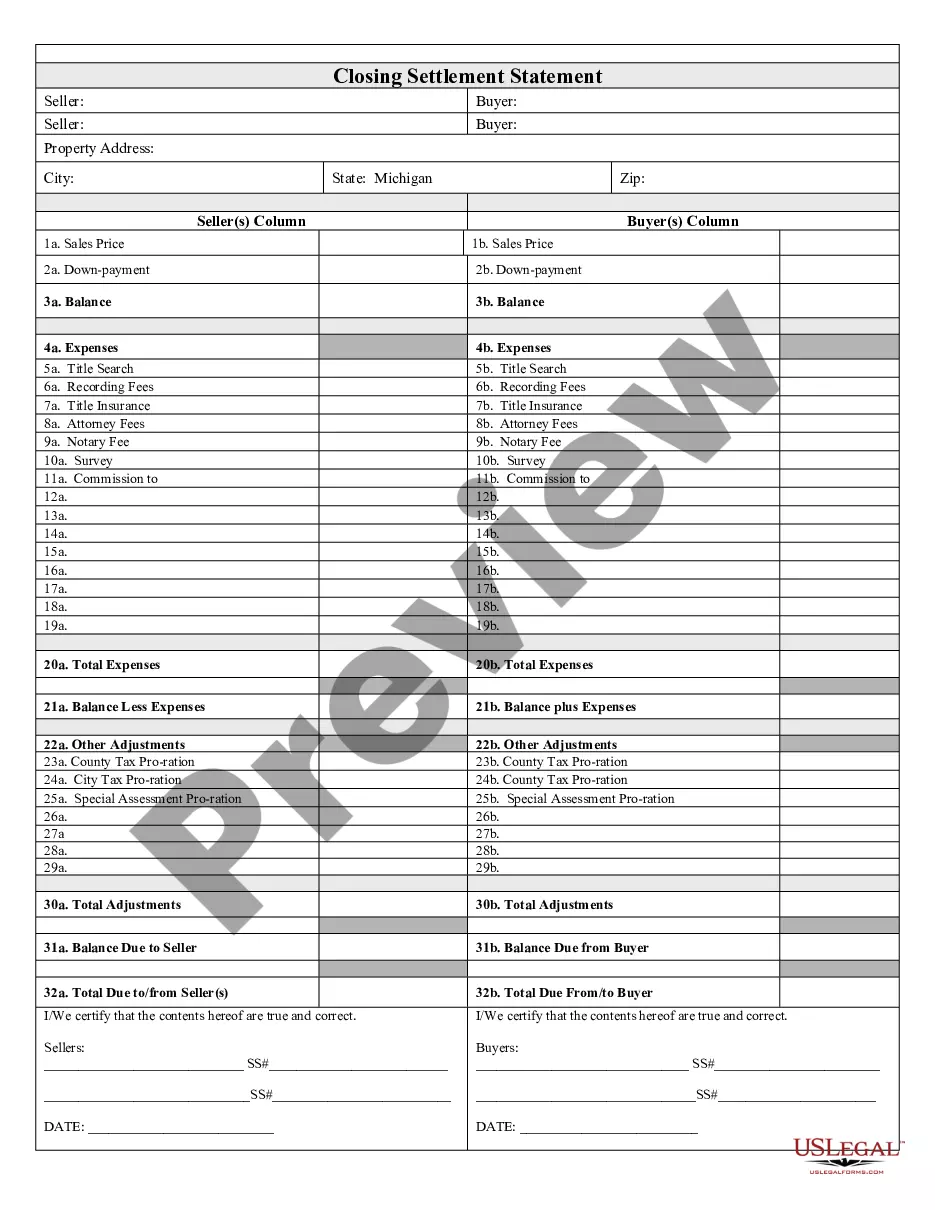

Michigan Closing Statement

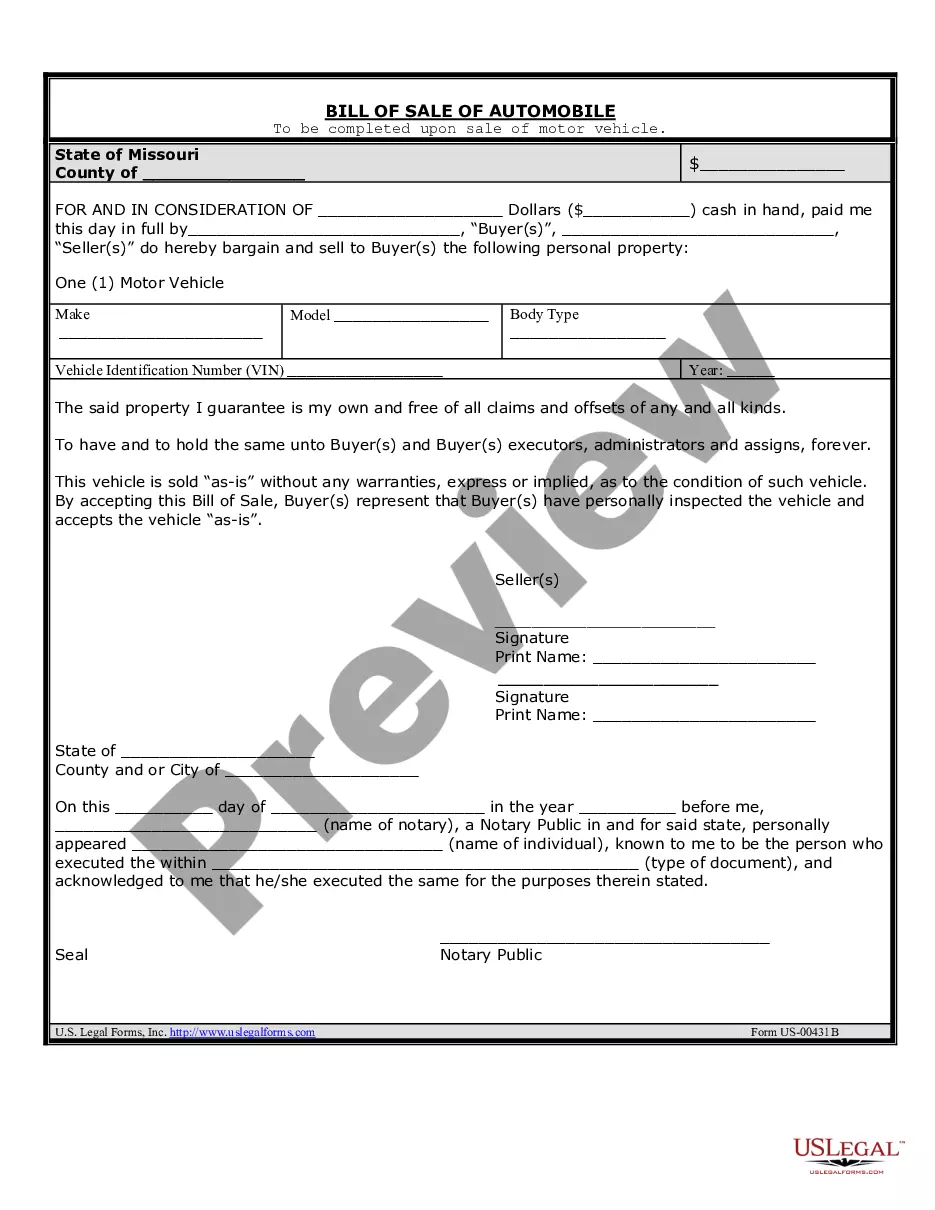

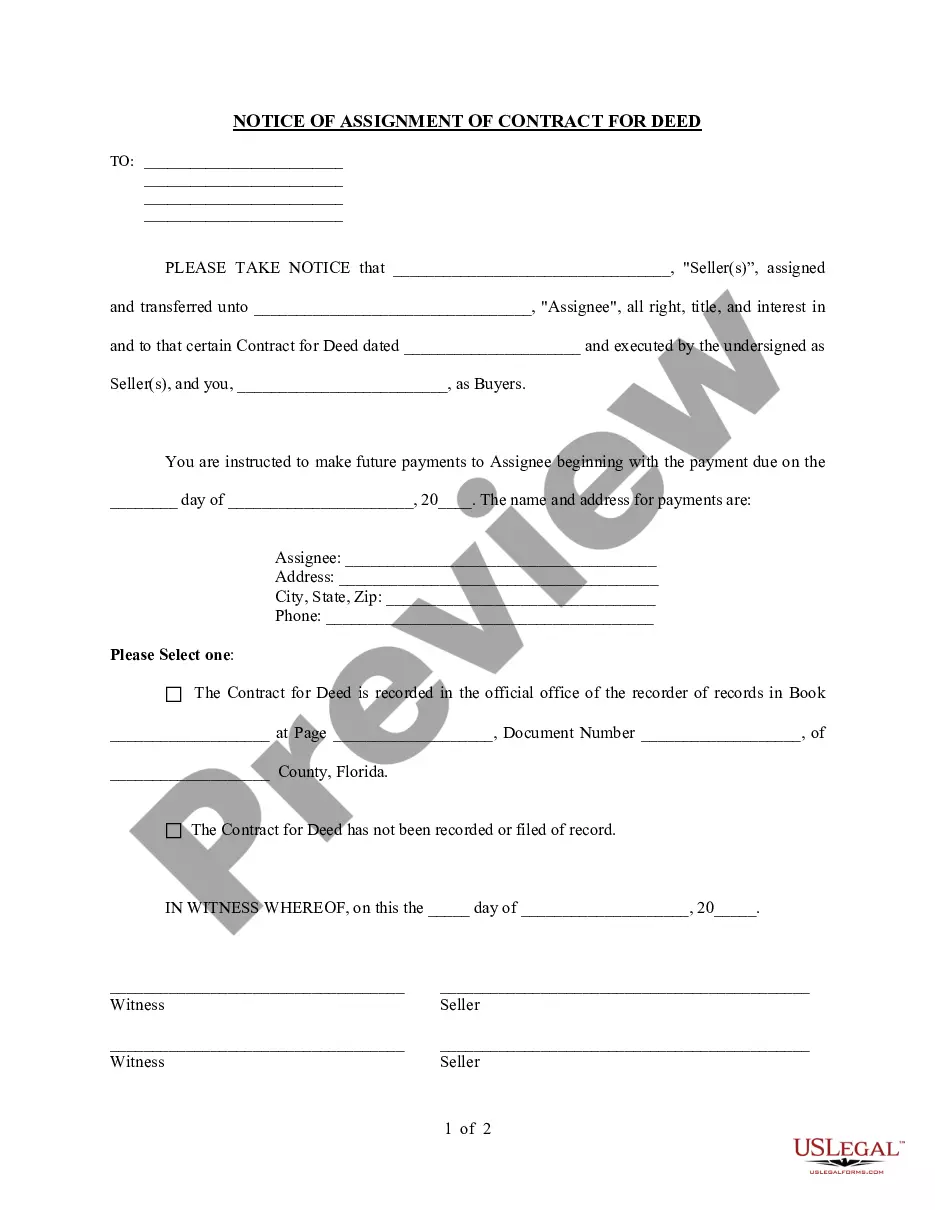

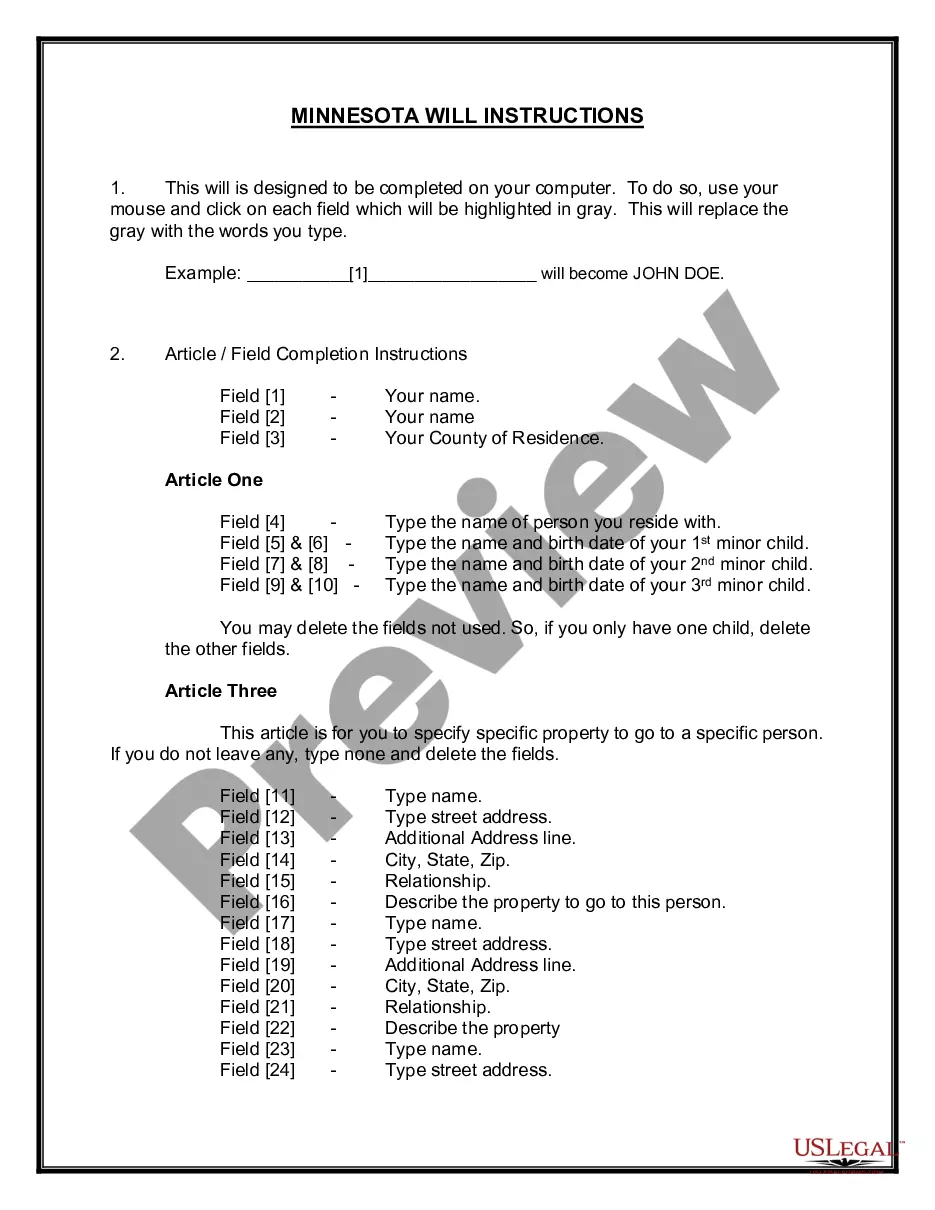

Description Settlement Statement Form

How to fill out Michigan Closing Settlement Form Complete?

Have any form from 85,000 legal documents including Michigan Closing Statement online with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Michigan Closing Statement you need to use.

- Look through description and preview the sample.

- Once you’re sure the template is what you need, just click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by bank card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the appropriate downloadable template. The platform gives you access to documents and divides them into groups to streamline your search. Use US Legal Forms to get your Michigan Closing Statement fast and easy.

Closing Settlement Statement Form Form popularity

Closing Settlement Form Other Form Names

Michigan Statement Document FAQ

Michigan statutes provide no specific requirements an executor must meet, and you are free to name any adult that you trust as your executor. The court must appoint that person unless someone else challenges your choice of executor and there is clear evidence that he or she is incompetent or unsuitable to serve.

If an estate doesn't go through probate and it is a necessary process to transfer ownership of assets, the heirs could sue the executor for failing to do their job. The heirs may not receive what they are entitled to. They may be legally allowed to file a lawsuit to get what they are owed.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

Many executors are able to wrap up an estate themselves, without hiring a probate lawyer.Many executors decide, sometime during the process of winding up an estate, that they could use some legal advice from a lawyer who's familiar with local probate procedure .

A closing statement, also called a HUD1 or settlement sheet, is a legal form your closing or settlement agent uses to itemize all of the costs you and the seller will have to pay at closing to complete a real estate transaction.

The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing. The inventory fee must be paid. Any estate/inheritance taxes must be paid (proof of payment required)

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

To close the estate you must file a specific document with the court that says you finished administering the estate and did what you were required to do as the personal representative. You may also need to get receipts from the estate beneficiaries and make a final accounting.

Executors have also traditionally set fees as a percentage of the overall estate value. So for example, a $600K estate which required 850 hours of work might generate $22K in executor fees (see calculator below). The executor may pay himself or herself this compensation as earned, without prior court approval.