Michigan Articles of Incorporation For Use By Domestic Nonprofit Corps are legal documents that are filed with the Michigan Department of Licensing and Regulatory Affairs (LARA). The articles are used to create a domestic nonprofit corporation in Michigan. The articles must include information about the corporation’s name, purpose, address, registered agent, incorporated, directors, and registered office. The articles must also be signed by the incorporated and witnessed. There are two types of Michigan Articles of Incorporation For Use By Domestic Nonprofit Corps: standard articles and special articles. Standard articles are used to create a standard nonprofit corporation, while special articles are used to establish a specialized nonprofit corporation, such as a religious or charitable organization.

Michigan Articles of Incorporation For Use By Domestic Nonprofit Corps

Description

How to fill out Michigan Articles Of Incorporation For Use By Domestic Nonprofit Corps?

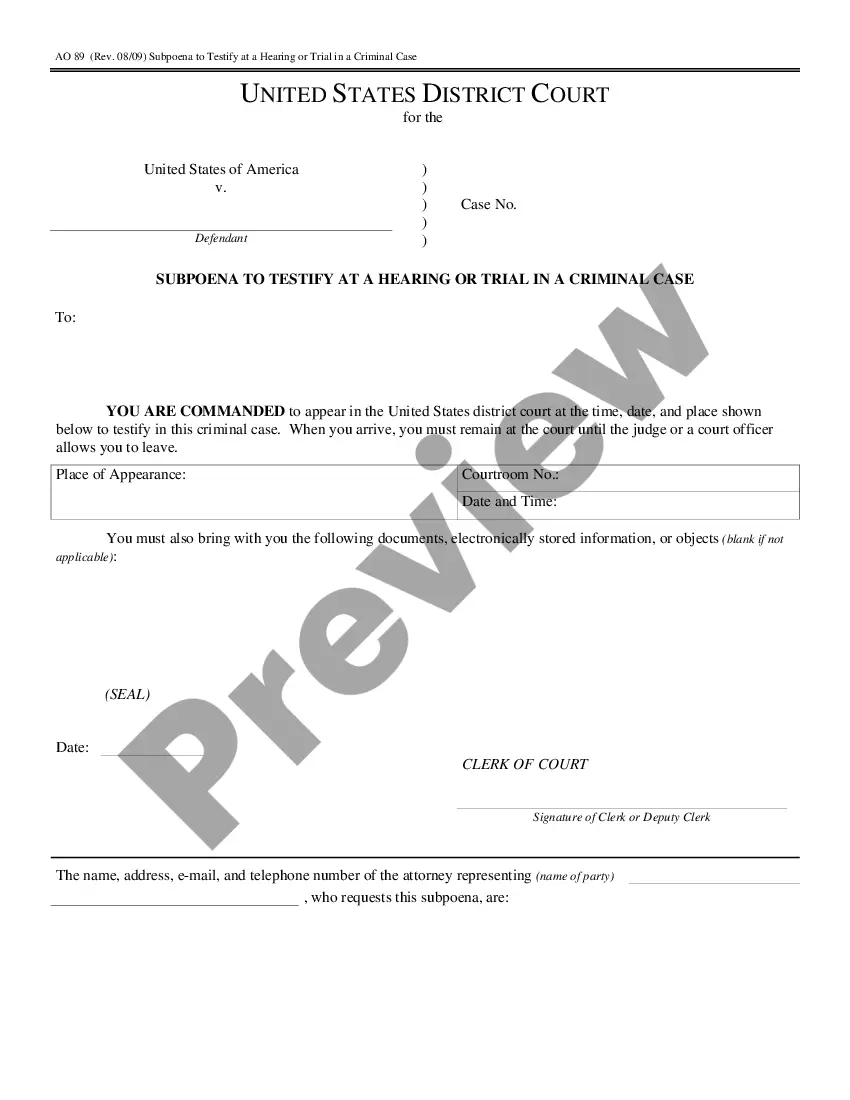

Coping with legal paperwork requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Michigan Articles of Incorporation For Use By Domestic Nonprofit Corps template from our service, you can be sure it meets federal and state regulations.

Dealing with our service is simple and fast. To obtain the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to get your Michigan Articles of Incorporation For Use By Domestic Nonprofit Corps within minutes:

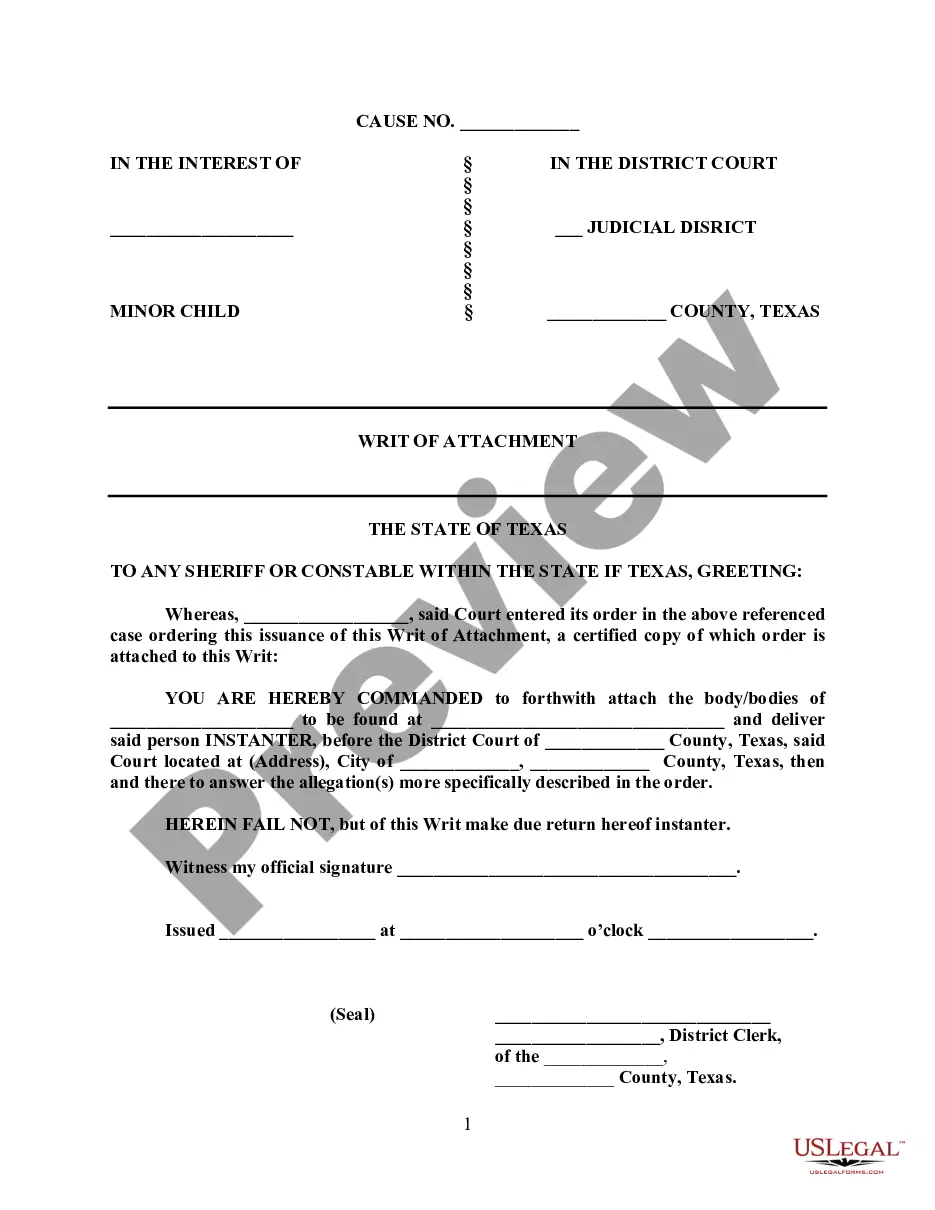

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Michigan Articles of Incorporation For Use By Domestic Nonprofit Corps in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Michigan Articles of Incorporation For Use By Domestic Nonprofit Corps you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Articles of Incorporation are legal formation documents that must be filed to create new profit, nonprofit, professional service, or ecclesiastical corporations.

The 990 is the tax form the Internal Revenue Service (IRS) requires all 501(c)(3) tax-exempt charitable and nonprofit organizations to submit annually.

While a nonprofit corporation is a state-level designation, the 501(c)(3) status is a federal, nationwide designation awarded by the IRS. If a group has 501(c)(3) status, then it is exempt from federal income tax, which often also means you don't need to pay state income taxes either.

Contact the Internal Revenue Service at 800-829-4933 to obtain the publication "Tax-Exempt Status for your Organization" (Publication 557) and the accompanying package "Application for Recognition of Exemption" (Form 1023 and Form 872-C).

Small nonprofits in Michigan are legible to file Form 1023-EZ, which is a Streamlined Application for Recognition of Exemption under Section 501(c)(3) of the Internal Revenue Code. It's a short form that can be found online. Further information on completing and submitting the forms may be found on the IRS website.

Michigan State Registration Documents All organizations (except those classified as churches) are required to file an annual 990 form (990N, 990EZ, 990 or 990PF) to be exempt from Income Tax. The 990 return is due on the 15th day of the 5th month after the end of the organization's fiscal year.

The Michigan Nonprofit Corporation Act 162 of 1982 was created to consolidate, revise, and classify the statutes related to the regulation and organization of nonprofit businesses. The act specifically made changes to the following areas of nonprofits: Defined the rights, duties, immunities, and powers.