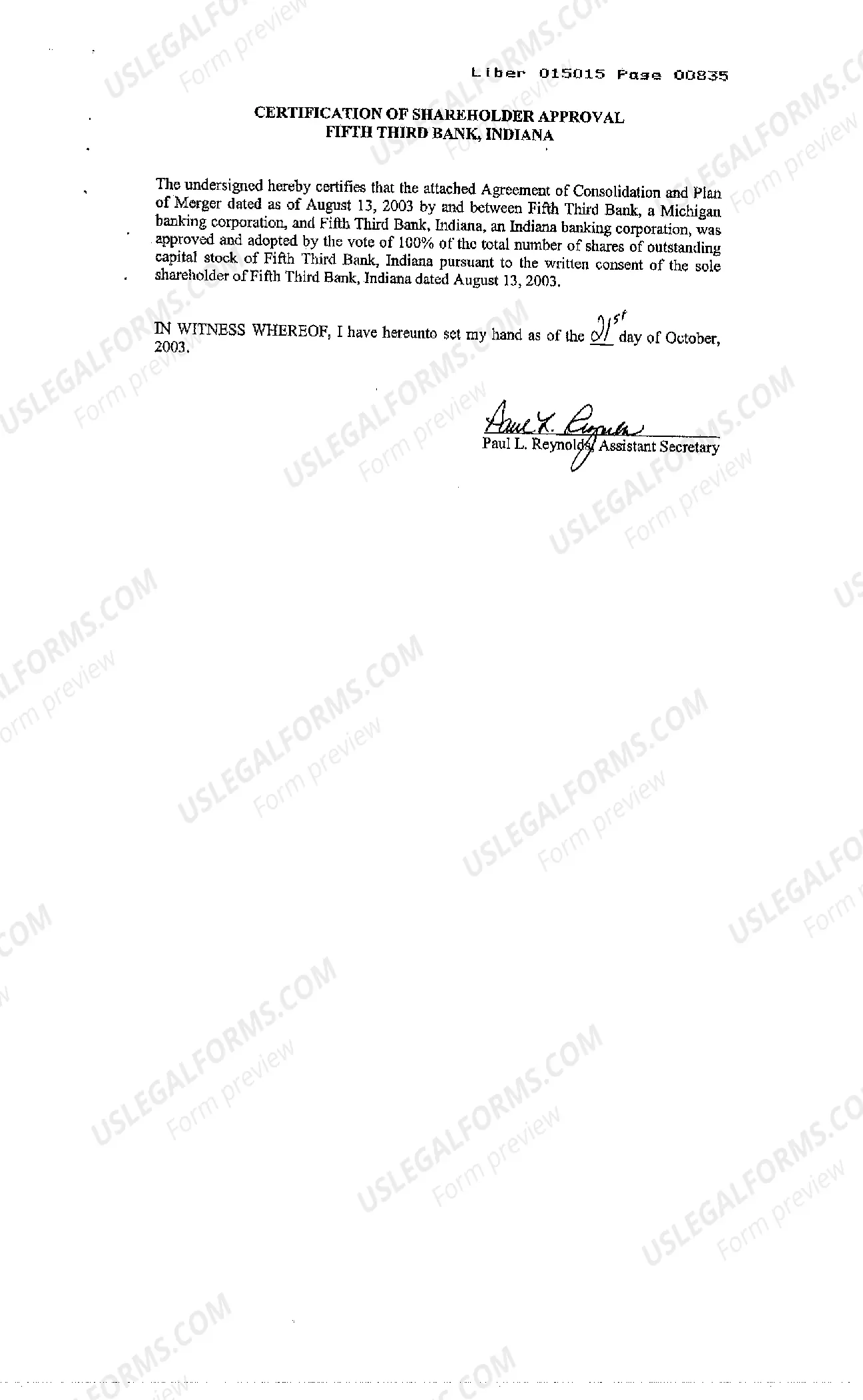

Michigan Agreement and Plan of Merger and Consolidation regarding banks

Description

How to fill out Michigan Agreement And Plan Of Merger And Consolidation Regarding Banks?

Have any form from 85,000 legal documents including Michigan Agreement and Plan of Merger and Consolidation regarding banks online with US Legal Forms. Every template is prepared and updated by state-accredited legal professionals.

If you already have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Agreement and Plan of Merger and Consolidation regarding banks you want to use.

- Read through description and preview the sample.

- Once you’re sure the sample is what you need, simply click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in a single of two suitable ways: by card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the proper downloadable template. The service provides you with access to documents and divides them into groups to streamline your search. Use US Legal Forms to get your Michigan Agreement and Plan of Merger and Consolidation regarding banks fast and easy.

Form popularity

FAQ

The Federal Reserve regulates state-chartered member banks, bank holding companies, foreign branches of U.S. national and state member banks, Edge Act Corporations, and state-chartered U.S. branches and agencies of foreign banks.

During a merger, essentially other corporate entities become a part of an existing entity. This can be useful for smaller companies merging into larger companies that have greater brand recognition and market traction. Conversely, a consolidation is when multiple companies join to form a new entity.

Statutory Consolidation When businesses are combined into a new entity, the original companies cease to exist. By combining these businesses together, they create a new, larger corporation. This is called statutory consolidation, which is normally done through a merger transaction.

In a statutory merger, one of the two parties retains its entity, and another party merges into the other by losing its entity. In a statutory consolidation, when two parties come together, both of their legal entities cease to exist, and a new identity is created.

The Department of Financial and Professional Regulation's Division of Banking oversees the regulation and licensure of State chartered banks, savings banks, savings and loan associations, trust companies, ATMs not owned by financial institutions, check printers, pawnbrokers, mortgage bankers, and mortgage brokers.

DIFS - Department of Insurance and Financial Services.

The Federal Reserve Board supervises state-chartered banks that are members of the Federal Reserve System.

Steps to achieve merger or consolidation The BoD of each corporation must draw up a plan of merger or consolidation. 2. A plan must be submitted to the S/M of each corporation for approval. The vote or two-thirds (members) or two-thirds of the outstanding capital stock (stockholders) would be required.

DIFS is the State of Michigan department responsible for regulating Michigan's financial industries including consumer finance, financial institutions, and insurance.