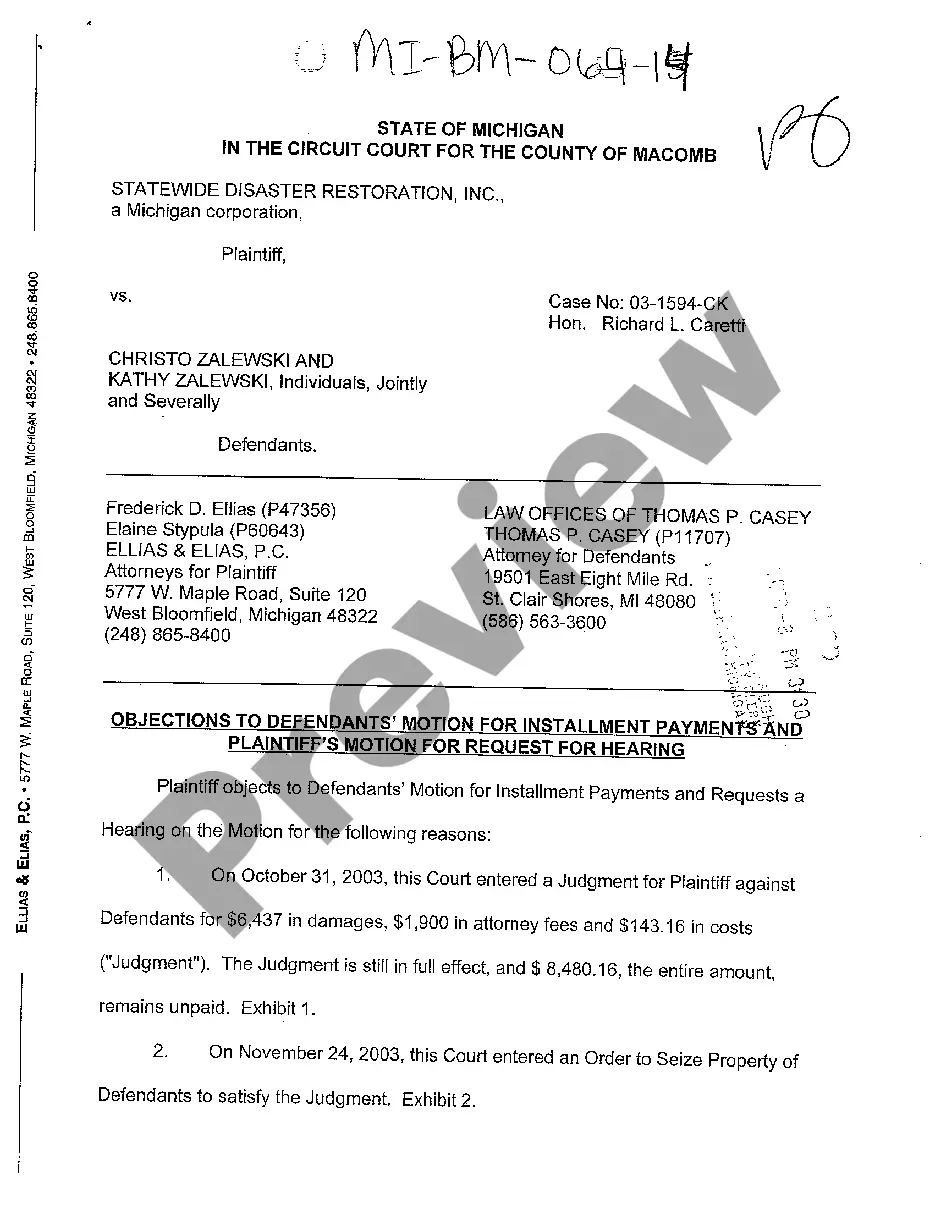

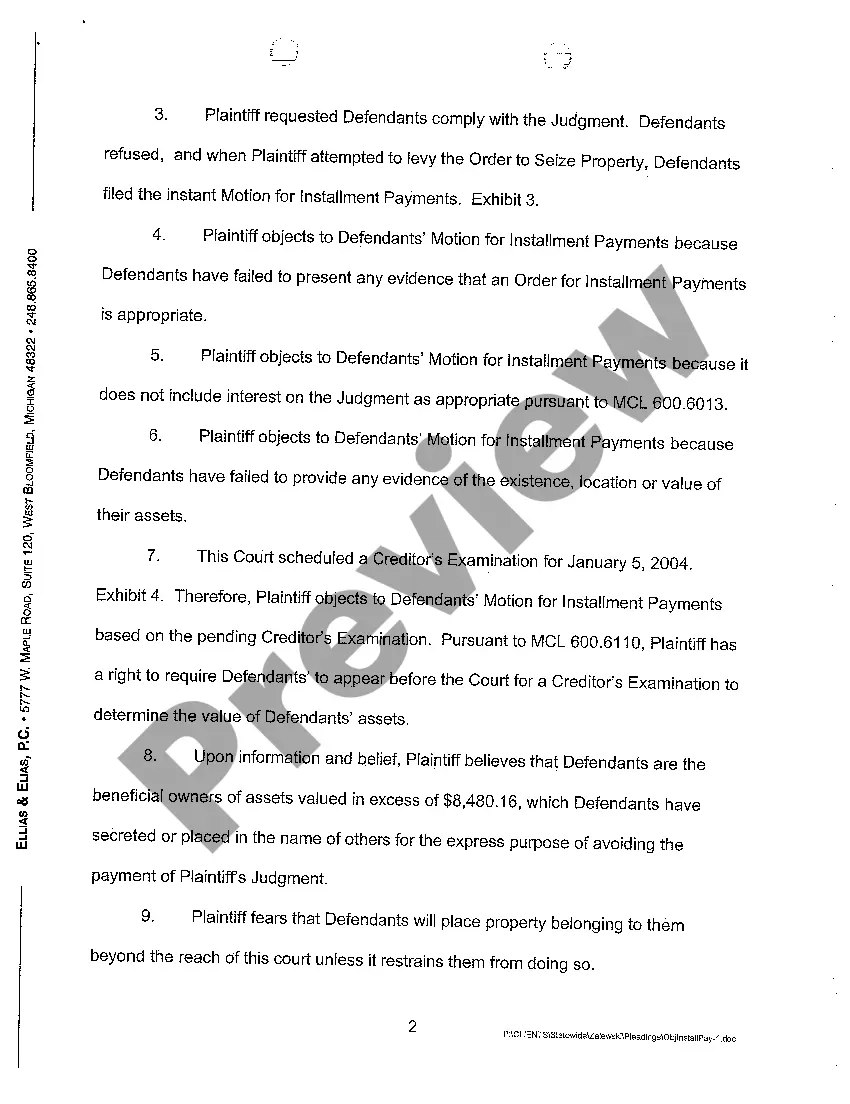

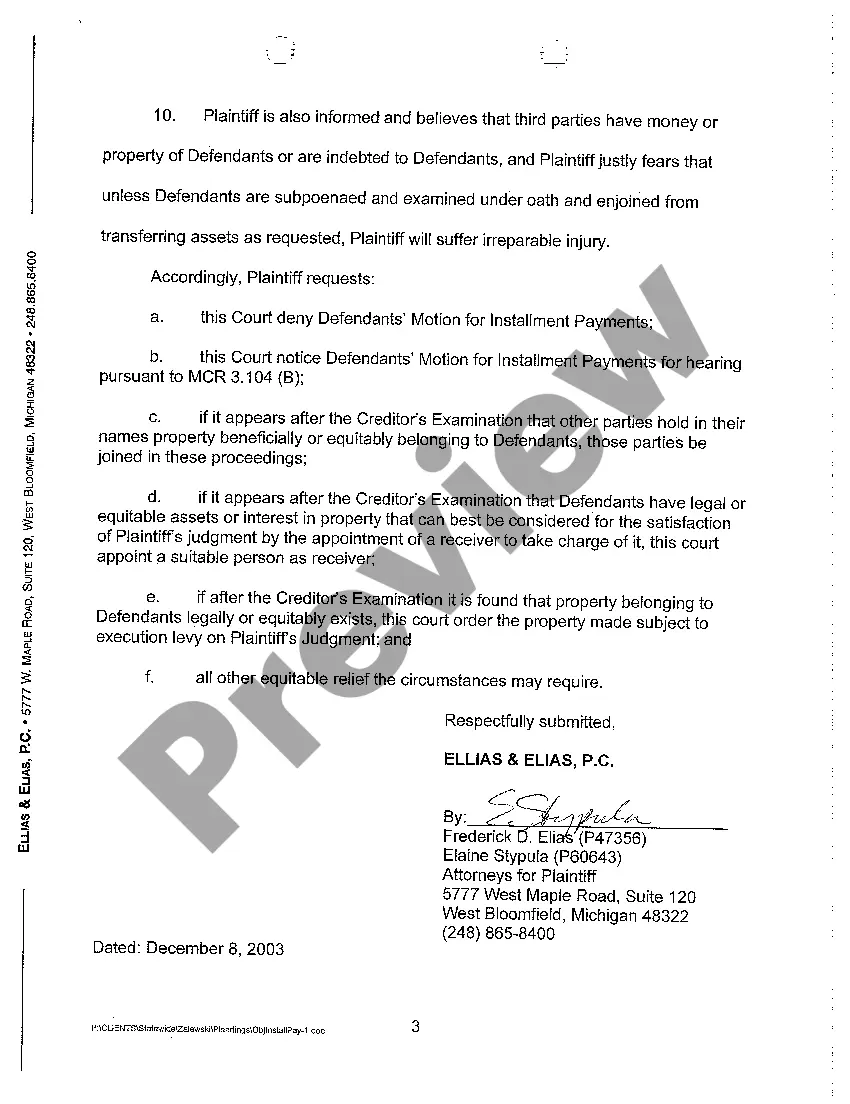

Michigan Objections to Defendants' Motion for Installment Payments And Plaintiff's Request for Hearing

Description

How to fill out Michigan Objections To Defendants' Motion For Installment Payments And Plaintiff's Request For Hearing?

Have any template from 85,000 legal documents such as Michigan Objections to Defendants' Motion for Installment Payments And Plaintiff's Request for Hearing on-line with US Legal Forms. Every template is drafted and updated by state-certified attorneys.

If you already have a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Michigan Objections to Defendants' Motion for Installment Payments And Plaintiff's Request for Hearing you would like to use.

- Read description and preview the sample.

- Once you are sure the sample is what you need, simply click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the proper downloadable template. The platform provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Michigan Objections to Defendants' Motion for Installment Payments And Plaintiff's Request for Hearing fast and easy.

Form popularity

FAQ

It is valid for 91 days or until the judgment, interest and costs are paid off, whichever occurs first. As such, the garnishment will continue each pay period for the 91 days or until the debt is paid off. Non-Periodic Garnishment: This is used to remove money from your bank account or other property.

You may be able to pay your judgment in installments or set up a payment plan. First, you can try talking to the creditor and see if they are willing to work out a payment plan with you. Remind the creditor that you want to pay but you just do not have the money to pay the judgment all at once.

Settling Debts Once a judgment is issued and the creditor is able to receive payment through wage garnishment, you have little leverage for negotiating a settlement. At this point, the creditor has sufficiently proven the debt is valid and the court has ordered you to repay it.

To ask a court to set aside (cancel) a court order or judgment, you have to file a request for order to set aside, sometimes called a motion to set aside or motion to vacate. The terms set aside or vacate a court order basically mean to cancel or undo that order to start over on a particular issue.

A series of payments that a buyer makes instead of a lump sum to compensate the seller. Installment payments often, but do not always, include interest to pay the seller for accepting the credit risk that the buyer will not make payments in a timely manner.

You may be able to pay your judgment in installments or set up a payment plan. First, you can try talking to the creditor and see if they are willing to work out a payment plan with you. Remind the creditor that you want to pay but you just do not have the money to pay the judgment all at once.

The wage garnishment continues until the debt is paid in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt. It is difficult to stop a wage garnishment after it begins. The time to fight a it is during the debt collection lawsuit or before the garnishments begin.