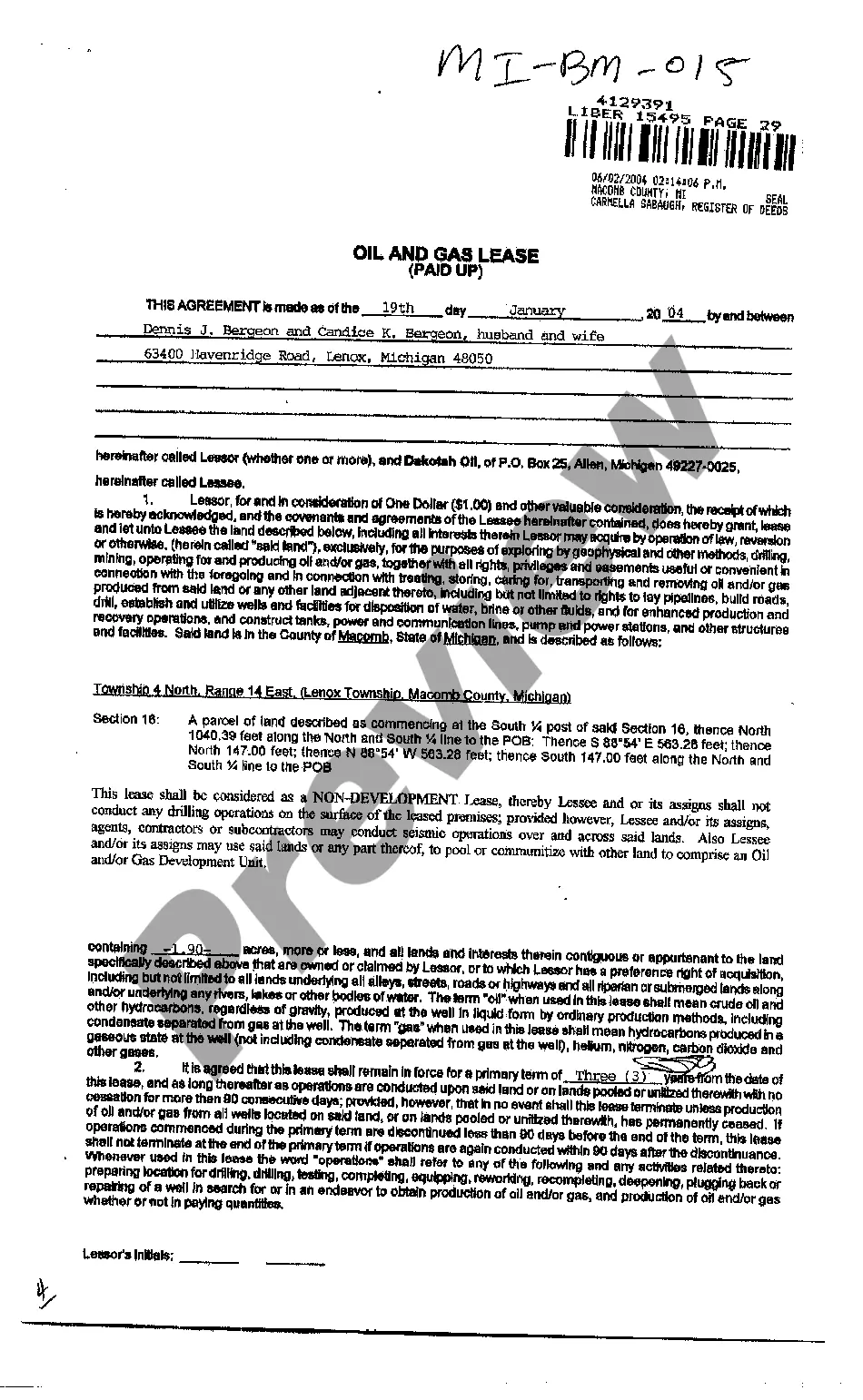

Michigan Oil And Gas Lease

Description

How to fill out Michigan Oil And Gas Lease?

Have any template from 85,000 legal documents including Michigan Oil And Gas Lease online with US Legal Forms. Every template is drafted and updated by state-certified legal professionals.

If you have already a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Michigan Oil And Gas Lease you want to use.

- Look through description and preview the sample.

- When you are confident the template is what you need, just click Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by bank card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have quick access to the right downloadable sample. The platform gives you access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Michigan Oil And Gas Lease fast and easy.

Form popularity

FAQ

Buying a Home, Land or a Farm In many areas the sale of mineral rights is recorded in the government record in a different deed book or database than the sale of surface property. This means that the deed to the surface property might not mention mineral rights which have been sold away.

If you're interested in who owns your Texas Mineral Rights located below your property, the best place to start is your local County Clerk's Officenot only is this a free resource; they typically have some of the most up-to-date information you can find.

Are mineral rights public records in Oklahoma? You can find out who owns the mineral rights on a tract of land by conducting a title search. Oklahoma real estate records are publicly registered with the Registrar of Deeds.

Not necessarily. Where your royalty is based on volume of production and your lease is for a period of years and as much longer as oil and gas is produced, or similar language is contained in your lease, your lease may not automatically expire at the end of its primary term.

Landowners who are considering purchasing, or have already purchased a property can search their county Register of Deeds registry to determine if an oil and gas lease is recorded.A search of the public records at the county register of deeds office is necessary.

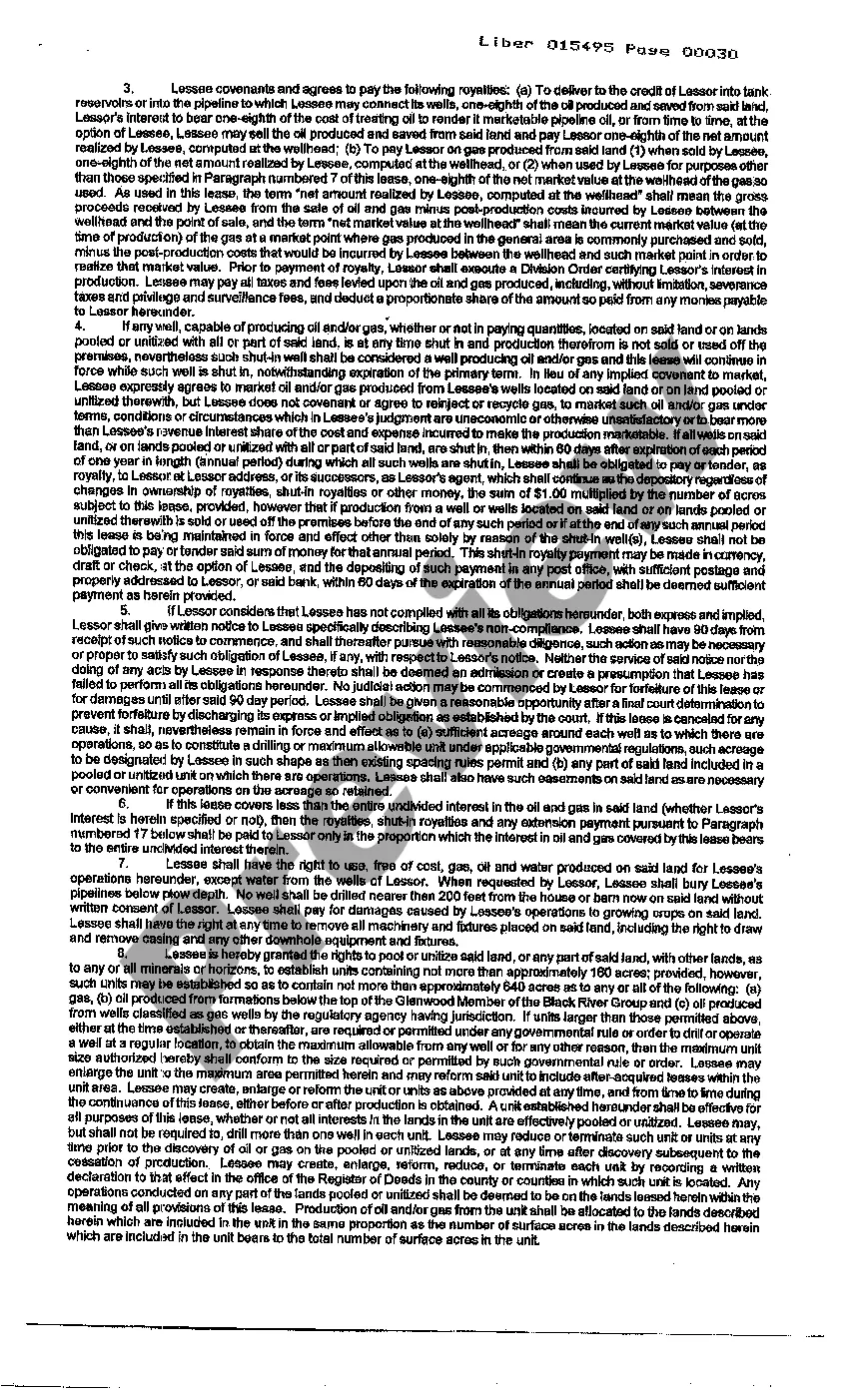

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.

¹ The term of an oil and gas lease is divided into two parts, a primary term and a secondary term. The primary term is usually for a set amount of years, 1, 3, 5, 7 or 10 years.

Further, annual rental fees for onshore oil and gas leases $1.50 per acre during the first five years and $2 per acre each year thereafter allow drilling companies to hold and explore mineral leases for the price of a cup of coffee.

An oil lease is essentially an agreement between parties to allow a Lessee (the oil and gas company and their production crew) to have access to the property and minerals (oil and gas) on the property of the Lessor. The lease agreement is a legal contract of terms.It establishes the primary term of the lease.