Notice to Quit. If the tenant resolves these issues on time, the eviction process does not continue. Lease violations may include: Damage to the rental property.

The Michigan Notice to Quit is a type of eviction notice form used by landlords, property managers, and property management companies to notify tenants that they must either comply with an order, or quit and give up possession of the rental property within a certain period of time.

(2) If a tenant neglects or refuses to pay rent on a lease at will or otherwise, the landlord may terminate the tenancy by giving the tenant a written 7-day notice to quit.

A Michigan 7-Day Notice to Quit (Non-Payment), also called a ?Demand,? is a rental notice used to inform a tenant of unpaid rent, which they will have 7 days to cure the breach. If the tenant decides to move out within 7 days, they may still be liable to pay rent.