Michigan Summary Administration Package for Small Estates

Description Mi Small Estates

How to fill out Proper Form Date?

Have any template from 85,000 legal documents such as Michigan Summary Administration Package for Small Estates online with US Legal Forms. Every template is prepared and updated by state-accredited attorneys.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Michigan Summary Administration Package for Small Estates you need to use.

- Read description and preview the template.

- As soon as you’re confident the sample is what you need, simply click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by credit card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform provides you with access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Michigan Summary Administration Package for Small Estates fast and easy.

Mi Summary Administration Form popularity

Summary Administration Packet Other Form Names

Summary Administration Bundle FAQ

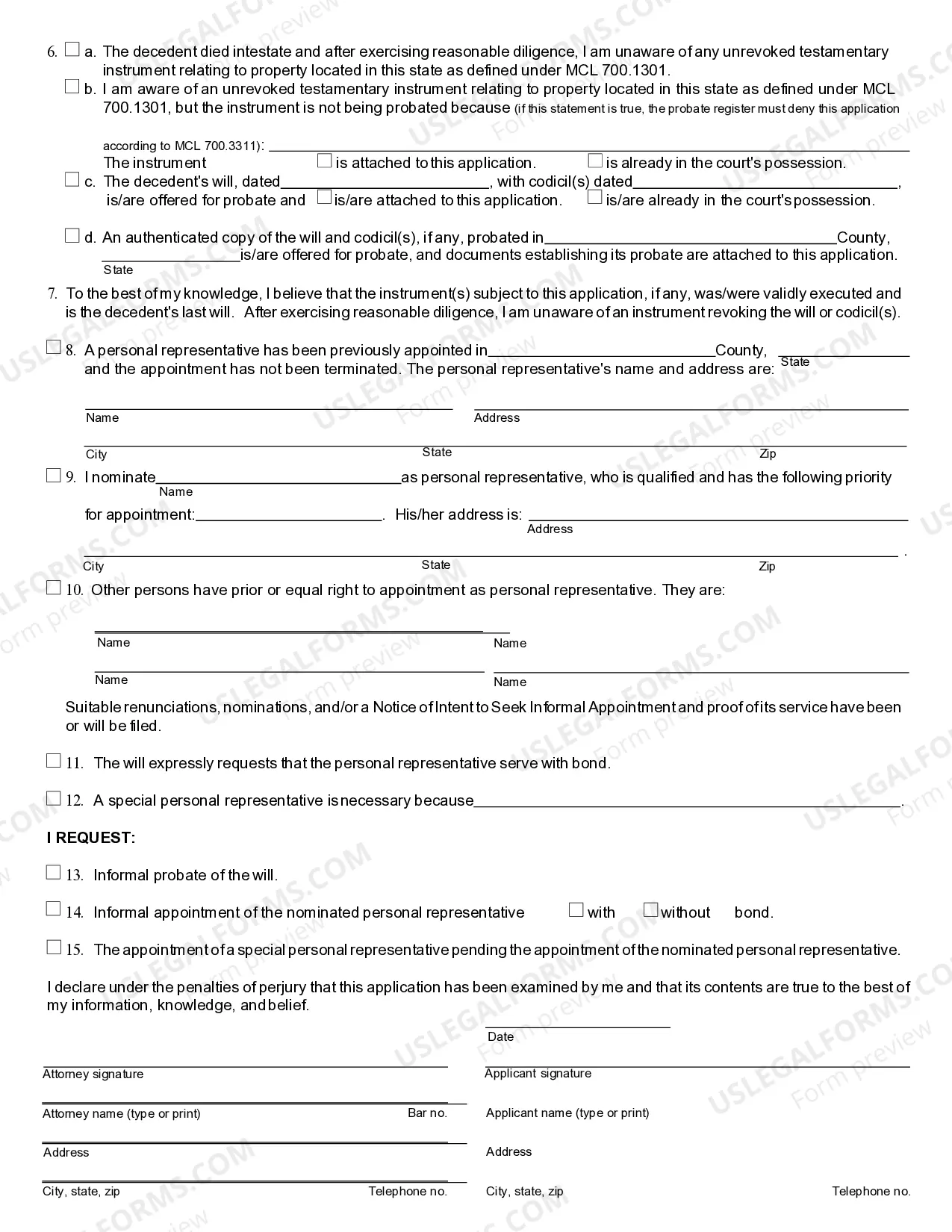

Small estate administration is a simplified court procedure that is an alternative to the longer probate process.This procedure asks the court to allow you to divide and distribute their property to people who either have a legal right to inherit or listed in the testator's will.

Whether an estate is small depends on the value of the property in it. The dollar limit can change each year. If a person dies in 2020, an estate must be valued at $24,000 or less to be small. If a person dies in 2019 or 2018, an estate must be valued at $23,000 or less.

Formal Probate Most Michigan probate cases can be wrapped up within seven months to a year after the personal representative is appointed. After notice of the probate is given, creditors have four months to file a claim.

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.

In order to qualify for a simplified process, an estate must be valued at or below $24,000 for a decedent who died in 2020. This number goes up every few years. To learn more about the simplified processes, read the article An Overview of Small Estate Processes.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.