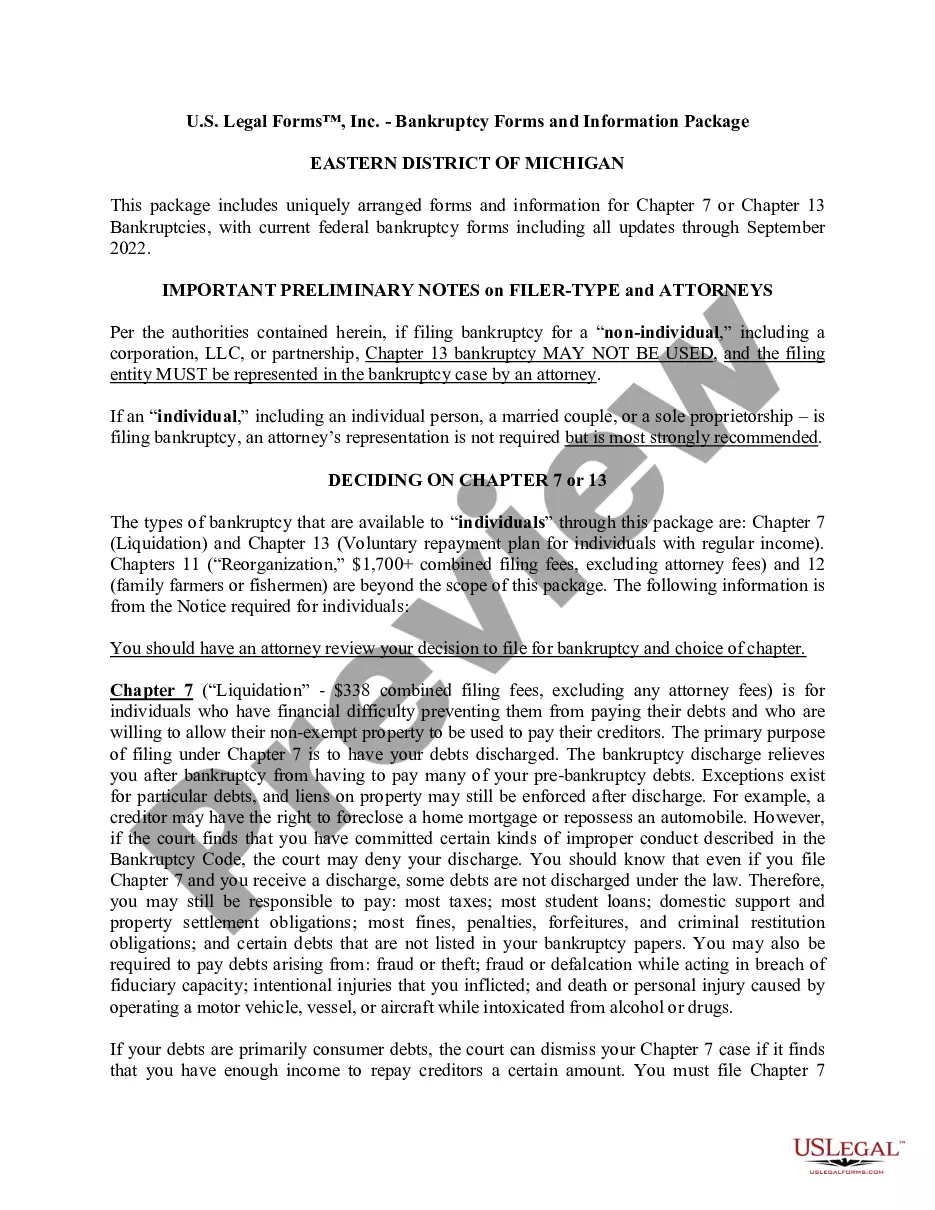

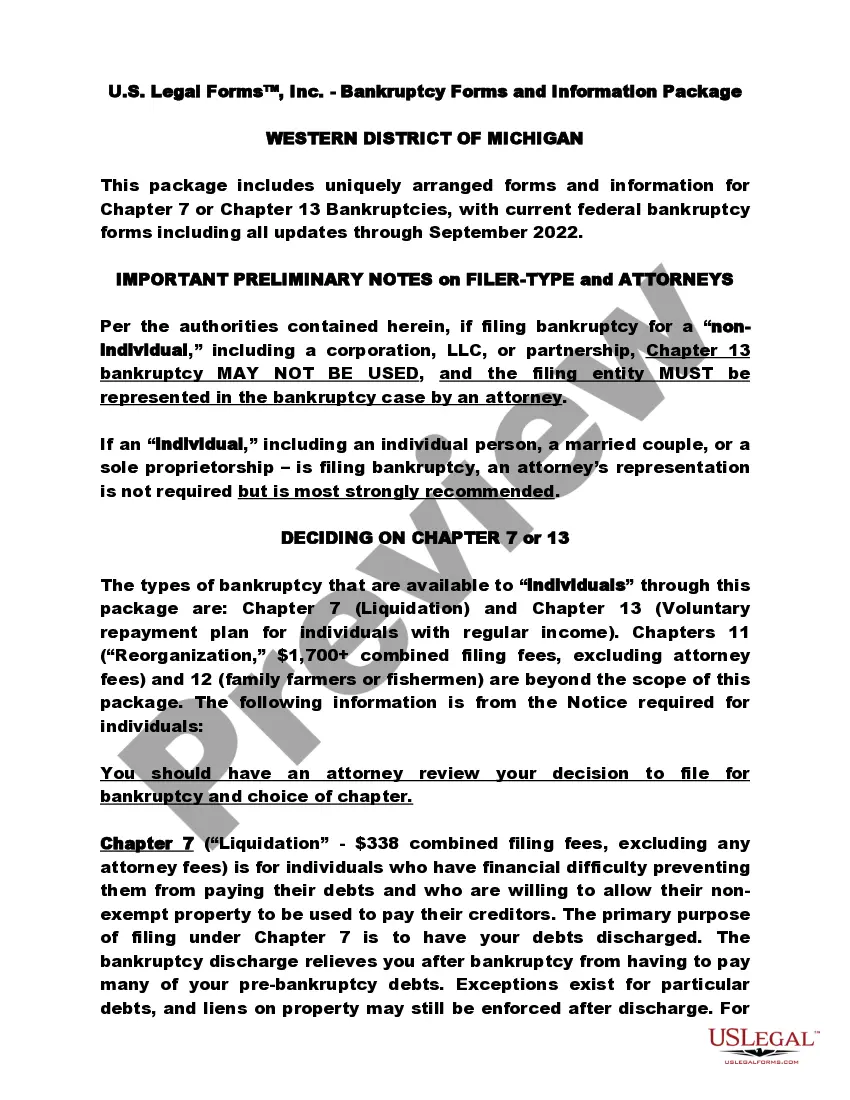

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Michigan Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

How to fill out Michigan Eastern District Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

Get any form from 85,000 legal documents including Michigan Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 online with US Legal Forms. Every template is drafted and updated by state-licensed legal professionals.

If you already have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Michigan Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 you would like to use.

- Look through description and preview the sample.

- When you’re confident the sample is what you need, click Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The platform will give you access to forms and divides them into categories to streamline your search. Use US Legal Forms to get your Michigan Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 easy and fast.

Form popularity

FAQ

In both cases, the bankruptcy court can discharge certain debts. Once a debt has been discharged, the creditor can no longer take action against the debtor, such as attempting to collect the debt or seize any collateral. Not all debts can be discharged, however, and some are very difficult to get discharged.

Chapter 7 is the most common type of bankruptcy and is often referred to as a straight bankruptcy. Under Chapter 7, you can eliminate most of your unsecured debts and some secured debts by surrendering your assets. Unsecured debts are debts not secured with collateral, including most personal loans and credit cards.

The potential disadvantages of bankruptcy include: Loss of credit cards. Many credit card companies automatically cancel any cards you hold when you file. You will probably receive numerous offers to apply for unsecured credit cards after filing.

Bankruptcy is a legal status that usually lasts for a year and can be a way to clear debts you can't pay. When you're bankrupt, your non-essential assets (property and what you own) and excess income are used to pay off your creditors (people you owe money to). At the end of the bankruptcy, most debts are cancelled.