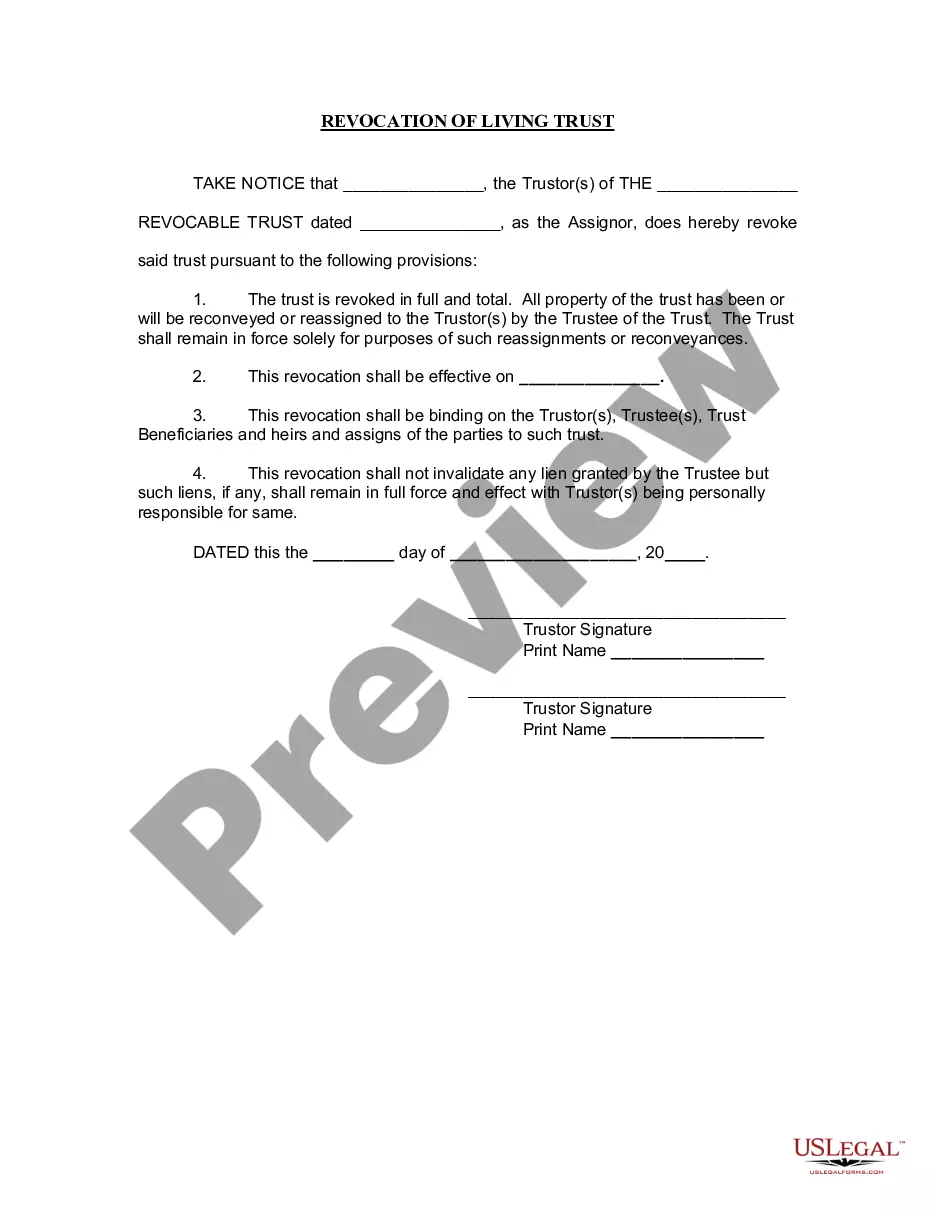

Michigan Revocation of Living Trust

Description Revocation Of Trust Form Pdf

How to fill out Living Trust Forms Michigan?

Have any template from 85,000 legal documents including Michigan Revocation of Living Trust on-line with US Legal Forms. Every template is prepared and updated by state-licensed legal professionals.

If you have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Revocation of Living Trust you want to use.

- Read through description and preview the sample.

- As soon as you are confident the sample is what you need, click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the proper downloadable sample. The service provides you with access to documents and divides them into categories to streamline your search. Use US Legal Forms to obtain your Michigan Revocation of Living Trust fast and easy.

Revocation Trust Form Form popularity

Revocation Of Trust Form Other Form Names

Revocation Statement FAQ

A revocable trust may be revoked, certainly. If you have transferred property into that trust, then you'll need to transfer it back to yourself and then into the new trust.You would then keep the old trust name and date of original execution, but the entire document will have changed.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

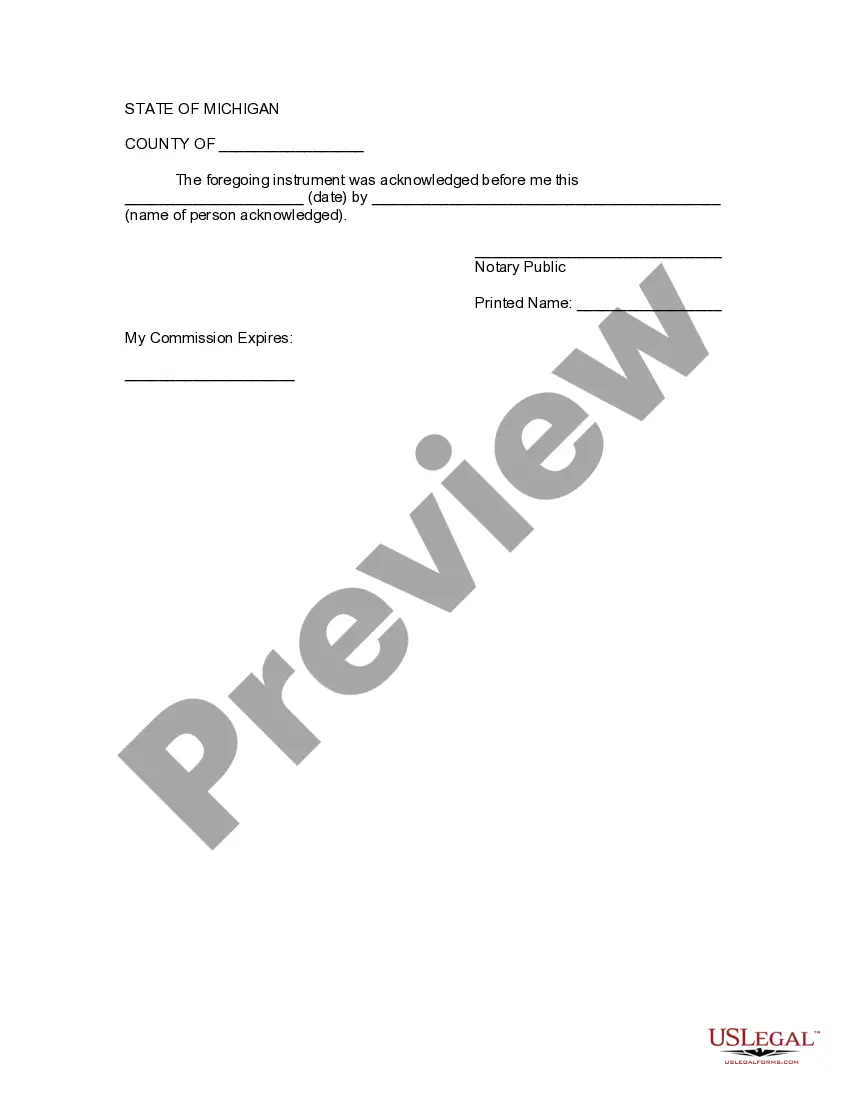

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

In some states, your trustee must submit a formal accounting of the trust's operation to all beneficiaries.Trustees can sometimes waive this requirement if all beneficiaries agree in writing. In either case, after the report is made, the trust's assets can be distributed and the trust can be dissolved.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.Such documents, often called a trust revocation declaration or revocation of living trust," can be downloaded from legal websites; local probate courts may also provide copies of them.

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.

Dissolving irrevocable trusts if you're a beneficiary or trustee. State trust law may also permit a trust beneficiary or trustee to petition the court if they want to dissolve (or amend) the trust. The court may grant approval based on reasons cited above.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.