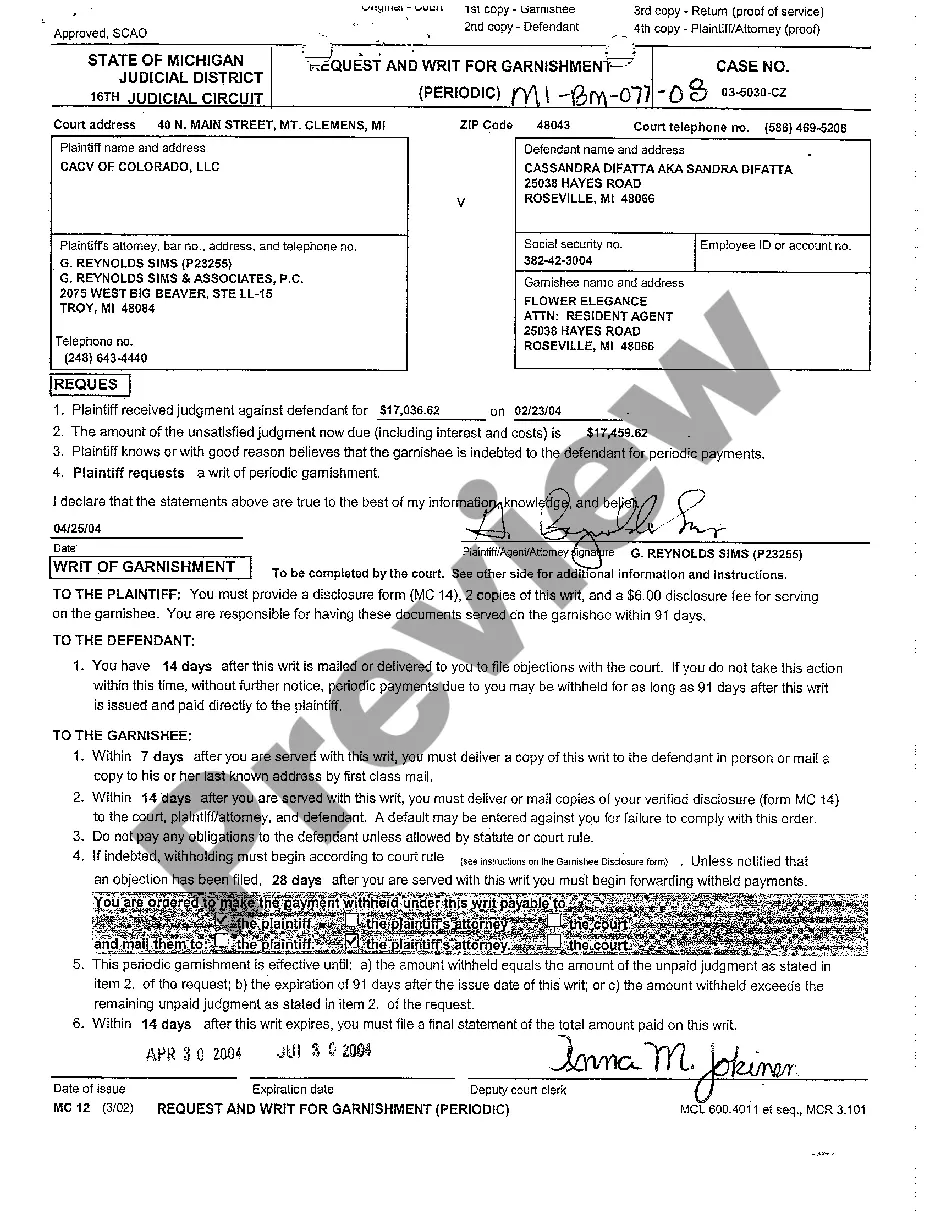

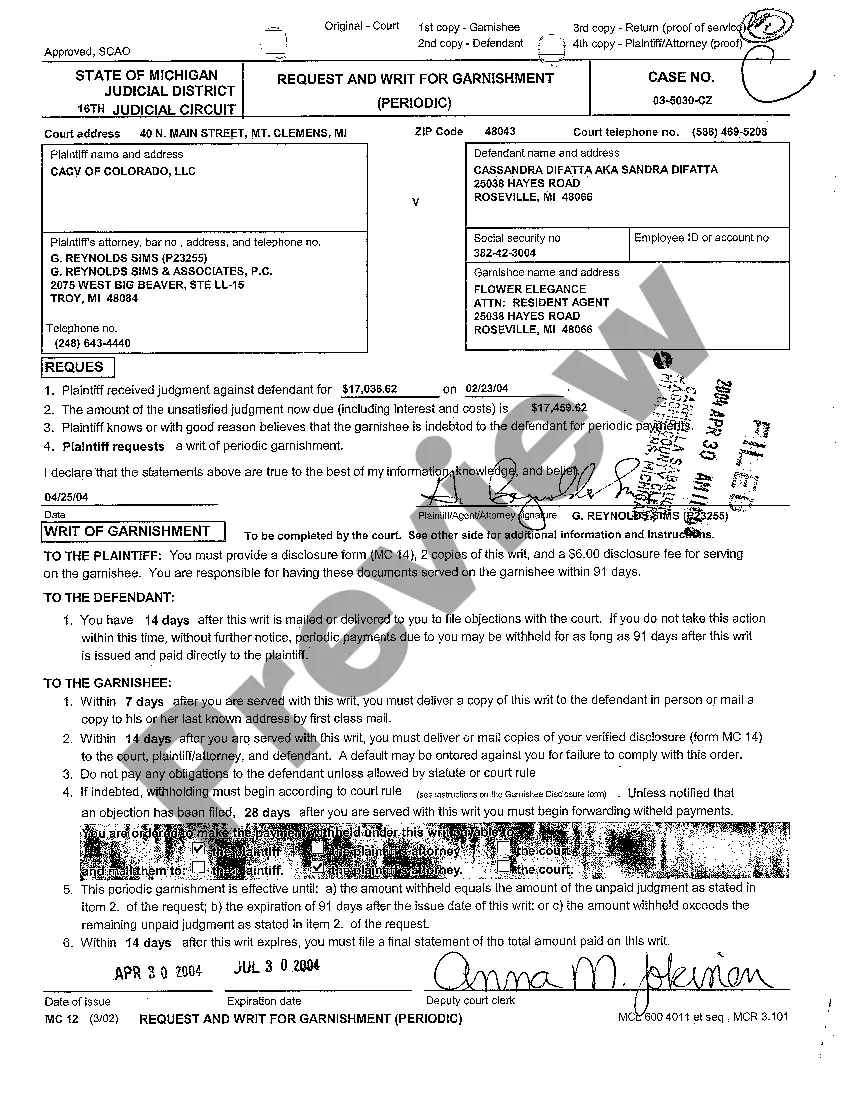

Michigan Request And Writ for Garnishment

Description Request And Writ For Garnishment

How to fill out Michigan Request And Writ For Garnishment?

Have any template from 85,000 legal documents including Michigan Request And Writ for Garnishment on-line with US Legal Forms. Every template is prepared and updated by state-accredited attorneys.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Request And Writ for Garnishment you would like to use.

- Read through description and preview the template.

- Once you are sure the sample is what you need, click on Buy Now.

- Select a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by credit card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- After your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the proper downloadable template. The platform gives you access to forms and divides them into groups to simplify your search. Use US Legal Forms to obtain your Michigan Request And Writ for Garnishment fast and easy.

Form popularity

FAQ

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Requesting a GarnishmentTop Start a garnishment by filing a Request and Writ for Garnishment with the court that entered the judgment. The writ is a court order. It tells the garnishee to give you the money it holds for the debtor (like money in a bank account) or would have paid to the debtor (like a paycheck).

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

It is valid for 91 days or until the judgment, interest and costs are paid off, whichever occurs first. As such, the garnishment will continue each pay period for the 91 days or until the debt is paid off. Non-Periodic Garnishment: This is used to remove money from your bank account or other property.

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

Limits on Wage Garnishments 25% of the debtor's disposable earnings (what's left after mandatory deductions), or the amount by which the debtor's wages exceed 30 times the minimum wage, whichever is lower.

Both the state of Michigan and the federal wage garnishment (or attachment) limits allow creditors who have sued you and obtained a money judgment to take 25% of your net wages (the amount left after subtracting required deductions).

In most cases, a creditor can't garnish your wages without first getting a money judgment against you.However, some creditorslike those you owe taxes, federal student loans, child support, or alimonydon't have to go through the court system to get a wage garnishment. Either way, you'll get notice of the garnishment.