Michigan Disclosure of Corporate Affiliations and Financial Interest is a legal requirement for certain types of business entities operating in the state. This disclosure requires public disclosure of certain financial and business relationships that an individual or company may have with other entities, including other companies, partnerships, or organizations. Depending on the type of entity, there may be different types of disclosures required. For corporations, the disclosure must include the names of officers, directors, and shareholders, along with information on ownership, capital structure, voting agreements, and financial interests. For limited liability companies, the disclosure must include the names of members or managers, their ownership interests, and any agreements between members or managers regarding the management of the company. For partnerships, the disclosure must include the names of partners, their ownership interests, and any agreements between them. For trusts, the disclosure must include the name of the trustee, the trust agreement, and any financial interests of the trustee. In addition to the basic disclosure requirements, certain entities must also file additional documents, such as annual reports, financial statements, and other documents related to their financial activities. All disclosures must be made in writing and filed with the appropriate state agency. Failure to comply with Michigan Disclosure of Corporate Affiliations and Financial Interest requirements can result in legal penalties.

Michigan Disclosure of Corporate Affliations And Financial Interest

Description

How to fill out Michigan Disclosure Of Corporate Affliations And Financial Interest?

If you’re searching for a way to properly prepare the Michigan Disclosure of Corporate Affliations And Financial Interest without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business scenario. Every piece of paperwork you find on our online service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Follow these simple guidelines on how to acquire the ready-to-use Michigan Disclosure of Corporate Affliations And Financial Interest:

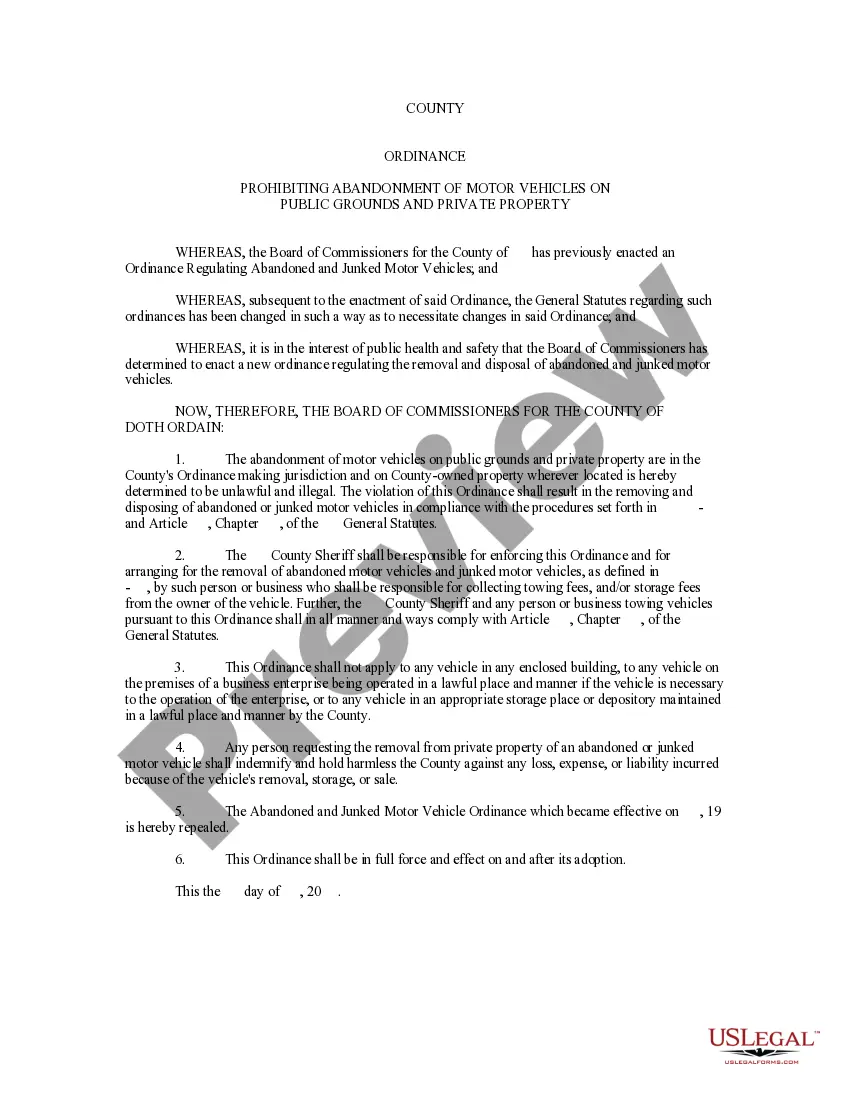

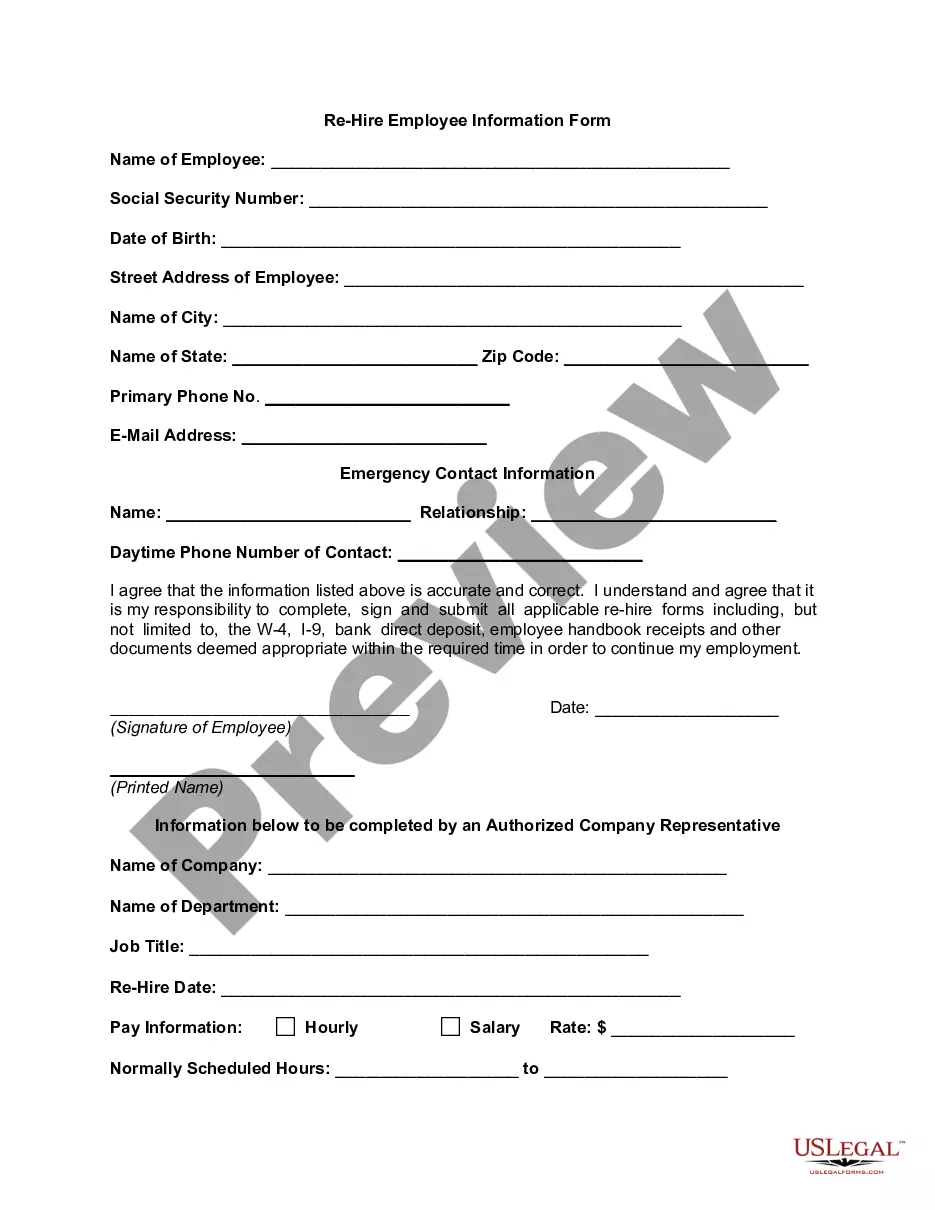

- Make sure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and choose your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Michigan Disclosure of Corporate Affliations And Financial Interest and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

A Michigan property disclosure statement is a form through which sellers must report the condition of their residential real estate to potential buyers. The items specified may include pending legal cases, unpaid fees, property defects, or damage from flooding or fires.

Rule 26.1(a) requires nongovernmental corporate parties to file a ?corporate disclosure statement.? In that statement, a nongovernmental corporate party is required to identify all of its parent corporations and all publicly held corporations that own 10% or more of its stock.

What is a Disclosure Form? A disclosure form is a formal document that contains all the terms, conditions, assets, risks, and liabilities associated with a specific contract or agreement.

The Seller's Disclosure provides a clearer picture of the home and its history, plus it allows buyers to make a more educated decision on whether to purchase the home, defects and all. For sellers, the Seller's Disclosure statement can protect them from being sued by the buyers after the sale is complete.

Corporate disclosure is giving relevant information about the company to the public with the help of the financial reports.

A party must file the statement with the principal brief or upon filing a motion, response, petition, or answer in the court of appeals, whichever occurs first, unless a local rule requires earlier filing.

Contents of the Seller Disclosure In addition, the SDS includes the condition of all structural aspects of the property and improvements, as well as specific information about water problems, insect infestations, legal issues, and environmental issues and hazards.

Under the Michigan Seller Disclosure Act, the transferor of real property must deliver to the transferee a seller's disclosure statement. In this statement the seller must disclose the condition of the property and any other information concerning the property that is known to the seller.