Michigan Articles of Incorporation For Use By Domestic Profit Corps are documents that must be filed with the state of Michigan when a company is incorporated as a domestic profit corporation. These documents are used to create the legal entity of the corporation, provide information about the company's management structure, and outline the company's purpose and rights. The articles are filed with the Michigan Department of Licensing and Regulatory Affairs and must include the company's name, address, type of business, registered agent, and officers. There are two types of Michigan Articles of Incorporation For Use By Domestic Profit Corps: Standard Articles and Custom Articles. Standard Articles are pre-filled documents that include the basic information required to incorporate a domestic profit corporation and are ready for filing with the state. Custom Articles are documents that are created and filled out by the company and are specific to their business. Both types of articles must be signed and notarized in order for the company to become legally incorporated.

Michigan Articles of Incorporation For Use By Domestic Profit Corps

Description

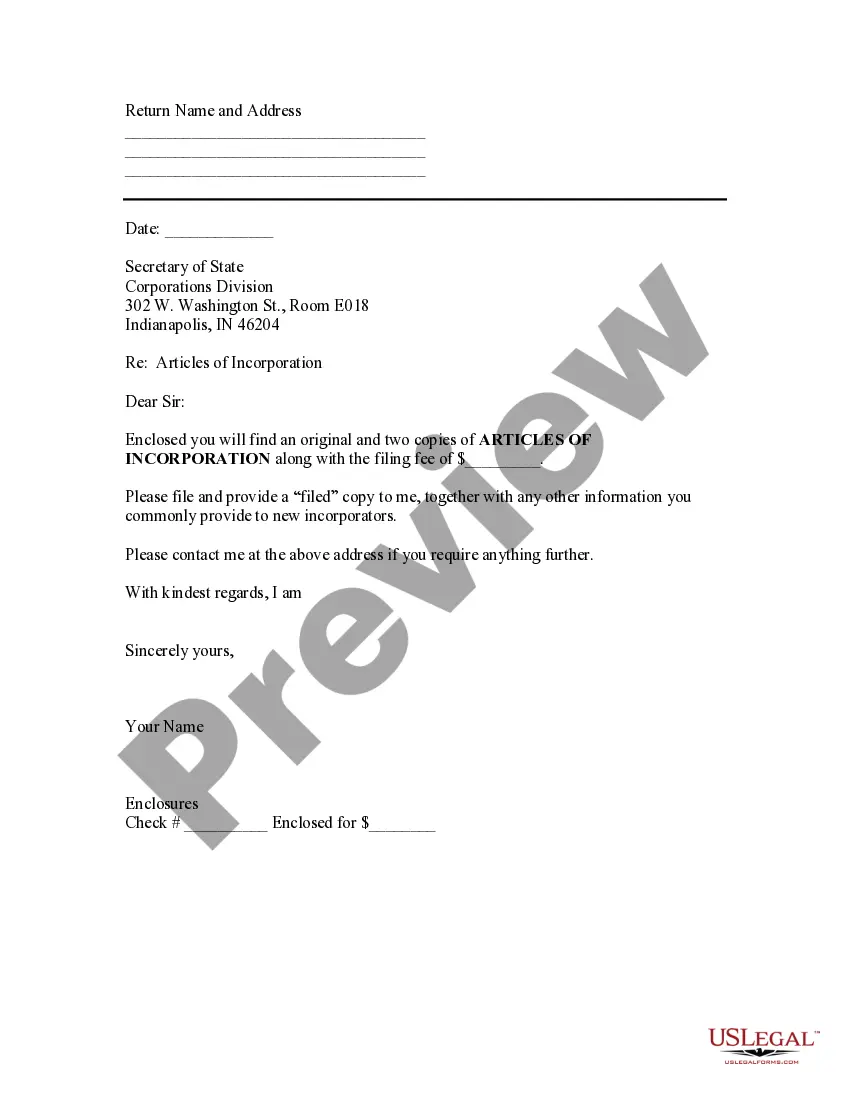

How to fill out Michigan Articles Of Incorporation For Use By Domestic Profit Corps?

Handling official documentation requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Michigan Articles of Incorporation For Use By Domestic Profit Corps template from our service, you can be certain it meets federal and state laws.

Working with our service is easy and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Michigan Articles of Incorporation For Use By Domestic Profit Corps within minutes:

- Make sure to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Michigan Articles of Incorporation For Use By Domestic Profit Corps in the format you prefer. If it’s your first time with our website, click Buy now to proceed.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Michigan Articles of Incorporation For Use By Domestic Profit Corps you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

A domestic profit corporation is a type of business structure in which the owners are taxed on profits made by their company. The profits of the business are taxed only once rather than twice, as with other corporate structures, and provide owners with limited liability protection.

A domestic corporation is a corporation that does business in the jurisdiction in which it is incorporated. This can be compared to a Foreign Corporation which conducts business in a jurisdiction other than its place of incorporation.

What Is a Domestic Corporation? A domestic corporation is a company that conducts its affairs in its home country. A domestic business is often taxed differently than a non-domestic business and may be required to pay duties or fees on the products it imports.

A domestic profit corporation is a corporation that operates in its country of origin.

profit corporation is an organization which aims to earn profit through its operations and is concerned with its own interests, unlike those of the public (nonprofit corporation).

Articles of Incorporation are legal formation documents that must be filed to create new profit, nonprofit, professional service, or ecclesiastical corporations.

The answer is yes. In the state of Michigan, an LLC must file an Articles of Organization form with the Corporations, Securities & Commercial Licensing Bureau of the Michigan Department of Licensing and Regulatory Affairs.

A domestic profit corporation is a type of business structure in which the owners are taxed on profits made by their company. The profits of the business are taxed only once rather than twice, as with other corporate structures, and provide owners with limited liability protection.