Michigan Worker Settlement Statement for Workers' Compensation

Description

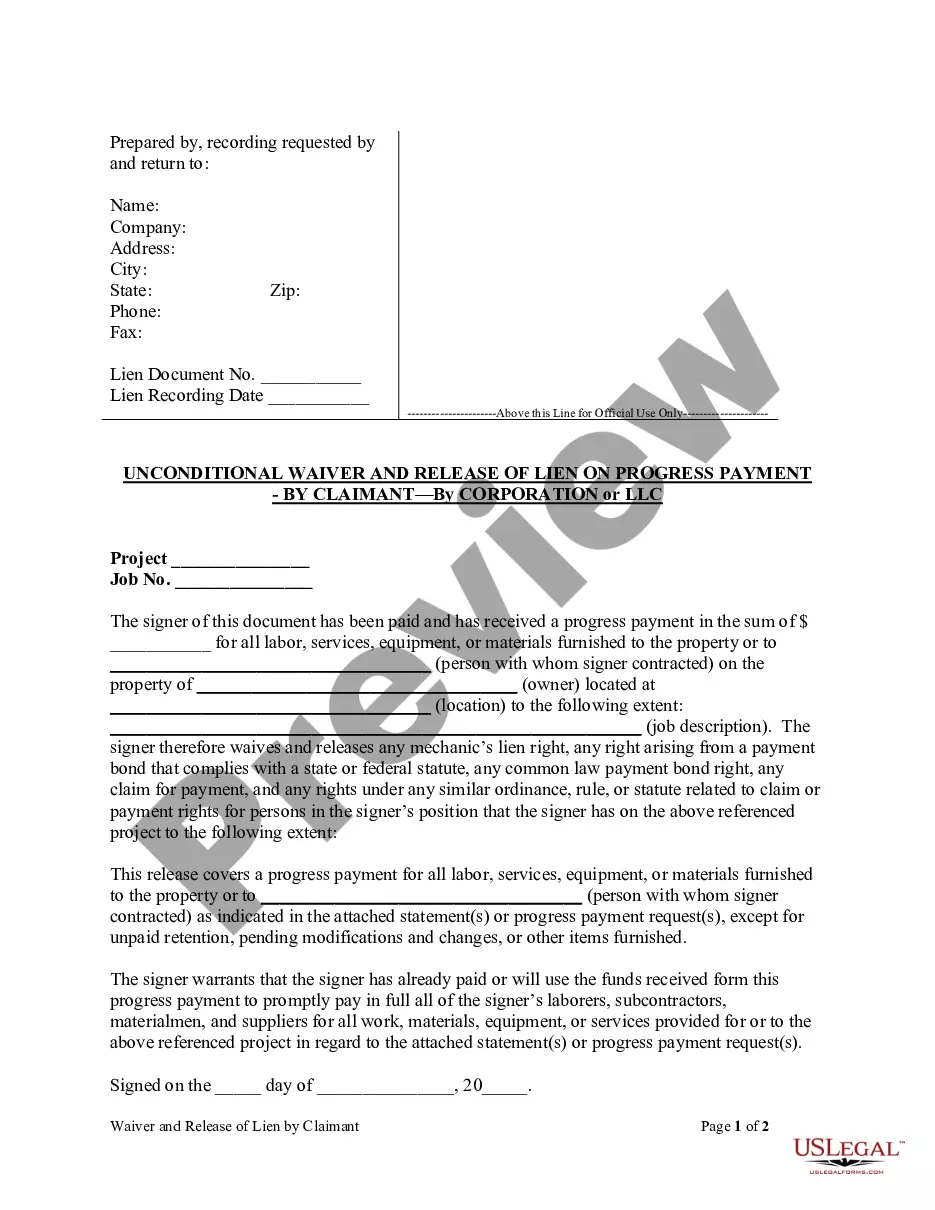

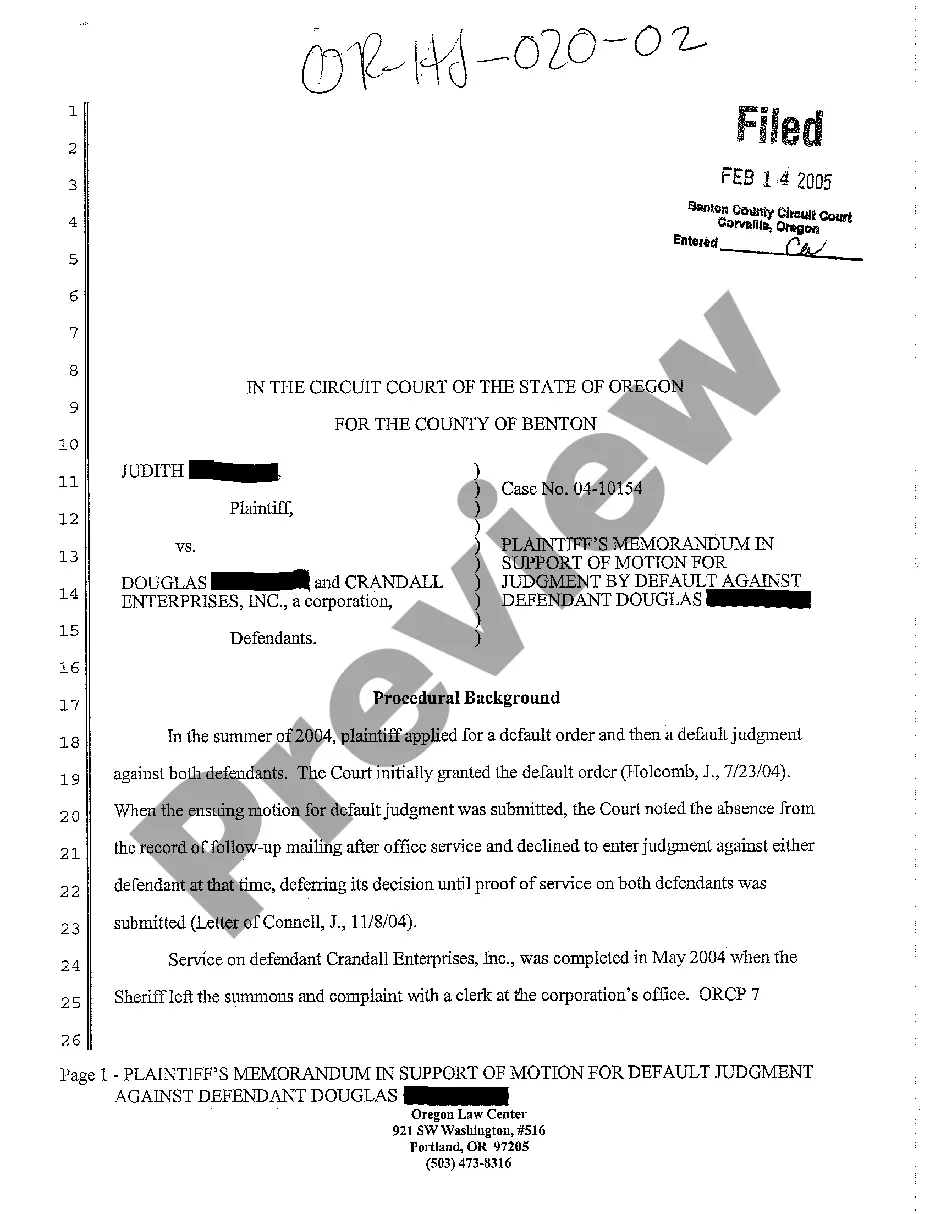

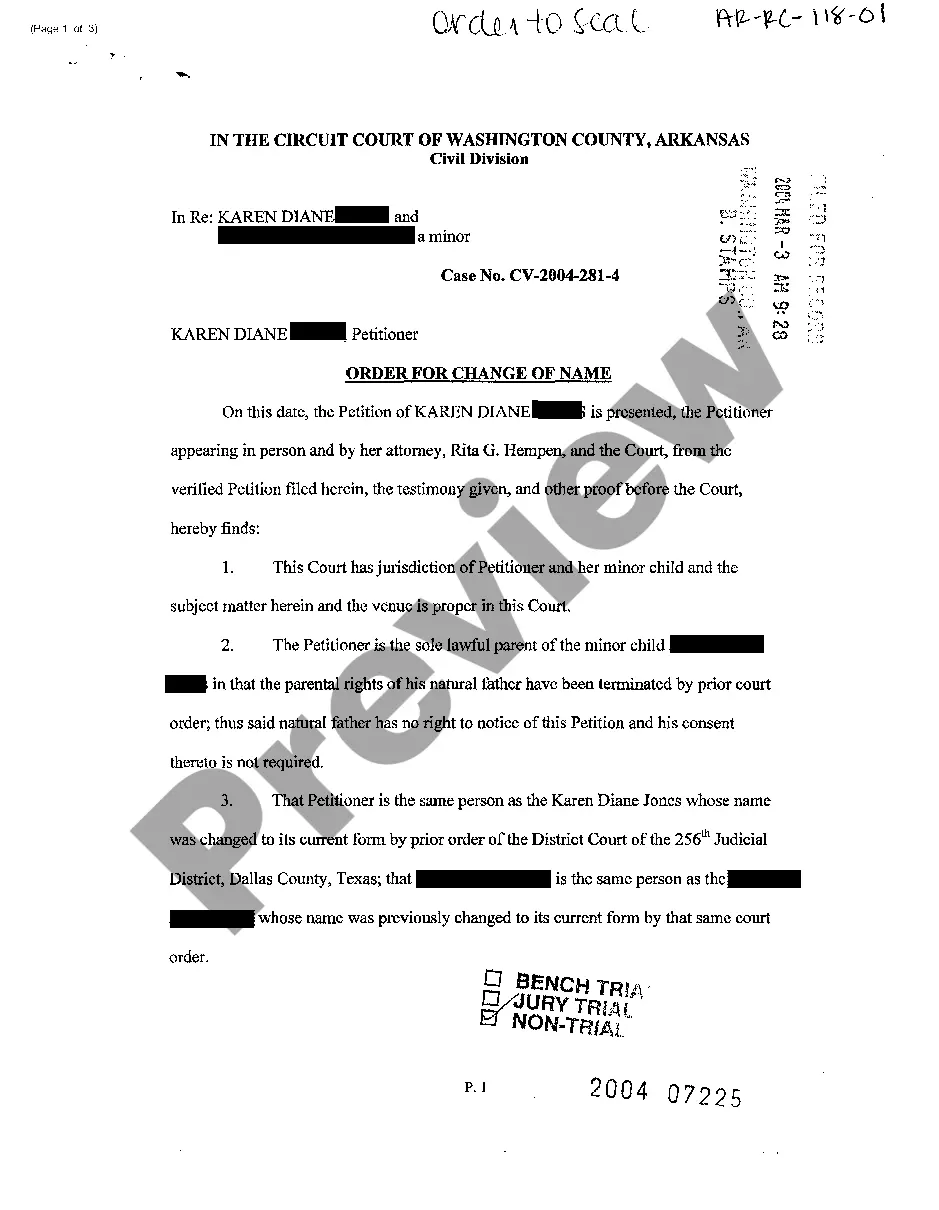

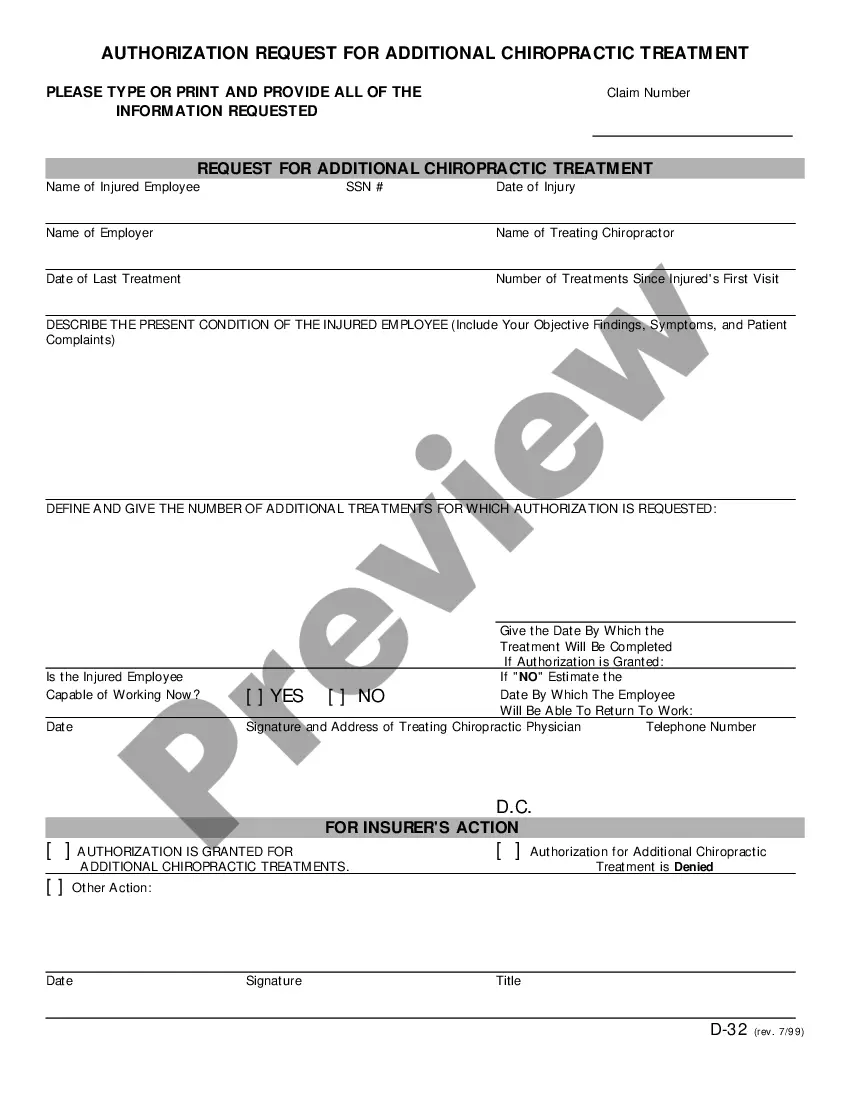

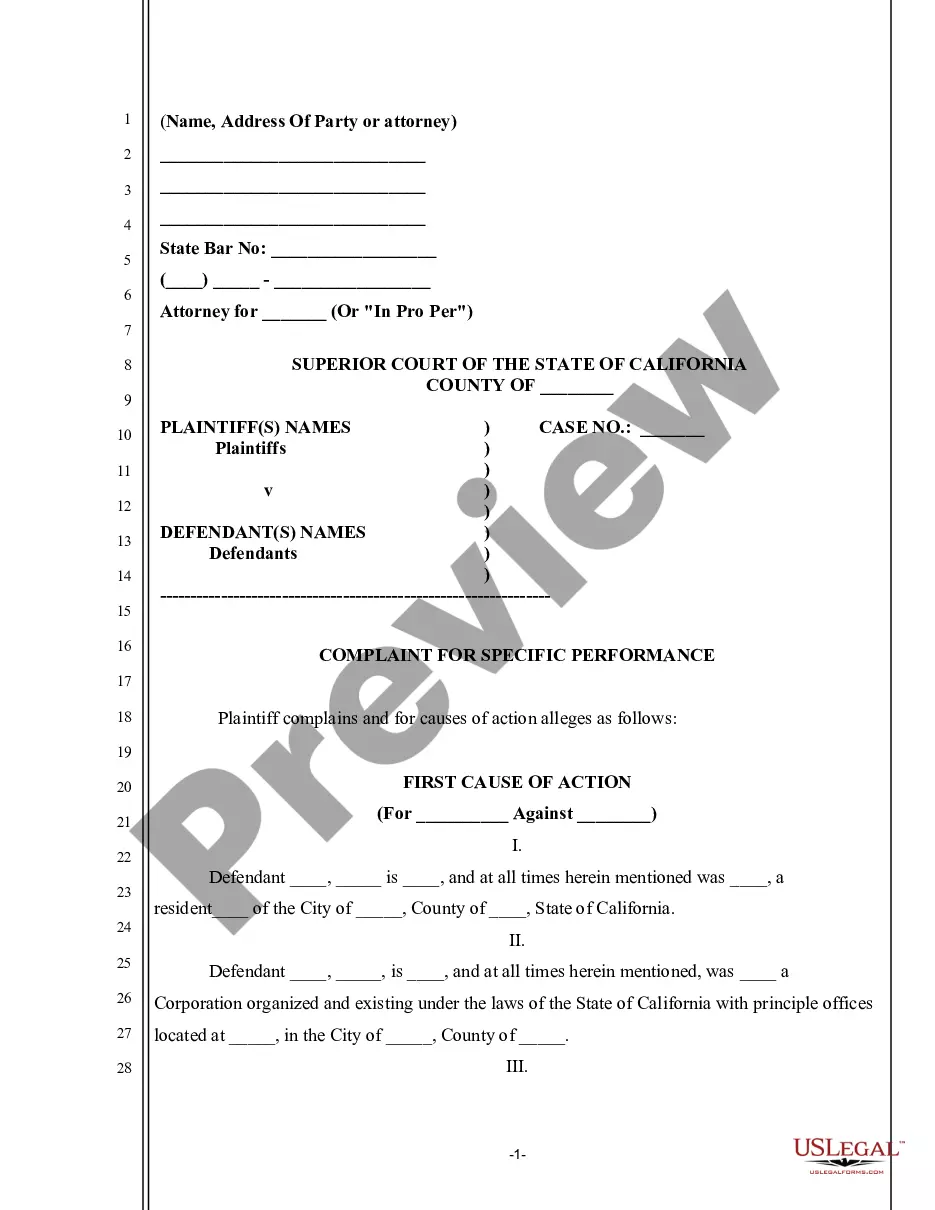

How to fill out Michigan Worker Settlement Statement For Workers' Compensation?

Have any form from 85,000 legal documents such as Michigan Worker Settlement Statement for Workers' Compensation on-line with US Legal Forms. Every template is prepared and updated by state-certified lawyers.

If you have already a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Worker Settlement Statement for Workers' Compensation you need to use.

- Look through description and preview the sample.

- As soon as you’re confident the sample is what you need, simply click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by credit card or via PayPal.

- Pick a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The service provides you with access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Michigan Worker Settlement Statement for Workers' Compensation fast and easy.

Form popularity

FAQ

Taxability of Workers' Compensation BenefitsWorkers' compensation benefits do not qualify as taxable income at the state or federal level. Lump sum settlements from workers' compensation cases do not count as taxable income either. Usually, workers' compensation benefits will not affect your tax return.

There are a variety of factors that go into how much an employee gets in a workers comp settlement. Overall, the average employee gets around $20,000 for their payout. The typical range is anywhere from $2,000 to $40,000.

Any change in the amount of these benefits is likely to affect the amount of your Social Security benefits. If you get a lump-sum workers' compensation or other disability payment in addition to, or instead of a monthly benefit, the amount of the Social Security benefits you and your family receive may be affected.

If you've been injured as a result of your work, you should be able to collect workers compensation benefits.Your employer or its workers' comp insurance company does not have to agree to settle your claim, and you do not have to agree with a settlement offer proposed by your employer or its insurance company.

Get your weekly disability check started, if you're not receiving it already. Maximize your weekly benefit check. Report all super-added injuries. Seek psychological care, when appropriate. Seek pain management care, when appropriate. Don't refuse medical procedures. Be very careful what you tell the doctor.

The IRS is authorized to levy, or garnish, a substantial portion of your wages; to seize real and personal property you own, such as your home and your automobiles and even take money that's owed to you. However, the IRS cannot take your workers' compensation settlement for several reasons.

For the most part, the answer is no. Worker's compensation benefits in California are considered non-taxable income.Death benefits paid to survivors in the event of a work-related fatality are also tax-exempt.

Settlements paid in a workers' compensation case are not taxed. If, however, you take a large settlement in a lump sum and invest the money on your own, all of the earnings on the money are taxed.In short, you get a better return on the money because of the tax-free benefit.

Always ask what the net amount will be after deducting lawyers' fees. A good California Workers' Compensation attorney should make sure that all medical expenses for your treatment are taken care of by the insurance company either prior to settlement or included in the settlement. You should not owe anyone.