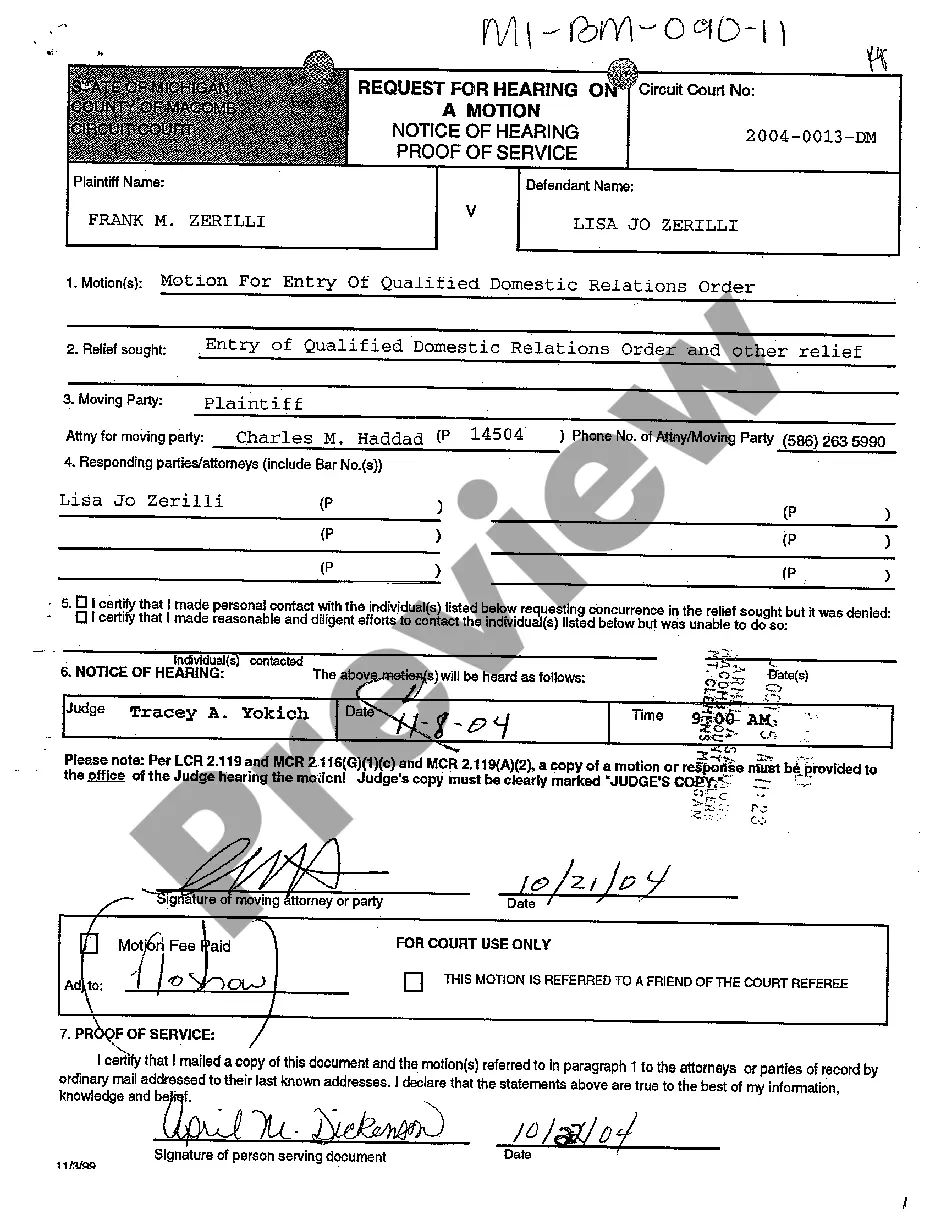

Michigan Request for Hearing On Motion for QDRO

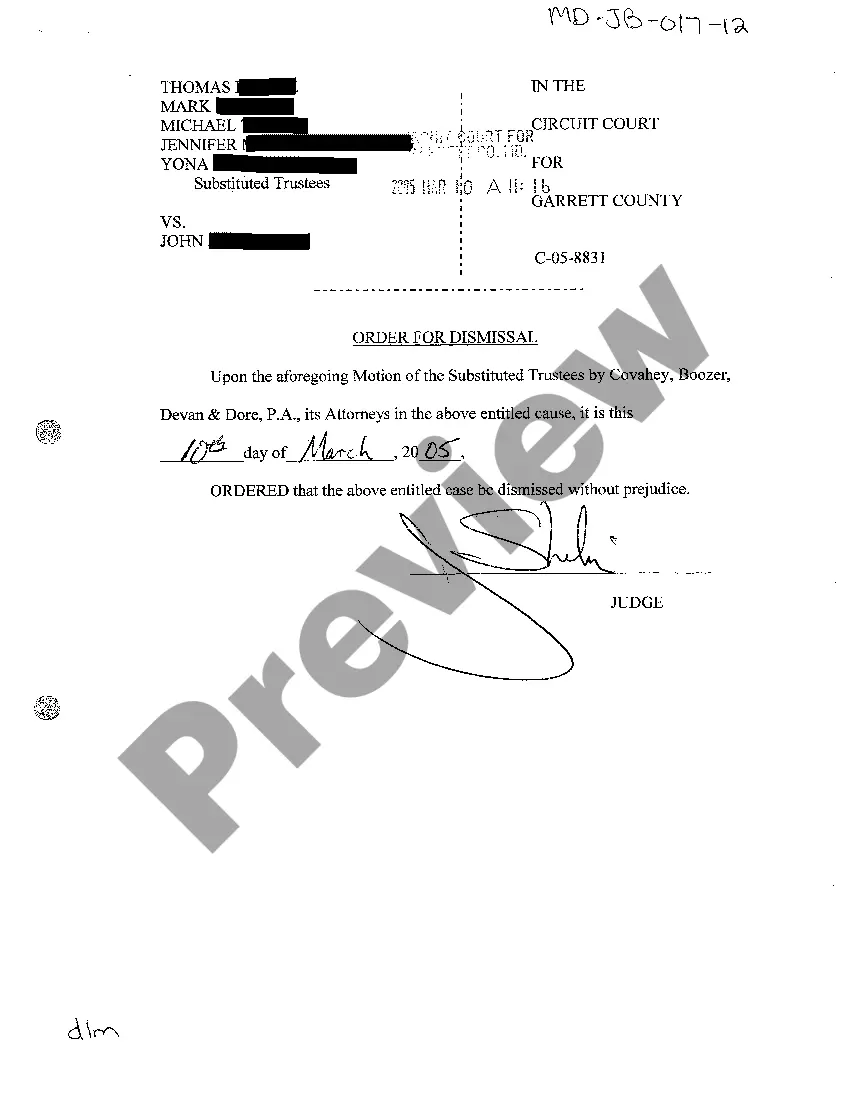

Description Printable Michigan Divorce Forms Pdf

How to fill out Michigan Request For Hearing On Motion For QDRO?

Have any form from 85,000 legal documents including Michigan Request for Hearing On Motion for QDRO online with US Legal Forms. Every template is prepared and updated by state-licensed attorneys.

If you have already a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Michigan Request for Hearing On Motion for QDRO you want to use.

- Read through description and preview the sample.

- When you are confident the template is what you need, simply click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by credit card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the appropriate downloadable sample. The service will give you access to forms and divides them into groups to streamline your search. Use US Legal Forms to get your Michigan Request for Hearing On Motion for QDRO easy and fast.

Qualified Domestic Relations Order Michigan Form popularity

FAQ

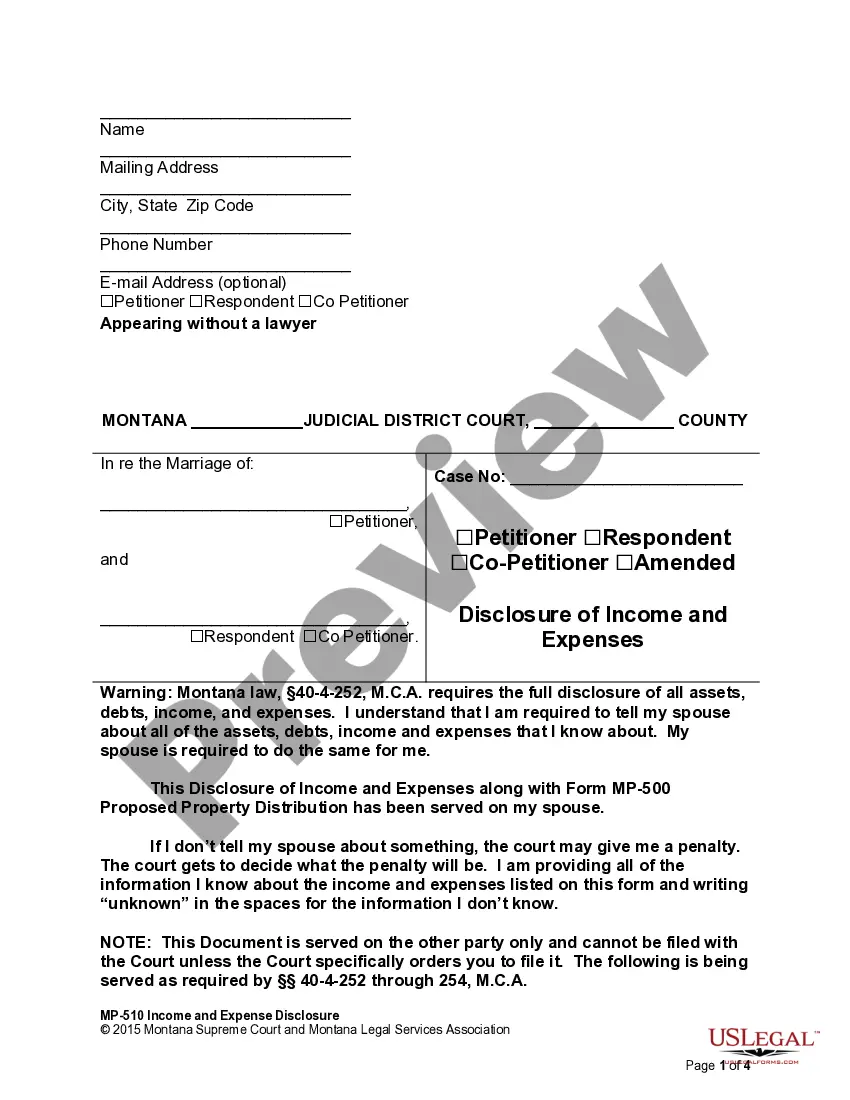

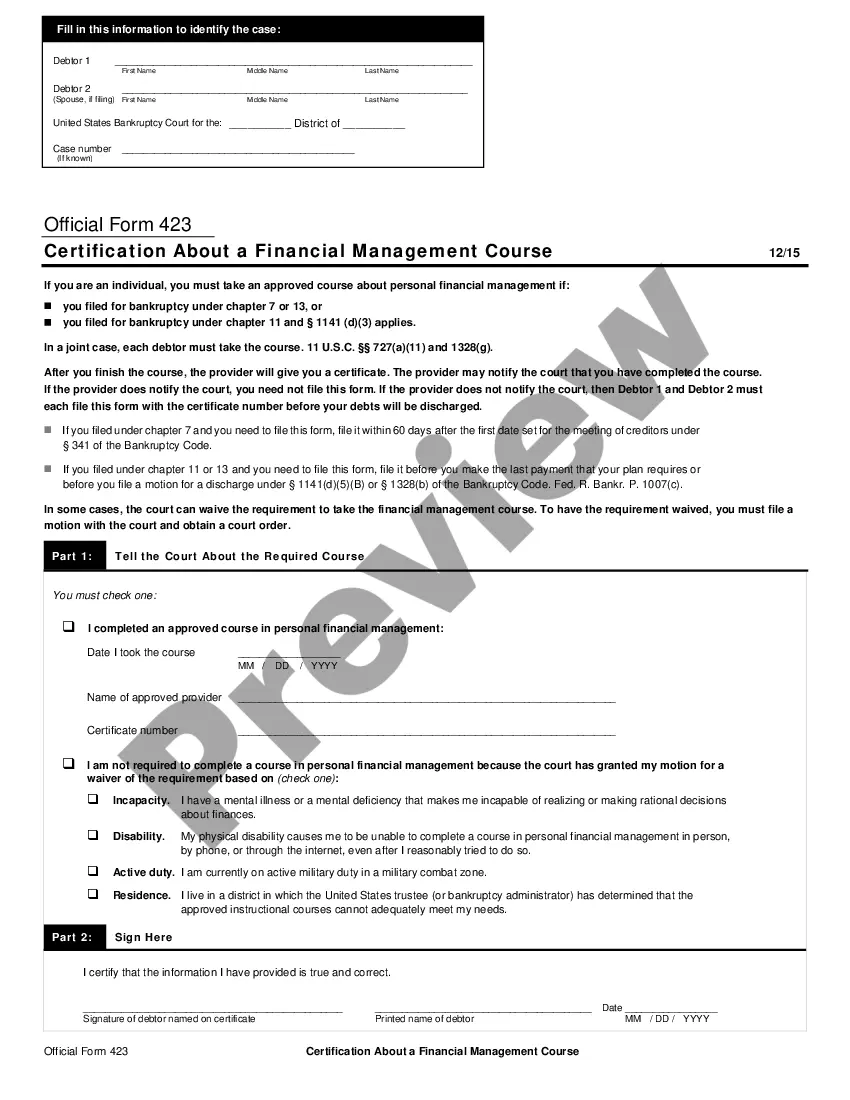

A QDRO will instruct the plan administrator on how to pay the non-employee spouse's share of the plan benefits. A QDRO allows the funds in a retirement account to be separated and withdrawn without penalty and deposited into the non-employee spouse's retirement account (typically an IRA).

The answer to this question depends on what type of retirement plan is being divided. If it is a defined contribution plan (a 401(k), 457, 403(b) or similar plan), or an IRA, the funds are typically transferred into an account in the alternate payee's name within two to five weeks.

Despite common belief, you do not need to hire an attorney to file a QDRO after divorce in California.

After pre-approval, spouses sign the document and the QDRO is submitted for a judge's signature by your attorney. After it has been signed and filed by the judge, spouses should obtain a certified copy of the QDRO which can be obtained from a clerk of the court for a small fee.

The short and simple answer: the spouse who is on the receiving end of their portion of the retirement assets should file the QDRO.

Who determines whether an order is a QDRO? Under Federal law, the administrator of the retirement plan that provides the benefits affected by an order is the individual (or entity) initially responsible for determining whether a domestic relations order is a QDRO.

During divorce proceedings, both parties will identify the assets that need to be divided, including retirement plans. If you're awarded part of your former spouse's retirement account (either through a property settlement or via a judge), the court will issue a QDRO that may have been drafted by your divorce attorney.

Answers: "The QDRO is written as a "stipulation" which means "agreement" between you and your former spouse. Therefore, you must both sign it, in addition to the Judge's signature.Generally, both parties' signatures are required in order to file the QDRO at court.